After a period of gains, an investment or group of investments could drop into correction territory. What is a stock market correction, and what does it mean for your investments? Here are answers to frequently asked questions about stock market corrections.

What is a market correction?

While there is no official definition, a stock market correction is generally considered a drop of at least 10% from recent market highs. Corrections could apply to any investment, including individual stocks, bonds, commodities, or stock indexes. Indexes are groups of stocks that share a common feature, like all being large companies, as with the S&P 500®.

How does a market correction work?

A stock market correction has historically been a regular part of investing. Just as markets can rise, they can also fall. These periods of lower values can last days to months. In fact, the S&P 500, which is often used to gauge total market performance, has spent more than a third of the time since 1927 trading 10% or more below a recent high. Each time, the market has recovered from those drops and continued to deliver long-term gains—though past performance is no guarantee of future results.1

What causes a market correction?

Many factors can contribute to a market correction, including the following:News headlines

Think: political news and global conflicts. For example, uncertainty due to policy changes may prompt investors to sell some stocks and consider safer havens, such as bonds or cash.

Economic data

Whether it's jobs numbers, inflation, or factory orders, disappointing economic data could trigger a correction. Investor sentiment can play a role too—no matter what the economic data says. For example, pessimism about unemployment, inflation, or consumer confidence could make investors fear an economic slowdown enough to sell investments, even if the data itself doesn’t spell trouble.

Earnings reports

Companies routinely release report cards called earnings reports to show investors how they’re faring financially. When company bottom lines are booming or beat expectations, their stock prices may rise, though not always. When the opposite happens, their stock prices may fall.

Stock market correction vs. bear market

While corrections and bear markets share some common features, they are distinct in a few key ways.

Similarities

- Experiencing both corrections and bear markets has historically been a normal part of investing.

- Both can be driven by investors’ response to factors like news headlines, economic data, and company earnings.

- The timing of exactly when corrections and bear markets start and end is unpredictable.

- Past corrections and bear markets have ended eventually, and gains have followed.

Differences

- A bear market (generally considered a drop of at least 20%) is a steeper drop than a market correction.

- Market corrections have historically been more common than bear markets.

- Bear markets have lasted longer than market corrections.

Stock market correction vs. crash

A stock market crash is a sudden, drastic drop. Infamous crashes include the onset of the Great Depression in 1929, the dot-com bubble burst in 2001, the Great Recession in 2008, and the pandemic’s onset in 2020.

Similarities

- The timing of when a crash or correction starts and ends is unpredictable.

- The market has historically recovered and delivered long-term gains after a correction or crash.

Differences

- Crashes’ declines have historically been faster and more severe than correction drops.

- Crashes could, but don’t always, precede a recession or depression.

- If too many investors are trying to sell at once, exchanges may halt trading to prevent a crash—or prevent a crash from worsening. Exchanges don’t go to such extremes over a correction.

How long do market corrections normally last?

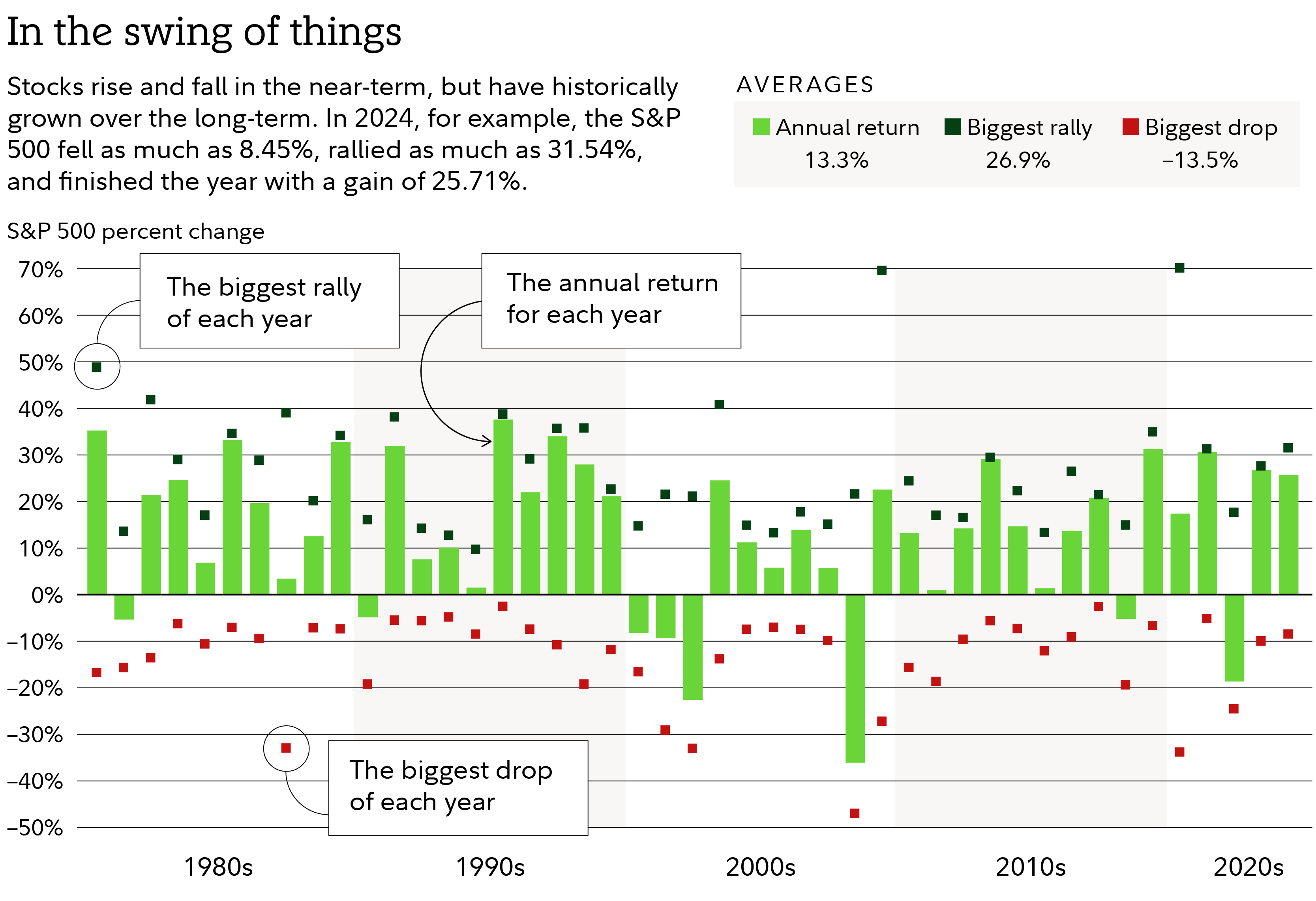

Market correction durations vary widely, but the average correction in the past has lasted 115 days, according to Yardeni Research, a consulting firm.2 Keep in mind, though, that a correction could turn into a bear market, which may last longer. Still, the market has bounced back in the past. Despite nearly half of calendar years since 1980 experiencing a correction, the average annual return over the same period has been above 13%.

Historical examples of market corrections

In this chart, red dots represent the biggest drops from market highs, while green bars show mostly positive annual returns. Red dots that appear in the -10% to -20% range represent corrections. You can see a few of these in virtually every decade. The S&P 500 and Nasdaq indexes also entered correction territory in March 2025.

Market correction of March 2011

This correction occurred after an earthquake and tsunami in Japan.

Market correction of February 2018

Skittishness surrounding inflation, interest rates, and the bond market sent shares down in early 2018, though the correction lasted less than 2 weeks.

Market correction of January 2022

Most major indexes, including the S&P 500, declined more than 10% in the largest drop since the March 2020 onset of the COVID pandemic. At the time, the US was dealing with Omicron (a COVID variant), inflation (with the Fed indicating it would raise interest rates), and supply chain disruptions.

What should you do during a market correction?

A good investing strategy accounts for your current financial situation, goals, time horizon for reaching those goals, and risk tolerance. The idea is to stick with that plan through the market’s peaks and valleys. This could help remove emotions from investing, so you don’t panic-sell at market lows, locking in losses and surrendering potential growth. Consider these other ideas for handling market volatility too.

Prioritize building up a cash cushion

Having emergency savings means you may not have to sell securities to raise cash to pay for expenses, should you lose your income or face a surprise bill. Fidelity suggests starting with $1,000, then building up 3 to 6 months’ worth of expenses.

Diversify

Diversification means investing in a wide range of investments across and within stocks, bonds, and short-term investments like money market funds, to minimize risk. When you diversify, your exposure to any one type of asset may be limited. When one kind of asset is on the downswing, another one might be rising. This is likely to lead to a smoother investment experience over time. Keep in mind that diversification doesn’t ensure gains or guarantee against losses.

Rebalance

Keep your target asset mix on track with periodic rebalancing, or making adjustments to the investments you hold and how much of each you have. If you don't rebalance, your portfolio could have a risk level that’s inconsistent with your goal and strategy.

Read more: A tactical guide to rebalancing your portfolio.

Consider investing regularly

While some investors may look at downturns as an opportunity to scoop up shares “on sale,” another investment strategy is dollar cost averaging. That’s when you invest a certain amount at regular intervals no matter how the market is doing. This way, you’re consistently buying shares, whether the market is down (and your money gets you more shares) or up (and your money gets you fewer shares). Knowing you’ll stick with the same strategy whether the market’s on a hot streak or in correction territory could take the pressure off needing to make game-time decisions you could regret. You may already be practicing dollar cost averaging in a workplace retirement plan like a 401(k) if an amount is deducted from every paycheck and deposited into an investing account. You can set it up for other types of accounts, including a regular brokerage account.

Tax-loss harvest

A down market could be an opportunity to try a strategy called tax-loss harvesting in a taxable brokerage account, since the strategy requires selling investments at a loss—and you may have multiple investments that would satisfy that requirement at that time. If you sell profitable investments, you’re taxed on those gains. But if you sell investments for less than you paid for them, you could offset gains with those losses and reduce your taxable income.