1. The Fidelity Security Screener is a research tool provided to help self-directed investors evaluate these types of securities. The criteria and inputs entered are at the sole discretion of the user, and all screens or strategies with preselected criteria (including expert ones) are solely for the convenience of the user. Expert screens are provided by independent companies not affiliated with Fidelity. Information supplied or obtained from these screeners is for informational purposes only and should not be considered investment advice or guidance, an offer of or a solicitation of an offer to buy or sell securities, or a recommendation or endorsement by Fidelity of any security or investment strategy. Fidelity does not endorse or adopt any particular investment strategy or approach to screening or evaluating stocks, preferred securities, exchange-traded products, or closed-end funds. Fidelity makes no guarantees that information supplied is accurate, complete, or timely, and does not provide any warranties regarding results obtained from their use. Determine which securities are right for you based on your investment objectives, risk tolerance, financial situation, and other individual factors, and reevaluate them on a periodic basis.

2. The Equity Summary Score is provided for informational purposes only, does not constitute advice, should not be considered as the primary basis for your investment decisions, and is not an endorsement or recommendation for any particular security or trading strategy. The Equity Summary Score is provided by LSEG StarMine, an independent company not affiliated with Fidelity Investments. The underlying analyst opinions are provided by Investars.com, an independent company not affiliated with Fidelity Investments. For more information and details, go to Fidelity.com/research/stocks.

3. The Fidelity Mutual Fund Screener is a research tool provided to help self-directed investors evaluate these types of securities. The criteria and inputs entered are at the sole discretion of the user, and all screens or strategies with preselected criteria (including expert ones) are solely for the convenience of the user. Expert Screeners are provided by independent companies not affiliated with Fidelity. Information supplied or obtained from these Screeners is for informational purposes only and should not be considered investment advice or guidance, an offer of or a solicitation of an offer to buy or sell securities, or a recommendation or endorsement by Fidelity of any security or investment strategy. Fidelity does not endorse or adopt any particular investment strategy or approach to screening or evaluating stocks, preferred securities, exchange-traded products, or closed-end funds. Fidelity makes no guarantees that information supplied is accurate, complete, or timely, and does not provide any warranties regarding results obtained from its use. Determine which securities are right for you based on your investment objectives, risk tolerance, financial situation, and other individual factors, and reevaluate them on a periodic basis.

4. The Fidelity ETF Screener is a research tool provided to help self-directed investors evaluate these types of securities. The criteria and inputs entered are at the sole discretion of the user, and all screens or strategies with preselected criteria (including expert ones) are solely for the convenience of the user. Expert Screeners are provided by independent companies not affiliated with Fidelity. Information supplied or obtained from these Screeners is for informational purposes only and should not be considered investment advice or guidance, an offer of or a solicitation of an offer to buy or sell securities, or a recommendation or endorsement by Fidelity of any security or investment strategy. Fidelity does not endorse or adopt any particular investment strategy or approach to screening or evaluating stocks, preferred securities, exchange-traded products, or closed-end funds. Fidelity makes no guarantees that information supplied is accurate, complete, or timely, and does not provide any warranties regarding results obtained from its use. Determine which securities are right for you based on your investment objectives, risk tolerance, financial situation, and other individual factors, and reevaluate them on a periodic basis.

5. The ETF Portfolio Builder is designed to help you create and research diversified portfolios that may be suited for your needs. Our model portfolios show one way to construct a portfolio aligned with a sample investment objective. Start by choosing your investment objective and whether you want a model of Fidelity only ETFs or one with a mix of Fidelity and iShares ETFs. Use the model portfolios as a starting point to help you research investments or help refine your existing portfolio. This information provided is intended to be educational and is not tailored to the investment needs of any specific investor or be the primary basis of your investment decision. Please see the model portfolio methodology (PDF) for more information about how the models are created. You should also carefully research any fund you may be considering prior to making an investment decision. You may consider another allocation and other investments, including non-Fidelity funds, having similar risk and return characteristics.

6. The Fidelity Mutual Fund Screener is a research tool provided to help self-directed investors evaluate these types of securities. The criteria and inputs entered are at the sole discretion of the user, and all screens or strategies with preselected criteria (including expert ones) are solely for the convenience of the user. Expert Screeners are provided by independent companies not affiliated with Fidelity. Information supplied or obtained from these Screeners is for informational purposes only and should not be considered investment advice or guidance, an offer of or a solicitation of an offer to buy or sell securities, or a recommendation or endorsement by Fidelity of any security or investment strategy. Fidelity does not endorse or adopt any particular investment strategy or approach to screening or evaluating stocks, preferred securities, exchange-traded products, or closed-end funds. Fidelity makes no guarantees that information supplied is accurate, complete, or timely, and does not provide any warranties regarding results obtained from its use. Determine which securities are right for you based on your investment objectives, risk tolerance, financial situation, and other individual factors, and reevaluate them on a periodic basis.

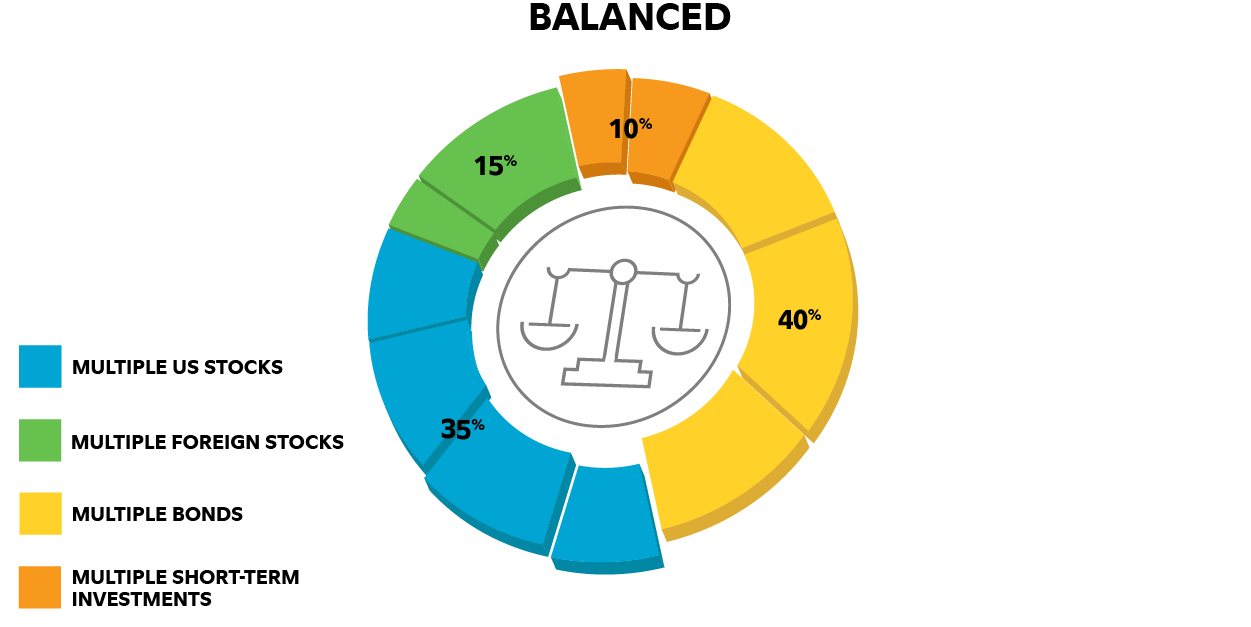

7. Data Source: Fidelity Investments and Morningstar Inc. Hypothetical value of assets held in untaxed portfolios invested in US stocks, foreign stocks, bonds, or short-term investments. Historical returns and volatility of the stock, bond, and short-term asset classes are based on the historical performance data of various unmanaged indexes from 1926 through the latest year-end data available from Morningstar. Domestic stocks represented by IA SBBI US Large Stock TR USD Ext Jan 1926-Jan 1987, then by Dow Jones US Total Market data starting Feb 1987 to Present. Foreign stocks represented by IA SBBI US Large Stock TR USD Ext Jan 1926–Dec 1969, MSCI EAFE Jan 1970-Nov 2000, then MSCI ACWI Ex USA GR USD Dec 2000 to Present. Bonds represented by US Intermediate-Term Government Bond Index Jan 1926–Dec 1975, then Barclays Aggregate Bond Jan 1976 - Present. Short-term/cash represented by 30-day US Treasury bills beginning in Jan 1926 to Present. Past performance is no guarantee of future results. The purpose of the target asset mixes is to show how target asset mixes may be created with different risk and return characteristics to help meet an investor's goals. You should choose your own investments based on your particular objectives and situation. Be sure to review your decisions periodically to make sure they are still consistent with your goals.

8. The ETF Portfolio Builder is designed to help you create and research diversified portfolios that may be suited for your needs. Our model portfolios show one way to construct a portfolio aligned with a sample investment objective. Start by choosing your investment objective and whether you want a model of Fidelity only ETFs or one with a mix of Fidelity and iShares ETFs. Use the model portfolios as a starting point to help you research investments or help refine your existing portfolio. This information provided is intended to be educational and is not tailored to the investment needs of any specific investor or be the primary basis of your investment decision. Please see the model portfolio methodology (PDF) for more information about how the models are created. You should also carefully research any fund you may be considering prior to making an investment decision. You may consider another allocation and other investments, including non-Fidelity funds, having similar risk and return characteristics.

9. Fidelity Go® provides discretionary investment management, and in certain circumstances, non-discretionary financial planning, for a fee. Advisory services offered by Strategic Advisers LLC (Strategic Advisers), a registered investment adviser. Brokerage services provided by Fidelity Brokerage Services LLC (FBS), and custodial and related services provided by National Financial Services LLC (NFS), each a member NYSE and SIPC. Strategic Advisers, FBS and NFS are Fidelity Investments companies.

Investing involves risk, including risk of loss.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Past performance is no guarantee of future results.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk.

Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Any fixed income security sold or redeemed prior to maturity may be subject to loss.

A bond ladder, depending on the types and amount of securities within it, may not ensure adequate diversification of your investment portfolio. While diversification does not ensure a profit or guarantee against loss, a lack of diversification may result in heightened volatility of your portfolio value. You must perform your own evaluation as to whether a bond ladder and the securities held within it are consistent with your investment objectives, risk tolerance, and financial circumstances. To learn more about diversification and its effects on your portfolio, contact a representative.

Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss. Your ability to sell a CD on the secondary market is subject to market conditions. If your CD has a step rate, the interest rate of your CD may be higher or lower than prevailing market rates. The initial rate on a step rate CD is not the yield to maturity. If your CD has a call provision, which many step rate CDs do, please be aware the decision to call the CD is at the issuer's sole discretion. Also, if the issuer calls the CD, you may be confronted with a less favorable interest rate at which to reinvest your funds. Fidelity makes no judgment as to the credit worthiness of the issuing institution.

©2025 Morningstar, Inc. All rights reserved. The Morningstar information contained herein (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or redistributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Fidelity does not review the Morningstar data and, for mutual fund performance, you should check the fund's current prospectus for the most up-to-date information concerning applicable loads, fees, and expenses.

Exchange-traded products (ETPs) are subject to market volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, foreign securities, commodities, and fixed income investments. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks, all of which are magnified in emerging markets. ETPs that target a small universe of securities, such as a specific region or market sector, are generally subject to greater market volatility, as well as to the specific risks associated with that sector, region, or other focus. ETPs that use derivatives, leverage, or complex investment strategies are subject to additional risks. The return of an index ETP is usually different from that of the index it tracks because of fees, expenses, and tracking error. An ETP may trade at a premium or discount to its net asset value (NAV) (or indicative value in the case of exchange-traded notes). The degree of liquidity can vary significantly from one ETP to another and losses may be magnified if no liquid market exists for the ETP's shares when attempting to sell them. Each ETP has a unique risk profile, detailed in its prospectus, offering circular, or similar material, which should be considered carefully when making investment decisions.

The S&P 500® Index is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent US equity performance.

Indexes are unmanaged. It is not possible to invest directly in an index.

Target Date Funds are an asset mix of stocks, bonds and other investments that automatically becomes more conservative as the fund approaches its target retirement date and beyond. Principal invested is not guaranteed.

NASDAQ®, NASDAQ Composite®, and NASDAQ Composite Index® are registered trademarks of The NASDAQ OMX Group, Inc. (which with its Affiliates are the "Corporations") and are licensed for use by Fidelity. The product(s) have not been passed on by the Corporations as to their legality or suitability. The product(s) are not issued, endorsed, or sold by the Corporations.

Generally, among asset classes stocks are more volatile than bonds or short-term instruments and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Although the bond market is also volatile, lower-quality debt securities including leveraged loans generally offer higher yields compared to investment grade securities, but also involve greater risk of default or price changes. Foreign markets can be more volatile than U.S. markets due to increased risks of adverse issuer, political, market or economic developments, all of which are magnified in emerging markets.

Although bonds generally present less short‐term risk and volatility than stocks, bonds do entail interest rate risk (as interest rates rise, bond prices usually fall, and vice versa), issuer credit risk, and the risk of default, or the risk that an issuer will be unable to make income or principal payments. The effect of interest rate changes is usually more pronounced for longer‐term securities. Additionally, bonds and short‐term investments entail greater inflation risk, or the risk that the return of an investment will not keep up with increases in the prices of goods and services, than stocks.

The third parties mentioned herein and Fidelity Investments are independent entities and are not legally affiliated.

The Fidelity Investments and pyramid design logo is a registered service mark of FMR LLC. The third-party trademarks and service marks appearing herein are the property of their respective owners.

Before investing in any mutual fund or exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus, an offering circular, or, if available, a summary prospectus containing this information. Read it carefully.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

© 2024–2025 FMR LLC. All rights reserved.

1156143.2.1