Question 1. What's the point of investing?

Investing has a superpower called compounding, or compound growth—that's when returns you earn in an investment account earn returns of their own. (So meta.) In other words, you earn on both your initial balance—the money you put in—and the potential returns that may be added over time if your investments rise in value. The longer you give your money a chance to grow, the longer it has to potentially benefit from compounding returns. (Though remember: There are no guarantees you'll gain money from investing.) The lesson? Consider investing as soon as you can, even if it's a small amount. Investing could also help you fight inflation if your investments earn a higher rate of return than the rate of inflation.

The potential power of compounding

Compound growth is especially powerful if you have a long time to stay invested. A single investment of $6,000 could potentially grow to as much as $90,000 after 40 years, depending on market conditions, thanks to the power of compounding growth—earning money on the money you earn. But remember, investing carries the risk of loss: compounding growth does not protect against loss in declining markets.

Question 2. What kind of investor are you?

Before you start investing, it might be helpful to check in with yourself about the type of investor you plan to be.

Which sounds the most like you?

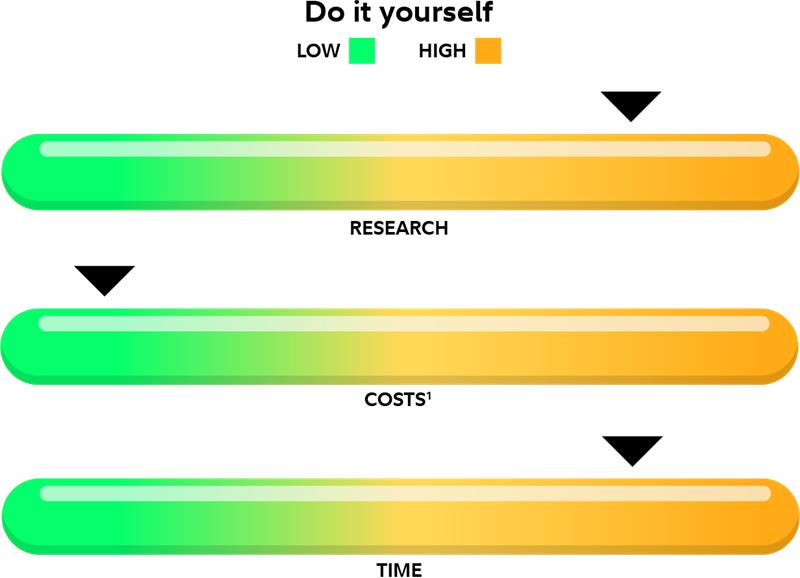

- Do you want to be a do-it-yourself investor? This will mean doing all your own research, choosing and buying your own investments, and managing your portfolio, aka your mix of investments. This could take up more of your time, but you’d have total control over what you invest in.

Knowing the answer could help you find what might work best for you in a provider or account type.

Question 3. What makes the stock market go up and down?

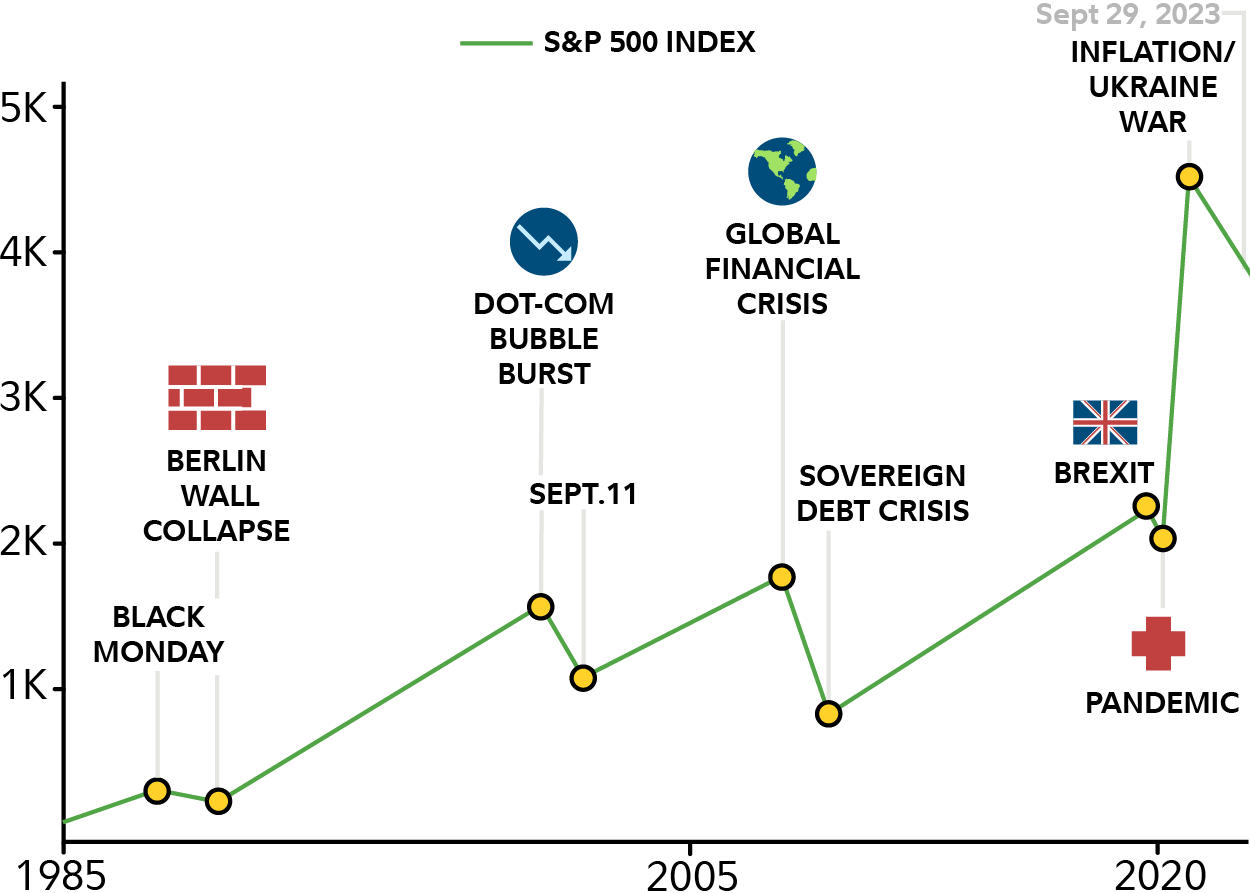

Good ol’ supply and demand. If more people want to buy a stock than sell it, the price could go up—and if more people want to sell a stock than buy it, the price could drop. This can happen in response to economic or political developments or a company’s performance, among other things. Those rollercoaster-like ups and downs are called market volatility—and just like a theme park ride it’s normal to feel some bumps and hit some peaks. While market downturns might be unsettling, history shows stocks have recovered. (But keep in mind that past performance can’t guarantee future results.)

Staying the course with your investments is usually key. If you sell and are still on the sidelines during a recovery, it could be difficult to catch up. Missing even a few of the best days in the market could significantly undermine your performance.

Despite market pullbacks, stocks have risen over the long term.

Question 4. What are you investing for?

Setting goals could get you going. So think about your reasons for investing. They can be serious, like funding retirement, but also fun, like a bucket-list trip. Make a list of those short-term and long-term wins you want to work toward. Then place the list in a spot where you’ll see it often. That could help you stay motivated to keep investing. You might estimate how much you’d like to save and think about when you’d like to hit that savings goal, which could help you pinpoint when to start investing and what your investing strategy should be.