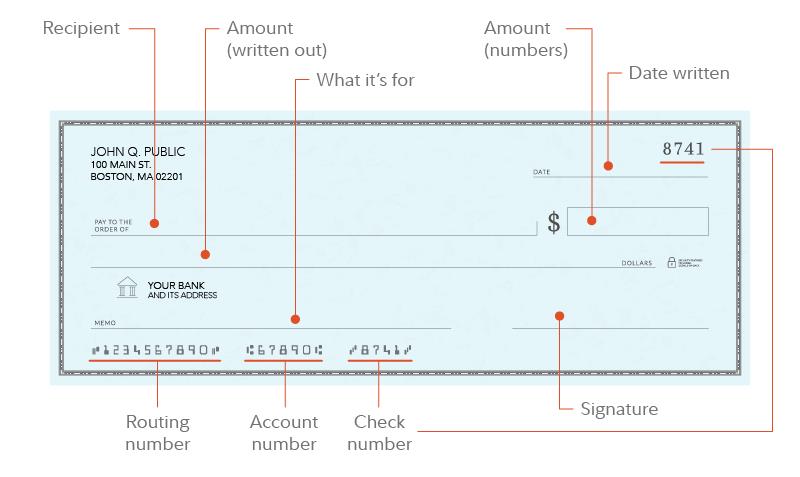

Writing a check may seem like an old-school skill you don't need anymore. But there are times when paying by check is required or preferred, such as paying rent or sending a gift to a family member through the mail. This step-by-step guide can help you feel more confident while writing a check—and understand some tips to help keep your money safe.

How to write a check

1. Date the check

Start by writing out the date in the upper-right corner of your check. Include the month, day, and year. Most times, you'll probably use the date that you are writing the check. But in some cases, you might do what's called "postdating" the check.

Postdating is when you write in a future date with the idea that the person who's cashing the check will wait until that date or later. (Certain states have postdating guidelines, so learn whether yours does before doing this.) However, just because a check has been postdated doesn't mean the person receiving it or the bank cashing it must honor that date. That's one reason why it's important to only write checks for amounts you have the money to cover as soon as you've written the check.

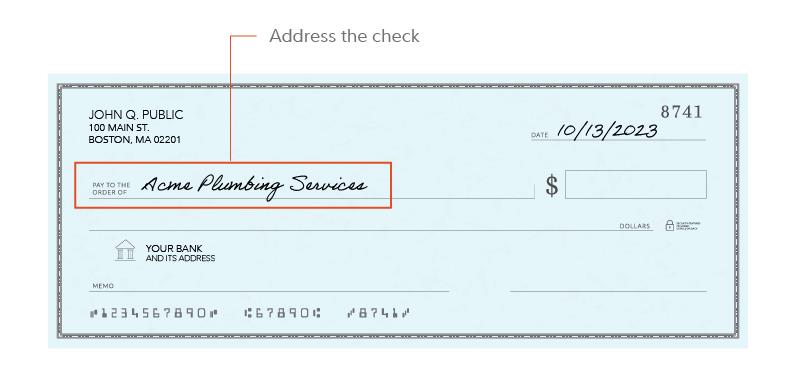

2. Address the check

Next, address the check to the person, business, or organization you are paying. You'll find this field below the date line toward the left of the check along with text reading "Pay to" or "Pay to the order of."

Use the full, complete name of the party that will cash the check. If it's someone you haven't paid before, verify what name to use. A local plumber, for instance, might need the check made out to the business they work for instead of their personal name.

If you want to make a withdrawal or transfer funds between accounts, you can write a check to yourself. Alternatively, you can address the check to "Cash." Be careful if you do this. Once written out to "Cash," anyone who finds the check can take it to a bank or financial institution and receive the check's value in cash.

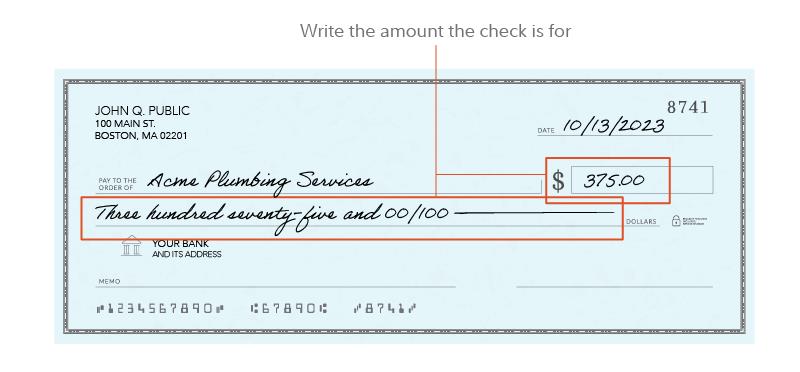

3. Write the amount the check is for

Beside and below the "Pay to" line, you'll write in how much money the check is for. To the right of "Pay to," you'll note the check's value in numerals (e.g., 375.00) in a box after a printed dollar sign. Then, on the line below with the word "Dollars" at the end, you'll spell out that amount ("Three hundred seventy-five dollars and 00/100"). It's a good idea to make a dash striking through any unused space on this line to prevent someone from writing in any additional amounts after you've handed off the check.

Do not write a check for an amount that's greater than what you have in your account. Having insufficient funds will cause checks to "bounce," which means they can't be cashed and may result in insufficient fund fees.

How to write a check with no cents

When your payment is for a whole number, simply put the number in the numerical box field using standard periods and zeroes to represent zero cents (e.g., 375.00). Then be sure to also spell out the amount in the written field below, noting either "00/100," "no/100," or "xx/100" to represent 0 cents (e.g., "Three hundred seventy-five dollars and 00/100").

How to write a check with cents

When your check includes cents, you'll need to write that out numerically and with words, just as you would a check with no cents. In the numerical box field, indicate any cents using a standard period and 2 digits (e.g., "375.62"). You'd then write out "Three hundred seventy-five dollars and 62/100" in the field below.

4. Sign the check

In the bottom right corner, you'll find a line that's typically labeled with "Signature" or "Authorized signature"—though sometimes it may have no text by it at all. This is where you'll sign the check to authorize payment.

5. Add a memo

This step isn't mandatory, but it's a good idea to fill in the memo (short for memorandum) field at the bottom left of the check. This is where you can include a note to remind yourself or the payee about the reason you're writing the check. If you're paying a plumber to fix your sink, you might note "Fix leaky kitchen sink." The memo line is also a good place to reference an invoice number or your account number if you're paying a bill.

6. Check your work

Be sure to look over your completed check at least once to confirm that all of the fields were filled in correctly. Making a mistake when you write a check could lead to delays in payment or even loss of funds if someone unintended cashes the check.

What to do if you miswrite a check

If you make a mistake while writing a check, "void" it and start over. Voiding a check means that the check will not be able to be processed for payment. To void a check, cross out any part of the check that is filled out, and largely write "VOID" over the entirety of the check. Then you can make your payment using a different check.

What to do after writing a check

Once you've written a check, here's how to help ensure your funds get to the right place:

- Make a record of the transaction. Be sure to keep up with your transactions so you know any outstanding payments that debit your account. You might do this in a typical checkbook register, which you can often find at the front of a checkbook, or you may choose to use a financial app or spreadsheet to help you stay on top of things.

- Keep a record of your check as you wrote it. Take a picture of each check you write before you send it. This way you have an exact record of the document in case there are discrepancies later. Depending on your check type, you may also have duplicate carbon copy paper attached to your checks, creating a replica of the check as you write it.

- Monitor your account. Keep an eye on your bank account in the days and weeks to follow to make sure the check has been cashed or deposited as expected.

- Know how to stop payment on a check. If one of your checks winds up with an unintended recipient, you can contact your bank or credit union to stop them from issuing payment when someone tries to cash the check. Check with your financial institution to find out its process and any associated fees.

Security tips when writing checks

Consider following these security best practices:

- Use a pen. To prevent your check from being altered, always write checks with a non-erasable pen with ink that does not fade or smudge easily.

- Store your checkbook in a safe place. Checks contain sensitive info, like your account number and bank's routing number. If this information or a blank check fall into the wrong hands, someone could forge checks or wire themselves money directly from your account.