If you’re looking for a low-risk and predictable way to earn money on your cash savings, then a certificate of deposit, or CD, might be worth considering. CDs allow you to lock in an interest rate on your savings, generating you extra income on that cash. Here’s a breakdown of how CDs work, how CD rates work, and how to buy CDs.

How does a CD work?

Think of a CD as a higher-commitment savings account, held at a bank, with a fixed interest rate. You agree not to touch your deposit for a specific period, in exchange typically for a higher return than a standard savings account.

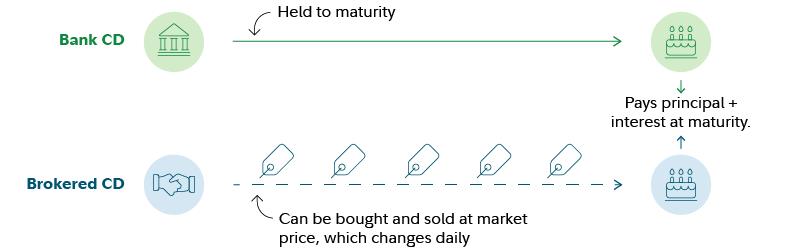

There are 2 main types of CDs—bank CDs and brokered CDs—each of which works slightly differently.

How does a bank CD work?

A common way to buy CDs is through a bank. With a bank CD, you deposit funds directly into a bank for a set period, and in return, that bank offers to pay interest on your deposit at a set rate. Different banks offer different rates, so it may be helpful to shop around to find the most competitive rate before you buy a CD. Bank-issued CDs aren't tradeable, meaning that when you buy a CD directly from a bank, you’re locked into that contract: either waiting for the deposit to mature or possibly paying fees or forfeit interest payments for withdrawing your money early.

How does a brokered CD work?

You can also buy CDs from brokerages. These are called (as you might guess) brokered CDs. Instead of working directly with a bank, a brokerage like Fidelity sells you the brokered CD, which allows you to shop dozens if not hundreds of different CDs through your brokerage rather than going to multiple individual bank websites to find the best interest rate.

Similar to a bank CD, if you hold a new issue brokered CD to maturity, you’ll receive back your principal and interest. Unlike bank CDs, though, you can trade brokered CDs prior to maturity. But because brokered CDs are tradeable assets, there’s a current market price attached to them, aka the approximate money you could receive for selling that CD right now. That market price isn’t necessarily the exact same as the value of the money in the CD plus its interest rate. Instead, it’s determined by current market interest rates (compared to the interest rate on the CD), the “liquidity” (the demand and supply conditions for that CD), the time left until the CD’s maturity, and wider economic conditions. While you can sell a brokered CD before its maturity date, you’ll likely lose part of your original investment due to trading costs. That’s why it’s important to chose a CD you can commit to for the entire investment period and simply let it mature and receive the full return of your principal plus interest.

That’s a lot to digest, so here’s a quick cheat sheet.

Note that in some circumstances, you may be able to leave a bank CD before maturity, but early withdrawal penalties may apply.

What are CD rates?

CD rates are the interest rates that banks offer on a CD. It’s the profit you’ll make—a percentage of your total deposit—for buying and holding the CD for a specified amount of time called the "term length." For example, if you bought a $1,000 CD with a rate of 3% and a term length of 1 year, you’d receive back your principal ($1,000) plus money made from interest ($1,000 x .03 = $30) after 1 year has elapsed if you don’t withdraw early.

Most CDs’ rates are predetermined and fixed over the term length of the CD. That’s why CDs are called a fixed income investment—because once you buy a CD, the interest rate won’t change. Regardless of whether you have a bank CD or a brokered CD, you’re entitled to the principal plus the interest income at the maturity date.

Keep in mind that CD rates are annualized, meaning they present the return you’d receive on your principal over a year, even if your CD maturity length is only a couple months or multiple years.

How do CD rates work?

A CD’s rate is determined by many different factors, but here are the 2 that have the largest impact.

1. Term length of your CD

The term length of a CD is the timeframe from when you buy the CD to when you receive back your principal plus interest. Generally, but not always, the longer the CD term, the higher the rate—you agree to have your dollars locked up for a longer time, and, in exchange, the bank rewards you with a higher interest payout. In investor speak, the bank offers you additional income for getting to hang onto your deposit for longer and for the risk you assume that interest rates will rise later. However, when people believe interest rates are higher now than what they’ll be in the months ahead, you might not get a higher rate for keeping your money tied up in a CD longer, so check the rate associated with each term length carefully.

2. Market rates

In the US and other markets, there’s an average cost of lending called the market interest rate. Banks set the rate of CDs based on the market interest rate. So if market interest rates rise, the rates of new CD contracts rise, and vice versa.

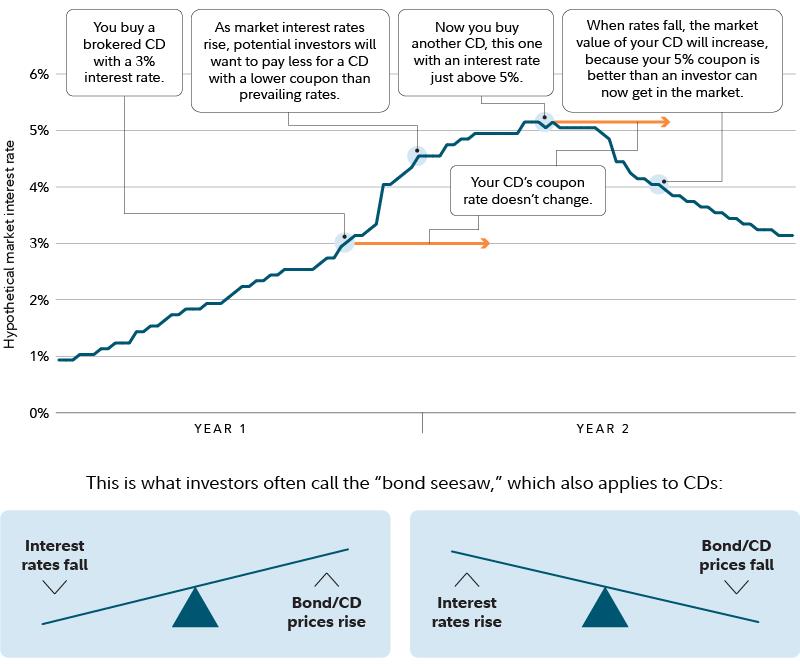

If you bought a brokered CD, you may notice that the price of that CD changes. This price reflects the estimated current market price of your CD or the price you’d get if you sold your CD today. That price is largely determined by the current market interest rates, among other factors. But remember, these price fluctuations don’t impact the terms of your CD, only the price if you were to sell the CD before it fully matures. You can always hold a CD you bought as a new issue to maturity to collect your par value (the face value of the CD) plus interest. If you buy a CD on the secondary market at a premium, you'll receive the CD's principal at maturity—which will be less than what you paid for it.

Brokered CDs trade on the secondary market somewhat like bonds do. Although brokered CDs can be held to maturity to receive par value, they can also be traded before maturity at a rate determined by the current market rates. When interest rates rise, the prices of existing CDs with lower rates (and therefore paying less interest) will fall. Because who would want to pay full price for a CD with a lower interest rate than what someone could get buying a new CD? When interest rates on new CDs fall, though, existing CDs with higher rates have higher market prices. Keep in mind too that because the secondary CD market isn't very liquid, if you sell before maturity, you're likely to lose money.

Let’s walk through an example. Say you’re holding a brokered CD that you bought with an interest rate of 3%, and 6 months later, market interest rates increase to 4%. The market value of your CD would go down. That’s because an investor could now receive a higher return on their investment by buying a new CD, of a similar maturity date, in the market than buying your CD with the 3% interest rate you’re locked into. Conversely, if you bought a CD with an interest rate of 3% and market rates decrease to 2%, the market value of your CD would rise because your CD contract rate is better than what an investor could now get in the market. Investors often refer to this pricing effect as the "bond seesaw," because an increase or decrease in interest rates has an inverse effect on the price of a bond or CD.

How to buy CDs

Buying bank CDs and brokered CDs are slightly different processes. Here’s a breakdown of the steps to buy either kind of CD.

How to buy bank CDs

- Choose a bank: It could be easiest to find out if your current bank offers CDs. Or you could seek out banks with the best CD rates for your timeframe.

- Select your CD: You’ll want to pick a term length that aligns with your financial goals and current savings. Remember, the only way to access your cash prior to maturity would be to incur an early withdrawal penalty, so you’ll be saying “see you later” to this money until that maturity date.

- Set your renewal preference: Some banks automatically reinvest the money from your CD plus interest earned once your CD reaches maturity. Double-check how your renewal preferences are set up in case you don’t want your cash reinvested.

How to buy brokered CDs

- Choose a brokerage: To buy a brokered CD, you need an account that has CD trading capabilities (like an IRA or brokerage account) at a brokerage firm. Research whether your brokerage imposes any fees or commissions for trading CDs. If you’re investing small amounts, commissions could have a significant impact on your returns.

- Review options: Typically, brokerages offer CDs from many different banks with varying rates. Look at a variety of choices within your desired timeframe to lock in the best rate for your dollars.

- Make a trade/purchase: It’s go time. Once you’ve confirmed the CD term length and the amount you want to invest, execute the trade or buy your CD. Typically, brokered CDs require purchase minimums and multiples of $1,000. Fidelity also offers fractional CDs, with lower minimums and at increments of $100.

- Set renewal options: Brokered CDs don't automatically renew into a new security; instead, the CD’s interest plus principal are automatically paid into your cash core position. However, some financial institutions have services that help you re-invest those dollars after your CD matures. At Fidelity, we have an auto roll service that allows you to automatically reinvest into a new CD that meets your criteria once your position reaches maturity.