Even your IRA gets paperwork. If you contributed to an IRA during a particular tax year, you should receive Form 5498 from the financial institution that holds your plan. This form's job is to tell the IRS how much you contributed, an important detail if you're eligible for a deduction. It's also used to report rollovers, track required minimum distributions (RMDs), and record your accounts' fair market value. So what's on Form 5498—and what are you supposed to do with it?

What is Form 5498?

Form 5498 is an IRS tax document that reports your IRA contributions. That includes any contributions you've made to:

- Traditional IRAs

- Roth IRAs

- SEP IRAs

- SIMPLE IRAs

The financial institution that holds your IRAs typically keeps track of your contributions and shares this info with the IRS. As the account holder, you don't actually need to file Form 5498, but keeping Form 5498 for your records could be useful to track your IRA transaction activity. Note: If you're making non-deductible traditional IRA contributions, you'll need to file Form 8606.

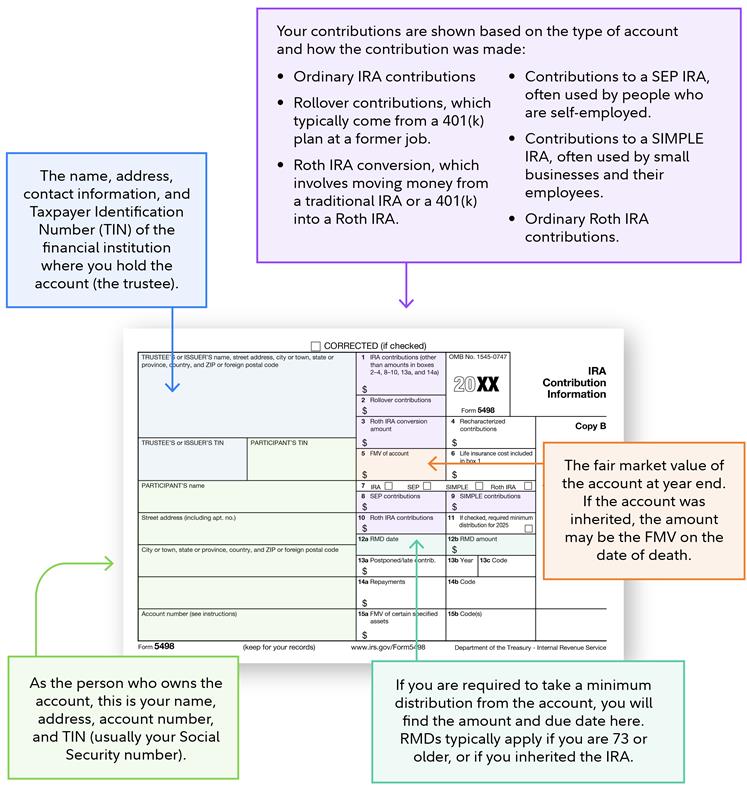

What's on Form 5498?

Form 5498 tracks important IRA transactions for the year. That includes:

- Contributions

- Rollovers

- IRA conversions

- Required minimum distributions (RMDs)

Form 5498 also documents the fair market value (FMV) of your IRA account at the end of the year. In the rare case you have an endowment contract with a life insurance company, a portion of your IRA contributions might be allocated to the cost of life insurance. Because that allocation counts against your IRA contribution limit, it's also included on Form 5498.

Now let's take a closer look at what's on the form using the blank sample below. If you receive this form, there will be info pre-filled in many of these boxes. We've added explanations for the most common.

Other boxes, like recharacterized contributions in box 4 and boxes 13a through 13c apply to a smaller subset of people. These savers transferred funds from one IRA type to another, made a rollover contribution more than 60 days after a distribution, or are allocating contributions to a different tax year. Boxes 14a and 14b also are filled out only for a smaller group—people who are repaying a qualified distribution, say, because of an emergency personal expense. Similarly, boxes 15a and 15b are for people with uncommon assets in their IRAs, such as stock in a company that isn't readily tradable on an established securities market. Here's how to read your Form 5498.

Who receives Form 5498?

Account holders who contributed to a traditional IRA, Roth IRA, SEP IRA, and/or SIMPLE IRA in a given year should receive Form 5498. If you didn't make any IRA contributions in a given tax year, you will not receive Form 5498.

How to find your 5498

Your IRA provider will provide you with your Form 5498 if you are eligible to receive one. They may send it to you via mail or digitally. You may also be able to find it on their website. At Fidelity, you can find your Form 5498 by following these steps:

- Log in to your Fidelity account from Fidelity.com.

- Under the "Accounts & Trade" menu, select "Tax Forms & Information."

- Select the blue button labeled "View your tax forms." If Form 5498 is scheduled to be available at a later date, you'll note "In Progress" under the "Status" column.

When is Form 5498 issued?

Every year, financial institutions that hold IRAs are required to file Form 5498 with the IRS by May 31. Yes, that's after your annual tax filing deadline in mid-April. That's because you can make prior-year IRA contributions up until the federal tax deadline. At Fidelity, Form 5498 becomes available to IRA account holders in May.

Who issues Form 5498?

Form 5498 is issued by the financial institution that holds your IRA. You will receive a separate Form 5498 for each IRA you contributed to in a given tax year. So if you contributed to a traditional IRA at one firm and a Roth IRA at a different firm, you'd receive 2 Form 5498s because you have 2 IRAs. You'd also receive 2 Form 5498s if you contributed to a traditional IRA and a Roth IRA, both held at the same firm.

What do you do with Form 5498?

Form 5498 is informational—again, you don't need to file it with your tax return—but it may help guide your future distribution decisions. Let's say you want to withdraw from your Roth IRA. Taking out investment earnings beyond your contributions could result in taxes and penalties before retirement age and meeting other criteria. If you hold on to your 5498 forms, you'd have a clear contribution record. You'd be able to add up all the contributions you made in prior years, take off prior withdrawals, consider converted balances, and determine earnings. Then, you could calculate how much you could potentially withdraw. You couldn't check out old tax returns to get this info, as Roth IRA contributions are rarely reported on them.

What happens if your Form 5498 shows you contributed too much to an IRA?

If Form 5498 shows that you contributed more than the allowable limit to a traditional or Roth IRA, you have a few ways to correct this mistake. Check out our guide to what happens if you overcontribute to an IRA for more information.

Who needs to file Form 5498?

No individual taxpayer needs to file Form 5498 with their tax return. You can think of this document as an FYI for your own IRA record-keeping. Your financial institution will automatically share Form 5498 with the IRS.

What to do if you don't get Form 5498

If you don't receive Form 5498, don't worry. If you made IRA contributions for the previous tax year, you can contact the financial institution that houses your account and request the form. Because you don't need to file this form yourself, it's normal to receive Form 5498 after the federal tax filing deadline.