When tax season rolls around, you'll probably receive a handful of documents. Form 1099-R might be among them. This form gives a record of certain income you may have received during the previous calendar year. It's common for retirees to receive this form, but it's also possible to get it during your working years. Here's a look at what Form 1099-R is, what information is on it, and what you need to do with the form.

Who receives Form 1099-R?

If you've received at least $10 from one of the above-mentioned income sources, you should have a 1099-R coming your way. You may also receive a 1099-R if you:

- Rolled retirement funds from one account to another, including Roth conversions and backdoor Roths

- Made excess contributions to an IRA or 401(k)

Keep in mind that retirement account loans, including 401(k) loans, aren't considered withdrawals (or "distributions," as the IRS calls them). That's because you're obligated to pay back these loans. They're only reported on Form 1099-R is if you stop making your payments or leave a job and aren't able to repay the loan amount by the deadline. At that point, the loan is treated as a distribution.

What is Form 1099-R?

Form 1099-R is an IRS tax form used to report income received from:

- Retirement plans, such as a 401(k)

- IRAs

- Pensions

- Profit-sharing plans

- Annuities

- Insurance contracts

- Survivor income benefit plans

Form 1099-R details key information, including how much you received over the course of the year and how much is taxable. It's one of many variations of Form 1099. Others include:

- 1099-DIV: Income received from stock dividends

- 1099-INT: Interest income

- 1099-NEC: Nonemployee compensation (for freelancers and independent contractors)

When is Form 1099-R issued?

Any plan administrator or financial institution that pays out distributions to you during the year must issue a Form 1099-R no later than January 31st of the following year.

What's on Form 1099-R?

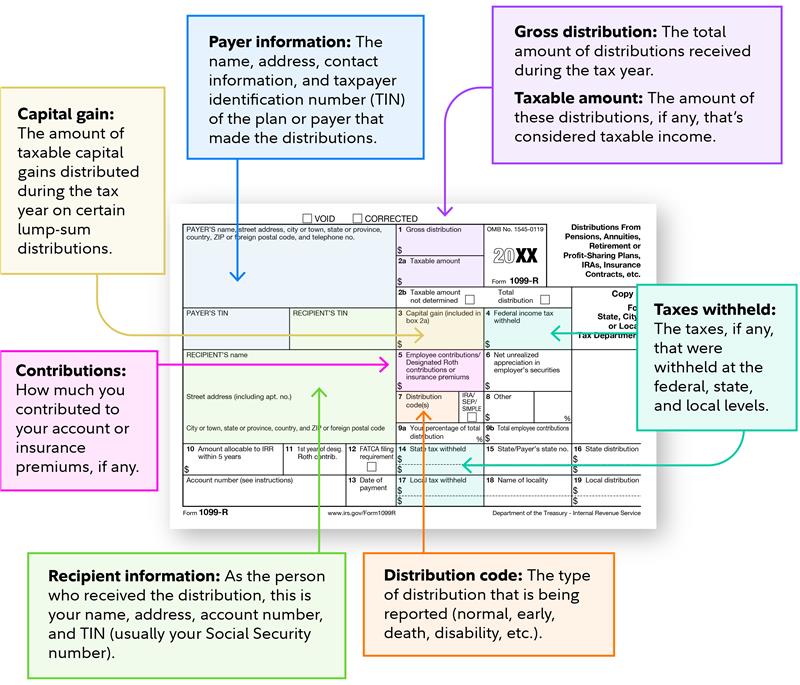

Form 1099-R contains a lot of information, which might feel overwhelming. We've flagged the most important parts below.

- Payer information

- Recipient information

- Gross distribution

- Taxable amount

- Taxes withheld

- Distribution code

Here's what it looks like on the actual form. This one has blank boxes; you'd receive one with relevant boxes filled out. The most commonly filled-out boxes are highlighted in the following image.

Less universally relevant boxes include box 2b. If the organization that holds your account can't figure out the amount in distributions you owe taxes on, they'll put an X in the leftmost box. If you emptied a retirement account in a single year, there will be an X in the rightmost box within box 2b. Another less commonly filled-out section is box 6. An amount may appear here if you've withdrawn from a qualified plan (that isn't a qualified distribution from a Roth account) that includes securities from the employer corporation (or a related business).

Form 1099-R distribution codes

Your 1099-R should include a distribution code, which shows what kind of distribution you received. These codes tip you off about which distributions you may owe taxes on. As of 2025, there are 30 1099-R distribution codes.

- 1: Early distribution, no known exception (in most cases, under 59½)

- 2: Early distribution, exception applies (like for a Roth IRA conversion)

- 3: Disability

- 4: Death

- 5: Prohibited transaction

- 6: Section 1035 exchange (for the tax-free exchange of life insurance, annuity, qualified long-term care insurance, or endowment contracts)

- 7: Normal distribution

- 8: Excess contributions plus earnings/excess deferrals (and/or earnings) taxable in 2025

- 9: Cost of current life insurance protection

- A: May be eligible for 10-year tax option (for people born before January 2, 1936 and their beneficiaries)

- B: Designated Roth account distribution

- C: Reportable death benefits under section 6050Y

- D: Annuity payments from nonqualified annuities and distributions from life insurance contracts that may be subject to tax under section 1411

- E: Distributions under Employee Plans Compliance Resolution System (EPCRS)

- F: Charitable gift annuity

- G: Direct rollover and direct payment

- H: Direct rollover of a designated Roth account distribution to a Roth IRA

- J: Early distribution from a Roth IRA, no known exception

- K: Distribution of traditional IRA assets not having a readily available FMV (fair market value)

- L: Loans treated as deemed distributions under section 72(p)

- M: Qualified plan loan offset (usually from employment severance or plan termination)

- N: Recharacterized IRA contribution made for 2025

- P: Excess contributions plus earnings/excess deferrals taxable in 2024 or a previous year

- Q: Qualified distribution from a Roth IRA

- R: Recharacterized IRA contribution made for 2024 or a previous year

- S: Early distribution from a SIMPLE IRA in the first 2 years, no known exception

- T: Roth IRA distribution, exception applies (such as the participant is 59½, has died, or has become disabled, and the 5-year holding period has not been met)

- U: Dividends distributed from an employee stock ownership plan (ESOP) under section 404(k)

- W: Charges or payments for purchasing qualified long-term care insurance contracts under combined arrangements

- Y: Qualified charitable distribution (QCD) claimed under section 408(d)(8)

What do you do with Form 1099-R?

If you receive a 1099-R, you (or your tax preparer) will need the information for your income tax return. Check out your 1099-R's gross distribution (box 1) and taxable amount (2a) from each of your retirement income sources. You'll likely need to copy over these amounts to their relevant lines on Form 1040.

Do you have to pay taxes on income reported on Form 1099-R?

Whether the distributions reported on Form 1099-R are taxable depends on the type of account they came from and the nature of the distribution (for example, whether it was a standard or early distribution). Here's how the tax rules break down for distributions taken from retirement accounts.

- Roth IRAs: You can withdraw contributions at any time, without tax or penalty. You may be taxed or penalized for tapping investment earnings if you're younger than 59½ and/or withdrew earnings less than 5 years from the beginning of the tax year of your first contribution to the account.1

- Traditional IRA or traditional 401(k): Distributions are generally treated as taxable income. You could also face a 10% early-withdrawal penalty if you're younger than 59½ and don't meet one of the IRS exceptions, relating to birth or adoption, death or disability, or qualified education expenses, among others.2,3

If you aren't sure of your tax liability, make sure to consult a tax professional.

What do you do if you don't get a Form 1099-R?

Form 1099-R is required to be delivered to you by early March. At Fidelity, most customers will have their Form 1099-R delivered by January 31. If you expected to receive a Form 1099-R but haven't gotten it by that date, contact the employer that sponsors your 401(k) or the entity that manages your other accounts.

What do you do if there's an error on your 1099-R?

If you come across a potential error on your 1099-R, immediately contact the plan administrator or other institution that issued the form. They should be able to correct it and issue a new one.

What to consider when filing your taxes with Form 1099-R

If you get Form 1099-R but don't copy over the distribution amounts onto the Form 1040 you'll file, the IRS could send you an underreported income notice, CP2000. It could say you owe additional taxes, penalties, and interest. Or you might not owe anything at all. To avoid getting that notice, make sure your tax return includes distributions listed on Form 1099-R.

Still, just because you've received Form 1099-R doesn't mean you owe income taxes on your distributions—but you might. Be sure to double check the numbers on your 1099-R against your own records to make sure they match. If they don't, request a correction from the form issuer as quickly as possible.

When in doubt, consider working with a tax professional who has a deep understanding of the various forms you receive each year and can help you file your taxes.