By this time next year, you could have an extra $1,300 in savings. And all you need is $1 to start. Meet the 52-week money challenge—a simple plan that could help you turn relatively small weekly savings throughout the year into a tidy sum.

What is the 52-week money challenge?

The 52-week money challenge could help you build a savings habit by putting away an amount of money that corresponds to the week you save it.

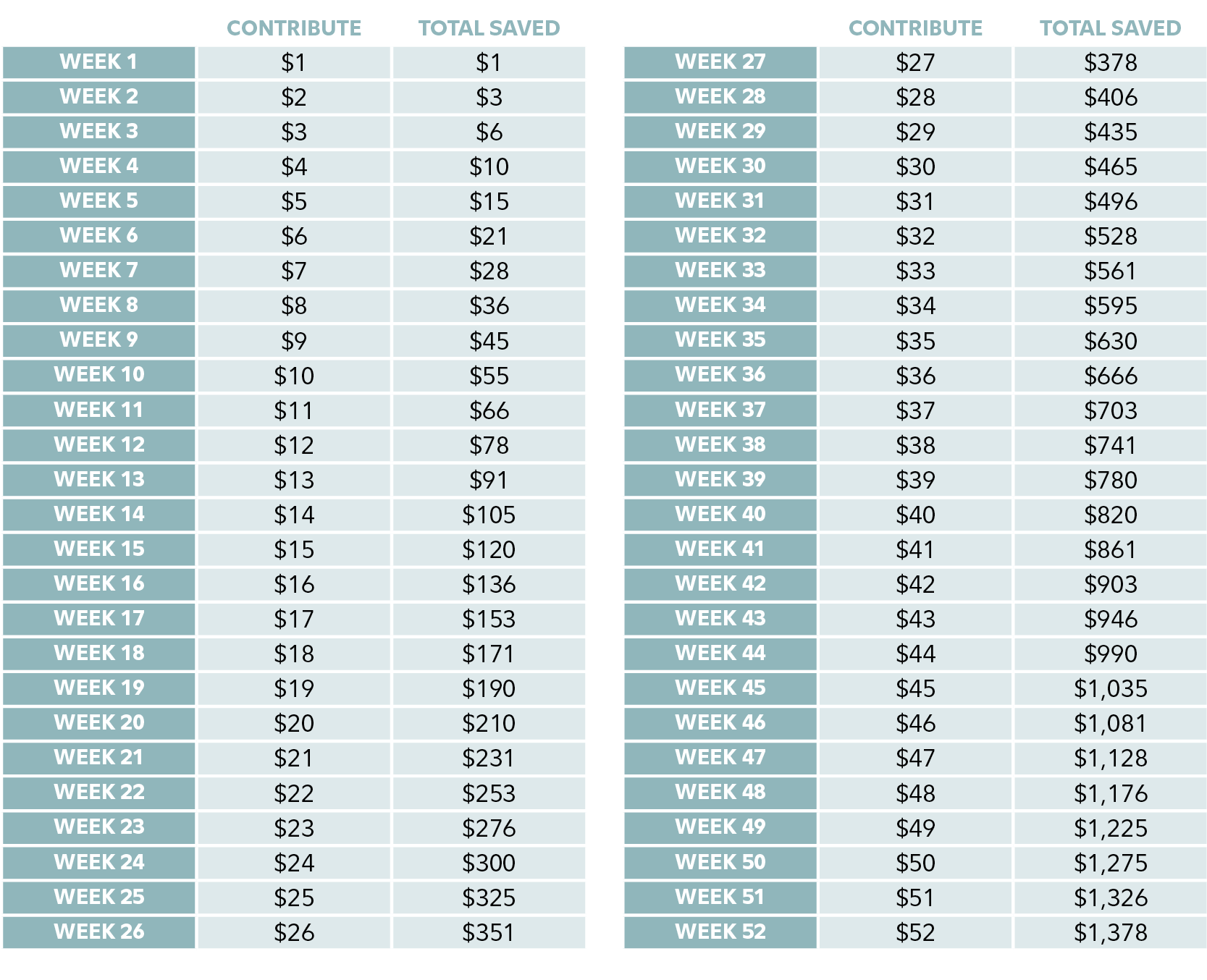

So, start with $1 in week 1. In week 2, save $2. In week 3, save $3. In the last week, save $52—you'll have stashed away a total of $1,378.

52-week money challenge1

How to do the 52-week money challenge

To do the 52-week money challenge most effectively, you'll want to pick an account to park your savings in. You could opt for a normal checking or savings account. Or you can consider the following options that may be offered at banks or other financial institutions.

- A high-yield savings account. Think of this as the savings account you already know and love—with an extra kick. As the name implies, the interest rates you'll find on high-yield savings accounts typically exceed the national average, which can help your savings grow. High-yield savings accounts are generally available with FDIC insurance.

- A cash management account. Cash management accounts are a special type of brokerage account that functions kind of like a hybrid checking and savings account. They also allow you to buy securities including certificates of deposit (CDs)—investments that generally pay a set rate of interest over a fixed time period.

- An investment account. Whether you opt for a regular taxable brokerage account or a tax-advantaged retirement account like an individual retirement account (IRA), investing your money, while risk of loss is involved, could give it a chance to grow over time. You may associate these types of accounts with investments such as stocks, bonds, mutual funds, and money market funds.

You could lose money by investing in a money market fund. An investment in a money market fund is not a bank account and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Before investing, always read a money market fund’s prospectus for policies specific to that fund.

Advantages of the 52-week money challenge

It establishes a savings habit Whether you're a long-term saver looking to spice things up or you're just getting started with your savings journey, trying (and sticking with) the 52-week money challenge can help cement a savings habit. After a year of regularly saving money, you may find yourself more motivated to continue saving going forward.

Keep in mind that ideally the 52-week challenge isn't your entire savings strategy, but a complement to it. You'll still want to work toward saving Fidelity's suggestion of at least 15% of your pre-tax income for retirement including any company match and 5% of your post-tax income for short-term savings.

It may highlight your spending habits If you aren't a natural saver, the idea of saving $52 in the final week of the challenge may seem like way too much. But saving $1 in the first week sounds doable. The 52-week money challenge allows you to work up to that milestone after a year of building your saving habit. If your budget is tight today, you should have plenty of time to figure out how to free up more money to save. Check out our guide on how to budget to start getting a handle on your spending and saving.

You'll end the challenge with over $1,300 saved If you successfully complete the 52-week money challenge, you'll have $1,378 set aside. You may have that earmarked for a specific financial goal—or you may choose to put it in a high-yield savings account as the start of emergency savings, if you don’t already have a stash. Once you've achieved some of these financial goals, you could consider putting this money to work by investing it—giving it a chance to potentially grow more that it would in a savings account.

You can personalize it to fit your needs and goals While the formula laid out above is the most common way to complete it, it isn't the only way. You can customize it to help you reach your personal money goals and preferences. For example, if you want a hands-off approach to the challenge, you could automate a transfer from your checking to savings account for $26.50 each week and wind up with the same amount. You can also adjust the amount you contribute so you have more than $1,378 at the end of the year.

Also, you don't have to align the 52-week challenge to any particular time of year. But it can also be a New Year's resolution if you want to focus on saving or investing.