If you earn money outside of your regular job, you need to tell the IRS about it. You might get a copy of IRS Form 1099-MISC, which lays out certain types of miscellaneous income you received during the previous tax year. What are you supposed to do with Form 1099-MISC? Here's what you need to know and how to use this information when filing your tax return.

What is a 1099-MISC?

A 1099-MISC is a tax form that shows taxable income you received outside of work. It's specific to certain types of miscellaneous income (hence the "MISC"). This is different from cash you may have earned from a side gig or freelancing, which is reported on Form 1099-NEC (aka nonemployee compensation). Businesses and individuals prepare and file a 1099-MISC for payments made to people who aren't employees, contractors, or freelancers.

1099 forms exist because the IRS wants to know about all sources of taxable income. If you earn a salary from a job, your payroll department reports that information to the IRS. Form 1099-MISC serves the same function, but for miscellaneous income unrelated to a job you've done that generates income reported on Form W-2.

Whoever made the miscellaneous income payment to you must complete this form and send 1 copy your way and another to the IRS. If you received miscellaneous income from multiple parties, you should receive multiple 1099-MISC forms.

Who receives a 1099-MISC?

Form 1099-MISC is sent to people who received specific types of income during the previous year above certain thresholds. Here are some of the more common reasons to receive a 1099-MISC and the minimum payments that would trigger receiving the form:

| You were paid at least $10 in: | You were paid at least $600 in: | You were paid at least $5,000 for: |

|---|---|---|

| Royalties or broker payments in lieu of dividends or tax-exempt interest |

• Rent (but only by a commercial tenant) • Prizes and awards • Medical and health care payments • Crop insurance proceeds • Cash for fish or other aquatic life if catching fish is your business or trade • Cash paid from a notional principal contract (like for swapping equities or commodities) to an individual, partnership, or estate • Payments to an attorney • Fishing boat proceeds |

Consumer products the buyer intends to resell outside of a permanent retail establishment |

What is reported on a 1099-MISC?

The 1099-MISC has several pieces of important information:

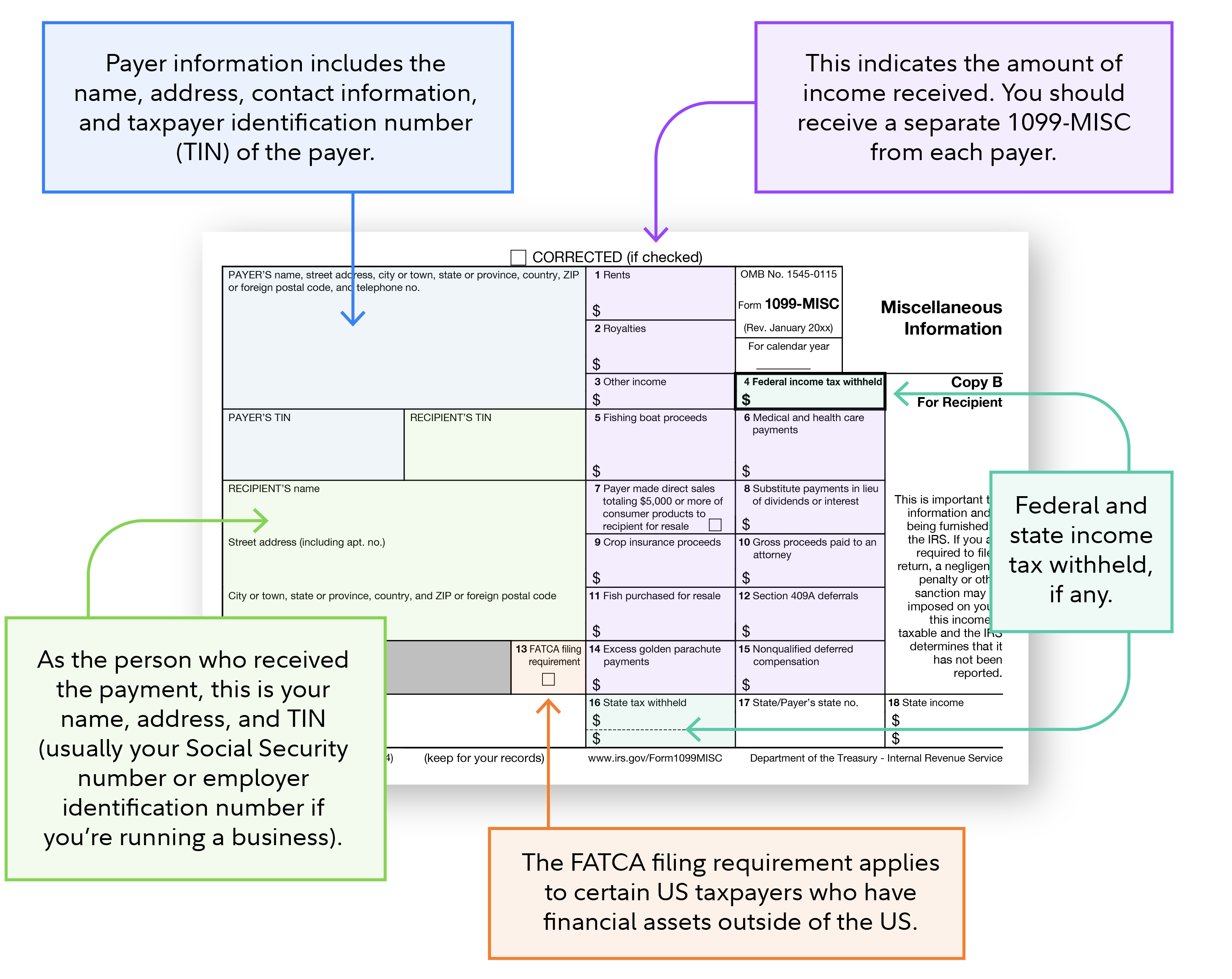

- The payer's name, address, phone number, and taxpayer identification number (TIN)

- The recipient's name, address, and TIN (or Social Security number or employer identification number)

- The amount and type of income received

- Whether the payer withheld federal or state income taxes

- Whether the Foreign Account Tax Compliance Act (FATCA) filing requirement is necessary, which applies to certain US taxpayers who have financial assets outside of the US

When is a 1099-MISC sent?

Payers are supposed to send out 1099-MISC forms to payees by January 31 for the previous year's income. You should have all your forms by mid-February, giving you plenty of time to complete your tax return by the filing deadlines.

What should you do if you don't get a 1099-MISC?

If you're expecting a 1099-MISC but don't receive it, you can reach out to the payer and ask for an update. They may have forgotten, or the form may not be required, perhaps because your payment was below the reporting threshold.

Luckily, you don't need any 1099-MISCs to file your tax return. That's because the payer files the form, not the payee. Still, you'll need to account for all your income on your return, including income from payers that didn't send you a 1099-MISC form. You can check your bank statements or the platform where you received payment to figure out how much to report to the IRS.

Another option is calling the IRS for guidance at 800-829-1040. They can contact the payer and request a 1099-MISC form.

What do you do if there's an error on your 1099-MISC?

If you catch an error on your 1099-MISC form, that means the IRS also has incorrect information. That could lead to an error in calculating your tax bill or refund.

Notify the payer of the mistake. Then ask them to send an amended 1099-MISC to both you and the IRS. You can also ask the payer to give you a letter explaining what went wrong. That way you'll have evidence if the IRS asks for verification.

If you can't reach the payer, report the accurate numbers on your tax return and attach an explanation with the incorrect 1099-MISC. It's possible you could be audited, and the IRS might want more information to verify your return. They may request your bank statements and other proof showing the true amount you received from the payer. Consult a tax professional regarding your personal situation.

1099-MISC instructions

If you receive a 1099-MISC tax form, you might be wondering how to use the information on it to file your return. The process is relatively straightforward.

Step 1: Collect all your 1099-MISC forms

Gather all your 1099-MISC forms for the tax year. Confirm that the reported payments and all other details are correct.

Step 2: Report the combined income on the appropriate tax form

If you receive miscellaneous income as an individual:

1. Complete Schedule 1, Additional Income and Adjustments to Income.

2. Report the total income as "other income" on your 1040 tax return.

If you're operating as a business:

1. Report the information from Form 1099-MISC on the appropriate business entity tax return, such as a Schedule C for a sole proprietorship or a Form 1065 for a partnership.

If you work with a tax pro, you can simply provide all your tax forms and let them report your 1099-MISC income on the appropriate form and complete your tax return.

Step 3: File your tax return

You'll report your 1099-MISC income alongside your other income for the year. You can calculate your tax bill based on your total taxable income, minus any tax deductions or credits you're claiming.

Step 4: Keep your 1099-MISC forms for your records

Again, you don't need to submit your 1099-MISC forms when you file your tax return. But it's a good idea to hold onto them in case of an audit. The IRS recommends keeping supporting documents like 1099 forms for 3 years after you file.