What is a 1099-DIV?

A 1099-DIV is a tax form that reports certain kinds of investment income. It's one of many 1099 forms, all of which report income outside of employee wages. The “DIV" in 1099-DIV refers to dividend payments from stocks, or when companies distribute some of their profits to shareholders. A 1099-DIV also reports capital gains distributions from mutual funds.

Who receives a 1099-DIV?

You’ll receive a 1099-DIV if:

- You earn at least $10 in dividends in a taxable brokerage account. Retirement accounts like 401(k)s and individual retirement accounts (IRAs) defer taxes, so investors don’t receive a 1099-DIV for dividends in these accounts.

- You receive capital gains distributions from a mutual fund. Even if you personally didn’t sell investments, if assets in a mutual fund you’re invested in were sold and the proceeds were passed along to fund investors, you’re on the hook for taxes. The 1099-DIV will clarify what part of the distribution is considered taxable income.

Brokers, banks, and other financial institutions prepare and send out 1099-DIV forms so investors know what income to report to the IRS. The IRS also receives a copy of each 1099-DIV to track a person's taxable investment income.

What’s on a 1099-DIV?

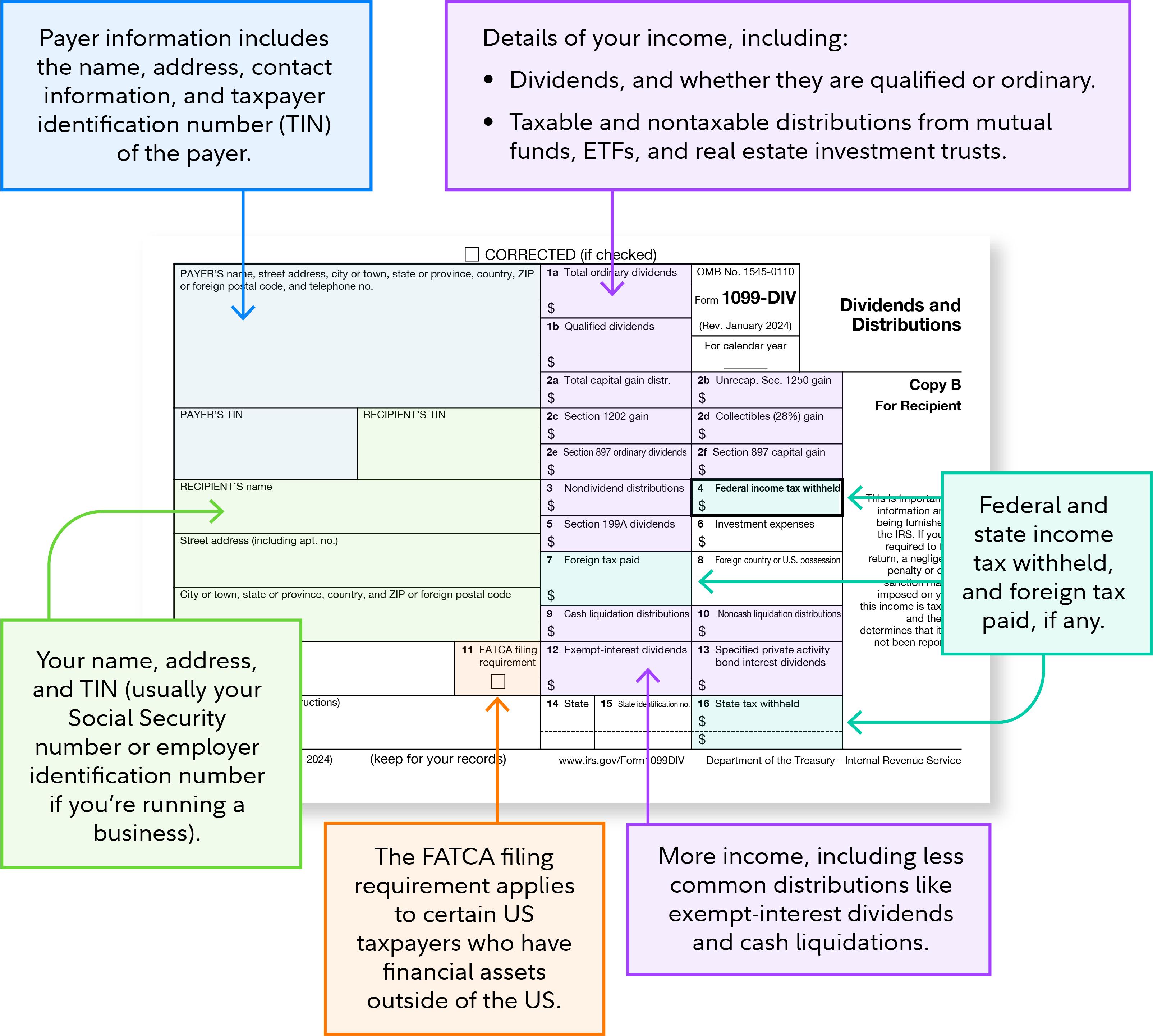

On the left side of a 1099-DIV, you’ll see your name, address, and taxpayer identification number (TIN) or Social Security number. This side of the form will also include the name, address, and tax ID number of the company that issued your 1099-DIV.

On the right side, you’ll see information about your investment income. This includes a series of boxes showing:

- Your dividend income and whether these dividends are considered qualified or ordinary.

- Any taxable distributions from mutual funds, exchanged-traded funds (ETFs), and real estate investment trusts (REITs), along with how the distributions should be reported for taxes.

- Any nontaxable distributions that aren’t factored into your dividend income.

- Any federal or state taxes that were withheld from your investment income.

The remaining boxes list other less common distributions, like exempt-interest dividends and cash liquidations. A 1099-DIV also shows if you paid any foreign tax.

Here is an example of a 1099-DIV, to give you an idea of what to expect.

Qualified vs. ordinary dividends on 1099-DIV

A 1099-DIV will show if your dividends are considered qualified or ordinary. The latter is taxed as ordinary income, aka subject to tax at your marginal rate, which could be as high as 37% for tax year 2025. Qualified dividends, on the other hand, are taxed at a more favorable long-term capital gains tax rate, ranging from 0% to 20%, depending on your income and tax-filing status. Higher earners are also impacted by the 3.8% net investment income tax (NIIT). Still, taxes on ordinary dividends tend to be higher than on qualified dividends.

How does a dividend qualify for the capital gains tax rate? Qualified dividends are generally from shares in domestic corporations and certain qualified foreign corporations. They must satisfy the following holding period requirements too:

For mutual funds

- The fund must have held the security unhedged (no puts, calls, or short sales associated with the shares during the holding period) for at least 61 days out of the 121-day period that began 60 days before the security’s ex-dividend date. (The ex-dividend date is the date after the dividend has been paid and processed and any new buyers would be eligible for future dividends.)

- For certain preferred stock, the security must be held for 91 days out of the 181-day period, beginning 90 days before the ex-dividend date. The amount received by the fund from that dividend-generating security must have been subsequently distributed to you.

- You must have held the applicable share of the fund for at least 61 days out of the 121-day period that began 60 days before the fund’s ex-dividend date.

For stocks

- You must have held those shares of stock unhedged for at least 61 days out of the 121-day period that began 60 days before the ex-dividend date.

- For certain preferred stock, the security must be held for 91 days out of the 181-day period beginning 90 days before the ex-dividend date.

When is a 1099-DIV sent?

Financial institutions are supposed to send out 1099-DIV forms by January 31 of the following tax year. For tax year 2025, forms should be distributed by January 31, 2026. That way, investors have plenty of time to prepare their tax returns by the tax-filing deadline in mid-April.

What should you do if you don’t get a 1099-DIV?

If you’re expecting a Form 1099-DIV and don’t receive it by early February, contact your broker or financial institution. Confirm that you were supposed to receive the form. It is possible you didn’t earn enough in dividends to require a 1099-DIV. If you were supposed to receive a 1099-DIV and it never arrived, ask the company that issued your 1099-DIV to send you a replacement. You still can prepare your tax return without the form by reviewing your brokerage statements and determining how much you received in dividends and other taxable investment income during the year. Of course, it’s ideal to confirm the information from a 1099-DIV. If your reported numbers aren’t correct, you could owe additional taxes or face IRS penalties. You can ask the IRS for help collecting a missing 1099-DIV form by calling 800-829-1040.

What do you do if there is an error on your 1099-DIV?

If there’s an error on your 1099-DIV, tell your broker or investment firm about the issue. Ask them to send a revised 1099-DIV with the correct information. They should also send an updated copy to the IRS.

If you can’t reach them to fix the error, you can complete your tax return using the correct dividend information. The IRS may reach out to ask about the discrepancy after you file. Be prepared to provide your investment statements to prove there was an error and show the correct amount of investment income. If you already filed your return before realizing there was an error, you can submit an amended return using Form 1040-X.

1099-DIV instructions

1. Collect all your 1099-DIV forms

If you have multiple 1099-DIV forms, gather them either for your tax preparer or for your personal records. This is how you or they will determine your total taxable dividend/mutual fund profit income and the taxes withheld.

2. Report your 1099-DIV income

If you’re preparing your own taxes, use your 1099-DIV forms to complete Form 1040, US Individual Income Tax Return. Enter dividend and other investment income where applicable. For example, lines 3a and 3b on Form 1040 ask for your total qualified dividends and ordinary dividend income for the year.

3. Complete a Schedule B if needed

If you received more than $1,500 in dividends throughout the tax year, you likely need to complete a Schedule B, Interest and Ordinary Dividends. This form asks you to list all the companies that paid you dividends, and the amount you received from each one. Then, attach your completed Schedule B to your tax return.

4. File your tax return and save your 1099-DIV for your records

As a last step, you need to submit your tax return—but don’t include your 1099-DIV forms with it. Instead, keep these forms for your records in case of an audit. The IRS generally recommends holding these forms for 3 years after you file.

A tax preparer or software program can help you properly report your investment income from a 1099-DIV. If you have a lot of investment income, working with a pro could give you peace of mind.