For better or worse there's no mandatory retirement age in the US. Americans can work as long as they want or are able to. That may actually be a good thing because, in some circumstances, work can actually be … great. Beyond the paycheck and benefits, it can provide structure and routine, camaraderie, and a sense of purpose—it may even help you live longer.1

Deciding when you can retire

The age at which you choose to stop working can have a big impact on how much income you need from your own savings. The average retirement age in America is about 65 for men and 62 or 63 for women (the 2020 COVID pandemic may have skewed the results down slightly for women due to caretaking).2 At 62, you can start claiming Social Security benefits. But if you're able to wait, your monthly Social Security benefit increases 8% every year you delay between age 62 and 70.

Consider using Fidelity's retirement guidelines to quickly gauge whether you are on track to retire at a given age. To retire at 67, we suggest aiming to save 10 times your final salary. To retire at 62, you'll want to consider saving more—14 times your final salary.3 Aiming for these guideposts can help ensure that your savings can provide enough income to cover your expenses in retirement—along with Social Security.

To learn more, read Viewpoints on Fidelity.com: 4 rules for retirement savings

Of course, not everyone can choose exactly when they leave the workforce. But if you have the opportunity to retire later, here are 5 reasons to consider it.

1. You can save more for retirement

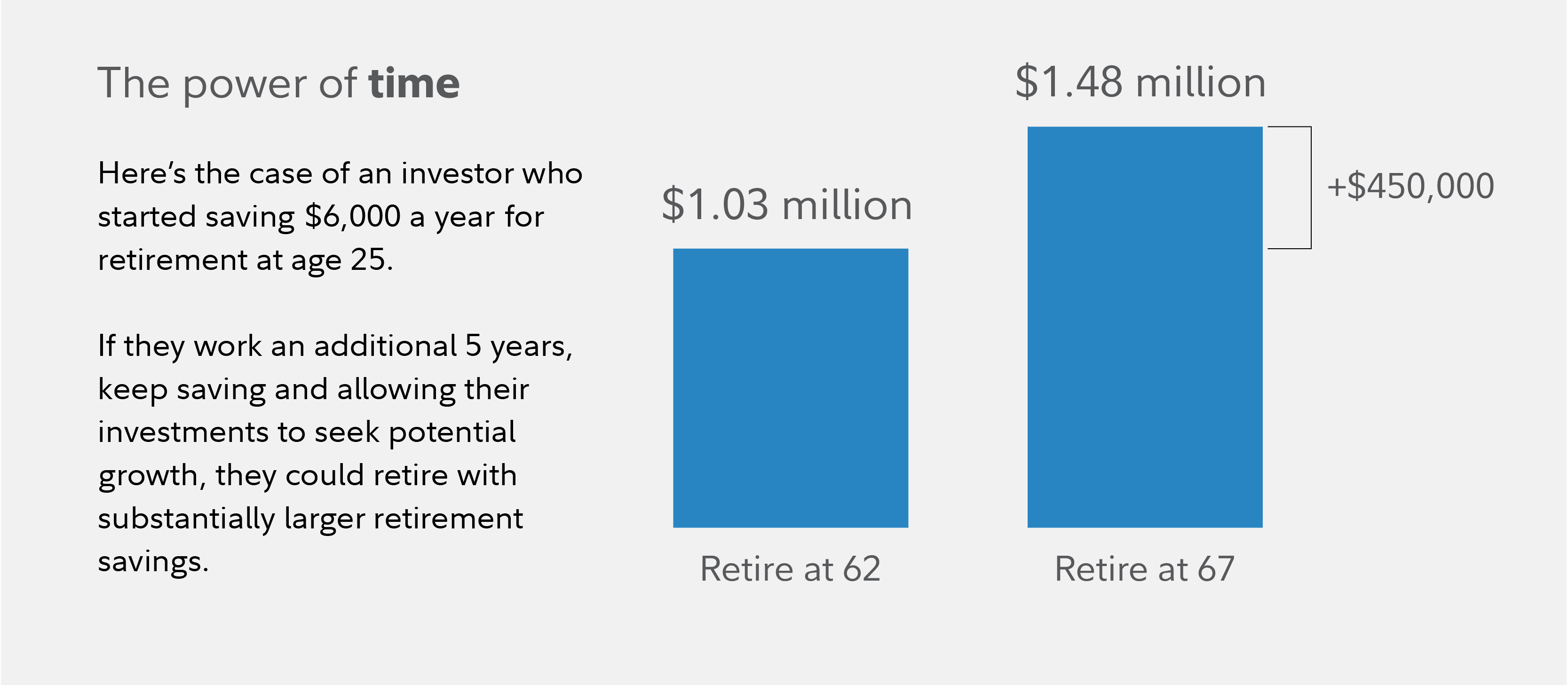

A few extra years to save can make a big difference. Time is one of the most critical elements in saving for retirement thanks to the magic of compounding. Consider the hypothetical example below in the illustration, The power of time. Delaying withdrawals and continuing to contribute to their retirement account could help our saver retire with $450,000 more than if they retired at 62.

2. Delay taking withdrawals from savings and filing for Social Security

Using your extra years in the workforce to continue saving would be ideal, but just leaving your money untouched and invested for growth potential can drastically improve your financial picture. Consider the graphic, The power of delaying withdrawals. This saver could retire at age 60 and begin withdrawals or they could choose to work for 5 more years to cover essential expenses and allow their savings to potentially grow. Even without contributing for the 5 years between age 60 and 65, their financial picture could get a boost.

A semi-retirement approach could work too. If you're able to cover your expenses with income from a job, you could delay or minimize withdrawals from investments and put off filing for Social Security benefits as long as possible. You'll get your full benefit by waiting until your full retirement age (67 for most people working now). For every year you delay your claim past your full retirement age, you get an 8% increase in your benefit. That could be at least a 24% higher monthly benefit if you delay claiming until age 70.

Read Viewpoints on Fidelity.com: Guide to working less and living more and Should you take Social Security at 62?

3. You could continue to reap employer benefits

Employer benefits can be significant. "A full-time 9-to-5 job comes with pros and cons," says Aditi Sharma, a vice president in Fidelity's Financial Solutions Team. Among the pros, she says, can be an employer contribution to your workplace retirement plan and to a health savings account, profit sharing, a flexible spending account, dental insurance, disability insurance, and life insurance.

The cons are easy to spot: Work takes up a lot of time and energy. Before retiring, "Take stock of what you will be leaving and the things your employer provides," Sharma says.

4. Work can provide physical and mental benefits

Staying physically and mentally active can keep your body and mind healthy as you age. Work is one way to help do that.

Research has found that:

- Mental challenges at work could lower the chances of later cognitive declines.4

- Men who work longer may live longer.1

- Working just 8 hours per week is enough to get the mental health and well-being benefits of working.5

5. You may live a long time

Life spans continue to lengthen. Living to age 90 was exceptional a few decades ago; now 1 in 3 people age 65 will live that long. And 1 in 7 will live to 95.6 Many of the people who live a long time may also spend a long time in good health.

To help ensure that your money lasts, Fidelity's planning tools use a default planning age of 94. For people who suspect they may be on the long-life side of the spectrum, working longer, if it's possible, could make sense.

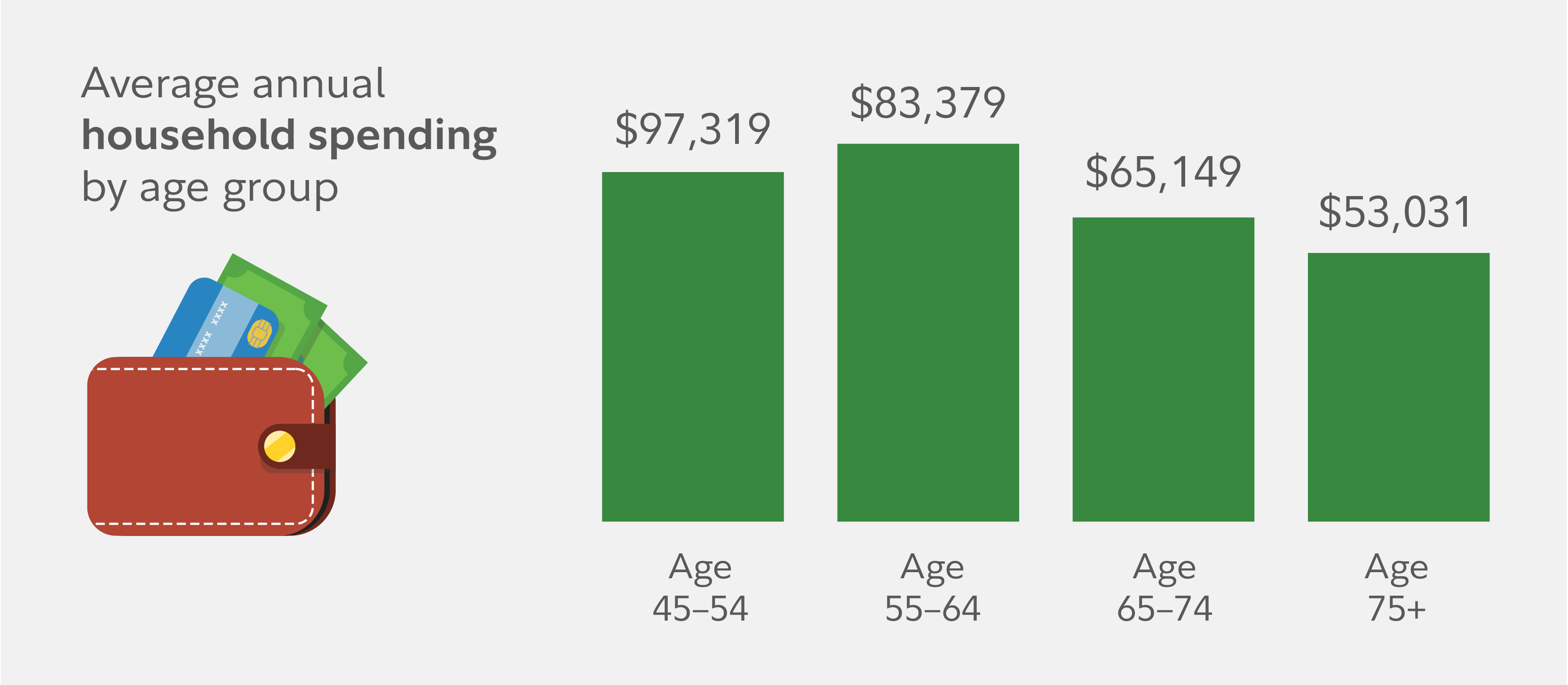

The good news is that spending tends to decrease with age, according to an analysis of US Bureau of Labor Statistics data.7 On average, US retiree households ages 45-54 spend almost $97,319 a year on a wide variety of expenses. Starting at age 55, spending tends to increase slightly, as some younger retirees travel or take on new pursuits. In the age range when most are retired at 65+, there is a significant drop in overall spending.

How to enjoy your third act

Some people would love to work for their entire lives while others would prefer more years of leisure. To help you have as many choices as possible, try to make saving for retirement a priority no matter where you are in your career.

Fidelity's guideline suggests saving 15% of your income annually—including any match you get from your employer.

If 15% is too much, start where you can. If you get a match from your employer, aim to contribute enough to get the entire match and then try to increase your contribution rate each year until you get to 15%.8

Consider investing that money for long-term growth potential. Over the long term, stocks have historically had higher returns than bonds or cash. Investors with many years before retirement have time to ride out the ups and downs in the market and the potential compounding and growth stocks can provide may help you reach your retirement goals. But balancing the growth potential of stocks with your own ability to tolerate risk is critical to staying invested for the long term.