Already maxing out your 401(k)? Earn too much to contribute to a Roth IRA? To be sure, these are good problems to have.

If you're an aggressive saver and your finances are in strong shape, you might be looking for additional ways you can save for retirement in a tax-advantaged way—beyond the basics of maxing out your 401(k) or other workplace retirement plan.

Read on for 5 strategies supersavers and high earners may be able to use to potentially sock away even more for retirement.

1. HSAs

You may be familiar with how health savings accounts (HSAs) can help cover health care costs with pre-tax dollars. But this tax-efficient savings vehicle can also be used as a powerful tool for retirement savings. One key to being able to use an HSA is that you must be enrolled in an HSA-eligible health plan at work or in the private and public marketplaces.

An HSA offers triple tax savings,1 where you can contribute pre-tax dollars, pay no taxes on earnings, and withdraw the money tax-free now or in retirement to pay for qualified medical expenses. That means if you pay qualified medical costs out of an HSA, the money you take out is tax-free.2 You can even use the money you save for nonmedical expenses after age 65 without any penalties. But note, you are taxed at ordinary income rates on nonqualified withdrawals, just as you would be with a traditional IRA or 401(k). (If you are under age 65, you pay a 20% penalty on nonmedical withdrawals, and you pay ordinary income tax in addition to the penalty.)

Because an HSA is one of the most tax-efficient savings options currently available, you may want to consider contributing the maximum allowed and paying for current health care expenses from other sources of personal savings. If you really want the power of HSA compounding to work for you, don't tap into it unless necessary, and consider investing it for long-term growth potential.

Learn more about HSA annual contribution limits and eligibility rules, and about 5 ways HSAs can help with retirement.

2. Backdoor Roth IRAs

A backdoor Roth IRA isn't a different kind of IRA. It can be a way for higher earners to access the benefits of Roth accounts. The strategy is accomplished by making nondeductible contributions—or contributions on which you do not take a tax deduction—to a traditional IRA and then converting those funds into a Roth IRA. The strategy could be useful to high earners as they may not be able to fully deduct IRA contributions, and they may not be able to contribute directly to a Roth IRA—i.e., via the "front door"—due to income limits on contributing.

The process behind a backdoor Roth strategy can be fairly simple. Set up a new traditional IRA and make a nondeductible contribution to it, and then go through the process of converting the contribution to a Roth IRA. There are no income or age requirements when making a conversion.

You can also contribute nondeductible funds to an existing traditional IRA and convert the funds to a Roth IRA. That said, if you have an existing IRA or you have more than one IRA, be aware that IRA aggregation rules will apply, meaning the IRS considers all your traditional IRAs a single tax entity. This means that any conversion will be taken on the aggregate of your accounts, and if you have deductible contributions in any of your accounts, you won't be able to only transfer the nondeductible portion.

Figuring out the taxes you may owe on a conversion can be complicated. Taxes resulting from a backdoor Roth IRA conversion can be significant, and they can also be complex. That's especially true if you have more than one traditional IRA, due to those IRA aggregation rules mentioned above.

If you're intrigued by the strategy and want to learn more, take a deep dive into the ins and outs of the backdoor Roth IRA strategy, and in particular the tax implications. Also be aware that future legislation could one day eliminate the strategy. If you're considering using a Roth conversion or the backdoor Roth as part of your retirement savings strategy, be sure to closely follow rules on conversions and speak with a tax advisor about the impact a conversion could have on your financial situation.

3. Mega backdoor Roths

A mega backdoor Roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a Roth account, based on their income or contribution limits, to transfer certain types of 401(k) contributions into a Roth—including a Roth IRA and/or Roth 401(k).

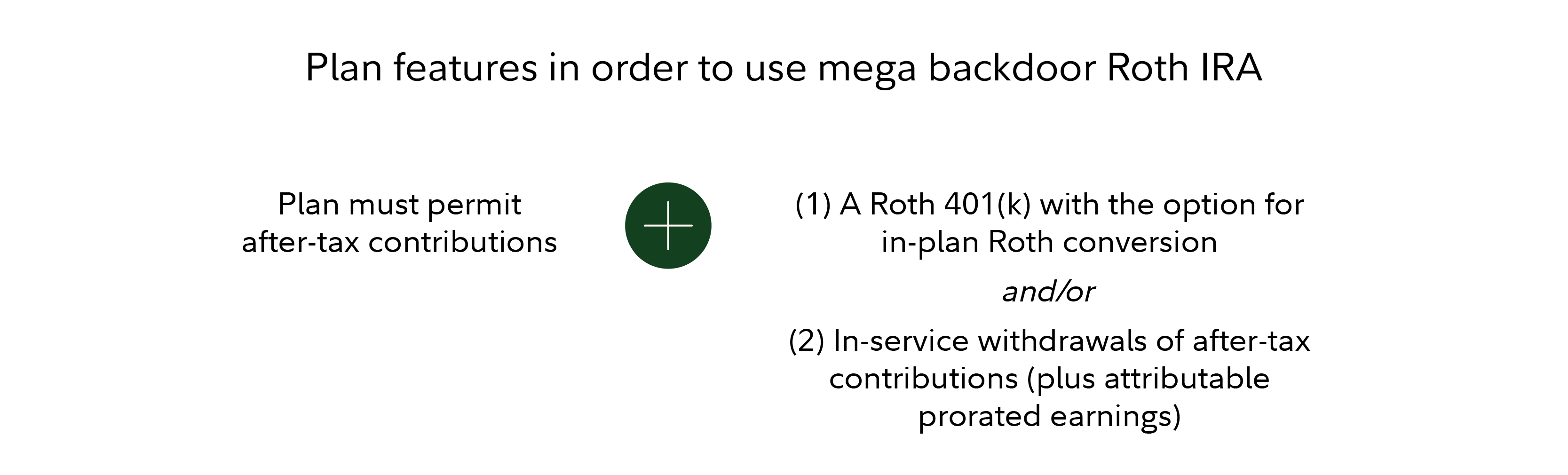

Put very simply, the mega backdoor Roth strategy entails 2 steps: (1) making after-tax contributions to your 401(k) or other workplace retirement plan, and (2) then doing a conversion either to a Roth IRA or Roth 401(k). Note that not all workplace retirement plans allow these steps, which means that not everyone will be eligible for the strategy. Here's what plans generally must permit in order to use the strategy:

If your plan permits it and you're considering using the strategy, you'll also want to be sure to understand the potential tax implications. Whether you convert to a Roth IRA or Roth 401(k), you will need to pay taxes on any earnings included in the conversion (you will not generally need to pay taxes on contributions you convert, as those amounts have already been taxed). A tax professional can advise you on the potential tax impacts of the strategy on your situation.

Similarly to the backdoor Roth strategy, future legislation could one day eliminate the mega backdoor Roth approach. So if you're considering using the strategy, you may need to stay on top of any rule changes—in addition to following your plan's rules and the strategy's tax implications.

Learn more about the ins and outs of the mega backdoor Roth strategy.

4. Tax-deferred annuities

Many savers may not realize that annuities can offer a tax-deferred way to help save for retirement.

Deferred annuities can help you grow retirement savings, once you've maxed out contributions for the year to qualified plans such as 401(k)s and IRAs, and they aren't subject to annual IRS contribution limits.3 Similar to retirement plans, any investment growth is tax-deferred and you won't owe taxes on an annual basis. Tax-deferred annuity assets can be converted into an income annuity upon retirement, which allows you to spread out the tax liability over the income stream. You may also take withdrawals from your tax-deferred annuity without converting it to an income annuity, but your gains would be taxed at ordinary income tax rates.4

There are 2 key types of tax-deferred annuities: tax-deferred fixed annuities and tax-deferred variable annuities. Tax-deferred fixed annuities have a fixed rate of return that is guaranteed for a set period of time by the issuing insurance company. In contrast, with tax-deferred variable annuities, the rate of return—and therefore the value of your investment—will go up or down depending on the underlying investment option(s) that you select, allowing you to potentially benefit from any market growth.

A tax-deferred variable annuity has underlying investment options, typically referred to as subaccounts, that are like mutual funds. There are no IRS annual limits to contributions and you choose how you'd like to allocate money among different investments to potentially benefit from market growth. You can reallocate assets or trade among subaccounts within the annuity tax-free. Additionally, you don't pay taxes until you receive an income payment or make a withdrawal, at which point earnings, as well as any pre-tax contributions, are taxed as ordinary income.

Learn more about understanding annuities and the roles they may play before and in retirement.

5. Tax-efficient strategies in a brokerage account

While brokerage accounts don't offer any built-in tax advantages, their flexibility can be compelling. You can contribute as much as you want to your account and choose from a wide variety of investment options. Plus there are no complex eligibility or withdrawal rules to navigate.

Even though brokerage accounts are not tax-deferred accounts, choosing tax-efficient investing options can potentially help reduce the taxes you owe during your saving and working years—allowing for more compounding potential.

If you're investing additional money toward retirement in a brokerage account, here are some potentially tax-efficient investing strategies to consider:

Investing with ETFs

ETFs—and in particular ETFs that track an index (aka passive ETFs)—can be relatively tax-efficient. In part, that's because index ETFs tend to have low portfolio turnover (meaning they don't make frequent changes to the portfolio of investments they hold). It's also in part due to the unique mechanics of how ETFs create and redeem shares. Read more about key features of ETFs.

Investing with tax-efficient mutual funds

Like passive ETFs, passive mutual funds may have lower portfolio turnover, and so may generate less taxable income than actively managed mutual funds. Additionally, some active mutual fund managers trade less frequently as part of their investing approach, so these funds may be more tax-efficient than many of their peers.

Investing with separately managed accounts (SMAs)

SMAs are portfolios of individual securities that investors own directly as a complement to their overall portfolios. Like mutual funds and many ETFs, they're managed by professional asset managers who focus on specific asset classes, such as stocks or bonds. Depending on the investment strategy of the SMA, investment managers can apply a range of personalized tax-smart investment techniques in an effort to increase after-tax returns.5 Learn more about tax-smart investing in SMAs.

Using asset location

Asset location is a way of strategically choosing which investments you hold in which accounts, in an effort to help lower your overall tax bill. For example, it can make sense to hold taxable bonds and high-turnover stock funds in a tax-advantaged account, like a 401(k) or IRA, because those tend to be less tax-efficient investments. Individual stocks that you plan to own for the long term could be held in a taxable brokerage account, as these tend to be more tax-efficient investments. In this way, you can save for retirement in a brokerage account in parallel with saving in tax-advantaged accounts—and use your mix of accounts strategically to help reduce the impact of taxes over time. Learn more about tax-smart asset location.

Finally, if you're interested in any of these strategies but you could use more support on your investing journey, consider how we can work together.