When folks get married, they typically know it's for better, worse, richer, or poorer. The good news? Most times, it will make you richer.

Tying the knot can bring couples a wide range of financial benefits. Among the potential perks: cost sharing on living expenses such as housing, food, and utilities, access to each other's employer-sponsored benefits, and often, the safety net of a second income to help cover emergency expenses. In fact, research from the US Census found that pre-retirees aged 55 to 66 who have been married generally have more retirement savings than those who are unmarried. Read more to learn about the financial and tax benefits of marriage.

Potential tax benefits of marriage

Getting hitched can also bring some tax breaks. "This is especially so in recent years, thanks to the Tax Cuts and Jobs Act (TCJA) of 2017, which went into effect in 2018," says Drew Bachman, CFA, CFP, director of financial solutions at Fidelity Investments.

Couples have 2 options when filing their income tax returns: married filing jointly or married filing separately. When filing jointly, which is the most common method, spouses combine their income and collectively deduct allowable expenses on one return. When filing separately, each person handles their own tax reporting.

"A popular myth is that there's a so-called marriage penalty—an increase in tax liability when 2 individuals previously filing single get married and begin filing jointly," says Bachman. "But because of the Tax Cuts and Jobs Act, that's no longer true at the federal level for most filers." Depending on the incomes, there still can be a marriage penalty.

Historically, the marriage penalty occurred because the income threshold for joint filers was not precisely double what it was for single filers. So when filing jointly, a couple's combined income could have pushed them into a higher tax bracket. For example, before the TCJA adjustments, if one person was in the 25% tax bracket (earning $90,000) and the other in the 28% tax bracket (earning $190,000) when filing single, their combined income after marriage and filing jointly could have moved them into the 33% tax bracket—assuming they take the standard deduction and personal exemption and have no other deductions or exemptions.

TCJA reduced or eliminated the penalties for many taxpayers by aligning income thresholds for married filing jointly to be exactly double those for singles in most tax brackets. The change allows most couples to remain in the same tax bracket—or in some cases, drop to a lower one.

For instance, in 2024, a couple with the same income as above would not move tax brackets. (They would get a benefit and see a fall in their effective tax rate, but no change in the marginal rate).

A single person earning $90,000 would be in the 22% tax bracket; an income of $190,000 would land in the 24% tax bracket. Together, if they filed as married filing jointly, they would be in the 24% tax bracket—again, the assumption is that they take the standard deduction and have no other deductions.

Tax brackets: Married filing jointly vs single

The Tax Cuts and Jobs Act aligned income thresholds between married filing jointly and single filers in most tax brackets.

| Tax rate | Upper limit single filers | Upper limit MFJ filers | MFJ multiple of single |

|---|---|---|---|

| 10% | $11,600 | $23,220 | 200% |

| 12% | $47,150 | $94,300 | 200% |

| 22% | $100,525 | $201,050 | 200% |

| 24% | $191,950 | $383,900 | 200% |

| 32% | $243,725 | $487,450 | 200% |

| 35% | $609,350 | $731,200 | 120% |

| 37% | $ No limit | $ No limit | 100% |

Source: Fidelity Investments as of 05/10/2024

"However, it is not all about marginal tax bracket. When married couples go to calculate their tax liability, they may find that filing together can reduce their total tax bill compared to when they both filed as singles," Bachman says.

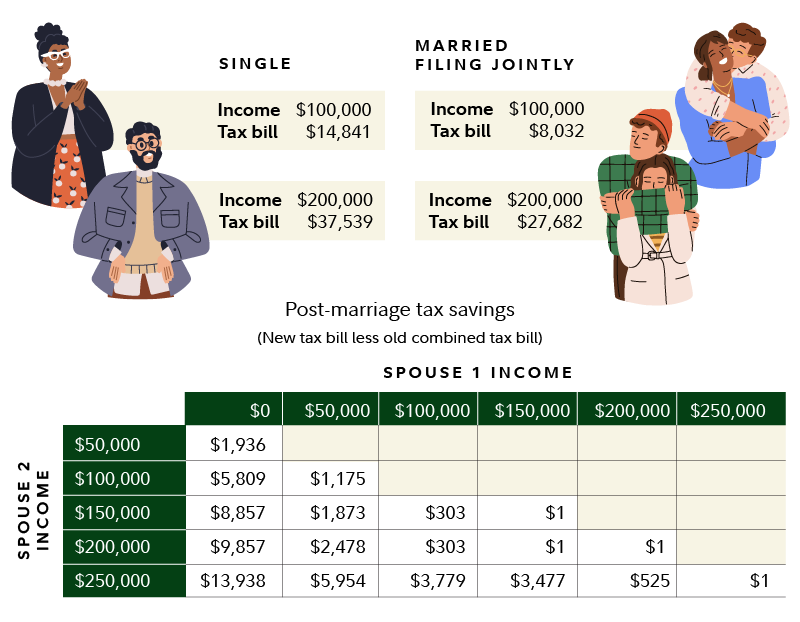

For instance, if one person earns $50,000 and marries someone earning $250,000, their combined tax bill would be approximately $6,000 less, notes Bachman, who ran an analysis based on 2024 tax brackets using standard deductions.

The potential benefit is most pronounced when the couple has disparate incomes, for instance if one spouse does not work and the working spouse is a high earner. Other examples Bachman gives about the potential tax break in that situation:

If a couple earning $100,000 married, and filed as married filing jointly, the tax bill on their total income would be $8,032 compared to $13,841 if either of them made the same amount and filed single.

If their income was $200,000 it would be $ 27,682 if they filed married filing jointly, compared with $37,539 if either of them made the same amount and they filed single.

However, high-income earners could still be hit with the penalty because the TCJA changes only extend to taxpayers who pay up to the marginal rate of 37%, which kicks in at an adjusted gross income of $731,200 for married filers in 2024. For those in the 37% bracket, the income threshold is only 20% higher than the threshold for single filers vs. double.

As with most tax-related topics, there are nuances to consider.

For instance, filers who itemize deductions can still face a marriage penalty due to the $10,000 limit on state and local tax (SALT) deductions, which is not doubled for married filers.

In addition, not all couples will benefit on the state level. In some states, the tax brackets for married couples filing jointly may not be exactly double those for single filers. This means their combined incomes could push them into a higher state tax bracket than if they had remained single filers.

Consult a tax advisor about your situation and for help factoring in elements such as tax credits and eligible deductions.

Many sections of TCJA's income tax provisions are set to expire at the end of tax year 2025.

A professional can also help you plan ahead for the expiration of areas that could affect your taxes.

Estate planning benefits of marriage at the federal level

Estate planning was also affected by the TCJA. The law nearly doubled the lifetime estate and gift tax exemption from the previous levels. In 2024, the estate tax exemption is $13.61 million, married couples get $27.22 million. If your wealth is below the exemption amount, your estate won't need to pay federal estate taxes. Your estate could be subject to state estate taxes, depending on where you live.

Married couples also get double the annual gift tax exclusion, $18,000 per person, per beneficiary in 2024. Any amount beyond that will involve using part of your lifetime federal gift tax exclusion, which is $13.61 million per person in 2024. A married couple could therefore give $36,000 to each of their children and grandchildren and anyone else each year without beginning to use any of their gift tax exclusion. Once those gifts are made, that money is removed from their taxable estate. If you do exceed the annual exclusion amount, you'll need to file a gift tax return (IRS form 709) and track the amounts given each year.

Read Viewpoints: How to give financial gifts to loved ones

But that's not all. Spouses do get some special transfer and inheritance rights as well. The unlimited marital deduction allows you to leave an unlimited amount of money to your spouse after your death. Any money left to a spouse at death will not be subject to the $13.61 million estate tax exemption. You can also transfer, free from estate and gift taxes, an unrestricted amount of assets to a spouse during life as well.

Spousal inheritors also get the opportunity to put the inherited money in their own tax-advantaged retirement account, allowing the money to potentially continue growing tax-deferred until they need it or until they reach their own required minimum distribution age (RMD).

A spouse who inherits an IRA, for example, can roll over the inherited IRA into an IRA in their name and treat the assets as if they were their own. You could also transfer the IRA to an inherited IRA if you are under age 59½ and need to use the inherited assets. Inheriting workplace retirement accounts, like a 401(k), from a spouse confers flexible options as well:

- You can take a lump sum distribution, penalty-free.

- You're able to roll inherited assets into your own retirement account.

- You could roll over funds into an inherited IRA.

Read Viewpoints: Inheriting an IRA from your spouse and What happens if you inherit a 401(k)?

Other financial benefits of marriage

Married couples have more options for making the most of their Social Security retirement benefits. Members of a couple have the option of claiming benefits based on their own work record or up to 50% of their spouse's benefit at full retirement age, typically referred to as a spousal benefit. For couples with big differences in earnings, claiming the spousal benefit may be better than claiming your own.

Estimating your own longevity may help you decide on the best claiming strategy for you. After the death of a spouse, you can receive their monthly Social Security payment as survivor benefits, if it's higher than your own monthly amount. Waiting until full retirement age (based on your date of birth) or age 70 for the maximum monthly benefit can help ensure that you and your spouse, or your surviving spouse, get the most out of Social Security. Read Viewpoints: Social Security tips for couples

For better or worse

Of course, getting married shouldn't be decided on a financial basis. Love rules supreme. But if you are considering marriage—or are married—it's important to understand and maximize the benefits that can help you and your partner secure a prosperous future.