Most Americans under retirement age doubt that Social Security will be available when it's their turn to receive it. In a worse-case scenario, reserves for Old-Age & Survivors Insurance (OASI) are projected to run out in 2033. Continued income into the program may be sufficient to pay only 79% of benefits thereafter without action from lawmakers.1

The good news is that there's still time for legislators to shore up the financing shortfall. That's important because Social Security benefits contribute significantly to a comfortable lifestyle in retirement—to the pleasant surprise of current retirees, it turns out.2

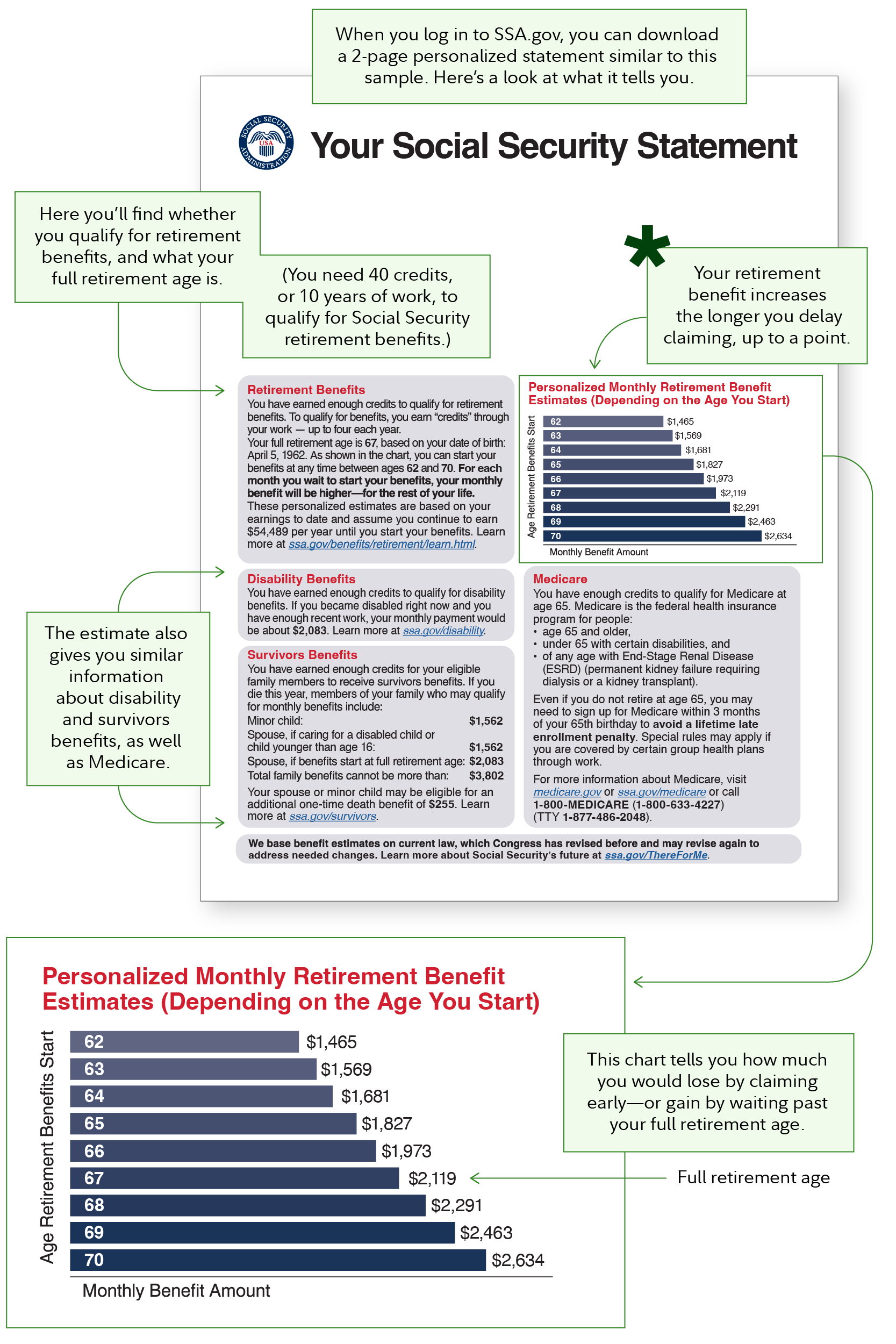

To find out what your benefits may be and how they may fit into your retirement plan, check out your Social Security statement, available at ssa.gov. Here's what you need to know.

What is a Social Security statement?

Your Social Security statement is an official document from the Social Security Administration that outlines your estimated retirement benefits, disability coverage, and potential financial support for a spouse and children.

It's critical to review this statement at least once a year, says Brad Koval, director of financial solutions at Fidelity Investments. By doing so, you can better plan for retirement, get a solid grasp of the protections available to you and your family, and catch any errors before they become an issue.

The ideal time to check it is each August, as by then, your benefit information should reflect your total earnings from the previous year, as well as any modifications made by the administration to account for inflation.

Here are 3 crucial parts of your Social Security statement to review.

1. Find out how much Social Security you may get

Your statement will show approximately how much money you may get each month based on the age you choose, which can range from 62 to 70.

The estimate of your benefits can be a key factor in your retirement plan. The more precise your estimates can be, the better. Knowing the approximate amount of income Social Security benefits may replace can help you decide how much you need to save.

To find out if you're on track, start with Fidelity's digital tool: Retirement analysis. If you're not yet a customer, get started with a free plan.

How to potentially boost your benefits: The longer you wait to claim your benefits, the larger your monthly amount will be, with the maximum payout if you claim at age 70.

This can be a great topic to discuss with a financial professional to decide when to start claiming Social Security and how to make your savings last if you retire before your full retirement age.

Claiming prior to full retirement age—which is 67 for those born in 1960 and later—can reduce your benefit by up to 30%, notes Koval.

"If you claim later than full retirement age, you get an additional 8% per year," he says. That translates into 24% more for those who wait until age 70.

The key assumption behind estimates: Estimates assume you'll maintain the same income until you begin taking Social Security, says Can Lu, director of financial solutions at Fidelity Investments.

"For instance, if you're a 40-year-old who made $100,000 last year, that would be the last entry in the earning history table," Lu explains. "The Social Security Administration assumes you'll continue to make $100,000 every year until you claim your benefits."

If you want to work less in the years leading up to retirement, your benefit may be less than the previous estimate. Conversely, if your earnings continue to increase, you can get a bigger benefit amount.

There is a cap on benefits payouts. If you claimed in 2025 at age 70, the age when you get the largest possible distribution, your maximum monthly benefit would be capped at $5,108.

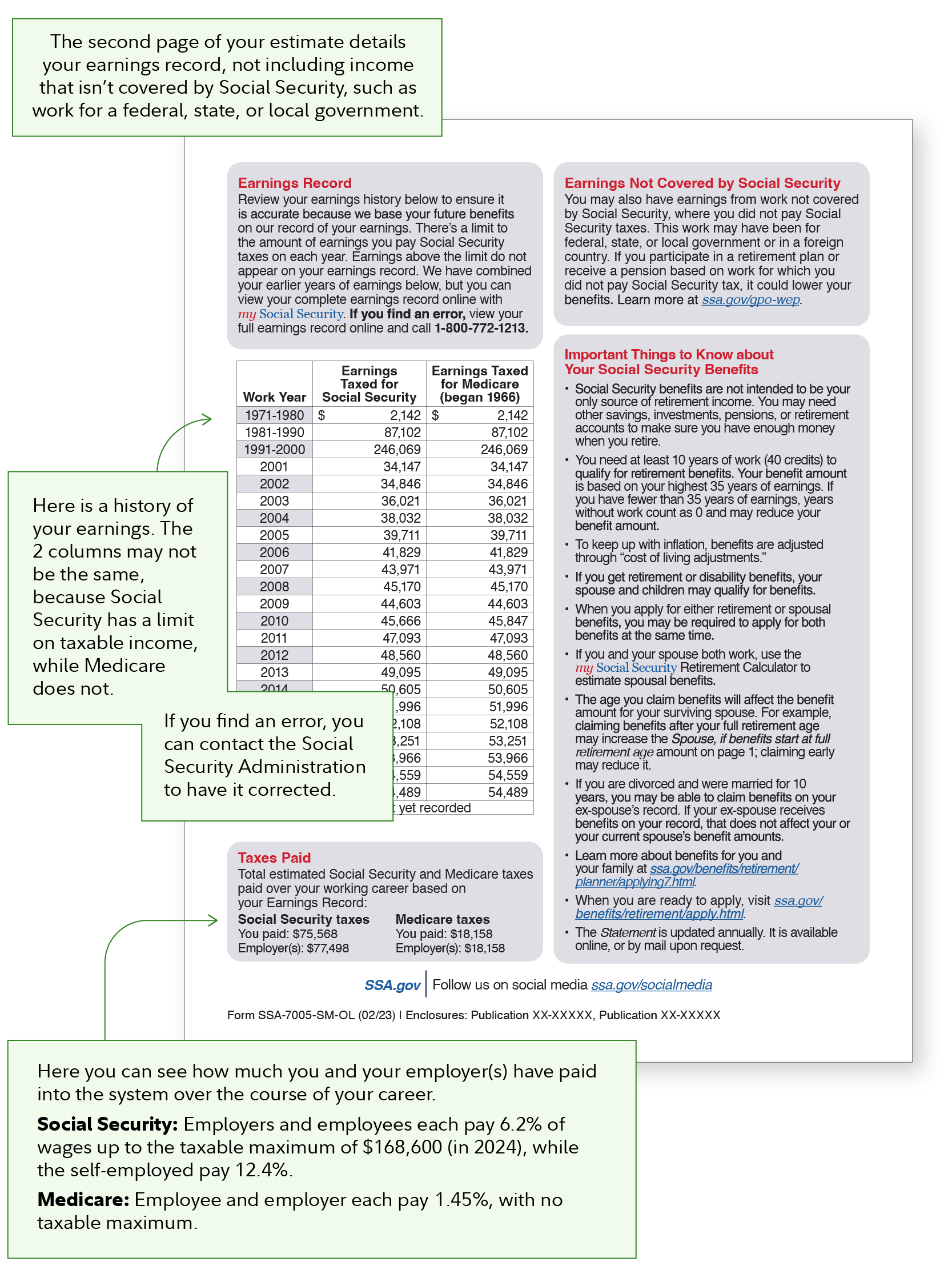

2. Check your earnings history

To be eligible for Social Security retirement benefits, you need 40 qualifying credits, which is about 10 years of work history. But the amount of your benefits is determined by your highest 35 years of earnings, adjusted for inflation.

If you have less than 35 years of employment history, zeros will be used for the remaining years in the benefits calculation, which can reduce your payout.

Look over the list of annual earnings for each year you were employed in a job where Social Security taxes were paid. Ensure the amounts are accurate, as any missing contributions can significantly reduce your benefits. If you spot an error, contact the Social Security Administration to get it corrected.

How to potentially boost your benefit: To improve your potential payout, stay in the workforce longer, and keep paying into Social Security. The more you work, the higher your benefit can go. But if you've already worked 35 years and are earning less than you did previously, your benefits may not go much higher—since the highest earning 35 years are already past.

When reviewing your report, note how many credits you've accumulated. If you have fewer than 40 credits and are thinking of retiring, consider working longer to secure at least some benefits, says Koval.

3. Understand the full benefits available for your family

"There's so much more than just retirement benefits," says Koval. "You could have a disability benefit. There are also family benefits."

For instance, you may be eligible for spousal benefits if you are married. These benefits generally allow you to receive Social Security funds either based on your work record or up to 50% of your spouse's benefit at their full retirement age, whichever is higher. In cases where there's a significant earnings gap between you and your partner, with them making substantially more, the spousal benefit may be greater than your own benefit.

That spousal benefit can also apply to divorced individuals if they meet certain criteria, such as being married for at least 10 years.

In addition, upon your death, a spouse or child may be eligible to receive survivor benefits. If a parent is dependent on your income, they may also be able to claim benefits as well. Your statement shows whether you've earned enough credits to qualify for survivor's benefits and how much they might be.

The statement will include specific monthly benefit figures for different scenarios, such as for a minor child and for a spouse caring for a minor child. Along with that, it will note a one-time lump-sum death benefit of $255 that a spouse or children can receive if eligible, which is separate from the monthly survivor benefits. Note that the $255 is in total, not per person.

Your statement will also show if you earned enough credits to qualify for disability benefits, which apply to those with a medical condition expected to last at least one year or result in death.

Adding Social Security to a savings strategy

It's important to note that Social Security is not meant to be your sole income stream in retirement, say Lu and Koval. It's best to consider it as one piece of your retirement income plan, with pensions, IRAs, annuities, or 401(k)s also providing part of your income.

Fidelity's general guideline is that you can estimate your savings may provide 45% of your pre-tax, pre-retirement income, depending on when you claim Social Security and your expenses in retirement. Read Viewpoints: What will my savings cover in retirement?

How to make the most of your benefits

There's a wide range of online tools that can analyze your Social Security information, show you different financial scenarios, provide helpful guidance on the optimal time to claim, and offer overall recommendations on how to make the most out of your benefits.

A financial professional can help with retirement planning, including helping you create a claiming strategy with your spouse to maximize your household benefits and modeling how Social Security could help support your broader retirement goals.

Trying to fit Social Security benefits and other sources of income into retirement planning can feel like "a big puzzle," says Koval. A planner "can help put all the pieces in place."