Katie Schwartz is basking in her semi-retired life. Untethered from a full-time schedule, she runs her speech coaching business during hours that work for her, giving her the flexibility to travel and live each day her way.

“I work part time and virtually, on my schedule, with great clients, and take vacations when I please,” she says. “I get to do what I love.”

Schwartz is among the many who’ve ditched the daily grind but weren’t ready for full-fledged retirement. By downshifting to fewer hours and less responsibility, semi-retirees still pull in an income while getting more time to spend on family, friends, hobbies, volunteer work, and travel.

But as Schwartz can attest, achieving a successful semi-retirement takes some foresight. It’s best to begin planning—and saving—during your wealth accumulation years to capitalize on employer benefits and the power of compounding. Schwartz, a former school speech pathologist, says she proactively considered her future goals. “I took that job knowing I was going to need really good benefits, such as a pension,” she says.

Here are 5 key steps to consider to help you achieve your semi-retirement bliss:

1. Understand your long-term financial needs

Semi-retirement can take on various forms, such as working reduced hours for an existing employer, transitioning to a money-making side gig like blogging, freelance writing, or consulting.

While semi-retirement can provide more work-life equilibrium, underestimating your long-term financial needs can tarnish the golden years of actual retirement. It’s also important to know what you’ll give up when quitting full-time work, especially if you work for an employer that provides generous benefits.

“You get so many things when you’re working in a full-time job,” says Aditi Sharma, a vice president in Fidelity's Financial Solutions. The list can include employer contributions to retirement accounts, dental, life, and disability insurance, a health savings account (HSA) or flexible spending account (FSA), and potential profit sharing.

“You’re leaving "free money" on the table,” Sharma says. “That’s something you really need to take into consideration.”

2. Prepare for semi-retirement while you are working full time

To counteract those losses, semi-retirees often need to make major adjustments earlier in their lives.

Many maximize contributions to health savings plans and 401(k)s before leaving a full-time job. They also slash spending, pay off significant debt, and often downsize their housing. Some create passive income from sources such as rental properties, dividend stocks, or online-based businesses that get advertising revenue. In 2019, at age 39, Christina Gawlik sold her belongings and “downsized to a suitcase and a daypack to live a nomadic lifestyle.”

Gawlik, now semi-retired, is self-employed and runs an editorial services business that she launched in 2017. She has contractors perform client services while she manages the projects from wherever she is currently living. She invested the $127,000 profit from the sale of her house and earns royalties from previous work, as well as dividends and interest from her investments.

“I am actively pursuing my life goals of living around the world, learning and exploring,” she says. “And I’m making the most wonderful friendships and connecting with people that I would have never met if I stayed in a more traditional lifestyle.”

3. Plan out your future income sources

While Gawlik made a big life shift, other semi-retirees want to ease into the next work phase with few changes to their current lifestyle.

Whether your goal is to travel the world or have more time to do gardening in your backyard, your first step is the same: “Get organized and create a plan,” says Ryan Viktorin, CFP®, Fidelity Investments vice president and financial consultant.

Examine your current income, savings, spending habits, and debt. Consider how long you’d like to work full time before entering semi-retirement and how long you plan to stay in semi-retirement before fully retiring.

Then do some forward thinking. Plot out what expenses will change between now and retirement. For instance, will your mortgage be paid off? Will a child be independent and supporting themselves?

Then plan out even further. Understand how much money you’ll need in retirement and what income sources will come in during those years. “You have to know what the cash flow is going to be,” says Viktorin.

Crunching all these numbers can feel overwhelming. But don’t let it scare you off from planning a move to semi-retirement if that’s your goal. Instead, seek the help of a financial professional.

A financial professional can review your information, then stress-test different scenarios. They can go through investment mixes to consider and talk about what to anticipate in the coming years, factoring in longevity and potential market downturns.

“The markets will always be volatile,” says Viktorin. “You want to make sure that you’re mentally prepared, and your financial plan accounts for the fact that not every year is going to be a great one in the markets.”

4. Understand current spending

Depending on your age and financial situation at the time of semi-retirement, you may not be able to withdraw from retirement accounts. In order to fund your full retirement, those accounts may need to have the chance to keep growing—plus, penalty-free withdrawals from retirement accounts generally are not available until age 59½.

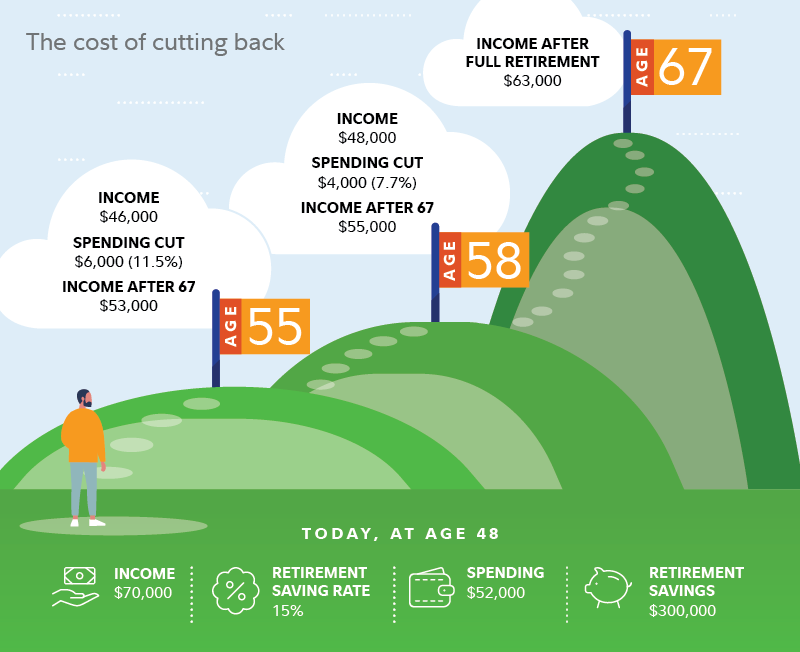

That's the case in our hypothetical illustration: Mike is planning to take a step back from work in the future to have more time for the things he wants to do.

His Fidelity financial consultant models his options for him in 2 scenarios: semi-retiring at age 55 and age 58.

The good news is that his retirement is on track according to Fidelity's retirement preparedness measure, and that boosts his odds of success. Mike can stop contributing to his retirement accounts when he semi-retires.

See where you stand: The Fidelity Retirement ScoreSM

If he waits until age 67 to claim Social Security and start withdrawing from retirement accounts, he'll have a great shot at a fully funded retirement in which all of his essential expenses can be covered. The main hurdle will be reducing his spending during the semi-retirement period.

His Social Security benefit will likely go down slightly if he semi-retires. If he worked his current job until age 67, he could expect about $33,500 a year from Social Security. If he semi-retires at age 55 or 58, he could expect $31,500 or $32,000 respectively.

"In general, discretionary spending is about 20% of people's spending. Mike is spending more than he thinks he will earn in semi-retirement so it may take a big move like downsizing for this to work for him—but it could be possible," says Can Lu, a director in Fidelity's financial solutions team.

IMPORTANT: The projections or other information generated by the Planning & Guidance Center's Retirement Analysis regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Your results may vary with each use and over time.

For hypothetical illustration only. Retirement income is based on estimated Social Security and estimated withdrawal amount from retirement savings after age 67.

The Social Security estimate assumes the hypothetical person's age is 48 and he earns $70,000 in annual income and that he will be claiming Social Security at his full retirement age of 67. Further assumptions are 4% income growth and 30% income reduction during semi-retirement at age 55 or 58.

Estimated withdrawal amounts are Monte Carlo simulations based on historical asset class returns and are not recommendations. It assumes the $300,000 balance is invested in a target date fund, and a 15% saving rate until semi-retirement, and then 0% saving rate during semi-retirement. Withdrawals begin at age 67 with a 10% effective tax rate in retirement and a plan to age of 93. See the methodology footnote for more.

All numbers are in today's dollar and rounded down to the nearest $1,000.

Source: Fidelity Investments.

5. Learn about your health care options

Health care coverage is one of the most important considerations when contemplating semi-retirement, says Sharma. “Understand the different health coverage options that you will have at your disposal before you leave your employer.”

Possibilities include going onto the insurance of a working spouse, continuing an employer’s plan under COBRA (which lasts 18 months), enrolling in a plan through an Affordable Care Act marketplace, or getting private insurance.

If you want to remain with your existing company and work reduced hours, ask if they offer a phased retirement or another plan where you can keep your existing health insurance.

Viktorin offers another approach. “Maybe you go work at a local coffee shop purely for the health benefits, or at a bookstore or garden store, doing something you like, and also getting health care,” she says.

6. Think through your “why.” What do you hope to get out of semi-retirement?

Doing the financial legwork is crucial, yet it’s also vital to do some self-reflection before you exchange full-time work for semi-retirement.

“Understand your ‘why.’ Why do you want to semi-retire? What are the goals and purpose?” says semi-retiree and world traveler Gawlik. “Understand what you are retiring to, not from.”

In making her transition, she received more flexibility and freedom. And recent life events reassured her that she made the right choice.

“The pandemic was a major reason why semi-retirement is important to me,” says Gawlik, adding that in the last few years, she’s lost friends and family to COVID, as well as cancer, suicide, and heart attack.

“So much death from loved ones ages 32 to 79, proved to me how short life is,” she says. “And today, I say, ‘yes’ to anything that truly excites and interests me, and politely decline invites or opportunities that I’m not interested or passionate about. There’s no time for doing things you don’t want to do anymore.”