A lot of financial planning for retirees revolves around how to minimize the tax bite on the money you may need to withdraw from pre-tax retirement assets. Once you reach age 73,1 you must start drawing down these accounts to satisfy required minimum distributions (RMDs), which are taxed as ordinary income.

But a little-known SECURE 2.0 Act rule allows individuals who purchase a qualified income annuity with all, or a portion, of their retirement account assets to then use the cash flow that exceeds the RMD amount for the annuity to also satisfy RMD requirements for the purchasing account.2 This includes traditional IRAs and workplace retirement plans that were used to fund the qualified annuity. That means more money can potentially stay invested and grow in your investment portfolio. What’s more, the rule change applies to an annuity you may have purchased today or years ago.3

What is a qualified income annuity?

Briefly, a qualified income annuity is a contract with an insurance company where you exchange a portion of your tax-deferred retirement savings for steady income payments. These payments can be either for as long as you live or for a set period of time; the income can also start right away or at a point in the future that you determine. The amount of income you receive generally does not change over the specified time frame and provides steady cash flow, which can help fill any income gaps you may have once you stop working.

Good to know: Annuities can be funded either with qualified (pre-tax) dollars held in a retirement account, or with nonqualified dollars held outside of a retirement account. Annuities funded with qualified dollars are subject to RMD requirements, unlike annuities funded with nonqualified dollars. The little-known RMD rule applies to qualified income annuities.

RMDs and income annuities: What’s changing

Prior to the SECURE 2.0 Act, payments from income annuities purchased with traditional IRA or other qualified assets could satisfy the RMD requirement only for that annuity. Since the passage of SECURE 2.0, income that exceeds the RMD from such an annuity can also be used to help satisfy your RMD from the originating account. And in some cases, the income stream from the annuity can also be part of the calculation used to determine your RMD from other qualified accounts.

For example, if you own more than one IRA, your RMD must be calculated for each account, but you may aggregate your IRA RMDs and withdraw the total from a single account or any combination of IRAs you own. It’s important to note that’s not the case if you have more than one workplace plan. RMDs must be calculated and withdrawn separately from each account. Spousal IRAs also would be calculated separately, although they may be aggregated with other spousal IRAs.

Since the excess cash flow—or the amount of annual annuity income minus the RMD associated with the annuity—can help satisfy your RMD for your IRAs or retirement plans, that means more of the money in your retirement portfolio can stay invested. In turn, that gives your assets the potential to grow tax-deferred for longer.

How annuity payments can be used for RMDs

The fair market value (FMV) of your annuity is determined at the end of each calendar year by the insurance provider. It is similar to the market value of other financial assets and takes into account the present value of the contract’s future cash flows. This FMV amount is reported on Form 5498 by your financial institution. If you are responsible for an RMD this form can be used to help determine the remaining RMD, if any, for the account used to purchase the annuity.

Important to know: Calculating your RMD can be complicated, so it’s a good idea to consider working with a tax professional who can help you calculate how much you need to withdraw from your IRAs, workplace accounts, or both.

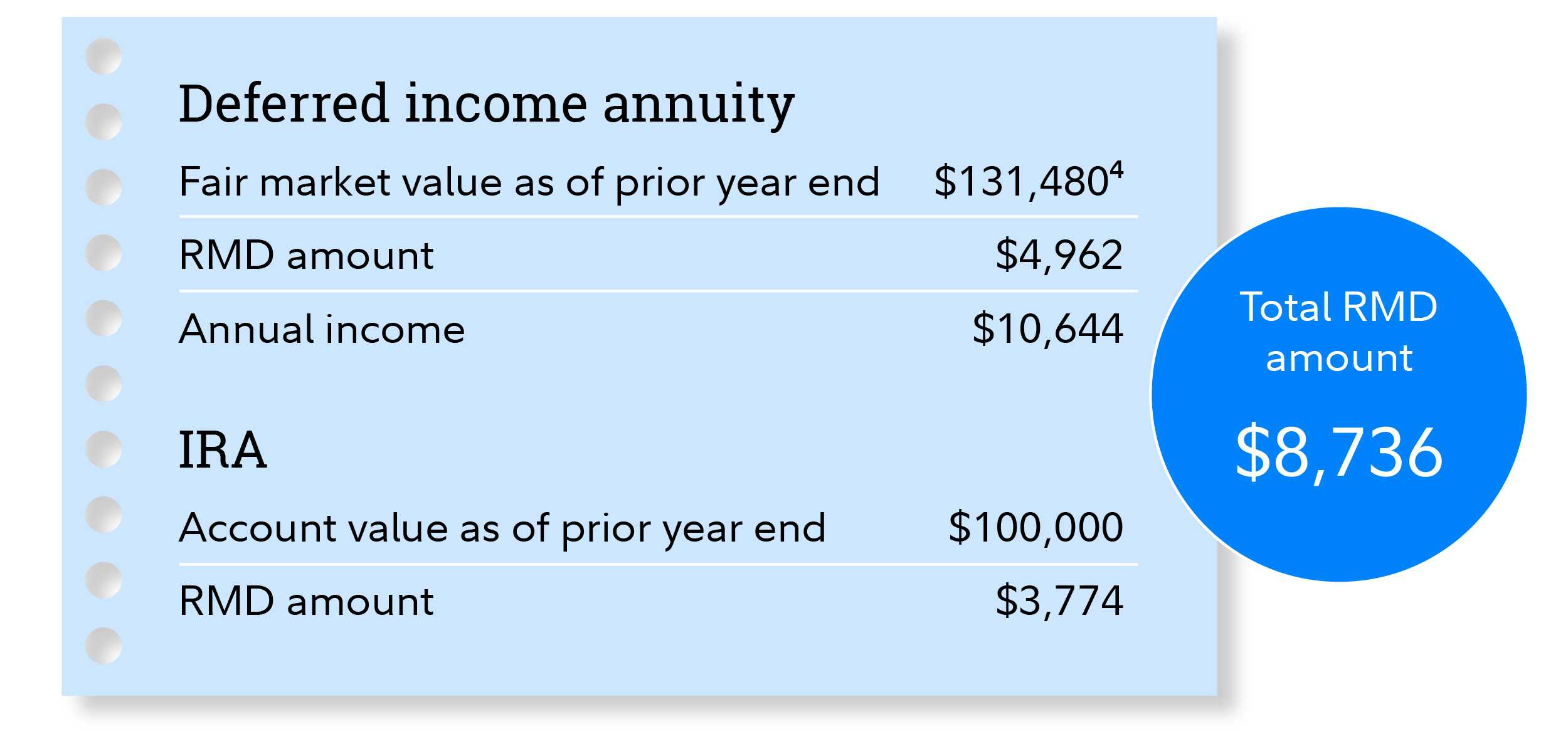

Let’s assume a hypothetical scenario where an imaginary person named Anne transfers $100,000 from an IRA to a qualified deferred income annuity. At 73 when annuity income is scheduled to begin, she must also start taking RMDs from her IRAs.

Anne’s situation

Age: Anne will turn 73 this year.

The annuity: At age 68, Anne used $100,000 from an IRA to purchase a deferred income annuity (DIA). She chose a 5-year deferral period, starting her annual lifetime income on January 1 of the year she turns 73.

DIA income: Anne's annual lifetime income from the DIA is $10,644.

IRA assets: Anne also has other IRA assets.

Anne’s RMDs: The DIA can cover Anne’s RMD up to $10,644, the amount of her annual income from the DIA. Any excess can be used to offset the RMDs of any of her other IRA assets, including any assets remaining in the IRA used to purchase the annuity.

In other words, Anne can use her DIA annual lifetime income to help satisfy the total RMD amount for her qualified income annuity and IRAs. This allows her to keep more of her money accumulating tax-deferred in her IRA accounts.

Annual considerations

The FMV of your annuity will change every year.5 While your financial institution will provide you with information documenting your annuity’s FMV, it’s important to remember to determine your RMD based on the FMV as of December 31 of the prior year. You also may need to take RMDs from other accounts, so consider meeting with a tax or financial professional to discuss the best way to manage your RMDs.

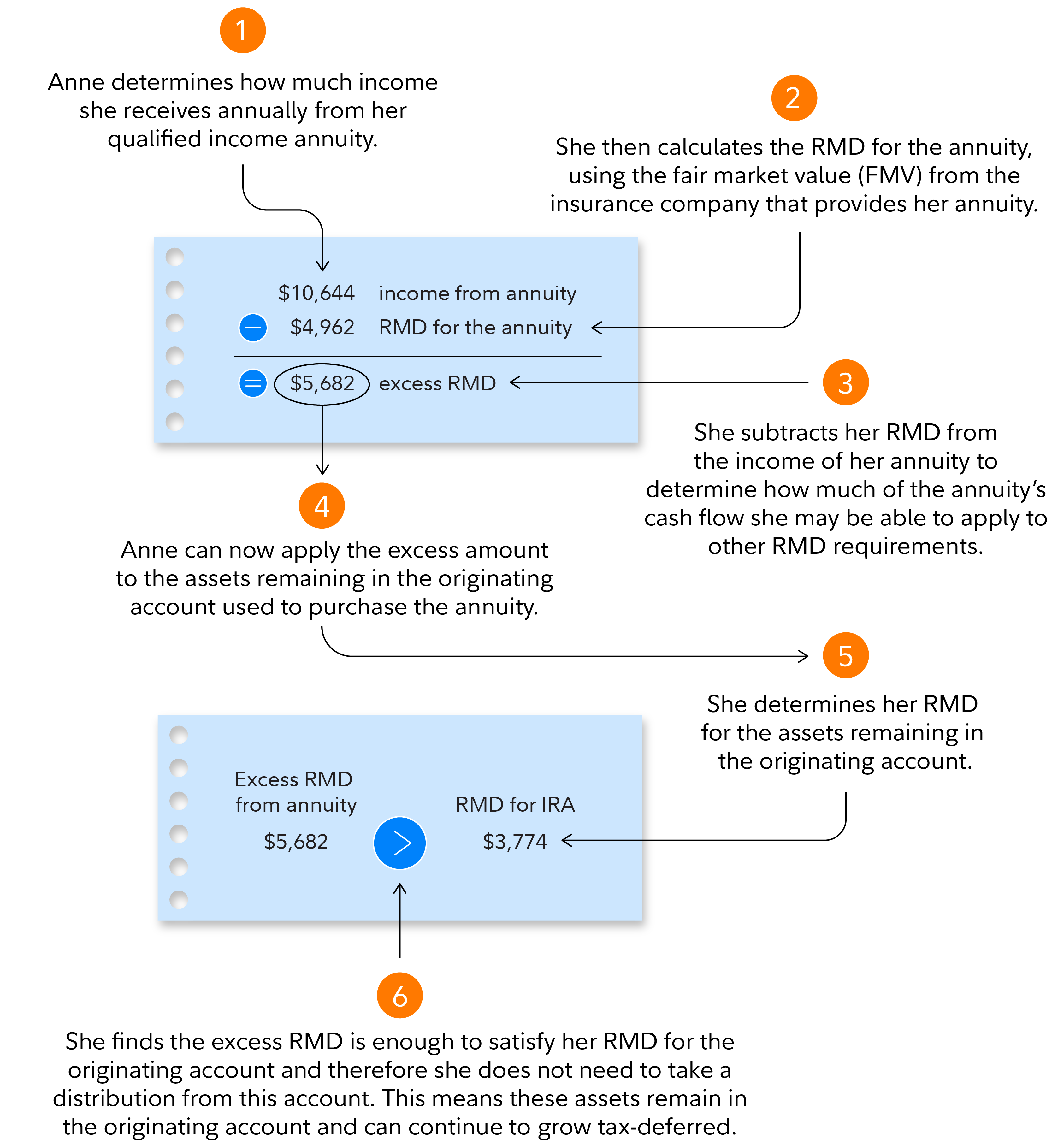

The following steps are required each year to determine how much of the cash flow from your qualified income annuities you may be able to apply to your overall RMD calculation. We suggest meeting with your tax advisor to calculate this amount.

Along with Social Security benefits, annuities can be an important part of your retirement plan, helping to add guaranteed income after you stop working. The SECURE 2.0 Act has potentially added more flexibility to how you take RMDs for your qualified accounts, giving your retirement portfolio the potential to grow tax-deferred for longer.