Many people feel they can’t save as much for retirement as they would like. And no wonder. It can be hard to save money for the future while keeping up with today’s expenses. And inflation makes it hard to predict how much money you’ll need next year, much less decades ahead in retirement.

For Gen X, ages 44–59, About 45% say they don’t feel confident about retirement, according to Fidelity’s 2025 State of Retirement Planning study. By contrast, just over a quarter of millennials (ages 28–43) say they lack confidence.1

The good news is that it’s never too late to plan and pursue the retirement you want.

Here are 4 tips to help save more for retirement.

1. Start with a plan

Consider creating a financial plan. There’s no age or asset level needed to create one on your own, or with a financial professional. A strong plan includes everything in your financial life: cash flow analysis, debt management, retirement and investment planning, taxes, estate planning, insurance, and more. If you’re saving for a child’s education, include that goal as well.

With the cost of living putting a strain on budgets, it’s not always easy to find areas in your budget to cut. But there may be other areas where you may be able to save some money and put it to work, for instance, managing taxes.

If you tend to get a big tax refund every year, you may be able to adjust your tax withholding. That could give you a little more money each paycheck, which could then go toward savings goals. Read Fidelity Viewpoints: Guide to the W-4

Using all the tax credits and deductions you’re eligible for could also help snowball savings. Once you’ve decided to put away a little more for retirement, consider contributing to a retirement account to help make the most of your money. Increasing the amount you’re saving by 1% of your pre-tax income could make a significant difference in retirement.

2. Maximize your retirement savings with tax advantages

If you’re already saving in tax-advantaged accounts, that’s great. Just 41% of respondents in Fidelity’s State of Retirement Planning study are contributing to tax-deferred retirement accounts like IRAs and 401(k)s, and only 39% are taking advantage of an employer 401(k) match.

Tax-advantaged accounts can offer powerful benefits. Contributing to a traditional IRA or a workplace savings account like a 401(k) or 403(b), can reduce your taxable income for the year. Any potential earnings grow tax-deferred and in retirement qualified withdrawals are taxed as ordinary income.

Contributing to a Roth IRA or a Roth workplace savings account is done with after-tax dollars. Any potential earnings grow tax-free and qualified withdrawals are tax-free.2 Read Fidelity Viewpoints: Traditional or Roth IRA, or both?

If your employer offers to match your retirement contributions, try to invest at least enough to get any match. That’s like free money, and it can significantly boost your own saving efforts along the way.

Health savings accounts (HSAs), available with enrollment in a high-deductible health plan, are an often-overlooked way to save and invest for future health care costs—and beyond. HSAs offer a triple-tax advantage:3

- Tax-deductible contributions

- Earnings grow potentially tax-free

- Tax-free withdrawals for qualified medical expenses

More than half of HSA owners in the survey say they invest at least some of their money in the account. That can be a good idea to help your money keep up with inflation and possibly grow and compound over time—which could help provide more money for health care or expenses in retirement.

Read Fidelity Viewpoints: 3 ways to use your health savings account

Fortunately, the flexibility of HSAs can make them useful for paying expenses today, in the future, and even in retirement. Using an HSA to fund current year medical expenses can help you save money and potentially reduce taxes. At age 65 and after, money saved in an HSA can be used penalty-free for any expenses—but income taxes will be due, like withdrawing from a traditional IRA.

Read Fidelity Viewpoints: 3 healthy habits for health savings accounts

3. Make the most of catch-up contributions

Once you reach age 50, you may be able to contribute even more to certain tax-advantaged accounts.

For a traditional or Roth IRA, the annual catch-up amount in 2024 and 2025 is $1,000, which boosts your total contribution potential to IRAs to $8,000.

If you participate in a workplace retirement savings plan, like a 401(k) or 403(b) the catch-up opportunity is even greater: up to $7,500 a year. That means you can contribute up to $31,000 in 2025.

Plus, beginning this year, people between ages 60 to 63 may be eligible to make increased “super catch-up” contributions to their 401(k) or other workplace plans. If your plan allows, you may be able to contribute up to 150% of the catch-up limit, up to $11,250 in 2025.

If you’re contributing to an HSA, you can contribute an additional $1,000 starting at age 55. If you’re married and covered by a family health plan, your spouse can also contribute $1,000 extra for a catch-up contribution but must contribute to an HSA opened in their name.

Even if you are on track with your retirement savings, contributing the extra money can be a boost to your income in retirement—in fact, 43% of retirees in Fidelity’s study say it’s among the most important actions you can take in the home stretch to retirement.

4. Invest for growth potential

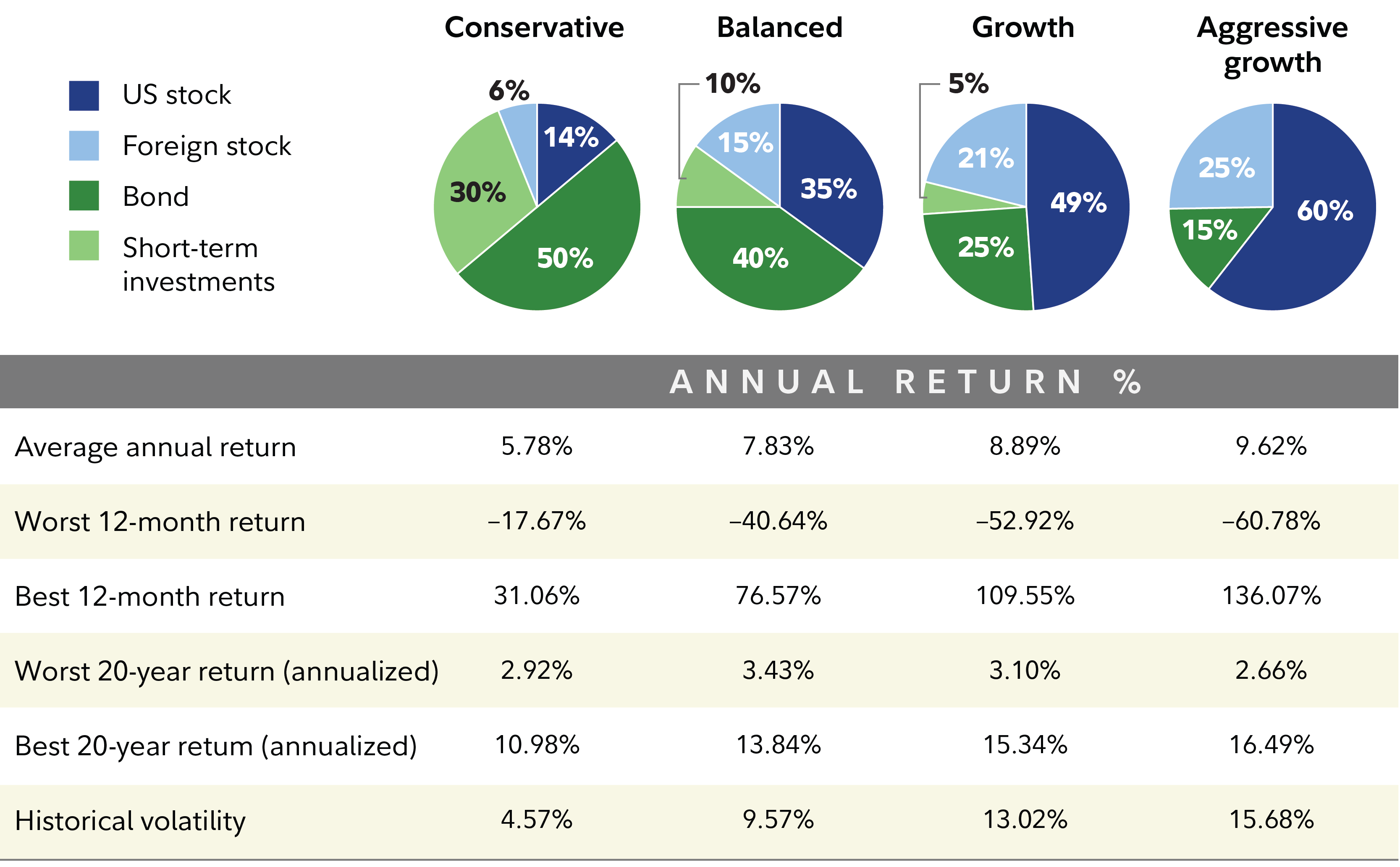

Your investment mix can be vital to helping you save enough to live the life you want in retirement. An investment strategy that fits your time horizon, risk preferences, and financial circumstances could significantly boost your chances of maintaining your lifestyle throughout retirement.

Growth potential can help your money keep up with inflation and (hopefully) help you accumulate wealth while staying invested over many years. The key is to strike a comfortable balance between the level of stock market risk you can live with that can provide the growth potential to meet your goals. If you’re not sure how to get started, consider working with a financial professional or try Fidelity’s planning tools to find out where you stand compared to your goals.

Read Fidelity Viewpoints: How to start investing

Retirement planning for life

It can take decades of saving and planning to feel confident about retiring. If you feel behind, consider doing what you can now and ramp up your efforts over time. Focus on what you can control and consider exploring Fidelity’s educational resources so you feel prepared for the next steps on the journey.

Retirement planning by age

20s: Consider saving as much as you can in tax-advantaged accounts and investing for growth potential.

30s and 40s: Saving is still key, concentrating on tax-advantaged accounts and continuing to invest for long-term growth potential.

50s and 60s: Catch-up contributions become available in tax-advantaged accounts and it can make sense to begin creating a retirement income plan.

Going from saving to living in retirement: Plan to cover essential expenses through guaranteed income sources that keep up with inflation (such as annuities) and cover discretionary expenses with savings or investment income.