Investing can be one of the best ways to help achieve your financial goals. But first you have to figure out what to invest in, or find a professional to help you do it. Either way, before you get started, you’ll want to answer a few key questions:

|

Let's go through these questions and why they're important.

Risk tolerance: Market ups and downs and you

There are many types of investment risks, but market risk (the possibility that the entire stock market falls) is the one most people think of when talking about risk. And it's easy to understand why: It's a headline-making event. In general, the more stocks there are in your investment mix, as a percent, the more your account value may rise and fall over time. Historically stocks have provided higher returns over time than bonds or short-term investments and cash. But stock prices rarely go up in a straight line. They may go up, then down, then stay flat for a while—and then go up again. (All investments may do this to some degree but the effect can be amplified for more volatile investments like stocks.)

For the chance to get higher returns over the long term, investors have historically had to accept the prospect of bigger fluctuations in value over the short term.

Risk tolerance is a measure of how much stock market up-and-down you're willing to put up with in exchange for potential longer-term growth.

Some people find themselves losing sleep over temporary stock market volatility. That can lead to selling investments at a low point, and ultimately losing money by realizing a loss—the very outcome they were trying to avoid. That's why it's vital to choose a level of stock market risk you can live with and understand how that level of risk/return helps the prospects for meeting your investing goal. Consider your comfort level with risk in the context of an investment plan.

Getting that right can help you stay invested over time, which could give you the best chance of achieving your long-term investing goals.

To determine your personal risk tolerance, it can be helpful to work with a financial professional and complete an investor profile questionnaire.

Your financial situation: Risk capacity can be important too

Your financial situation, or risk-bearing capacity, is another important gauge for how much risk you can take on. It assesses your financial ability to weather declines in your account.

For instance, an investor with 6 months' of expenses saved in an emergency fund and relatively safe and stable job prospects may have a relatively higher risk capacity than one with no emergency savings who works in a competitive and unstable field.

Read Viewpoints on Fidelity.com: How to start investing and The guide to diversification

Time to invest: Calculating your time frame

Much of investing is goal based—for example, saving for retirement, buying a home, or funding a child's education. That makes it easy to understand how long you have to be invested in order to hit your goals—your time horizon would be the years over which you will be contributing to the account and investing until the money is needed, in whole or in part.

Risk and return over time

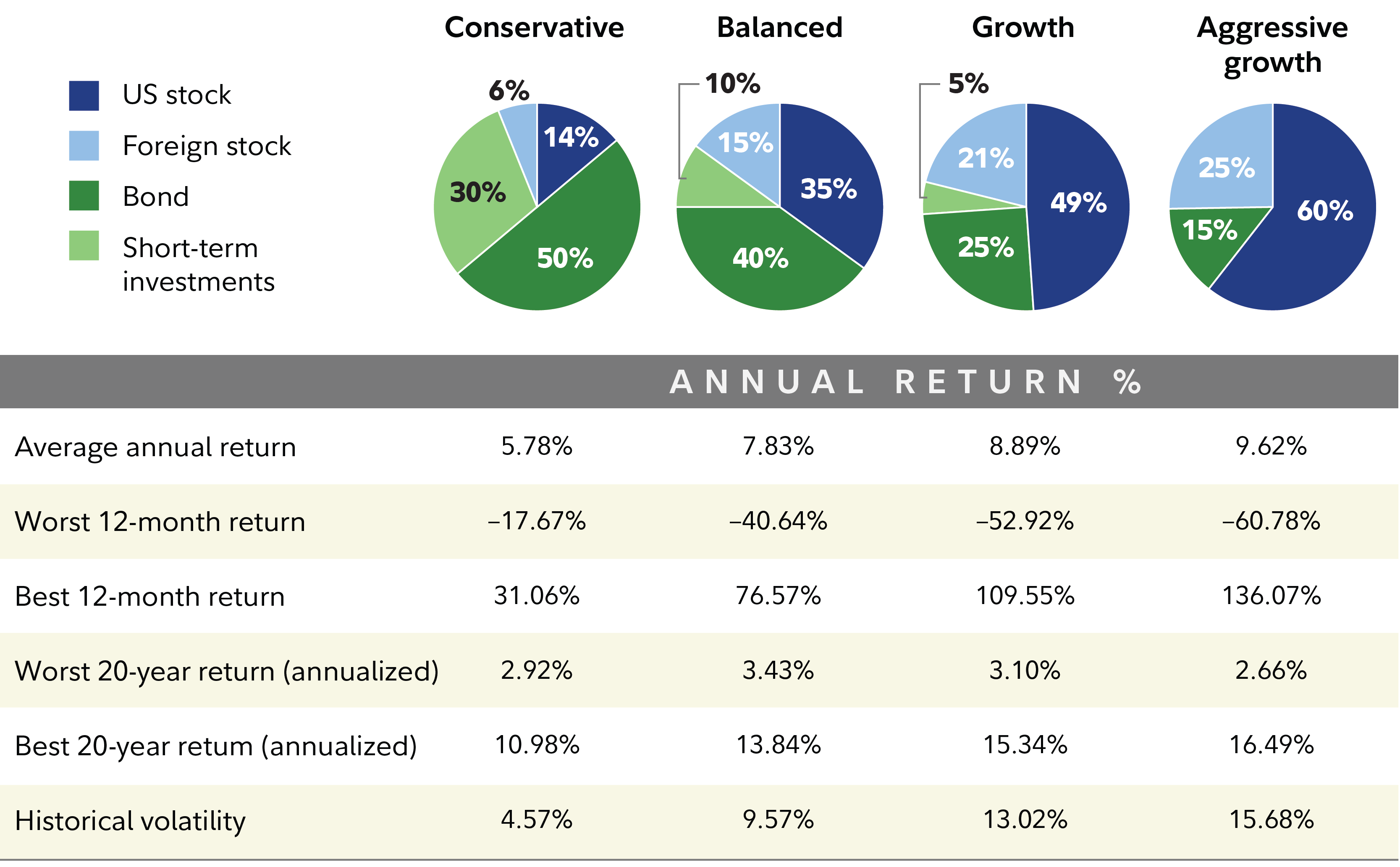

Time makes all the difference when it comes to taking risk with your investments and the ability for your account to recover from market drops. The allocation chart illustrates portfolios with varying degrees of stock market exposure—from 20% for a conservative investment mix to 85% for an aggressive growth one. Over a 12-month period, the worst-case scenario would have been quite bad if you held a lot of stocks. But over 20 years, the annualized worst-case scenario for the aggressive growth portfolio would have been about the same as that for the conservative one, while the annualized best case scenario would have been 50% better for the aggressive growth mix than the conservative one—though you would have experienced bigger swings in your account value along the way.

If you have the investment horizon that allows you to take advantage of the potential for greater longer-term returns from riskier asset classes and you have the emotional discipline to look past shorter-term volatility, then more aggressive asset mixes may be appropriate.

You simply don't know which outcome you're going to get in the short term, and you may not be able to afford to lose any money in a short time frame.

Putting them all together

It's important to consider your investment time frame, and both your willingness and ability to take risk. They don't always match up. Your ability to emotionally endure losses could exceed your ability to withstand them given your particular financial situation. The reverse is also true: Some people are extremely loss averse no matter how much money they have. It may take an objective third party to help you accurately assess how to balance these 2 issues, so that you have the best chance to reach your financial goals.

Your goals and time frame, your financial situation, and your feelings about risk will be key factors in deciding how to distribute your investments between stocks, bonds, and short-term investments. And then hopefully you'll be able to stick with it. Being able to stick with your plan through the ups and downs of the market is vital, because staying invested over many years is nearly always preferable to the alternative—letting time go by when you're not in the market.