If you like the tax advantages that come with traditional workplace savings plans, you might love a nonqualified deferred compensation plan—if you're among the fortunate few who have access and the financial ability to use it.

Nonqualified deferred compensation (NQDC) plans are typically offered by an employer to company officers and other highly compensated employees, enabling them to save more in a tax-advantaged account than is allowed under 401(k) plans.

Deferred comp and you

Explore our 5-part series on making the most of nonqualified deferred compensation plans.

The advantages of participating in an NQDC plan

The primary advantage of deferring income in an NQDC plan is tax deferral. From a tax perspective it's like contributing pre-tax to a 401(k)—but on a much larger scale.

There’s no limit specified by the IRS on how much compensation a participant can defer into a corporate NQDC plan each year (although plan provisions may limit the level of contributions, usually expressed as a percentage of compensation).

"Many people expect to be in a lower tax bracket in the future when they stop working—but even without a decrease in tax rates, the value of tax deferral is more significant than you might think," says Prasenjit Mazumdar, a director in Fidelity’s Financial Solutions Team.

The value comes from deferring the money that would have been paid in taxes because of the potential compounding over time. The greater the tax rate you pay, the greater the potential advantage of tax deferral.

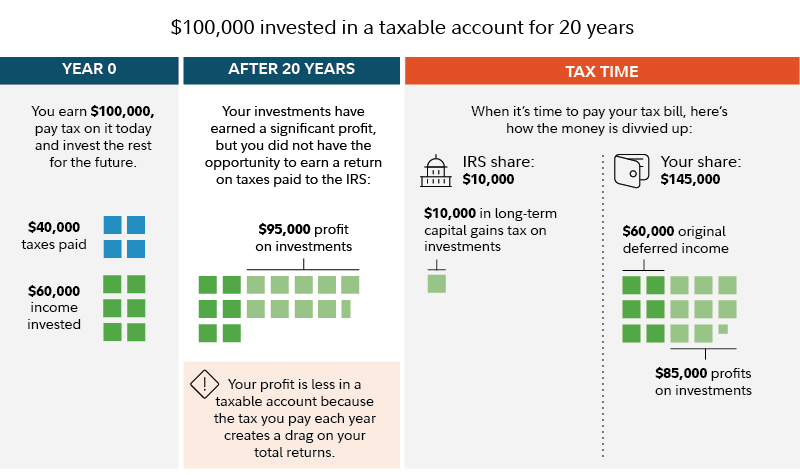

Take a look at this illustration with a 40% tax rate (35% marginal federal tax rate plus state tax rate of 5%). We assume a 7% investment growth rate and a deferral period of 20 years.

Why not use a taxable account2

Investing the same amount of money in a taxable account would receive long-term capital gains tax treatment, which is likely lower than income taxes. But the strategy of deferring into an NQDC could still provide a bigger benefit.

Comparing the taxable account and the NQDC

- In the NQDC, investing $60,000 results in $172,000 worth of investment earnings (pre-liquidation of the account).

- In the taxable account, investing that $60,000 results in $95,000 of investment earnings.

Tax-drag explains the difference between the 2 potential outcomes.

Once the investor sells the investments and closes the account after 20 years:

- In the taxable account, $95,000 of pre-liquidation investment earnings become $85,000.

- In the NQDC account, $172,000 of pre-liquidation investment earnings become $103,000, $18,000 more than the taxable account.

And what about the $40,000 of deferred taxes? The NQDC investor also gets a portion of the potential earnings—an additional $69,000 at the end of the twentieth year.

So the hypothetical investor in the NQDC account would be $87,000 richer than the investor in the taxable account: $18,000 coming from lower tax-drag on the investor’s share plus $69,000 of investment earnings on the IRS share, i.e., deferred taxes.

Taking NQDC payments over time could pay off

Executives looking to use NQDC deferrals for income over time (often for retirement) can expect to generate higher income on an after-tax basis. An executive deferring $100,000 for 20 years and then withdrawing over a 10-year period could expect to generate 76% higher income compared to a taxable account, assuming a 7% annual return.

Lower tax rate at withdrawal

If marginal tax rates at the time of withdrawal are lower than they are today, then the value of an NQDC plan can be even greater.

A decrease in marginal tax rates can occur because of 1) lower income at the time of withdrawal, 2) moving to a state with lower or zero income taxes, and 3) a change in the actual tax rates and brackets. Naturally, if your marginal tax rate is higher at the time of withdrawal, then the opposite effect would occur.

For example, if your marginal income tax rate is 10% lower3 when the account is liquidated after 20 years, the advantage of an NQDC plan grows from $87,000 to $122,000.

Lower marginal tax rates in the future could increase the benefit of investing in an NQDC

| Tax rate at liquidation | |||

|---|---|---|---|

| Years of deferral | Today's rate of 40% | 5% lower (35%) | 10% lower (30%) |

| 5 | $10,000 | $16,000 | $23,000 |

| 10 | $25,000 | $34,000 | $43,000 |

| 20 | $87,000 | $104,000 | $122,000 |

Varying tax rates overall

All else equal, the higher the current tax rates, the greater the advantage of an NQDC plan over a taxable account. In the table below we show what the advantage of an NQDC plan would be for different tax rates and deferral periods. In this table, based on the same $100,000 deferral, tax rates remain the same from deferral to liquidation (payout).

Your tax rate boosts your potential gain: NQDC vs. taxable account

| Tax rate | 5 years | 10 years | 20 years | 30 years |

|---|---|---|---|---|

| 50% | 15% | 33% | 74% | 133% |

| 45% | 15% | 32% | 71% | 119% |

| 40% | 14% | 29% | 64% | 105% |

| 35% | 13% | 26% | 57% | 93% |

| 30% | 12% | 24% | 51% | 81% |

"The higher one’s tax rate when deferring income via an NQDC plan and the longer the funds are able to be invested, the higher the resulting account balance will be compared to the amount that would have been accumulated in a taxable account over the same time period," says Shailendra Kumar, a director in Fidelity's Financial Solutions Team.

Some important caveats

There can be significant potential tax advantages in NQDC plans but it’s important to keep some caveats in mind.

Credit risk. An NQDC plan represents an unsecured promise by a company to pay out a participant’s account balance in the future. It is not covered by the Employee Retirement Income Security Act (ERISA), which protects qualified employer retirement plan participants if the plan sponsor runs into financial trouble.

Nonqualified plan participants could potentially lose some or all of their NQDC assets if the company falls into insolvency. That would leave employees essentially standing in line with the company’s other unsecured creditors, behind its secured creditors.

Can’t borrow against assets. In an NQDC plan there is no ability to borrow against one’s account balance. Nor can it be rolled over into an IRA or another company’s retirement plan if an employee changes jobs.

Lack of flexibility. Distribution elections must be made when deferrals are made. Some employers may force payments as a lump-sum distribution per plan rules, while others require you to defer compensation until a specified date, which could be during retirement. Other plans allow for earlier distributions. Depending on your personal situation and income needs, you should evaluate if your NQDC plan is a good fit for your financial needs.

Little or no access to funds. NQDC money is generally not accessible until the distribution date or another allowable event such as termination. Unlike a 401(k) plan, an NQDC generally does not allow early distributions.