Inflation has hit everyone where it hurts—in the wallet. But there's some good news if you save through a workplace retirement plan. Your savings may already have inflation protection built in if you save a percentage of your income versus choosing the option to save a fixed amount—which may be an option offered by your employer. If you're lucky enough to get regular raises or salary increases, using the option to save a percentage of your income will help ensure that the amount you're saving will increase as your income does.

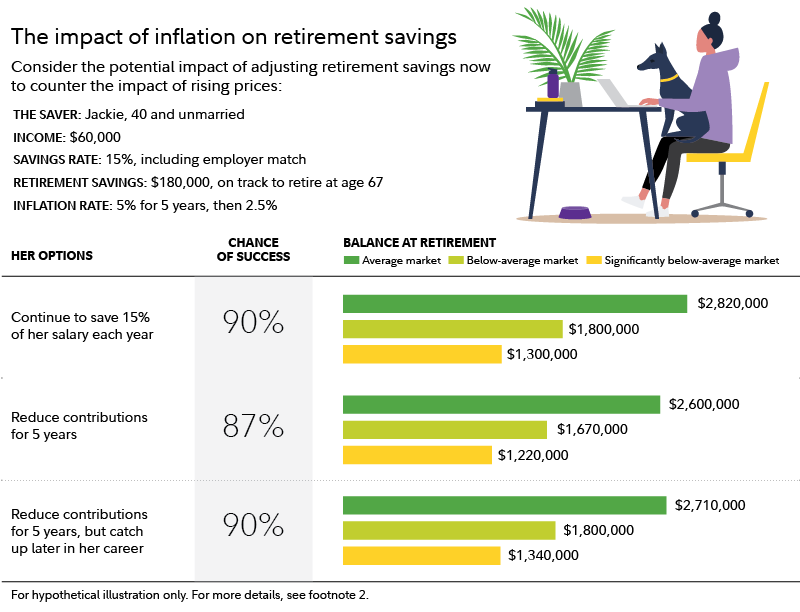

Annual salary increases are one of the assumptions behind Fidelity's retirement guidelines. A hypothetical saver who earns $60,000 at age 40 and saves 15% of her income each year, including an employer match, would see the amount saved increase by an average of $490 per year. That assumes a 4% annual salary increase, no withdrawals or loans, and a retirement age of 67. (The 4% salary growth rate assumption includes 2.5% inflation and 1.5% excessive growth above inflation.1)

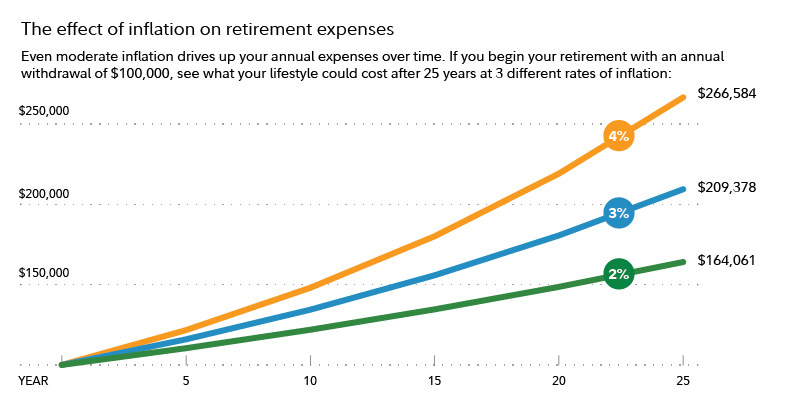

Consider that in retirement, even moderate inflation can drive your annual expenses up over time. Your expected retirement expenses are a key factor in deciding how much you may need to save for retirement.

Here are 5 time-tested strategies to keep your retirement savings on track despite rising prices and stock market volatility.

Fight rising prices with a budget

With rising costs, many are looking for ways to save money and trim extra expenses.

"There aren't really any magic bullets," says David Peterson, head of wealth planning at Fidelity. "I know people hate the word budget. But it can make sense for people to sharpen their pencils on their budgets. Understanding where the money goes can help you evaluate where to potentially reduce or cut back, if needed."

Here's what Fidelity's 50/15/5 budget guideline suggests:

- Spending no more than 50% of your take-home pay on essential expenses.

- Saving at least 15% of your pre-tax income for retirement, including any match from an employer.

- Saving 5% of your take-home pay for emergencies or short-term goals.

Keeping your spending and saving aligned to these guideposts can help keep your financial boat afloat amid rising inflation.

Invest in yourself

Reducing your expenses through budgeting can help in the short term. But for a longer-term solution, it may make sense to focus on ways to boost your earnings potential, if possible. "In the longer term, you can have more control over the amount of money you have coming in through improving your skill set," Peterson says.

If there are ways to improve your earning potential, it can make sense to take the plunge when you can. Be advised that there can be a cost involved, usually money and a hefty amount of time. But adding skills or education has the potential to improve your financial position in the long run.

Keep saving through periods of high inflation

Families hit hard by inflation may struggle to keep saving at their previous rates. Don't give up if you find yourself in that predicament: You can catch up if inflation keeps you from saving as much as you would like. Here are the ways to come back from a saving setback:

- Save more later

- Work longer

- Spend less in retirement

- A combination of all 3

The example below shows the outcome at retirement in several different scenarios. As you can see, even with a saving setback, if you're able to get back to saving consistently and catch up later in your working years, the outcome can be improved significantly. Working longer and spending less in retirement could further boost the odds of a successful retirement.

Saving for retirement is a lifelong project that can take many twists and turns. With myriad uncertain and uncontrollable factors contributing to the outcome of your plan, the best thing individuals can do to help ensure success is consistently save and invest.

The key variables that you can control are the amount you save and when in life you start saving. The best time to start is at the beginning of your career but the next best time is now—or as soon as you're able to start.

Keep investing through uncertainty

On any given day, the world is an uncertain place. But it's important to keep it in perspective. Recency bias lends heavy weight to news and events that just happened. Events that are happening now feel much more urgent than something that happened 5 months or 5 years ago.

This is where the value of a financial plan can really shine. Having a plan can give you peace of mind that you're on the right track.

Here are 3 actions that an investor saving for retirement could have taken during the Global Financial Crisis in 2007–2009 and the long-term effect on their savings.

Give up: Sell all stocks and stop making contributions. Bail out: Sell all stocks and leave the money in cash, but keep saving. Stick with it: Don't sell. Continue making new workplace contributions and stick with their investment plan, including annual rebalancing.

As you can see, continuing to save and invest through the Global Financial Crisis would have helped the investor's account recover from the downturn and take advantage of subsequent growth.

Control investment taxes and fees

Consider the cost of investing. Every dollar counts when you're hoping for long-term compounding and appreciation.

"There are 3 main drags on performance: inflation, taxes, and fees,” says Fidelity’s Peterson. “Be sure to talk to a tax professional on how to manage taxes. Additionally, it's important to evaluate what it costs to invest, and this, of course, is where Fidelity has advantages over many competitors in the marketplace.”

Read more about pricing and fees at Fidelity: Value you expect from Fidelity

The value of a plan

Financial planning can help you find a way to keep working toward your goals when the future seems unclear. Though you may not always be making as much progress as you would like, a plan can provide milestones to aim for.

If you're not ready to build a financial plan yourself, consider working with a financial professional.