You've probably heard about the common myth that everyone is required to claim Social Security at age 62. The reality: You can claim your inflation-adjusted Social Security income anytime between age 62 and 701. The longer you wait, the greater the monthly benefit.

If you decide to claim early, then are you stuck with that decision? - Not necessarily. Social Security allows you to change your mind once during the first year of receiving benefits, but you have to pay back everything you've already claimed that year.

What if you have second thoughts after the first year? Good news: There's a little-known strategy to readjust your Social Security claim and produce additional guaranteed lifetime income. It's called "claim-suspend-restart"—CSR.

"Some people claim Social Security early even though it may not be in their best interest. In fact, 58% of people claim before their full retirement age (FRA)," says Brad Koval, director of Financial Solutions at Fidelity. "However, CSR may be a good strategy if you can afford to forgo some payments for 1 to 3 years in exchange for a greater payout of guaranteed income in later years."

CSR Social Security claiming strategy: How it works

Why do so many people claim Social Security early?

About 27%2 of people claim at the earliest possible age of 62, locking in a 30% permanent reduction in monthly benefits compared to claiming at FRA3.

Here are 8 key reasons:

1. You don't expect to live that long. Health status, longevity, and retirement lifestyle are three variables that can play a role in your decision when to claim your Social Security benefits. Generally, many people who suffer from poor health decide to claim early, as they don't anticipate that they will live into their 90s.

2. You planned to keep working. Some people planned to work a few more years, but may have been laid off and unable to secure another job. This could result in claiming Social Security early because they need the money.

3. You never established an adequate emergency savings. Having an emergency savings can help protect you and your loved ones from unexpected expenses. If you don't have one, claiming Social Security early may provide you with a cash buffer to cover those expenses.

4. You need a bridge to Medicare. One of the biggest challenges for people age 62 to 65 is to find and afford quality health care. Health care options between retirement and Medicare coverage include COBRA, private insurance, the public marketplace, and a spouse's plan. Tip: Read Fidelity Viewpoints on Fidelity.com: Your bridge to Medicare

5. Your young children are receiving a benefit. If you remarried later in life and had children, they may still be under age 18, living in your household, and able to receive a payment based on your claim.

6. Opportunity to invest. Some people claim their monthly benefit, and then invest it because they believe this way their returns will exceed the increase in benefits offered by the Social Security Administration (SSA) for claiming later. This could be difficult for the average investor and involves risk.

7. Belief that Social Security will run out. About 45% of people fear Social Security money may run out, leaving them to not wait for their full benefit4.

8. Caregiving. Maybe you decided to end your career early to take care of a loved one.

Why suspend Social Security after FRA?

After a few years into retirement, you probably have settled into a retirement lifestyle that fits your budget. You may have decided to lower expenses or you may seek ways to boost your income in retirement.

"Some people regret claiming their Social Security early because they left money on the table," says Koval. "They wonder about outliving their money and would like a slightly higher standard of living in retirement. With this CSR claiming strategy, they can achieve that goal."

For others, they may have experienced a rising stock market, found a great part-time job in retirement, or may have even received a windfall from a relative. In any event, their circumstances have improved and now they don't have to rely on Social Security to pay the bills. Maybe their kids have finished college or they've gone through a "gray divorce" and decided to remarry. Either way, you find people who are hopeful about their finances in retirement. With more money, they have more options.

Now they've discovered they can actually delay gratification by suspending their Social Security at FRA for a while, then restart their claim. The net result is a boost of monthly payments by 8% per year5. "Once some people are retired, they may realize they don't need their Social Security income over the next few years. They would rather have a higher benefit down the road as inflation and longevity protection," says Koval.

Restarting Social Security after FRA

If your retirement planning is in order by the time you reach your full retirement age, this CSR strategy may make a lot of sense. After you suspend Social Security, you still have a few options to consider. For every month you suspend, you are adding "retirement credits" to your Social Security. For the biggest gain possible, consider suspending your claim when you reach your FRA, and waiting until age 70 to restart your claim.

If you choose this route, the Social Security Administration will reinstate and increase your benefit automatically when you reach age 70. Remember, for every full year you suspend, your benefit increases 8% per year. If you suspend for three years from age 67 to 70, your benefits jumps by 24% when your resume claiming benefits—that's a guaranteed benefit that will also increase with inflation for the rest of your life.

Tip: If you've reached your FRA, do the calculations to see if you have the financial capacity to fund retirement expenses during the delay period. If you can, then "test drive" the suspension of benefits for a year see how it works for you. Then, review this option annually to see that it still makes sense for your situation. Fortunately, there's no commitment to keeping it in place through age 70. You can employ it for up to 36 months (the time between FRA and age 70) at your discretion.

Case study: Claiming at age 62 vs. CSR strategy

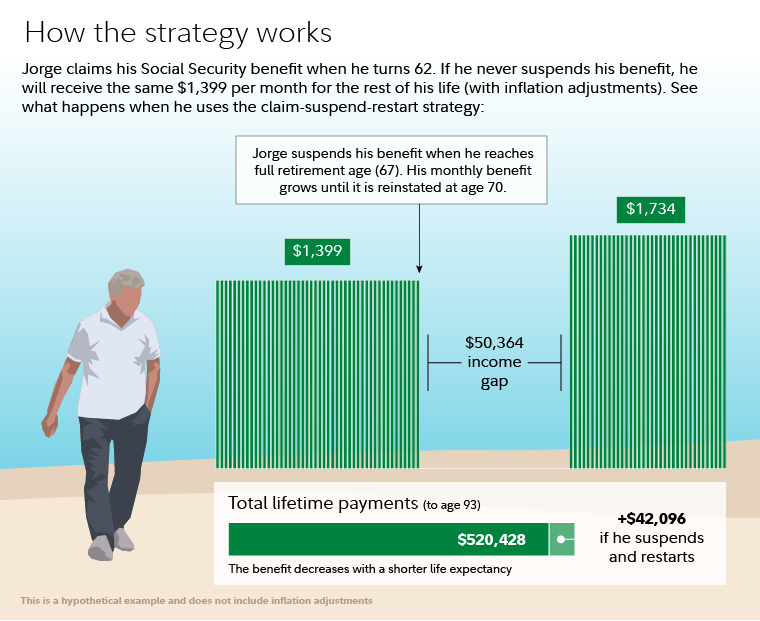

In a hypothetical example, Jorge plans to claim his Social Security benefit at age 62 (see left side of the chart below) and receive $1,399 per month. Over his expected lifetime (93 years), his total benefit is estimated to be $520,428.

Now, let's examine if Jorge employed the CSR strategy. In a scenario where he decides to employ the strategy to its maximum benefit, he would suspend his benefit from FRA at age 67 to age 70. The amount of benefit foregone during the suspension period is estimated to be $50,364 and he would have to tap into retirement and personal savings to cover his expenses over that timeframe in order to maintain the same level of spending during the suspension period (see right side of the chart below).

When Jorge restarts his claim, his monthly benefit jumps to $1,734 per month. That's an increase of 24% over the first scenario and is estimated to boost his total benefit by $42,096 — increasing his lifetime benefit to $562,524. However, if he had a shorter life expectancy than 93, as assumed here, his potential payoff in the form of his lifetime benefit could be substantially lower. Jorge would then need to fund a $50,364 income gap for the three years he is suspending his benefit.

Jorge's hypothetical case: Claim at 62, suspend at FRA, and restart Social Security benefit at age 70 for a bigger payoff

Summary

One of the keys to this CSR strategy is to be able to tap into retirement or personal savings for a period of approximately 1 to 3 years when you won't be getting your monthly Social Security checks. "You need the financial capacity to self-fund the so-called bridge from approximately age 67 to 70," adds Koval.

"This strategy represents a cost-effective way of purchasing inflation-adjusted retirement benefits that are also guaranteed for a lifetime," says Koval. "Despite what most people are told, claiming Social Security is not an irrevocable decision. You can still take advantage of the positive impact of delaying your final claim which is maximized at age 70. Those increased payments really add up over time, especially if you live into your 90s."

In life, we often try to make the best choices based on information that we know—at that time. If you've already claimed Social Security, or reached your FRA recently, it makes sense to work with a financial professional and consider this CSR strategy, which may help boost your retirement income over your lifetime.