Early retirement isn’t just a daydream—it’s a goal more and more people are chasing. And for many, it’s paying off: Over 70% of recent retirees say their retirement is going as planned, and nearly as many say it’s even better than expected.1

So if you’re hoping to fast-track your own retirement, you’re not alone—and it might be more doable than you think. At its core, retirement is just a math problem: You have a certain amount of money to cover your expenses for a number of years. Changing one of the variables can change the outcome of the equation. In order to lengthen your retirement, you may need more money, lower expenses, or both.

To make it happen, “You have to set up a plan,” says Ryan Viktorin, CFP®, a Fidelity Investments vice president and financial consultant.

Your plan needs to factor in everything from future income sources and health care costs to longevity. The overarching goal: “You want your assets to be here if you are still here,” Viktorin says.

Here are 5 tips to help you retire 5 years earlier.

1. Determine how much you need to save for retirement

Comparing your current expenses with future retirement expenses can help you understand how much retirement will cost. So grab a pen and some paper or turn on your computer, then write out what you expect your later years to look like, starting with your target retirement age.

“Figure out what you are going to do with your time and who you will spend it with,” says Brad Koval, director of financial solutions at Fidelity Investments. Then ask yourself: Will you spend more or less in retirement than you spend now?

The more detailed your responses, the better, as this outline will help you get a good feel for the money you’ll need to support yourself.

To help you along, here are some thought starters:

- Where will you live? In what location and in what type of home? Will you “age in place”—remaining in your existing home—or relocate to a new community?

- What will a regular day in your life look like in the initial years of retirement, as well as the longer term?

- What hobbies and social activities will you participate in?

- Will you travel? If so, how often will you take trips, and where will you go?

- What are your plans for gift-giving to family, friends, and charitable causes?

- If you retire before age 65, what type of health insurance will you get before Medicare kicks in? Do you plan on having long-term-care insurance?

A financial professional can give you a more thorough list of questions and help you account for all possible later-in-life expenditures.

How much do I need to save for retirement?

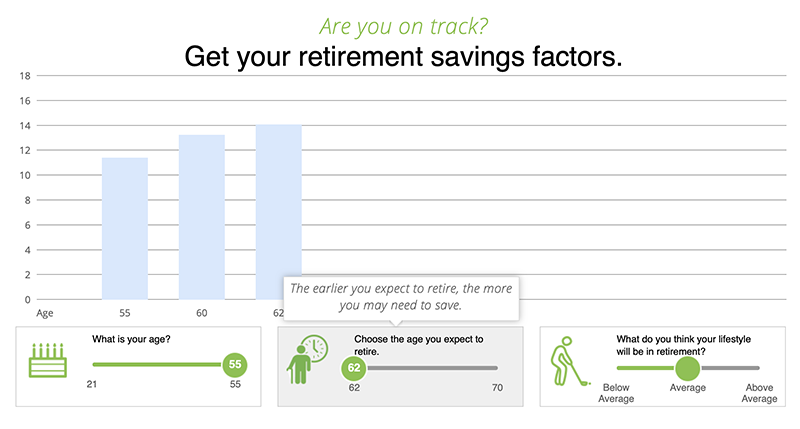

For a rough estimate of how much you may need to save for retirement, consider Fidelity's retirement saving factors. Generally, someone retiring at age 67 should aim to save 10 times their salary by that age. To retire at age 62, they could aim for 14 times their salary.2 Try our calculator: Get your retirement savings factors.

2. Run different scenarios to pressure-test your plan

Many elements can affect your plan, such as when you stop contributing to retirement accounts, potential market downturns, the age you take Social Security, and future health care outlays.

If you want to retire before age 60, keep in mind that, with some exceptions (such as Roth contributions), you’re not eligible to take funds out of a retirement account without penalty until age 59½, notes Viktorin. (The IRS does allow some distributions called substantially equal periodic payments, aka 72(t) distributions. The amounts of your withdrawals are based on your age and account balance, and you must take them for 5 years or until you reach age 59½, whichever is longer. Consult with a tax professional if you are considering this strategy.) So it's important to consider where your income will come from after you stop working.

After you get your ideal situation set, the moment of truth comes. Compare your potential income with your spending and evaluate how long your savings may last.

“Run the numbers to see how well your plan can support your expenses and needs,” says Klara Iskoz, vice president of retirement income solutions at Fidelity Investments. “Run it as if you’re retiring 5 years early and at a later age, maybe at 64, to see how the plans would differ, with everything else being equal.”

If the numbers don’t play out how you want, you’ll need to make some adjustments. Fidelity's Planning and Guidance Center can help you test out different scenarios. In addition, most financial professionals will have sophisticated modeling tools to help you develop a plan that reflects your specific financial situation, goals, and risk tolerance.

In this hypothetical example, Enrique wants to retire at age 62 instead of 67. He plans to continue saving 15% of his income pre-tax (including any employer contributions) until he retires, and has already saved $600,000. He anticipates his monthly expenses of $5,760 will stay about the same in retirement. He may need to save a little more, work a little longer, or reduce his spending (or a bit of all 3) in order to retire a full 5 years early.

3. Rein in spending and try to save more

If you feel like you could be a little more disciplined with spending, it can make sense to build up that skill well before retirement. Spending less now can also help you save more for the future. During inflationary times, that is sometimes easier said than done.

The key to success? “Budgeting, budgeting, budgeting,” says Iskoz. “You have to create a very detailed budget and see where you can cut things out.”

Reviewing recent credit card and bank account statements is an easy way to get started. Scrutinize non-essential spending to determine where you can save money. Two prime candidates: restaurant food and streaming services.

Then you can go even further by reducing home energy costs, opting for more-affordable vacations, and looking for less expensive home, auto, and other insurance. To reap even bigger savings, sell a second car—which will bring in cash while eliminating gas, insurance, and maintenance outlays for that vehicle—and consider downsizing your home or moving to an area with a lower cost of living.

4. Earn extra income to close any savings shortfalls

There are more ways than ever to create an extra income stream, from side hustles and seasonal work to selling goods online and renting out a spare room.

The additional cash can help you meet your savings goals—and your side job may be something you're able to continue doing after retiring from your full-time job if you want to or need the extra money. It could be an opportunity to spend time doing something you love or find meaningful.

Are you an animal lover? Pet sitting could be for you. If crocheting is more your thing, you can sell hats, scarves, and mittens through an online platform or at in-person craft fairs. And if hospitality comes to you naturally, listing an extra room on a home-rental platform could be an option.

“Think creatively,” says Viktorin. For instance, a ski-loving client of hers took a job at a local ski area while a gardener client got work at a nursery. “The nice thing about those types of roles,” Viktorin adds, “is you can try it, and if you hate it, you can stop.”

5. Make the most of workplace benefits and invest for growth potential

Capitalize on every perk coming your way. If you have access to tax-advantaged retirement accounts like a 401(k) and a Roth 401(k), be sure to get all matching contributions from your employer. And if you have the means to do so, invest the maximum amount allowed.

In 2026, you can contribute up to $24,500 pre-tax or Roth to your 401(k). Some plans may allow after-tax contributions up to the combined employee and employer limit of $72,000. If you're at least age 50 at the end of the calendar year, you can add a pre-tax or Roth catch-up contribution of $8,000 (or $11,250 if age 60–63).

According to the SECURE 2.0 Act’s higher earner rule, in 2026, catch-up contributions for earners whose FICA wages (typically Box 3 of Form W-2) exceed $150,000 in the previous tax year, must be designated as Roth or after-tax contributions.

If your employer's plan does not offer a Roth contribution feature and you fall under the high-earner rule, you won’t be able to make catch-up contributions to that plan.

A financial professional and tax professional can help you determine the best allocations for your money, as well as help you decide what to invest in a traditional 401(k) and a Roth 401(k) if both are available. (You’ll make traditional 401(k) contributions with pre-tax dollars, while Roth 401(k)s are funded with post-tax contributions, so any Roth 401(k) earnings grow tax-free.)

If available, consider a health savings account (HSA), which is “a great savings vehicle,” says Koval. With an HSA, contributions are tax-deductible or made with pre-tax dollars.4 The money you contribute is tax-free and any earnings come out tax-free as long as you use the funds for qualified medical expenses. Starting at age 65, the money in your HSA can be used to pay for nonqualified medical expenses, but you’ll have to pay state and federal taxes on the amount of the distribution.

And no matter what vehicle you’re using, “make sure you’re invested appropriately,” Koval adds. It’s critical to keep your financial goals and retirement time frame in mind. A financial professional can assist you in this area as well.

Keep pursuing your retirement dream

Recent years have highlighted how resilient and resourceful Americans are. Continuing to save for the future and plan for financial stability over the long term, through good times and bad, can help ensure you reach your goals. And Fidelity is here to help you make it happen.