During tough times, the strength of your financial plan can be tested in ways you may have not imagined. And that can cause some strong feelings—which can sometimes complicate financial decisions. So it's always a good idea to prepare for a recession before one pops up again.

Economic uncertainty can drive up anxiety, particularly when headlines and economic news seem negative. Here are 6 smart steps you can take now to manage your emotions and help bolster your finances.

1. Practice mindfulness to help make better money moves

Sometimes our natural reactions are not the most helpful. "Some people disengage from their finances in down markets because they feel anxiety at the thought of knowing how bad their situation might be. Others, meanwhile, engage more in down markets, spurred by feelings of fear into behaviors like panic selling," says Brianna Middlewood, PhD, a director of behavioral research at Fidelity.

That's why it's always important to keep your long-term goals in focus. If you find yourself checking out or tempted to cut your losses in the market despite a well-considered long-term investment plan, take a moment to reflect on what's really driving your choice and if it’s in your long-term interest. Practicing mindfulness can help you develop the discipline you may need to avoid emotional money moves that you may regret down the road.

2. Get a financial plan or stress-test the plan you have

If you don't have a financial plan, it can make sense to build one and adjust as needed along the way. A financial plan is intended to serve you for the long run and weather both the market ups and downs. Planning can help you see where you stand now and give you a roadmap to a financially secure future. As part of the planning process, you can test the impact of various market and economic scenarios on your financial well-being; for instance, calculating the amount you may need to save to hit your major goals if some factors change.

"The thing I worry about are the big shocks to the system—like a recession and being laid off. You want to try to ensure you have enough liquidity to get through those periods," says David Peterson, head of wealth planning at Fidelity. "With a plan in place, you can play around with estimates. What if I get laid off and am out of work for 6 months? Where is money going to come from to cover essential expenses? And how might it impact my retirement plan? A plan can be modeled and you can estimate what 6 months with no income means for you.”

It can be a balancing act, saving and investing for the distant future while also taking steps to protect what you have today. Preparing early can help make sure you have money for unexpected expenses, a plan to protect what you have, and growth potential to reach your long-term goals.

3. Look for ways to spend less or earn more

In the short term, it's very difficult to conjure up more money. If it were easy we'd all be doing it already. So spending less is the obvious lever to pull when casting around for more cash to save or to pay bills.

To get started, look at your spending versus your income. You don't need to track every penny but having a rough idea of how much you're spending and where can help you get started.

4. Bolster your emergency savings

Emergency savings can be a lifeline during hard times. It's a good idea to start by saving $1,000 and then keep going until you've hit a level that helps you feel secure. Ideally, you should try to save enough to cover 3 to 6 months of essential expenses. Some people may want to save even more than that. Don't worry if your emergency savings isn't quite up to that standard; 3 months' worth of essential expenses is quite a lot of money to squirrel away, but if you are diligent in saving each month, you can slowly but steadily build up to that point.

It can make sense to keep a significant portion of your emergency savings liquid—that way you can easily access your money if it's needed. "It doesn't necessarily need to be all in cash, but consider a relatively low-risk investment like money market funds or CDs that you can depend on if you do need to access it," says Peterson.

5. Try to stay the course with your investments

Investing for the long term takes some belief that things are going to be OK in the future. Though it can be disconcerting and even upsetting, market volatility is a regular part of life in the stock market.

Stock market trade-offs

| Historically, on average, investors | |

| have received: | have tolerated: |

|---|---|

| ~8% annual return | 3 downturns of 5% per year |

| Positive calendar returns ~75% of the time | 1 correction of 10% per year |

| 1 correction of ~15% every 3 years | |

| 1 bear market greater than 20% every 6 years | |

Past performance is no guarantee of future results. It is not possible to invest directly in an index. Index performance is not meant to represent that of any Fidelity mutual fund. Source ("Receive"): macrotrends.net, via Investopedia; Source ("Tolerate"): RIMES, Standard & Poor’s; Source: Forbes, Steve Vernon; all as of 10/29/2021.

Looking on the bright side, the stock market has had more up years than down years historically. But there's a trade-off: stock prices don't go straight up forever—they tend to fall a bit a few times per year. Corrections of up to 15% may occur every few years. Sometimes the market goes down more than 20%. Those events tend to be rare but are not entirely unprecedented. A decline of more than 10% but less than 20% is called a correction. A decline of at least 20% from the market's high point to the low is known as a bear market.

Historically, the stock market has produced positive returns following significant corrections and bear markets. And that is one reason why it can be a good idea to stick with your investment plan through market ups and downs.

Median returns following large stock market selloffs (1950–2022)

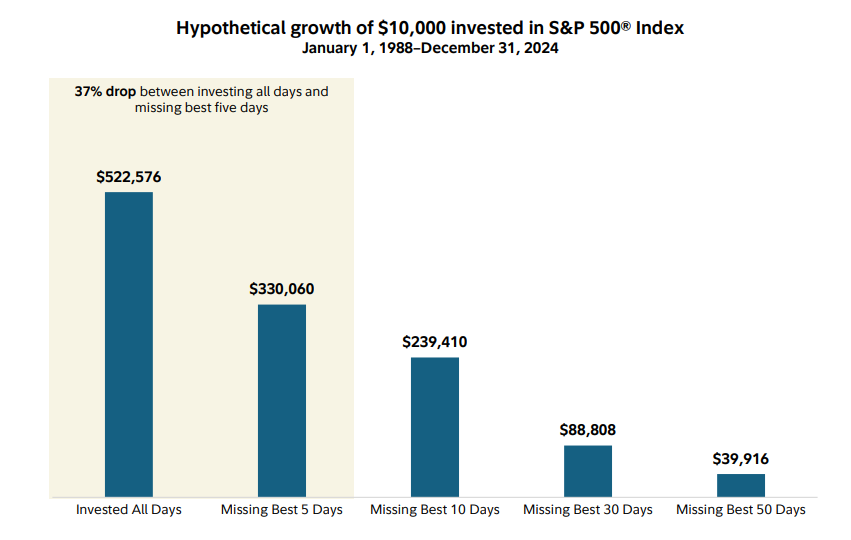

Because investors never know when the tides will turn, sticking to your investment plan has historically been a better bet than trying to time your exit and re-entry. Missing just a few of the best days in the market has the potential to affect long-term returns.

Hypothetical growth of $10,000 invested in the S&P 500 Index, January 1, 1988–December 31, 20241

6. Update your resume and sharpen your skills

Slowing economic growth can mean layoffs but the good news is that the overall picture for the labor market is still strong. As of September 3, 2025, 7.2 million jobs remain open, down 901,000 year-over-year.2

Whether you're concerned about potential layoffs or you're just ready to make a change, refreshing your resume with your latest skills and achievements can help make sure you're prepared.

Do your best to cope with tough financial times

The best time to plan for worst-case scenarios is when everything is going great. Nothing lasts forever. Bull markets will end and so will bear markets; economic expansions will eventually contract into a recession, but growth will start again. To get your financial plan started, or to strengthen the plan you already have, consider working with a financial professional.