Watching the market rise and fall could make anyone a little concerned. But there are things you can do when the markets get volatile to help protect yourself and position yourself to achieve your long-term goals.

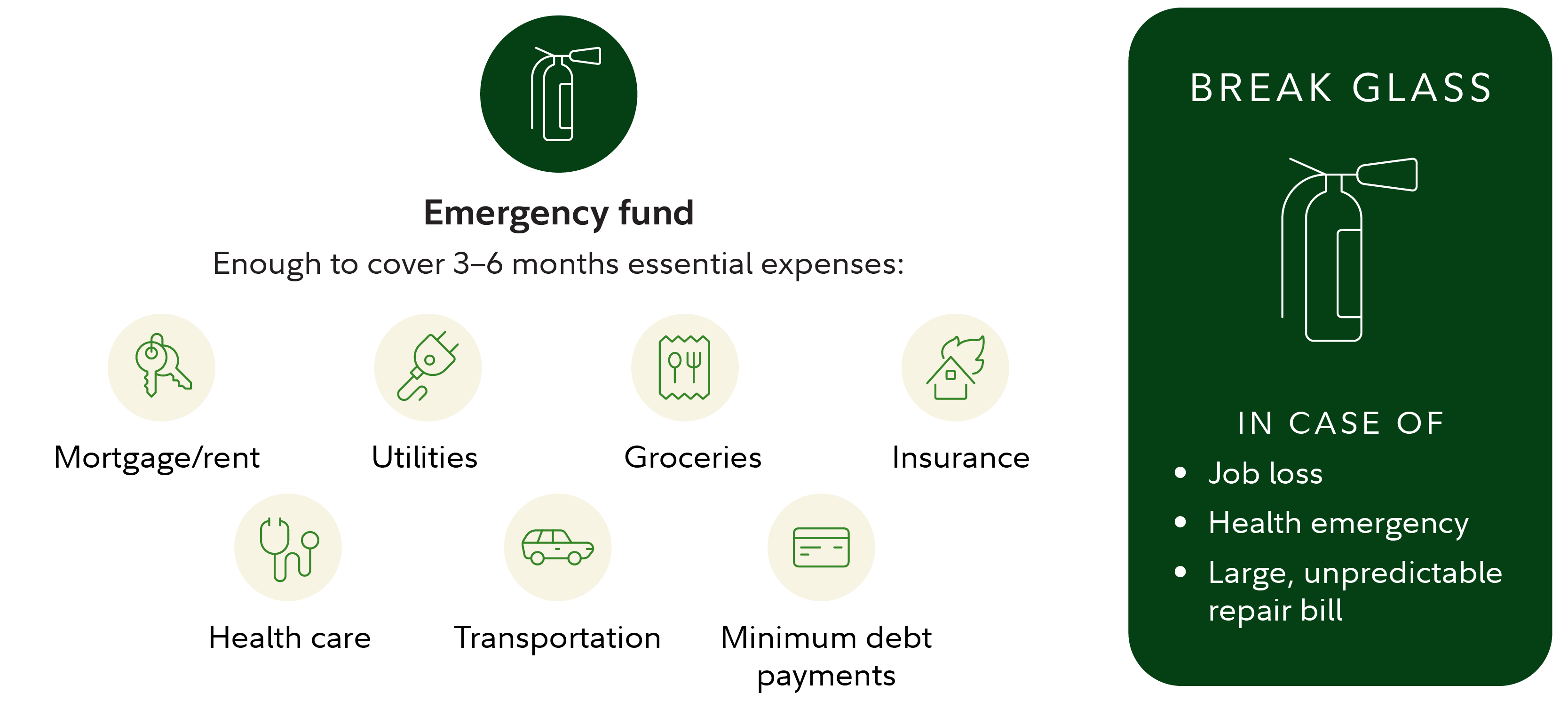

1. Shore up your emergency fund

When the economy is uncertain, it’s a good idea to check your emergency fund to make sure you have a comfortable cushion.

Our general rule is to start by setting aside $1,000, then aim to save enough cash to cover 3 to 6 months' worth of essential expenses. If you're the sole income earner for your household or your employment status could potentially change soon, you may want to put away a bit more if you can.

Read Viewpoints on Fidelity.com: How much to save for an emergency

2. Make investing automatic

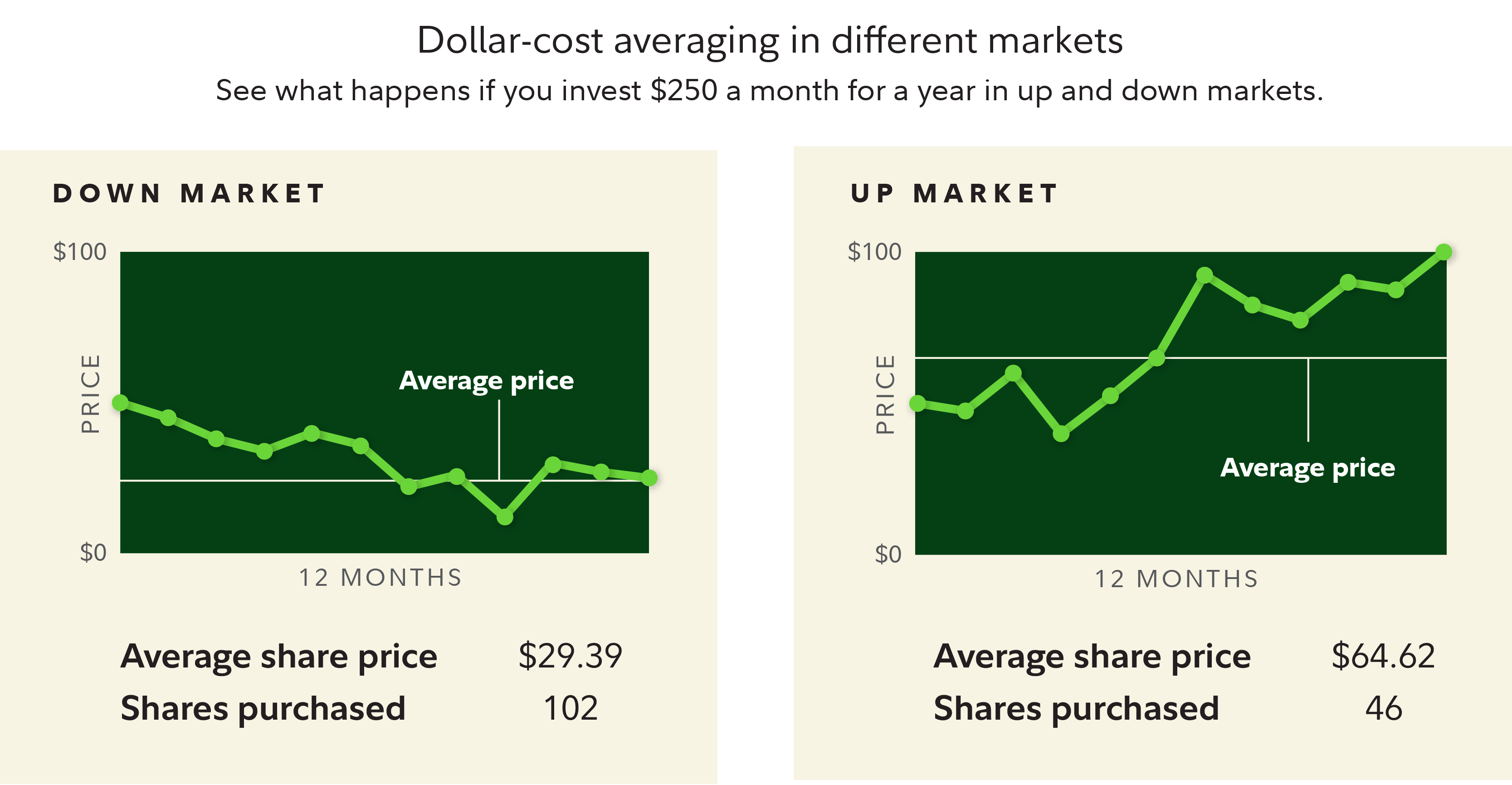

It can be easy for investors' emotions to take over when markets get choppy. Dollar-cost averaging is one way to take the emotions out of your investing decisions.

With this strategy, you invest your money in equal amounts at regular intervals regardless of which direction the market or a particular investment is going. If you keep investing regularly through a volatile or down market, you're likely to purchase more shares, more cheaply than you would in a bull market.

Let's assume you have $250 a month to invest and have identified a mutual fund you'd like to invest in. Using dollar-cost averaging, you invest that amount each month for a year. In an up market, the fund's share price might be gradually increasing over the year—meaning your $250 investment buys fewer shares each month as the year goes on. In a down market, by contrast, your monthly investment goes further—letting you buy more shares with the same amount of money.

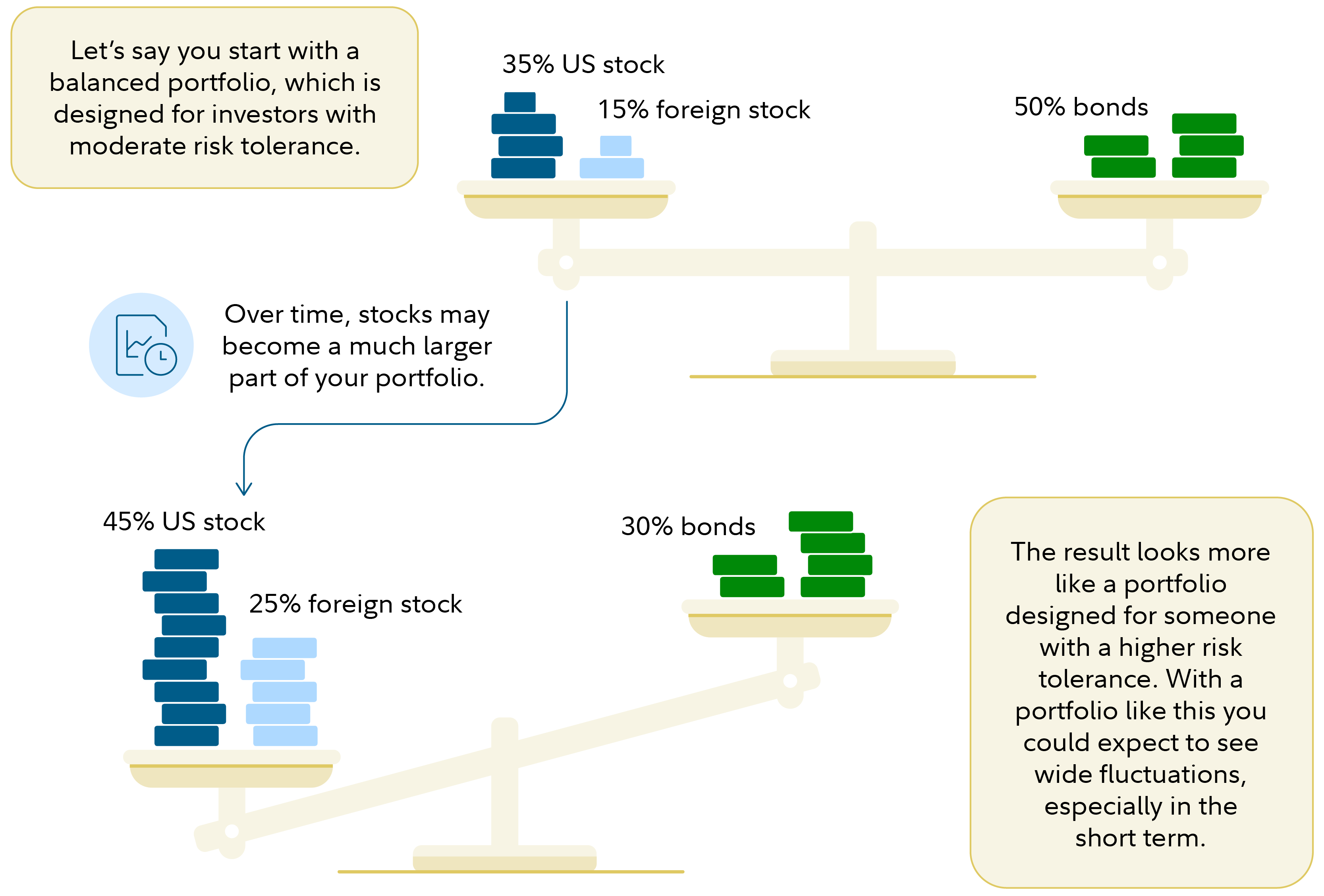

3. Check your portfolio and rebalance if necessary

The S&P 500 started off this year 80% higher than it was 5 years earlier. After a prolonged streak like that, your portfolio may include a higher percentage of stocks than you initially intended, raising the level of risk you’re exposed to.

Consider taking a look at your holdings now and rebalancing if necessary.

Rebalancing means bringing your portfolio back into line with your targeted asset allocation, by reducing positions that have grown larger than intended and adding to positions that have grown smaller. This may help you control how much risk you’re taking and stay diversified.

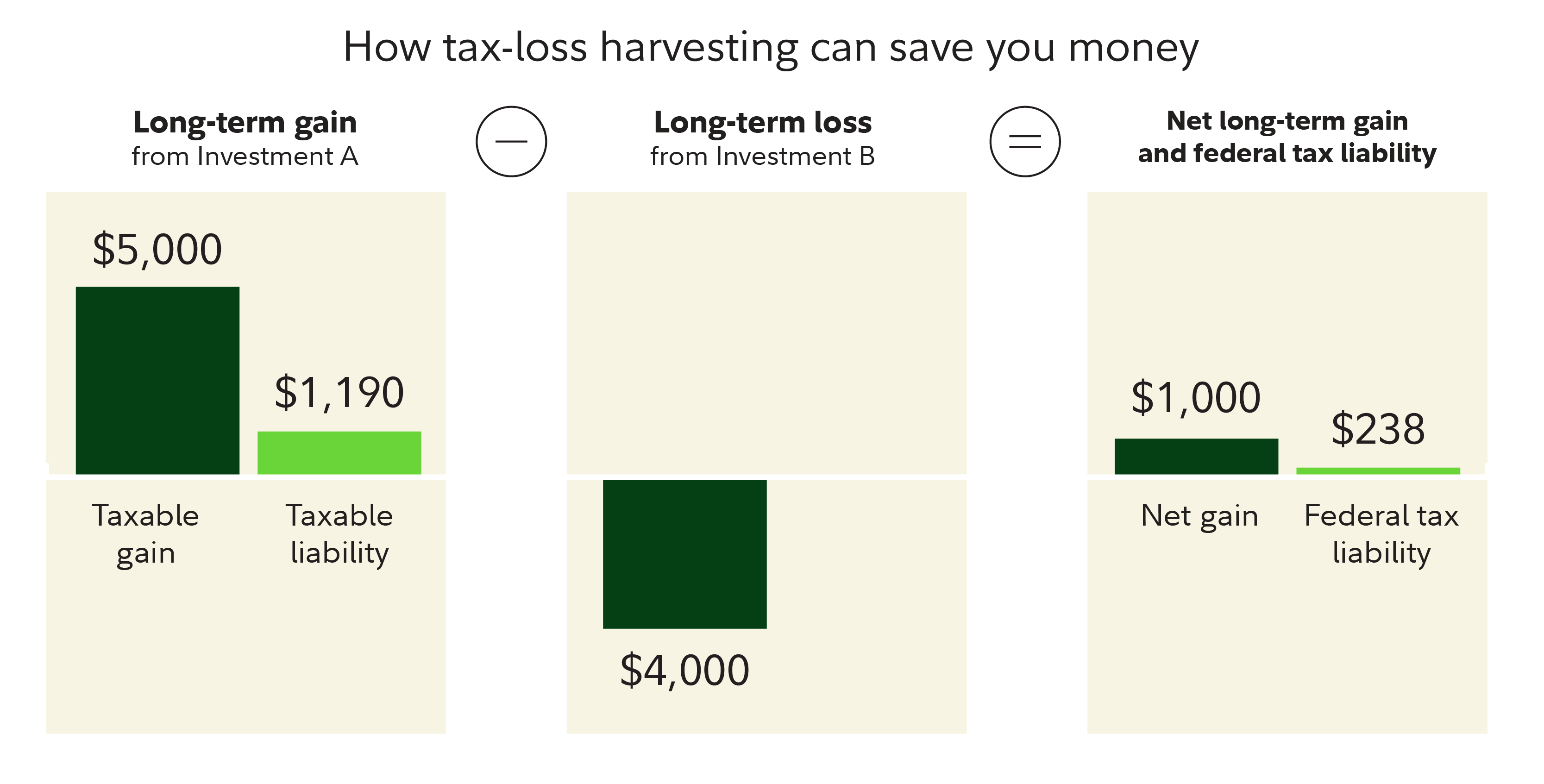

4. Explore tax-loss harvesting opportunities

If you realize a loss on the sale of a security this year, your loss can be used to offset any realized investment gains. If your realized losses for the year are greater than your realized gains, you also can offset up to $3,000 in ordinary income annually. If you will have realized gains this year and you have unrealized losses on investments that are currently worth less than when you bought them, you may want to consider whether it makes sense to sell them for a loss to lower your tax bill.

If you choose to implement tax-loss harvesting, be sure to keep in mind that tax savings should not undermine your investing goals. And be sure to comply with Internal Revenue Service (IRS) rules on wash sales and the tax treatment of gains and losses.

If you have an investment manager, they may already be doing your tax-loss harvesting. If you're doing it yourself, it's always a good idea to consult a tax professional.

5. Consider a Roth conversion

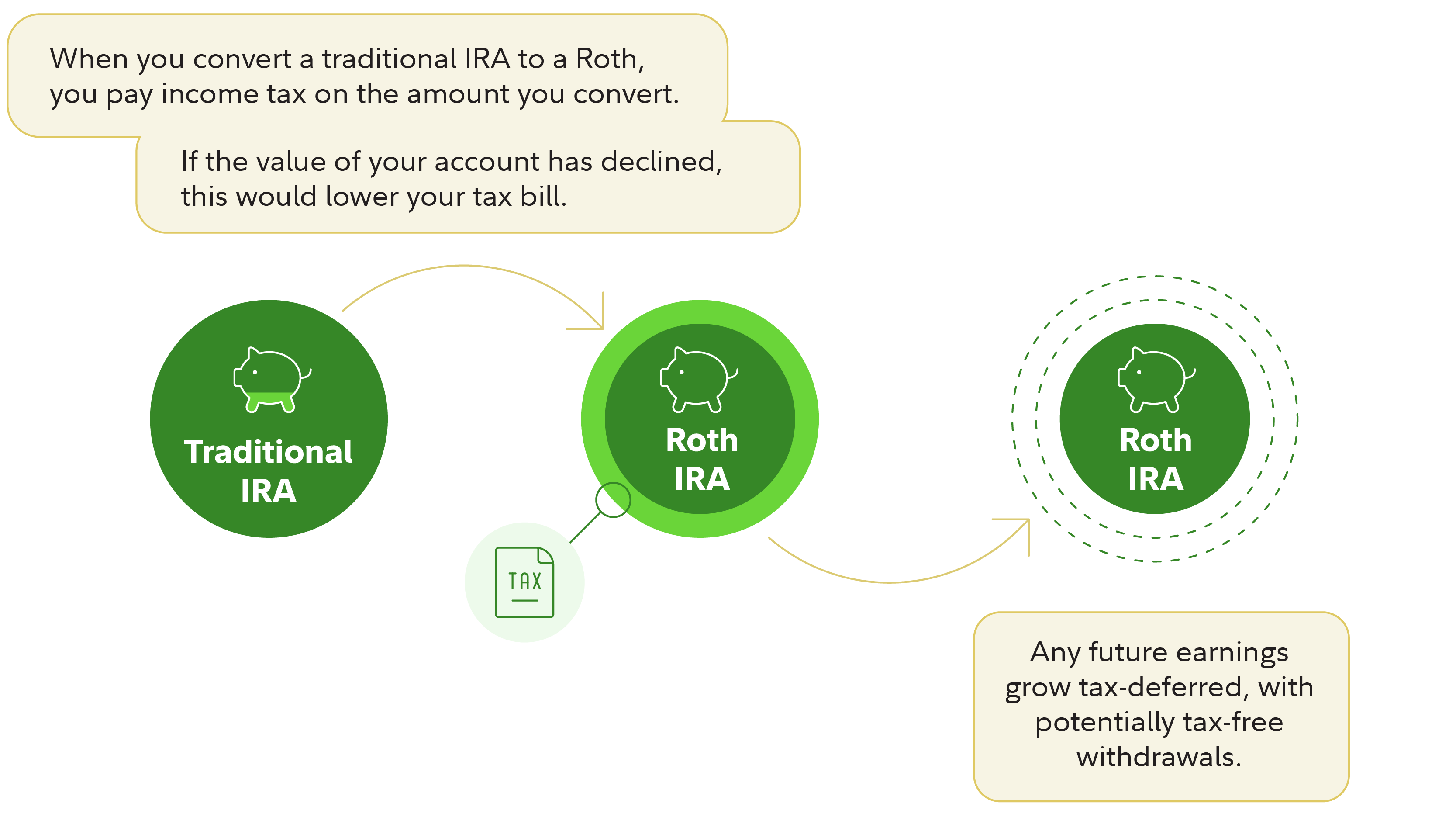

If you’ve been considering a Roth conversion, a market decline may present a money-saving opportunity.

When markets are down, the value of your traditional IRA or 401(k) may be lower. This means that converting to a Roth may result in a lower tax bill, as you will be paying taxes on the potentially lower value of your investments. Essentially, you are getting a "discount" on the taxes owed for the conversion.

Once the funds are in a Roth account, they have the potential for tax-free growth, and the converted balance can be withdrawn tax-free.2

Another benefit is that Roth IRAs do not have required minimum distributions during your retirement. This gives your investments the potential to continue growing tax-deferred for a longer period, providing more flexibility in retirement planning.

The bottom line

Market volatility can be unsettling, but it shouldn't be a reason to panic. It may present an opportunity to try to boost your savings and revisit your investments. Overall, if you have a solid plan based on your situation, it’s a best practice to stick with that approach even through the uncertain times.