If you've ever gone online and researched ways to save more for retirement in general, or save more in a Roth IRA in particular, you may have come across a strategy commonly referred to as the "mega backdoor Roth."

So how does this strategy work, and is it potentially an option in your situation? Read on for more.

What is a mega backdoor Roth?

A mega backdoor Roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a Roth account, based on their income or contribution limits, to transfer certain types of 401(k) contributions into a Roth—including a Roth IRA and/or Roth 401(k).

If available, the strategy can be particularly useful for those who earn too much to contribute to a Roth IRA directly.1 If you earn $165,000 or more as a single taxpayer, or $246,000 or more as a married-filing-jointly taxpayer, then you can't contribute anything directly to a Roth IRA in the 2025 tax year.

How does a mega backdoor Roth work?

Put very simply, the mega backdoor Roth strategy entails 2 steps: (1) making after-tax contributions to your 401(k) or other workplace retirement plan, and (2) then doing a conversion either to a Roth IRA or Roth 401(k). (Note that not all plans allow these steps; more details on that below.)

Let's break down those 2 steps. First, it's important to understand that the strategy starts with a specific type of contribution: after-tax 401(k) contributions. An after-tax 401(k) contribution is different from a Roth 401(k) contribution and different from a pre-tax contribution, which is often the default option with a 401(k). Why does it start with after-tax contributions? Because after-tax contributions may enable you to save in your workplace retirement plan beyond the annual contribution limit for pre-tax and Roth contributions. Here's a look at how that breaks down:

As you can see, if you only make pre-tax and/or Roth contributions, then the most you can contribute is $23,500 (or $31,000 if age 50 to 59, and $34,750 if age 60 to 63). With after-tax contributions, you may be able to increase the total amount saved to $70,000 (or $77,500 if age 50 to 59, and $81,250 for those age 60 to 632)—although any amounts contributed by your employer would count toward that limit. However, after-tax contributions can come with some downsides. One key drawback is that when you make withdrawals in retirement, any earnings will be taxed at ordinary income rates. And, depending on your plan, after-tax contributions may not be eligible for an employer match.

That brings us to step 2 of the mega backdoor strategy: converting the after-tax contributions to a Roth account. If you have a Roth option within your retirement plan, you may be able to convert the after-tax 401(k) amounts to a Roth 401(k). This is called an in-plan Roth conversion. Or, if your plan allows it, you may be able to roll your after-tax contributions to a Roth IRA. Prorated earnings attributable to the original contribution can be rolled to the Roth IRA, incurring taxes, or separately directed to a traditional IRA without incurring taxes.

Whether you convert to a Roth IRA or Roth 401(k), you will need to pay taxes on any earnings included in the conversion (you will not generally need to pay taxes on contributions you convert, as those amounts have already been taxed). A tax professional can advise you on the potential tax impacts of the strategy on your situation.

Are you eligible for a mega backdoor Roth?

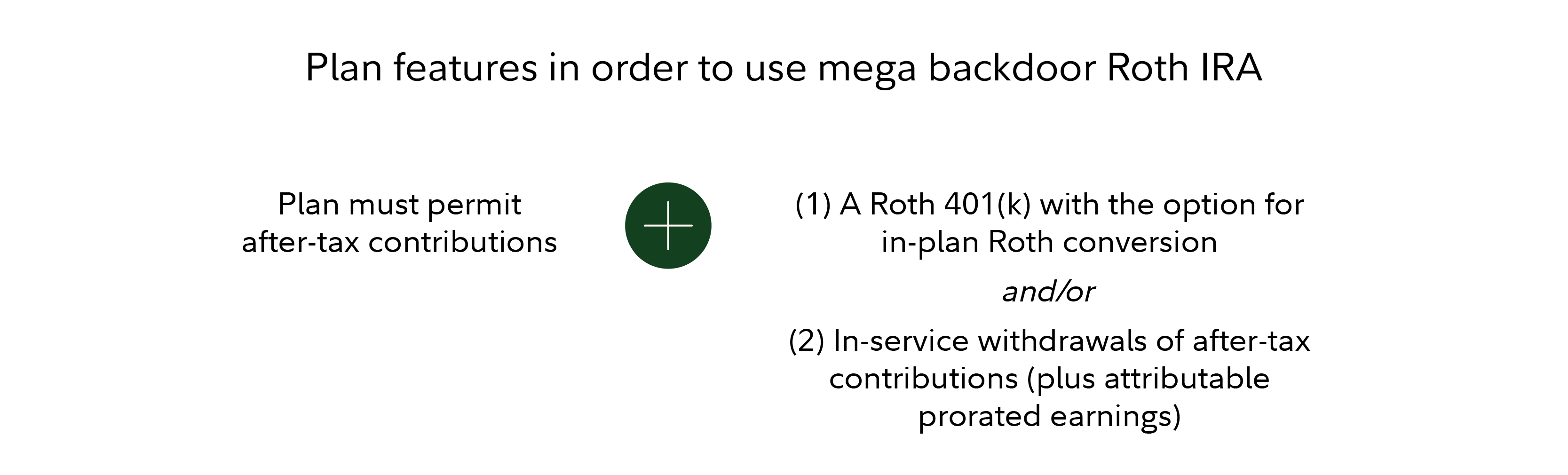

Whether you are eligible for a mega backdoor Roth depends on the specifics of your workplace retirement plan. Here's what plans generally must permit in order to use the strategy:

Plan features can vary widely. For example, many plans do not permit in-service withdrawals, which means taking a distribution from your 401(k) while you are still employed.

Consult your plan documents and plan administrator to better understand the rules and features of your employer's plan, and consider also how the rules could change should you switch employers.

How to set up a mega backdoor Roth

If you are considering trying to set up a mega backdoor Roth for yourself, the first step may be to check the details of your workplace retirement plan to make sure that it offers the features and that you are eligible for the strategy.

The next step may be to consult a tax and/or financial professional to see if the strategy makes sense in your situation, and to better understand the impacts on your taxes and planning.

If you determine that it is permissible and appropriate in your situation, then you can set one up by making after-tax contributions to your 401(k), and periodically rolling those contributions via a rollover distribution to a Roth IRA or doing an in-plan conversion to a Roth 401(k). Some employers even offer an auto-convert feature inside their plans, in which case participants can set it up so that any after-tax contributions are automatically converted to a Roth at regular intervals.3

Contribution limits

If you use the mega backdoor Roth strategy, how much you can save is limited by the annual caps on 401(k) contributions. It also depends on how much you have contributed via pre-tax and Roth contributions, and how much your employer has contributed. As the earlier chart showed, for 2025, people under age 50 can contribute a maximum of $23,500 in pre-tax and Roth contributions, and the maximum for all types of contributions is $70,000.

So, for example, suppose that someone is 35 years old and has contributed the maximum of $23,500 in pre-tax and/or Roth contributions. And suppose that their employer has also contributed half of this amount, or $11,750, in matching contributions. In that case, the maximum that they could contribute after-tax to their 401(k) for 2025 would be:

$70,000 ‒ $23,500 ‒ $11,750 = $34,750

There are no limits on how much you can convert to a Roth IRA in a given year, nor are there limits to in-plan conversions.4 However, these conversions can trigger tax consequences in the year in which you convert, which may be a drawback to converting large amounts in a single year.

Is a mega backdoor Roth worth it?

Whether the mega backdoor Roth strategy is worth it in your situation can depend on a range of factors. Some issues to consider include:

- Whether it is allowed under your workplace retirement plan

- How much you are currently saving for retirement and how much you already have saved

- What other financial goals you have, and how much you have saved toward these goals

- Your current tax rate versus your potential tax rate in retirement

- How a Roth conversion would impact your taxes for the year in which you convert

In addition to those financial considerations, there can be practical ones. The mega backdoor Roth can be a complex strategy. Consider whether you have the time and interest to learn the rules and stay on top of the administrative legwork it can take to make the strategy work.