Fidelity consolidates several 1099 forms—the 1099-DIV, 1099-B, 1099-INT and 1099-MISC—into one tax reporting statement. Here are 8 key things to look for on yours.

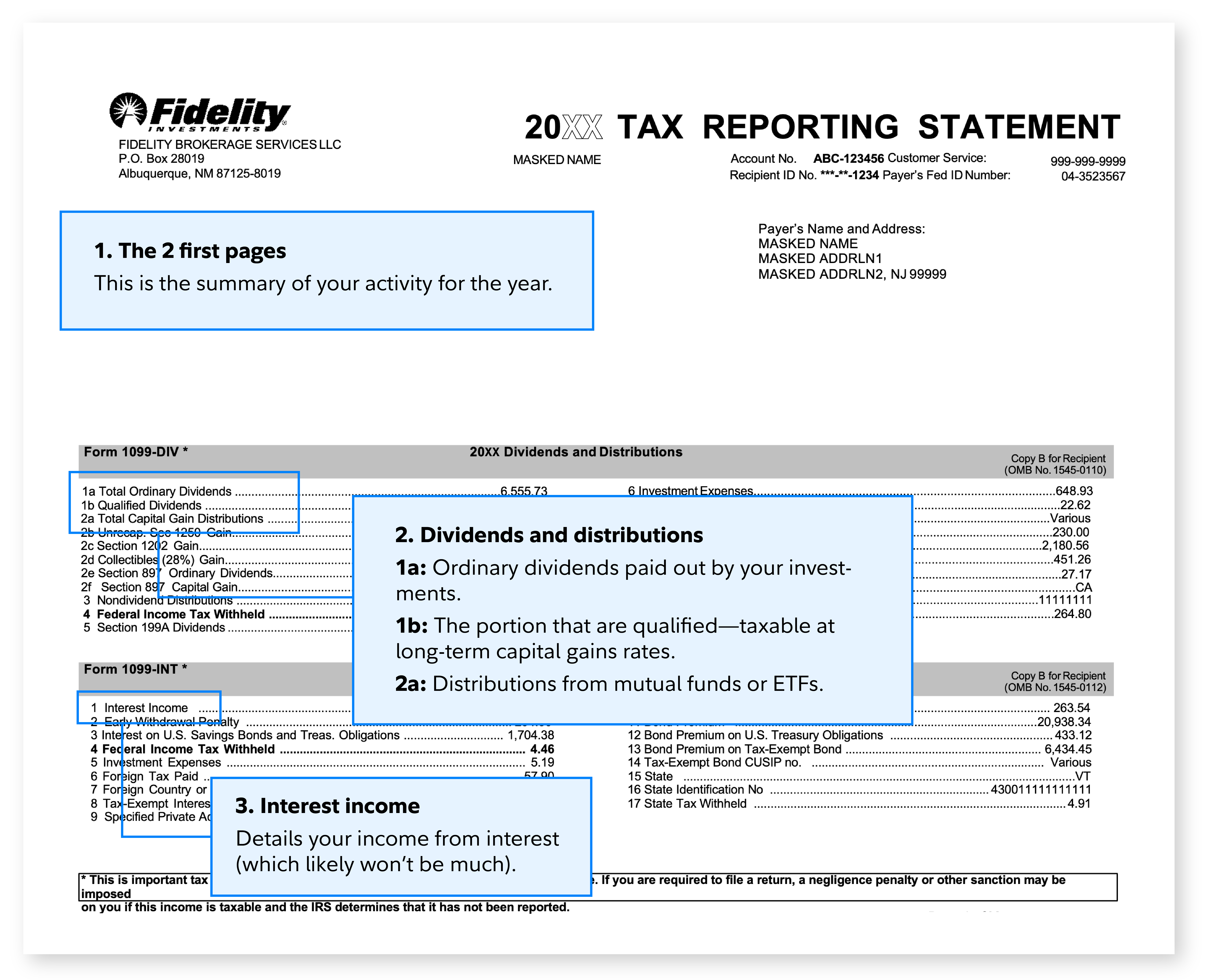

1. The 2 first pages: This is the summary of your activity for the year.

2. 1099-Div summary section: Dividends and distributions Line 1a: Ordinary dividends distributed by your investments. Line 1b: The portion of 1a that are “qualified”— taxable at long-term capital gains rates. Line 2a: Distributions from mutual funds or ETFs.

3. 1099-Int: Interest income Line 1: Details your income from interest from money market funds (which likely won’t be much).

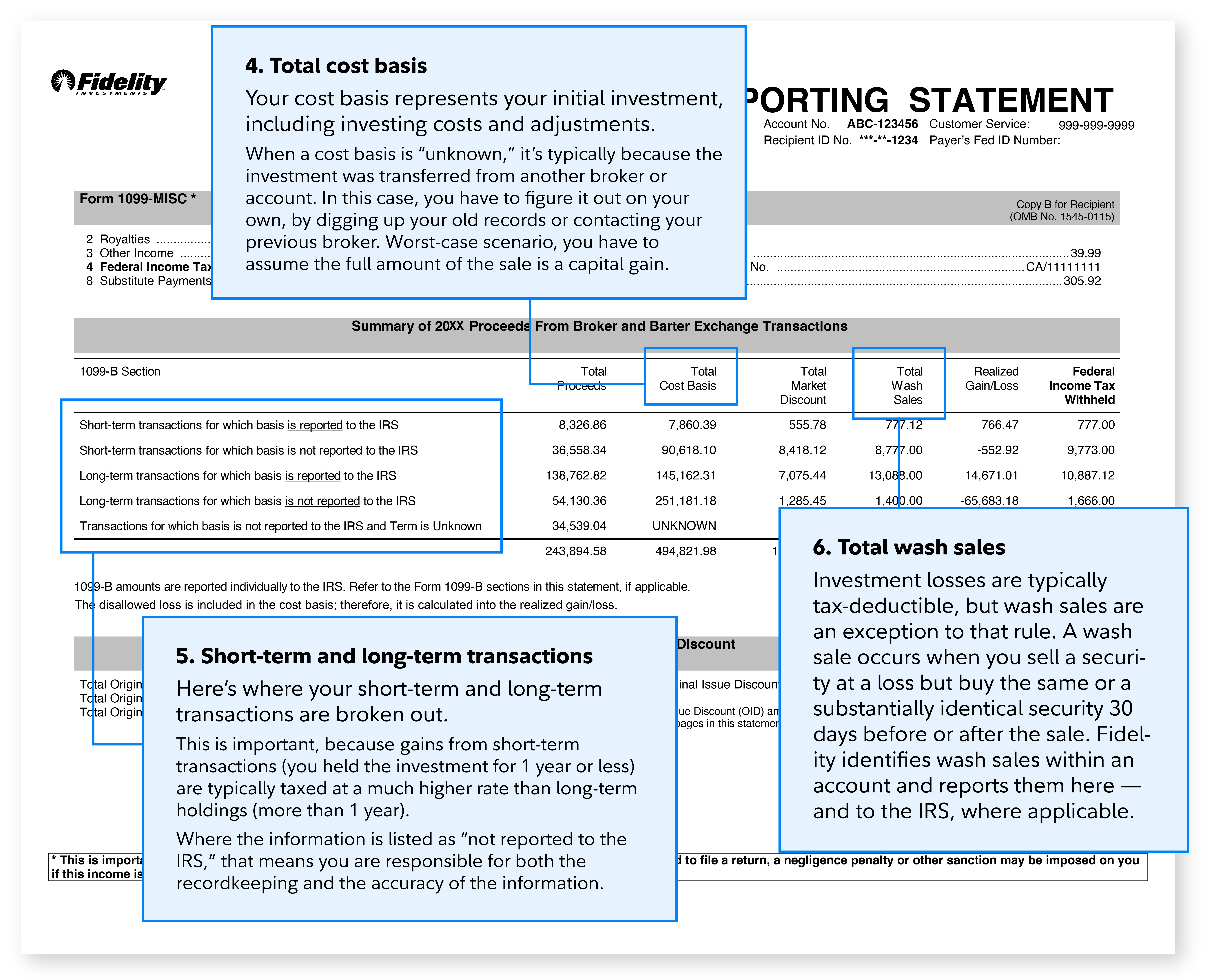

4. 1099-B section: Total cost basis column Your cost basis represents your initial investment, including investing costs and adjustments. When a cost basis is "unknown," it’s typically because the investment was transferred from another broker or account. In this case, you have to figure it out on your own, by digging up your old records or contacting your previous broker. Worst-case scenario, you have to assume the full amount of the sale is a capital gain.

5. Short-term and long-term transactions column Here’s where your short-term and long-term transactions are summarized. This is important, because gains from short-term transactions (you held the investment for 1 year or less) are typically taxed at a much higher rate than long-term holdings (more than 1 year). Where the information is listed as “not reported to the IRS,” that means you are responsible for both the recordkeeping and the accuracy of the information. If you’re new to trading, this probably won’t apply to you, but: Different types of securities had to be reported to the IRS starting at different times. So if you bought stock in the same company in both 2010 and 2012, only the cost basis from your 2012 purchase would be reported to the IRS if you sold.

Cost basis reported after: Jan. 1, 2011: Equities. Jan. 1, 2012: Mutual funds and dividend reinvestment plans Jan. 1, 2013: Bonds, options, and commodities or their contracts or derivatives

6. Total wash sales column Investment losses are typically tax-deductible, but wash sales are an exception to that rule. A wash sale occurs when you sell a security at a loss but buy the same or a substantially identical security 30 days before or after the sale. Fidelity identifies wash sales within an account and reports them here — and to the IRS, where applicable.

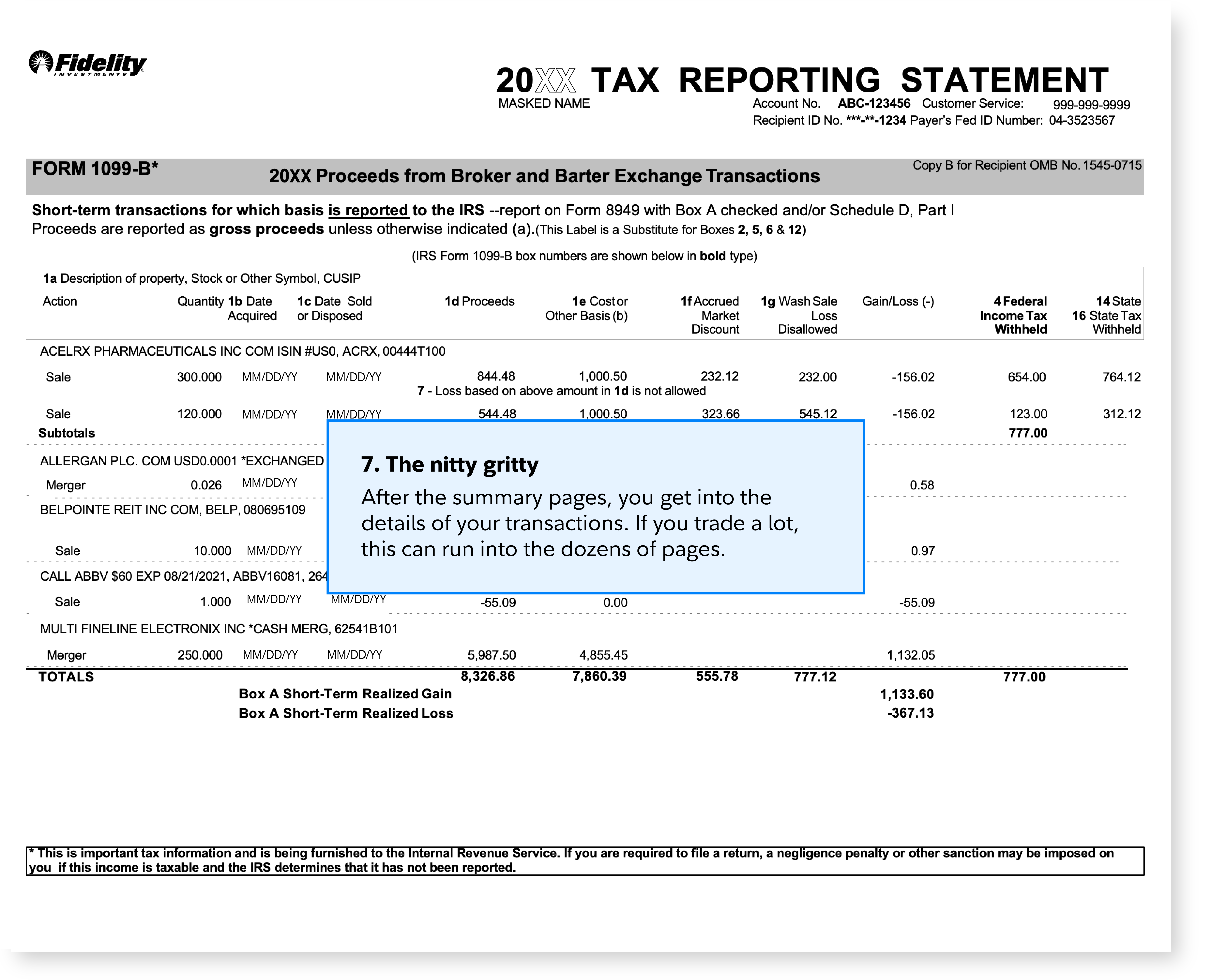

7. 1099-B details section. The nitty gritty After the summary pages, you get into the details of your transactions. This is the breakdown of what is reported on the summary pages. If you trade a lot, the details can run into the dozens of pages.

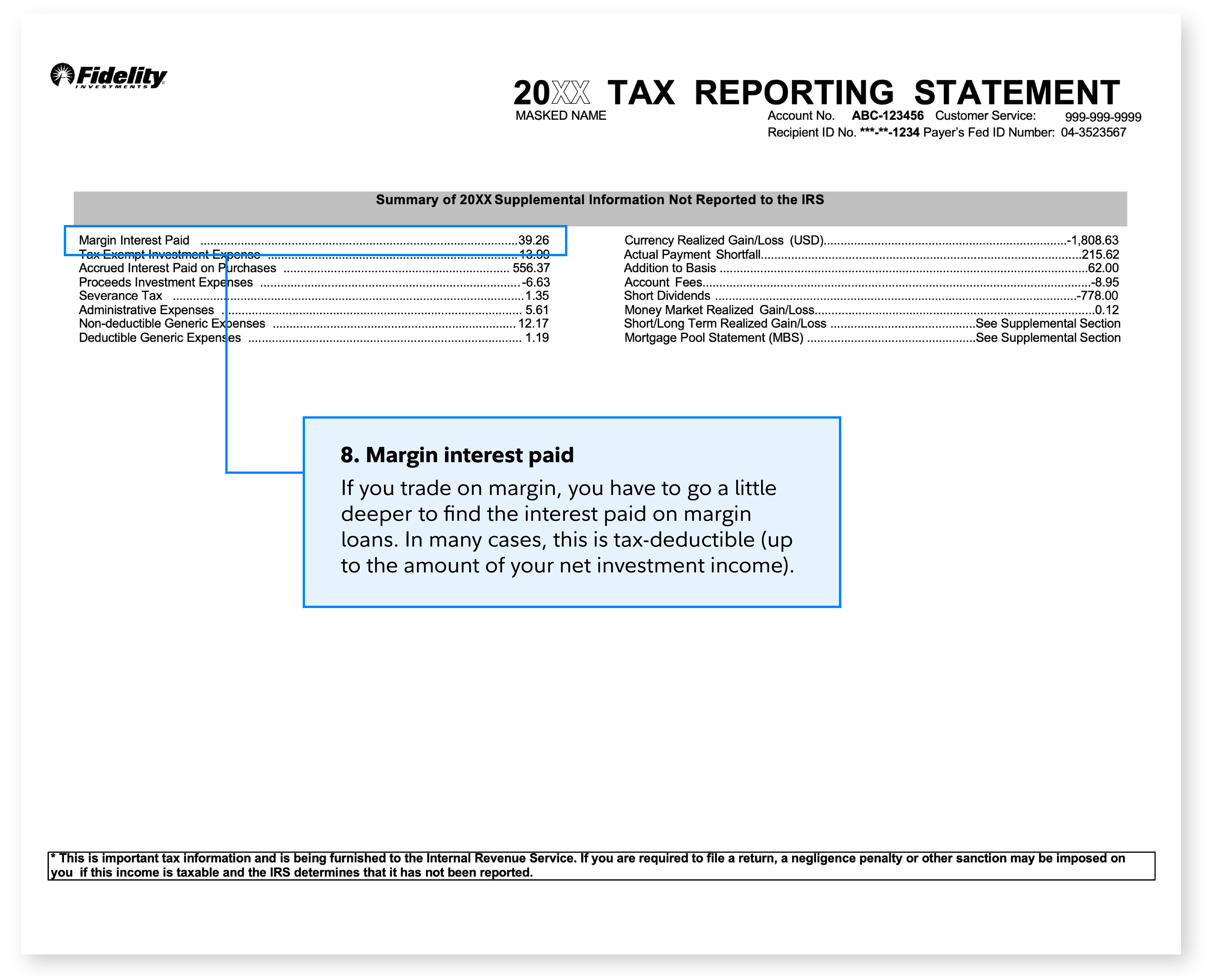

8. Summary of supplemental information not reported to the IRS: Margin interest paid If you trade on margin, you have to go a little deeper in the statement to find the interest paid on margin loans. In many cases, this is tax-deductible (up to the amount of your net investment income).