There's a well-blazed trail to the million-dollar mark and beyond. Normal people do it every day. It doesn't take entrepreneurial genius, investment wizardry, or wealthy relatives. The secret is that it's not a secret at all. It's mostly about dedication and commitment to your goals.

"Be patient," says Ryan Viktorin, CFP®, vice president and financial consultant at Fidelity's Investor Center in Framingham, Massachusetts. "It can happen over time with a consistent, repeatable process."

"The people I've worked with who reached their goals through saving and investing followed a straightforward path. They made a plan, created a saving strategy, and automated their saving. After that it's a matter of executing the plan and continuing to refine it over the years," she says.

Here's what you should know about making $1 million.

1. Plan for it to happen

Making $1 million as a saver and investor often starts with a financial plan. A financial plan is simply a strategy for your future money. It can be back-of-the-envelope estimates, or it could be a formal plan created on your own, or with a financial professional.

Only about a third of Americans have a financial plan, a recent survey found. But nearly everyone who has a financial plan (96%) said they feel confident that they will reach their financial goals.1

A financial plan can be like a map showing you how to reach your goals, Viktorin says.

For in-depth help on foundational financial steps like budgeting, emergency savings, and paying off debt, read Viewpoints: 5 small steps that can make a big impact.

2. Set up a savings strategy

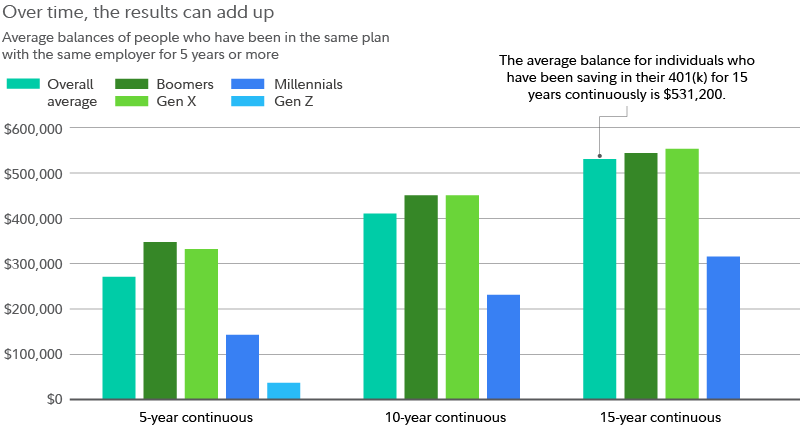

Consistently saving what you can over time can be a powerful tool when it comes to building wealth.

- Establish a habit of paying yourself first, even if it's a few dollars from every paycheck to start, to get the ball rolling. Aim for at least enough to capture the full match from your employer in a workplace retirement plan, if applicable.

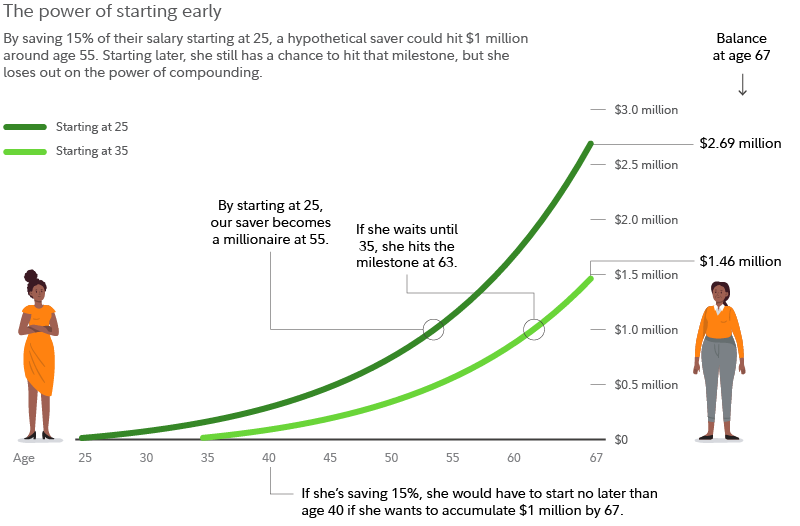

- Prioritize increasing the amount that you're able to save over time. As your income rises through your career, make sure your savings rate keeps up. Fidelity suggests aiming to save 15% of pre-tax income to help keep your lifestyle in retirement—which includes any employer match.

- Your total savings rate might need to be higher than 15%, depending on your goals and time frame.

- Save and invest in tax-advantaged accounts when possible. Contributing to accounts that offer a tax deduction like a traditional IRA, a 401(k), or health savings account (HSA) can help lower your tax bill for the year in which the contribution is made. That can help free up some money you may be able to save for the future. Contributing to a Roth account does not confer any tax breaks today, but qualified withdrawals of earnings are tax-free.2 Learn more: Which IRA is right for you?

- If you don't have access to a workplace savings plan or you've already maxed out your tax-advantaged options, investing in a taxable brokerage account could help you save and invest more for the future. Using tax-efficient investment strategies and products can help keep taxable events in the account to a minimum. Plus, you do have access to the money when you need it. Read Fidelity Wealth Insights: 5 ways to be a tax-smart investor

Assumptions: Starting salary at age 25: $60,000; at age 35: $69,632. Ending salary: $112,131. Annual contribution of 15% which includes any employer match with a salary growth rate of 1.5% and a hypothetical return of 7%. Contribution of 15% of salary is made at the end of the year. Starting at age 25, the annual contribution was $9,000 a year and it grew to $16,820 by age 67 to match salary increases of 1.5% annually.

The ending values do not reflect taxes, fees, or inflation. If they did, amounts would be lower. Earnings and pre-tax contributions are subject to taxes when withdrawn. Distributions before age 59½ may also be subject to a 10% penalty. Contribution amounts are subject to IRS and plan limits. Systematic investing does not ensure a profit or guarantee against a loss in a declining market. This example is for illustrative purposes only and does not represent the performance of any security. Consider your current and anticipated investment horizon when making an investment decision, as the illustration may not reflect this. The assumed rate of return used in this example is not guaranteed. Investments that have potential for 7% annual rate of return also come with risk of loss.

3. Invest for growth potential

To reach big, long-term goals, you may need the growth potential of stocks or stock funds. Over time, the growth potential of stocks can help your money keep up with the rate of inflation and (hopefully) beyond. The key is to strike a balance between the level of stock market risk you're comfortable with that also could provide the level of returns you need to meet your goals.

If you need help building your investment mix, Fidelity has a collection of digital tools, educational content, and financial professionals that can help. Read Viewpoints: How to start investing

4. Minimize fees

Just like your savings can add up over time, so can the impact of fees. Fortunately, mutual fund fees have come down dramatically over the past 30 years. The average expense ratio for equity mutual funds was 0.4% in 2024.3 Fidelity even offers some mutual funds with zero expense ratios: We're raising the bar on value.

Using exchange-traded funds (ETFs) can be another cost-effective way to diversify your investments. ETFs offer some of the same benefits as mutual funds with a few differences. ETFs tend to have a lower expense ratio than mutual funds—the average equity ETF had an expense ratio of 0.14% in 2024.3

For more on the differences between mutual funds and ETFs, read Viewpoints: Mutual funds vs. ETFs: Which is right for you? and Fidelity Wealth Insights: Are fees holding your portfolio back?

5. Automate: Make your strategy repeatable

Workplace savings plans like 401(k)s benefit from the power of automation. No matter what happens in the market or how you're feeling on a particular day, contributions are taken from your paycheck and invested on a regular basis.

Automation can help when you're saving in other types of accounts as well. By setting up recurring transfers from your bank or cash management account, or setting up direct deposit to an investment account, you can ensure that your savings are happening at a regular cadence.

And that's not all. A couple of cool new features at Fidelity let you automate your investing as well. You can set up recurring investments and purchase fractional shares of stocks and ETFs. Being able to trade fractional shares lets you trade a dollar amount of stocks or ETFs instead of shares.

6. Protect what you have

Knowing when to avoid risk, when and how to manage it, and when to transfer risk can help put safety nets under your plan.

Management could mean taking steps to limit the amount of risk to which you're exposed. Diversification is a way of managing the risk of one company, industry, or sector being hit with bad news. Another strategy could be dollar-cost averaging, to help mitigate the risk of market timing and emotional decisions.

Transferring risk can be done with insurance. Though insurance can be costly, it should protect you against catastrophic losses. It can make sense to review your coverage annually and shop around to make sure you're getting the coverage you need.

Read Viewpoints: 3 strategies to help reduce risk

If it were easy, everyone would do it

It's not always easy to get to a million dollars but it is very attainable, says Viktorin. With planning, wise choices, and persistence, becoming a millionaire (and beyond) could be within reach.