If you’re unsure about whether you are eligible to contribute to a Roth IRA, deduct the contributions you made to a traditional IRA, or claim certain tax credits, the answer lies in knowing your modified adjusted gross income (MAGI).

Below, we define MAGI, walk through the different ways you can calculate it, and take a closer look at the different tax benefits influenced by this critical number.

What is modified adjusted gross income (MAGI)?

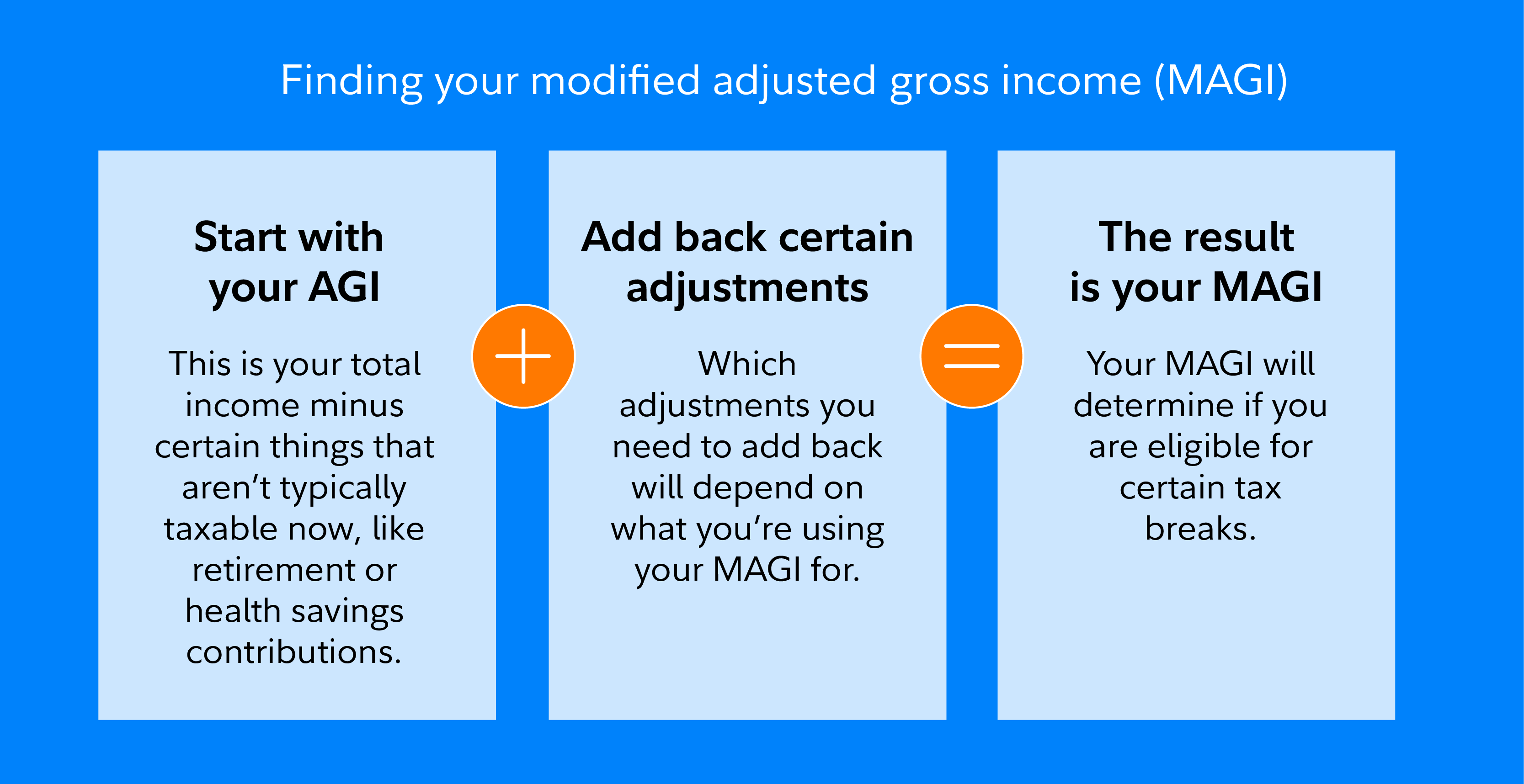

Your modified adjusted gross income (MAGI) represents your annual income once a number of adjustments and modifications have been made to it. It’s essentially your adjusted gross income (AGI) with certain above-the-line deductions added back in.

The IRS and some other government agencies use MAGI to determine whether or not you are eligible to receive certain tax credits and deductions. Likewise, your MAGI can help determine whether and how you can participate in certain types of retirement accounts and government programs.

MAGI vs. AGI

MAGI and AGI share a number of similarities. Both reflect your income for the year; both are used to determine whether or not you can receive certain tax credits and deductions; both can influence your eligibility to participate in other types of government programs.

The key differences between MAGI and AGI lie in how they are calculated, and which tax credits, deductions, and government programs they are relevant to.

Why is MAGI so important?

Your MAGI will determine which tax credits and deductions you qualify for, which retirement accounts you are eligible to contribute to or deduct contributions for, whether certain surcharges apply to you, and whether or not you can participate in certain other government programs, making it an important tax number to know.

MAGI and tax credits

In order to qualify for certain tax credits, your MAGI will need to fall under a certain threshold. In most cases, these credits begin to phase out once your MAGI reaches a certain level, before disappearing entirely once you reach the maximum threshold.

Examples of tax credits affected by your MAGI include:

- Child Tax Credit: In order to claim the maximum tax credit of $2,000 per child your MAGI as a single filer must be less than $200,000 for the year ($400,000 for married couples filing jointly). Once your MAGI reaches $240,000 and $480,000, respectively, the credit is phased out completely.

- Education credits: To claim the full tax credit of $2,500 for the American Opportunity Tax Credit or $2,000 for the Lifelong Learning Tax Credit, you must incur relevant expenses and have a MAGI that is less than $80,000 for single filers or $160,000 for married couples filing jointly. The credit is phased out entirely for those with a MAGI of $90,000 or $180,000 for single individuals and married couples filing jointly, respectively. Note that you may not claim both credits in the same year.

- Premium Tax Credit: The Premium Tax Credit is designed to help low- and middle-income Americans afford health insurance. Whether or not you receive the credit, and the size of the credit, will depend on your MAGI, among other factors. MAGI lower limits are determined by individual states.

MAGI and IRA deductions

In order to deduct the contributions you make to a traditional IRA, you may be subject to MAGI requirements.

Individuals who are not covered by a workplace retirement plan and married couples filing jointly where neither individual is covered are allowed to deduct the full value of their IRA contribution for the year. But if you or your spouse are covered by an employer’s retirement plan, then your ability to deduct contributions to an IRA will depend on your MAGI.

For those covered by an employer’s retirement plan, the deduction begins to phase out for single filers in 2024 with a MAGI greater than $77,000 ($123,000 for married couples filing jointly) and phases out completely once MAGI hits $87,000 and $143,000, respectively. If you and your spouse file jointly and you are not covered by a retirement plan at work but your spouse is, your ability to deduct contributions begins to phase out at a MAGI over $230,000 and phases out completely at $240,000.

MAGI and Roth IRA contributions

Whether or not you can contribute to a Roth IRA, and how much you can contribute, will depend on your MAGI for the year.

In order to make the maximum $7,000 contribution ($8,000 if you are 50 or older) to a Roth IRA, your MAGI must be below $146,000 (for single filers) or $230,000 (for couples who are married filing jointly). From there, the amount you can contribute shrinks as your MAGI climbs, phasing out entirely once you reach $161,000 and $240,000 respectively.

How to calculate your MAGI

Below are the steps to follow to determine your MAGI.

1. Find your AGI.

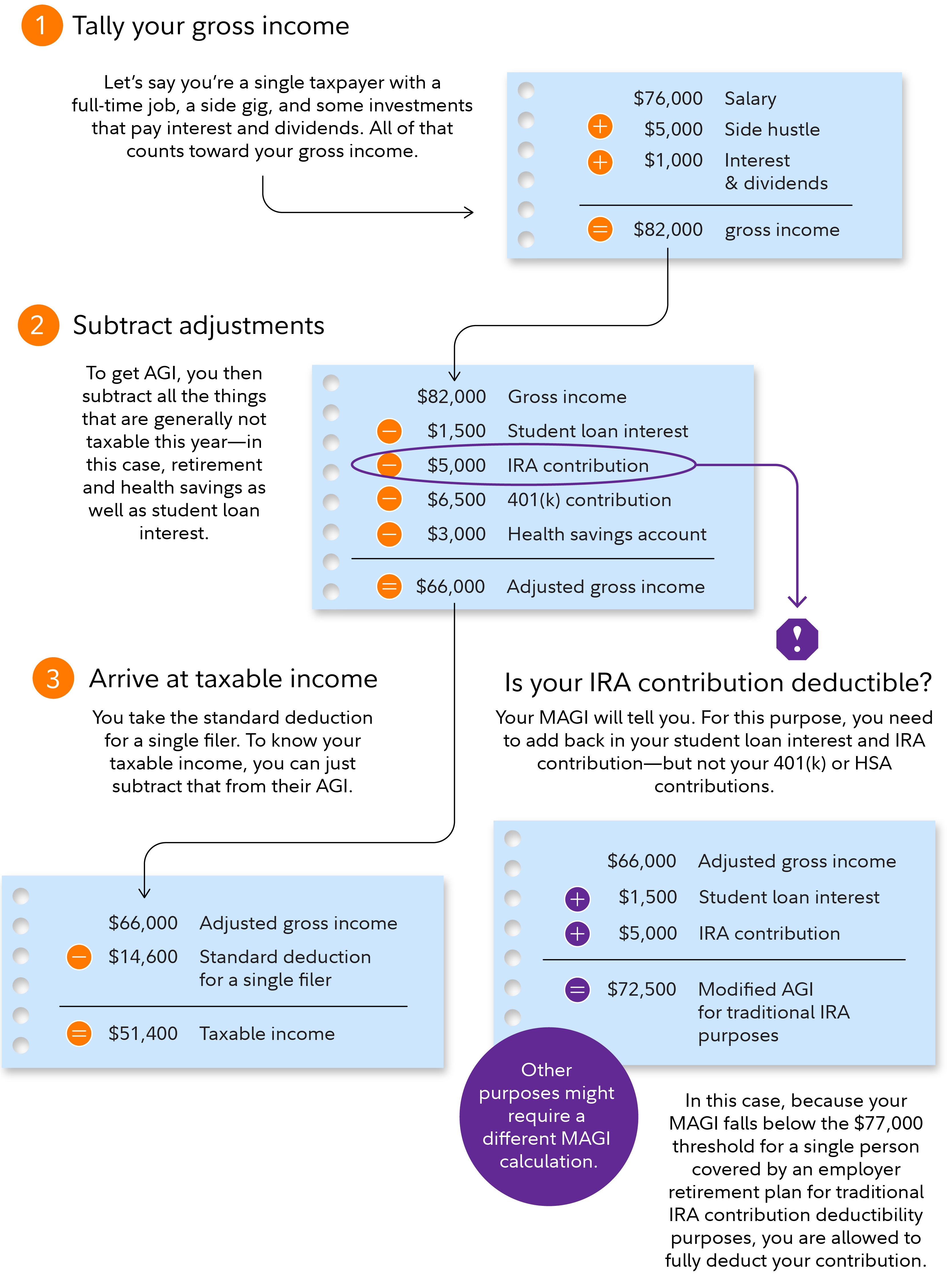

In order to calculate your MAGI, you will first need to calculate your adjusted gross income (AGI). To do so, tally up your gross income for the year. Then, subtract the relevant adjustments. The remaining number is your AGI. You can also find your AGI on line 11 of your tax return.

Check out this guide for step-by-step instructions on finding your AGI.

2. Add back the relevant deductions.

Next, you’ll need to add back certain (but not all) deductions in order to find your MAGI. Among other deductions, these can include:

- Student loan interest deductions

- IRA contributions

- Excluded savings bond interest

- Tuition and fee deductions

- Qualified tuition expenses

- Qualified adoption expenses

- Half of the self-employment tax

- Foreign earned income exclusions

- Foreign housing exclusions

- Non-taxable Social Security payments

- Rental losses

Which deductions you add back in will depend on the specific government benefit, subsidy, or credit you are checking your eligibility for. This means that it is very possible for one person to have a different MAGI depending on the situation.

How it works

Here’s a hypothetical example of where MAGI comes into discussions of taxable income.

Where to find your MAGI on your tax forms

Unfortunately, you won’t find your MAGI anywhere on your tax forms. That includes your tax return (Form 1040), W2, and 1099. Your AGI — which you’ll need to calculate your MAGI — can be found on line 11 of your tax return.