If you've got kids who aren't old enough to vote yet, that doesn't mean they are exempt from paying taxes. In fact, no matter how much they make from jobs or earnings from investments, the IRS wants to know about it. Depending on the amounts involved, they may even end up owing the IRS an amount based partially on what the parents earn.

Welcome to the complicated world of the kiddie tax.

The kiddie tax technically pertains to only the unearned portion of your child's income—from investments and savings. But if your child has any sort of earned income from a job, receiving either an official W-2 wage statement from an employer, a 1099 for freelance work, or just cash, you might have questions about their tax liability as well. Here are some answers to the most common concerns parents have.

Does my child need to file their own tax return?

The answer is generally yes if your child had unearned income of more than $1,350 or earned income over $15,000 (for the 2025 tax year). Those may sound like big numbers for mowing lawns or racking up interest on a few hundred dollars in a savings account, but your child could have a more lucrative job or make significant money from their social media channel(s). "The 2 most common scenarios we see are a child who had an internship during college and is still a dependent, or a child who has an invested custodial account with a substantial balance that will throw off income," says Chris Williams, a principal at the accounting firm EY.

What tax rate will my child pay?

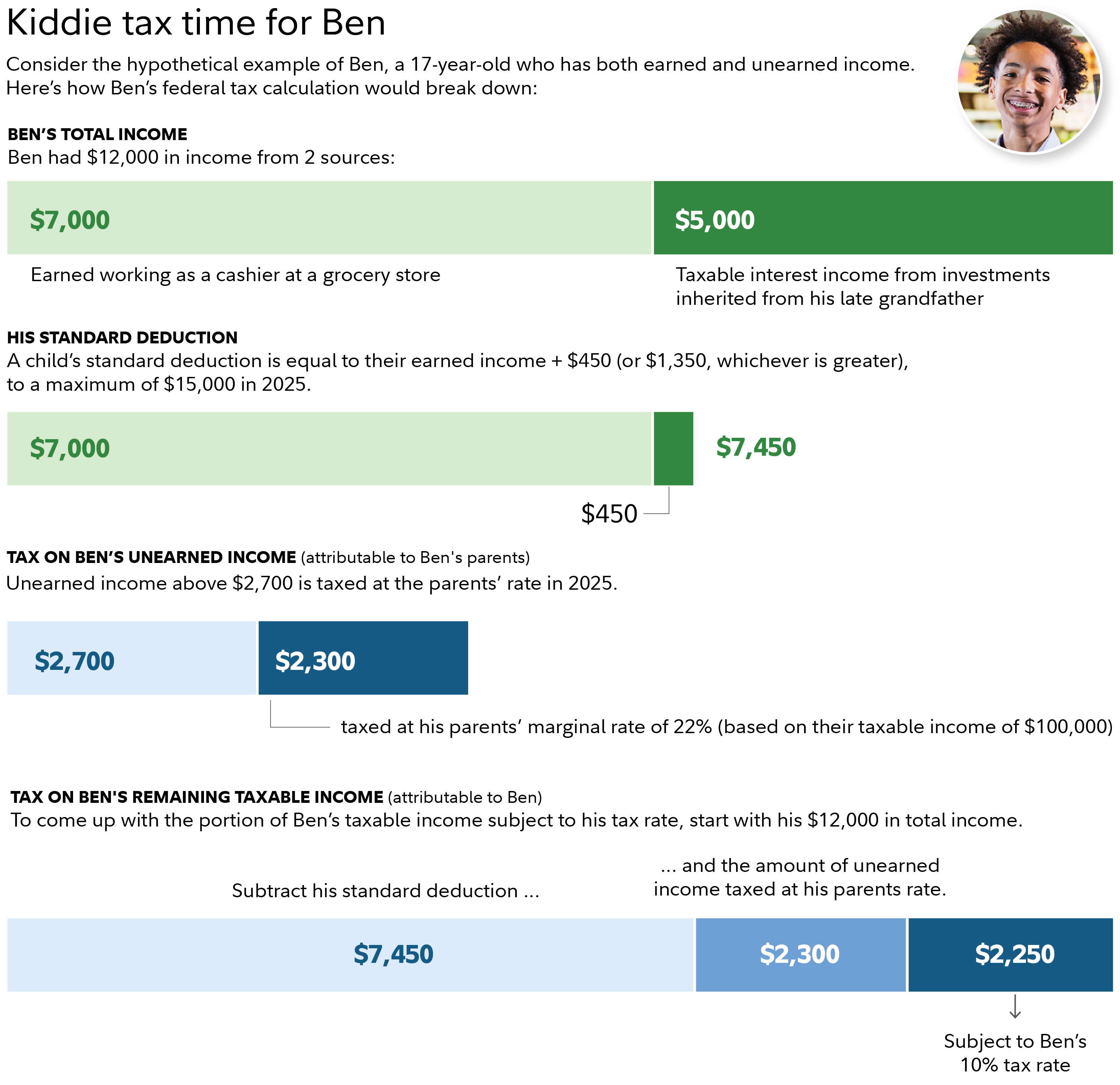

The IRS sets specific limits on the type of income and the tax rates. Earned income will be taxed at the child's rate above their applicable standard deduction, which is equal to their earned income plus $450 (or $1,350, whichever is greater), up to a maximum of $15,000 in 2025. But investment income is a more complicated formula. Unearned income from interest, dividends, and capital gains are taxed in tiers defined by the IRS.

- For a child with no earned income, the amount of unearned income up to $1,350 is not taxed in 2025.

- The next $1,350 is taxed at the child's rate.

- Any amount above $2,700 is taxed at the parents' rate.

These rules cover children under the age of 18, and also those under the age of 24 who are full-time students.

Can my child complete their own tax return?

Given how hard most adults find it to file taxes, it's unlikely your industrious babysitting 12-year-old is going to be able to handle the forms on their own. An older teen might be able to follow the prompts of an online tax preparation program but still will likely require adult supervision. Williams suggests making them part of the process when you decide it's age-appropriate, even if you do it for them. "I do my teenage son's with commercial software, but I make him sit there while I do it, and I'll do the same with my daughter next year when she's old enough to have earnings," says Williams.

How much can the bill be?

If your child has a significant investment portfolio in a custodial account (like an UGMA or UTMA in the child's name, or a child-owned brokerage account like Fidelity's Youth Account) or a trust, the amounts can add up. "If you have trust income such as interest and dividends flowing through to a child that could very much impact their tax rate," says Williams.

An investment account above, say, $20,000 might generate enough income to tip the child's rate on unearned income over into the parent's tax rate, and this is especially true if the account is invested in mutual funds that make taxable distributions.

How can my child manage their assets for tax efficiency?

If your child has earned income, you can invest that income (up to $7,000 per year) in a Roth IRA for kids. The same rules apply to a Roth IRA for this age group as for adults. While money is in the Roth IRA, no taxes will be due on any investment earnings. Contributions can always be withdrawn tax- and penalty-free. Qualified distributions of earnings are tax-free, assuming conditions are met.1 An added bonus: Assets in retirement accounts do not generally count as assets for college financial aid calculations.

You may also want to consider using a 529 savings account for educational savings instead of, or in addition to, a custodial account. While money is in the 529 account, no taxes will be due on investment earnings. When you take money out for qualified education expenses, withdrawals are federal income tax-free. You may also get a state tax deduction for your contributions, and the account will be counted as a parental asset (rather than a student asset) which can be beneficial when determining financial aid for college.

Bottom line

Your child's tax situation can be more complicated than you imagine, so consider consulting a tax advisor or financial professional to figure out your responsibilities and the best strategies to help address the kiddie tax.