Is the income you receive from Social Security taxable? With the new tax law, Social Security income continues to be taxable, but an additional deduction for seniors may help offset what is owed.

Under the new law, taxpayers age 65 or older—and their spouses, if filing jointly—can each claim a $6,000 deduction for tax years 2025–2028. This senior deduction is reduced by 6% (but not below zero) for adjusted gross income that exceeds $75,000, or $150,000 for joint filers.

With the new deduction, only about 12% of seniors will pay taxes on their Social Security benefits, according to a White House Council of Economic Advisors analysis.

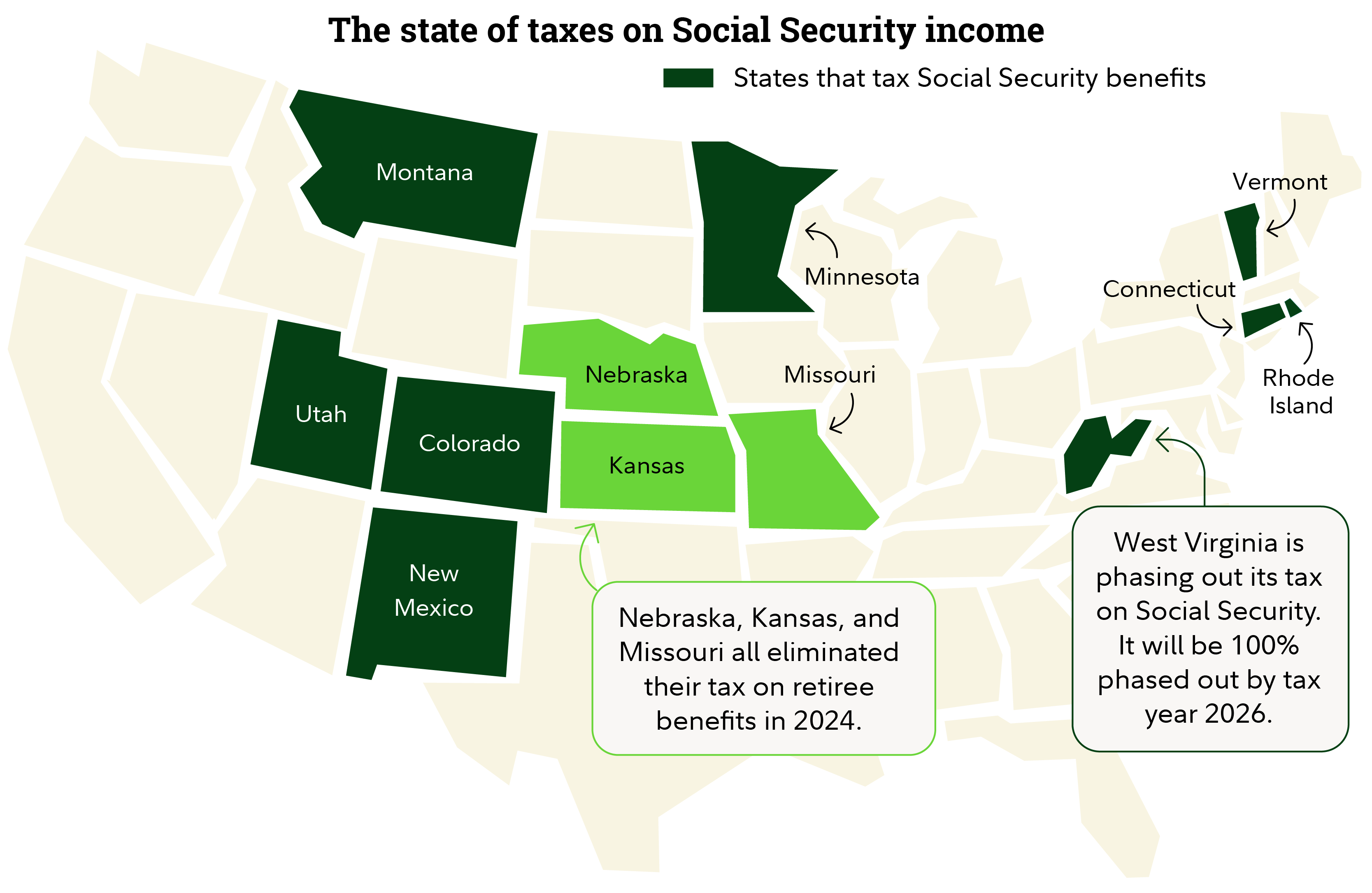

Some also will pay state income taxes, if they live in one of the few states that doesn’t exempt Social Security benefits.

Let's look at the formula for federal income tax and the states that still tax Social Security income.

Social Security and federal income tax

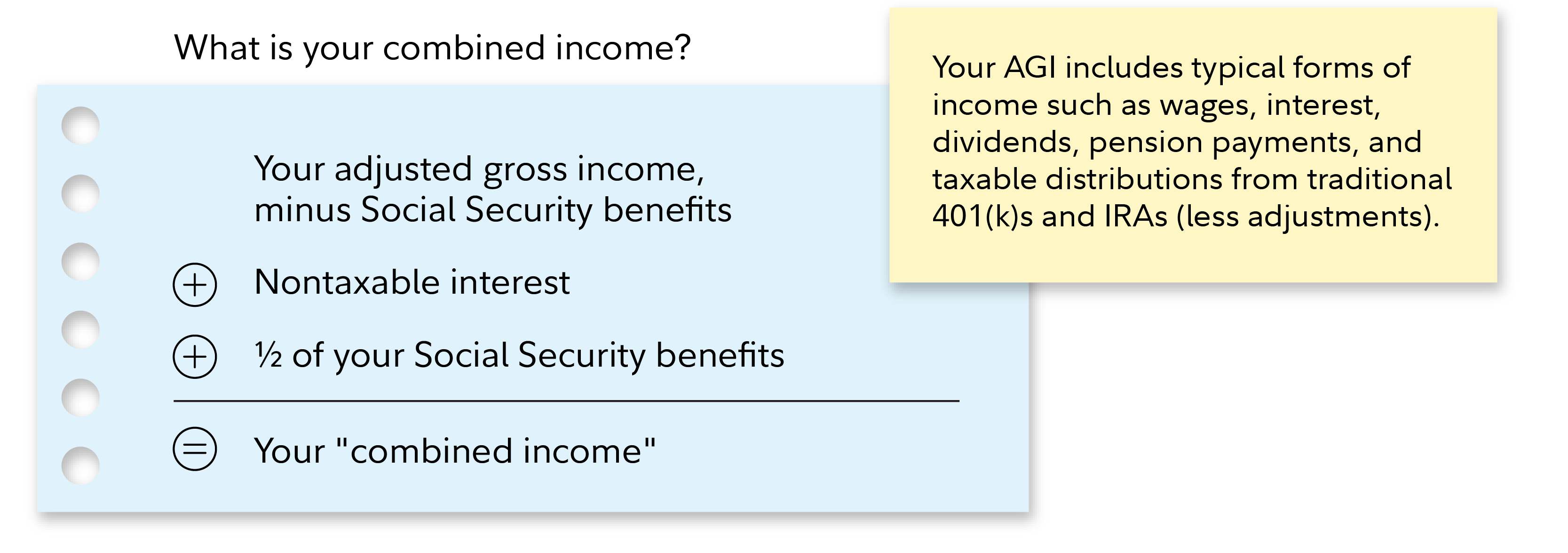

The IRS uses a “combined income formula” to determine if you must pay taxes on your benefits. Combined income includes typical forms of income such as wages, interest, dividends, pension payments, and taxable distributions from traditional 401(k)s and IRAs (less adjustments), as well as nontaxable interest and half of Social Security benefits.

Whether you will have to pay federal income tax on your Social Security benefits depends on your combined income:

- If you file as an individual:

- Up to $25,000: No tax

- $25,000–$34,000: Up to 50% of your benefits may be taxed.

- More than $34,000: Up to 85% of your benefits may be taxed.

- If you file a joint return:

- Up to $32,000: No tax

- $32,000–$44,000: Up to 50% of your benefits may be taxed.

- More than $44,000: Up to 85% of your benefits may be taxed.

Tip: There are ways to save on taxes in retirement. Read Viewpoints on Fidelity.com: 2 ways to save on Social Security income tax.

Do states tax Social Security income?

Most states do not tax Social Security income. But some portion of your benefits may be subject to state tax if you live in one of these 9 states: Colorado, Connecticut, Minnesota, Montana, New Mexico, Rhode Island, Utah, Vermont, or West Virginia. The rules vary widely from state to state. Some states may allow you to exclude federally taxable Social Security benefits for state income tax purposes based on your adjusted gross income, or AGI, so keep this in mind when reviewing the information below.

Quick refresher: What is adjusted gross income? Your AGI is income for the year after you subtract amounts—or “adjustments”—that are not taxable. The IRS uses your AGI as a starting point for calculating how much income tax you owe for the year.

Here's a closer look at how those states tax Social Security benefits for 2024:

Colorado

- Under 65: Up to $20,000 of federally taxable Social Security benefits are not taxed by the state of Colorado. Beginning in 2025, individuals ages 55–64 will be able to deduct all federally taxable Social Security income if their AGI is $75,000 or less for an individual and $95,000 or less for a couple filing jointly. Above those thresholds, $20,000 of federally taxable Social Security income may be excluded.

- 65 and older: No state taxation of federally taxable Social Security benefits.

Connecticut

Up to 25% of benefits may be taxed above these thresholds:

- Single filers: Federally taxable Social Security benefits are not taxable in Connecticut if AGI is below $75,000.

- Married filing jointly: No tax if AGI is below $100,000.

Minnesota

- Single or head of household filers: Federally taxable Social Security benefits are exempt from Minnesota state income tax if AGI is $82,190 or below for 2024. Starting at $82,191 in income, federally taxable Social Security benefits receive a partial exclusion from Minnesota state income tax, and at $118,191 and above, all federally taxable benefits are subject to state tax.

- Married filing jointly: Federally taxable benefits are exempt if AGI is at or below $105,380. Starting at $105,381 in income, federally taxable Social Security benefits receive a partial exclusion from Minnesota state income tax, and at $141,381 and above, all federally taxable benefits are subject to state tax.

Montana

- Social Security benefits are taxed as they are at the federal level.

New Mexico

- Single filers: No tax on federally taxable benefits if AGI is below $100,000.

- Married filing jointly: No tax on federally taxable benefits if AGI is below $150,000.

Rhode Island

The following apply once residents reach their full retirement age (66 or 67, depending on year of birth):

- Single filers: No tax on federally taxable Social Security benefits if income is below $104,200.

- Married filing jointly or qualifying widow(er): No tax on federally taxable Social Security benefits if income is below $130,250. If only one spouse has reached retirement age and both are receiving Social Security benefits, only the percentage of taxable Social Security benefits attributable to the spouse who has reached full retirement age are exempt from taxation.

Utah

- Single filers: Federally taxable Social Security benefits are taxed if modified adjusted gross income (What is MAGI?) exceeds $45,000. A state tax credit may reduce the amount of income tax paid.

- Married filing jointly: Federally taxable Social Security benefits taxed if MAGI exceeds $75,000. A state tax credit may reduce the amount of income tax paid.

Vermont

- Single filers: Federally taxable Social Security benefits are not taxable in Vermont if AGI is $50,000 or below. Federally taxable Social Security benefits are partially exempt from state income tax if AGI is above $50,000 and less than $60,000. If AGI is $60,000 and above, federally taxable benefits are fully taxable in Vermont.

- Married filing jointly: Federally taxable Social Security benefits are not taxable in Vermont if AGI is below $65,000. Federally taxable Social Security benefits are partially exempt from state income tax if AGI is above $65,000 and less than $75,000. If AGI is $75,000 and above, federally taxable benefits are fully taxable in Vermont.

West Virginia

West Virginia is one of the latest states to phase out taxes on Social Security benefits. Single filers with AGI at or below $50,000 and married filers with AGI at or below $100,000 can exclude 100% of federally taxable Social Security benefits from West Virginia state income tax. If they have AGI above their respective thresholds, they can deduct the following percentages of federally taxable Social Security benefits until they are fully exempted for all income levels in 2026:

- 2024: 35% exempt

- 2025: 65% exempt

- 2026: 100% exempt

State and federal income tax rules can be confusing, especially as they can change year to year. That’s just one of the things that can make managing taxes through retirement complicated. Working with a tax professional can help you better understand the potential tax impacts of any planning decisions.