When the stock markets start to slide, it can be difficult to stay invested. But time and again, financial professionals have cautioned that falling markets can turn on a dime when things seem only slightly less bleak than the day before. Historically, every severe downturn has eventually given way to further growth.

Despite market pullbacks, stocks have risen over the long term

Steps to consider now

Consider these 8 ways to make sure your financial plan is on track through down markets so you're positioned to benefit from potential growth later.

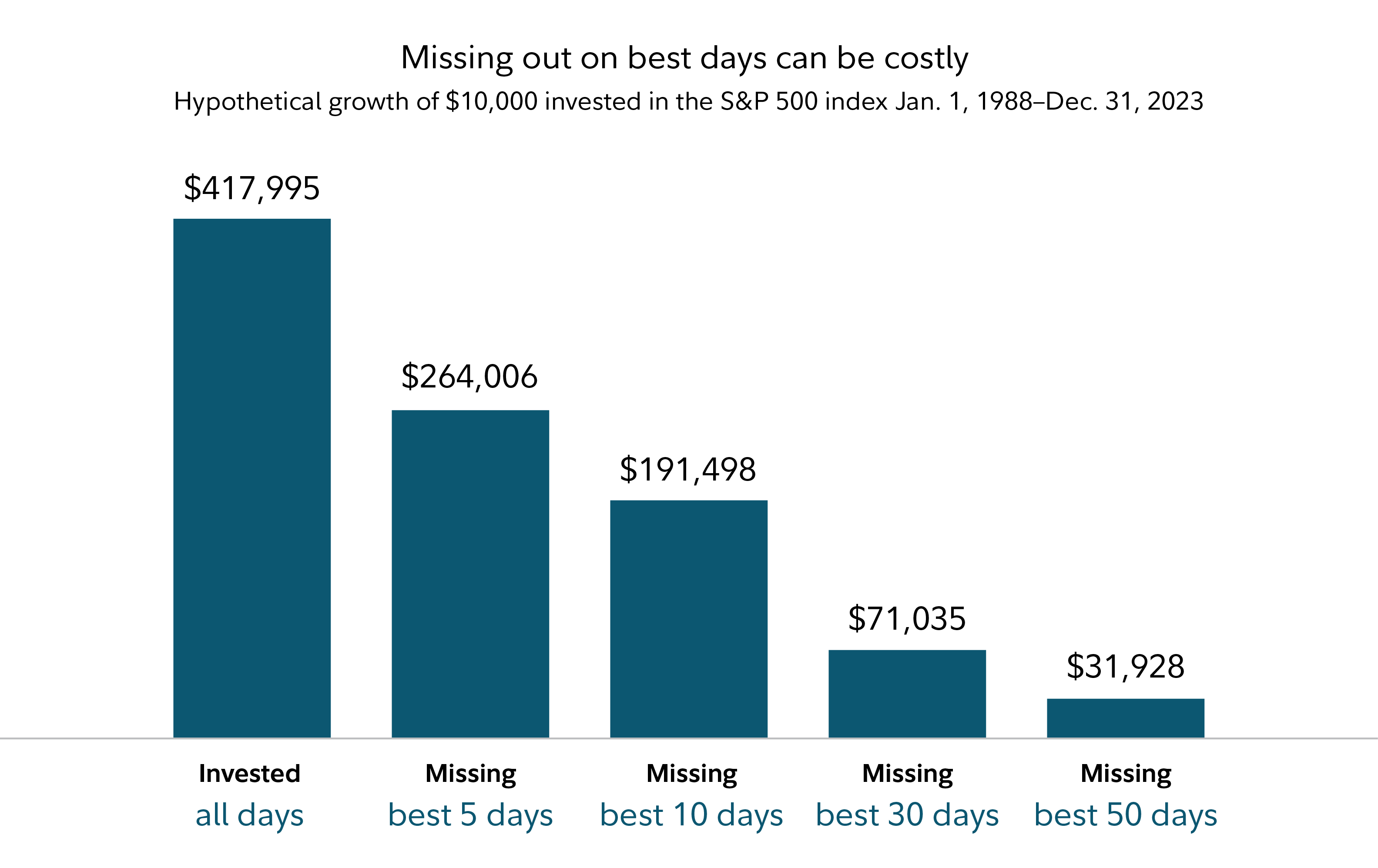

1. Try to stay disciplined with your investing

Staying invested through downturns can seem counterintuitive but it can be key to benefiting from potential rallies and the long-term growth potential of the stock market. Missing just a few of the best days in the market can undermine long-term return potential.

2. Work to maintain a diversified investment mix

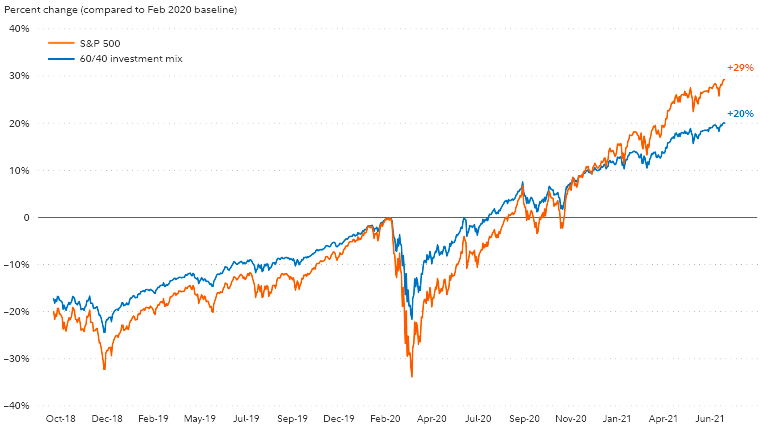

Setting and maintaining your diversified asset allocation are among the most important ingredients in your potential long-term investment success. Though diversification and asset allocation won't ensure gains or guarantee against losses, they may smooth out returns for the level of risk you choose to target.

Read Viewpoints on Fidelity.com: The guide to diversification

Diversification can help smooth the ups and downs of your portfolio

2020: S&P 500 vs. 60% stocks/40% bonds investment mix

3. Consider reviewing investments at least annually and rebalancing as needed

Big shifts in the market can throw your plan off track. For instance, if you had a portfolio with about 60% stocks and about 40% bonds in January 2020, the portfolio would have been closer to 52% stocks by the end of March 2020.

When investing for Fidelity's managed account clients, the investment team believes that regular rebalancing is an important activity to help clients remain invested in a manner that is consistent with their financial goals.

As a general rule, Fidelity suggests rebalancing if the share of stocks, bonds, or cash veers more than 5%–10% from its target weight in your portfolio. For instance, if the stock market goes up or down significantly, you may have more or less risk than your plan calls for and may want to adjust your holdings to return to your target asset mix.

It can also be a good idea to evaluate your investment mix if your life goals change.

Read Viewpoints on Fidelity.com: Give your portfolio a checkup

4. Consider reinvesting if you already sold out of the market

Seller's remorse can happen to anyone. If you've sold all your investments and are on the sidelines during a recovery, it can be difficult to catch up. But there's good news: You can reinvest. Historically, the market has eventually gotten through these periods and gone on to produce positive returns—the largest of which often come right after big selloffs.

Median returns following large stock market selloffs (1950–2022)

When to get back in

If jumping back into the market all at once seems too risky now, consider a dollar-cost-averaging strategy, putting a set dollar amount into a portfolio each month. While dollar-cost averaging won't insulate you from losses or guarantee a profit in a volatile market, investors can purchase more shares when prices are lower, and fewer when they are higher. But for dollar-cost averaging to be effective, an investor must continue to make investments in both up and down markets.

5. Consider the impact of taxes

When investing outside of tax-advantaged accounts (like an IRA, 401(k), or HSA), the taxes generated by realizing gains on investments may lower your after-tax returns.

Strategies like asset location or tax-loss harvesting may help reduce the impact of taxes.

- An asset location strategy can help ensure that your investments are held in accounts where you pay lower taxes. By putting tax-inefficient investments in tax-deferred or tax-exempt accounts rather than in taxable accounts, you can potentially improve the overall tax efficiency of your investments.

- Tax-loss harvesting may allow you to offset taxes on realized gains. And if you have more capital losses than gains, you can use up to $3,000 a year to offset ordinary income on federal income taxes and carry over the rest to future years.

6. Evaluate your emergency savings

Generally, it's a good idea to keep 3 to 6 months of essential expenses in cash or cash-like investments (like a money market fund, for example) in case of a job loss when you are still working. As you move toward retirement, it’s also a good idea to keep a cash reserve to prepare for any unexpected large expenses. If you want to be extra cautious, building up your cash savings to cover a year or more of essential expenses may help you feel more comfortable and prepared for the unexpected.

7. Have a plan for retirement income for good markets and bad

People are living longer now, which means planning for a retirement that may last 20 or 30 years—or more. For more people, that means building a retirement income plan that includes growth potential as well as income guarantees and flexibility. Fidelity suggests a layered approach, which includes 3 things:

- Guarantees to ensure core expenses are covered. These can include Social Security benefits, pensions, and annuities.3

- Growth potential to meet long-term needs and legacy goals. This would come primarily from the stock portion of your investment mix.

- Flexibility to refine your plan as needed over time. Combining income from multiple sources can help reduce the effects of some important key risks, such as inflation, longevity, taxes, and market volatility.

The ability to be flexible with withdrawals from investments during and after market downturns can have a significant impact on the success of your retirement income plan.

Read Viewpoints on Fidelity.com: The impact of down markets for retirees

8. Stress test your retirement income plan

Instead of focusing on market ups and downs, stress test your retirement income plan and make short-term adjustments as needed. How can you do this? One way is to work with an investment professional who can help you test drive your investment plan by illustrating the potential trade-offs of different strategies under different market scenarios. They can use planning software to run hypothetical scenarios and illustrate the potential implications of several different investment paths. Knowing that your plan is designed to provide the income you need can be comforting. Talk to a Fidelity advisor or other financial professional to understand how market downturns could affect your income.

Read Fidelity Viewpoints: Test drive your investment strategy

Focus on what you can control

In the short term, extreme market fluctuations are painful. But over time, they may have less of an impact on long-term goals than one might fear. That's because focusing on the things you can control, and continuing to save and stay invested with a diversified plan, can have an even bigger impact on the outcome.