It’s a pretty common misconception that your tax bracket represents how much of your income you’ll have to pay in federal income tax. But that’s not how tax brackets work.

Americans have a progressive tax system with rates that rise along with income, so the higher your income, the higher your tax bracket. No one really pays the top tax bracket percentage on every dollar of their taxable income. Usually, it’s a much lower amount.

Let’s look at a hypothetical example.

How tax brackets work

Cyrus lands a great job making $95,000 a year. Yay!

He looks at the 2025 IRS tax brackets for single filers to see where his $95,000 income falls and is a little alarmed to see his income fall into the 22% tax bracket.

(Tax brackets above $197,300 are not illustrated here. Here’s where you can check out the complete 2025 and 2026 marginal tax rates.)

Does this mean Uncle Sam gets 24% of Cyrus’ hard-earned money this year? Not quite.

Different types of tax rates

Before we talk about why Cyrus shouldn’t panic, let’s stop to define a few of the ways people talk about income tax rates (in this case, federal).

- Tax rate: A percentage of your income the government claims for taxes. Without more detail, the phrase is mostly meaningless.

- Marginal tax rate: The rate you’ll pay on your last (highest) dollar of income. For Cyrus, that’s 24%. Here’s how you can calculate your own marginal tax rate.

- Effective tax rate: The actual percent of your gross income you pay once you’ve reduced your income with deductions and filed your taxes. This rate is generally much lower than your marginal tax rate.

OK, now let’s get back to that 24%.

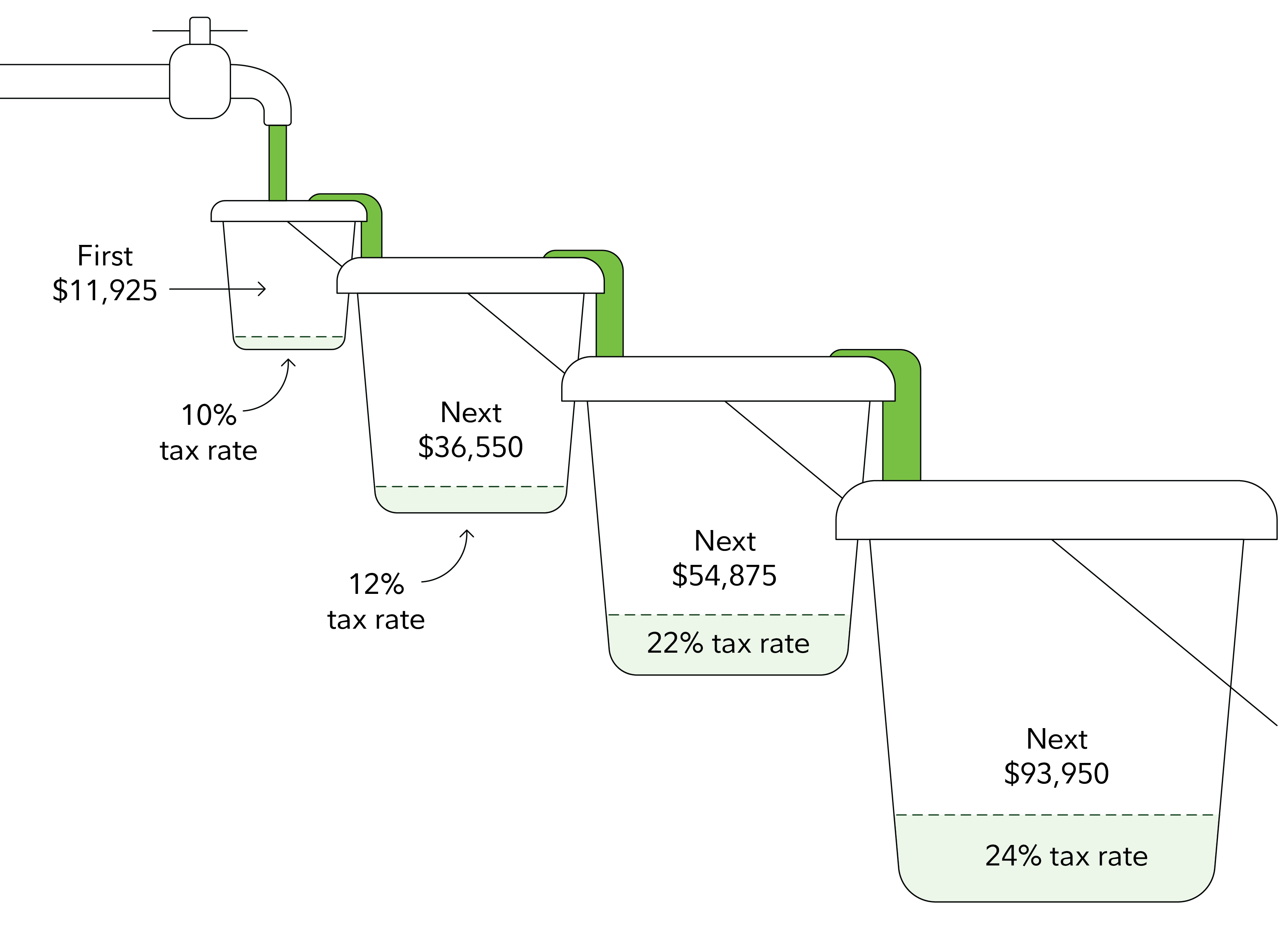

It’s helpful to think of these income ranges as falling into buckets rather than brackets. Each bucket holds a different amount of money that’s taxed at a different rate. When the first one fills up, your income spills over into the next one, and so on.

That’s how it works in theory, but no one pays taxes on every dollar of their income. Cyrus contributes to a 401(k) and a Health Savings Account, which help reduce his taxable income—in other words, he can scoop it out of those buckets.

(The maximum contributions to both his 401(k) and his HSA are much higher. If he maxxed out both in 2025, he could reduce his taxable income by more than $27,000. He could also contribute to an IRA, potentially further reducing his current taxable income if he qualifies for a tax deduction.)

And then there are other deductions he takes when it comes time to file his taxes. As a single filer with a simple return, Cyrus takes the standard deduction—a bigger scoop out of the bucket. (If he had mortgage interest, big state and local tax bills, or significant charitable contributions, he might be able to deduct even more by itemizing those write-offs.)

Let’s see what these deductions do to Cyrus’ taxable income:

What is an effective tax rate?

After deductions, Cyrus’s marginal tax rate is 22% (the biggest bucket his income falls into). But that’s still not his effective tax rate, the actual percent of his gross income he pays, after deductions.

To get there, we do just a little more math:

That gives Cyrus an effective tax rate of 11.34%, far from the 24% he feared he would owe.

For details on tax rates and how to minimize your effective tax rate, read Viewpoints: 2025 and 2026 tax brackets and federal income tax rates.