Planning for retirement is a key part of any comprehensive financial plan. It involves saving to make sure you have enough resources to support your life when you stop working and begin the next chapter.

But life sometimes throws us curveballs, and it's important to incorporate potential changes as your financial picture evolves. One of these changes might be retiring earlier than you expect.

In fact, many workers say they plan to retire at age 65, while the median age for retiring is actually 62.1 Additionally a quarter of workers say they plan to retire at age 70 while only 6% report they actually achieved that goal.1 There are many reasons for unexpected retirement, including job elimination or downsizing, health problems, or needing to care for a loved one. Job-related burnout might be yet another reason.

While an unplanned retirement can create stress and challenges, it's important to understand you still have choices and you can create a new financial plan that reflects new paths you may want to take. "No one retirement is exactly like another," says Andrew Atkins, a vice president and financial consultant at Fidelity. "It is a blank canvas, and you get to paint the picture of what you want it to look like."

Although the contours of your original retirement plan may change when faced with an unexpected retirement, there are ways to prepare for it, as well as tools and resources to help make the process more manageable.

Meet Cory

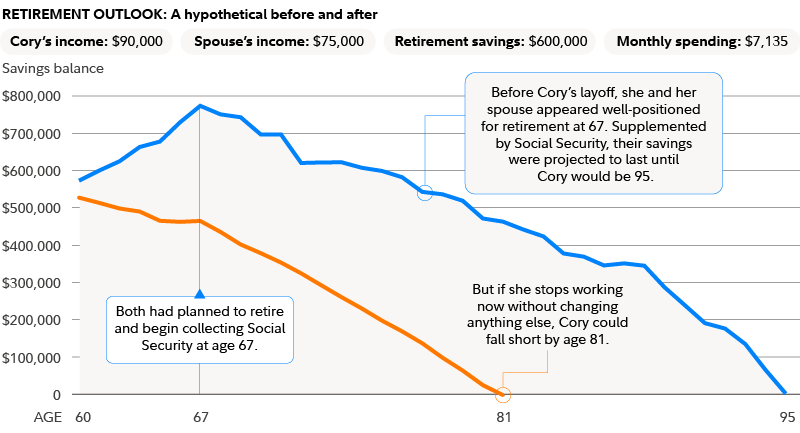

To understand how you can create a new plan if you find yourself retiring sooner than you expect, let's consider a hypothetical example. Cory is 59. She lives and works in Massachusetts and gets laid off 8 years before her planned retirement date at age 67. While the layoff is unexpected, there are numerous things she can do to help make sure her retirement savings might last and can support her and the lifestyle she wants in retirement. Note: The scenarios that follow are unique to the hypothetical customer and are not intended as general financial planning advice that might be suitable for everyone.

In the following scenarios, we assume Cory makes $90,000 a year at her current job and has $600,000 in retirement savings. She also has workplace health insurance and a spouse who works, earning $75,000 a year, for total household income of $165,000. Her monthly expenses are estimated to be $7,135.

IMPORTANT: The projections or other information generated by the Planning & Guidance Center's Retirement Analysis regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Your results may vary with each use and over time.

The chart uses information from Fidelity's Retirement Analysis in the Planning & Guidance Center as of July 2024. It assumes the person planning and her spouse are age 59, live in Massachusetts, have an expected retirement age of 67, and are planning until ages 95 and 93, respectively. It further assumes estimated monthly retirement expenses of $7,135, yearly household income prior to layoff of $165,000, and Social Security benefits of $2,500 and $2,250 per month starting at age 67. Retirement assets are assumed to be invested in a Growth with Income portfolio and taxes are assumed to be filed as married filing jointly.2

You can explore retirement planning with Fidelity's calculators and tools. For more information about the Planning & Guidance Center Retirement Analysis tool, including the methodology and any limitations, visit: https://www.fidelity.com/bin-public/060_Guidance_Pages/documents/IRE_METHODOLOGY.pdf

Income Analysis: What does this show? A hypothetical illustration, in today's dollars, of the amount of monthly income we estimate you could potentially have in retirement. It also shows your estimated monthly expenses in retirement, allowing you to determine whether or not there may be a gap between the two.

If Cory had been able to continue working and saving at the same rate until age 67, hypothetically she might have enough retirement savings to last until age 95. The example assumes she'd collect about $2,500 in monthly Social Security benefits at full retirement age and begin taking required minimum distributions from her retirement accounts starting at age 73.

However, in her new situation where she retires sooner than she expected, Cory could experience a cash shortfall by age 81.

Here are 3 ways Cory can structure her finances to help ensure her retirement savings can last.

1. Back to basics with a budget

It's important for Cory to take a comprehensive look at her budget now, including her income, expenses, and assets to understand how much money she has coming in and going out each month. By doing so, she can make changes that can potentially help her retirement savings work for her longer.

In this scenario, we assume Cory receives a 6-month severance package from her employer, worth $45,000. She may need to use some of it for short-term expenses. But if she has some flexibility, she could put it toward her retirement savings goals. By investing the money post-tax in an investment portfolio along with the rest of her retirement savings, she can potentially extend her cash shortfall by 2 years.

By examining the "expenses" portion of her budget, she may find she can eliminate some unnecessary costs. For example, she may be able to reduce what she previously spent on transportation since she's no longer commuting to work. Cutting or reducing other items might entail a conversation with her spouse: If they dined out regularly, they could consider 4 instead of 6 times a month. Similarly, if they typically took 2 vacations a year, they could talk about potentially taking 1.

IMPORTANT: The projections or other information generated by the Planning & Guidance Center's Retirement Analysis regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Your results may vary with each use and over time.

The chart uses information from Fidelity's Retirement Analysis in the Planning & Guidance Center as of July 2024. It assumes the person planning and her spouse are age 59, live in Massachusetts, have an expected retirement age of 67, and are planning until ages 95 and 93, respectively. It further assumes estimated monthly retirement expenses of $6,635, yearly household income prior to layoff of $165,000, and Social Security benefits of $2,500 and $2,250 per month starting at age 67. The chart further shows the impact of investing a $45,000 severance and cutting $500 per month in expenses. Retirement assets are assumed to be invested in a Growth with Income portfolio and taxes are assumed to be filed as married filing jointly.2

You can explore retirement planning with Fidelity's calculators and tools. For more information about the Planning & Guidance Center Retirement Analysis tool, including the methodology and any limitations, visit: https://www.fidelity.com/bin-public/060_Guidance_Pages/documents/IRE_METHODOLOGY.pdf

Income Analysis: What does this show? A hypothetical illustration, in today's dollars, of the amount of monthly income we estimate you could potentially have in retirement. It also shows your estimated monthly expenses in retirement, allowing you to determine whether or not there may be a gap between the two.

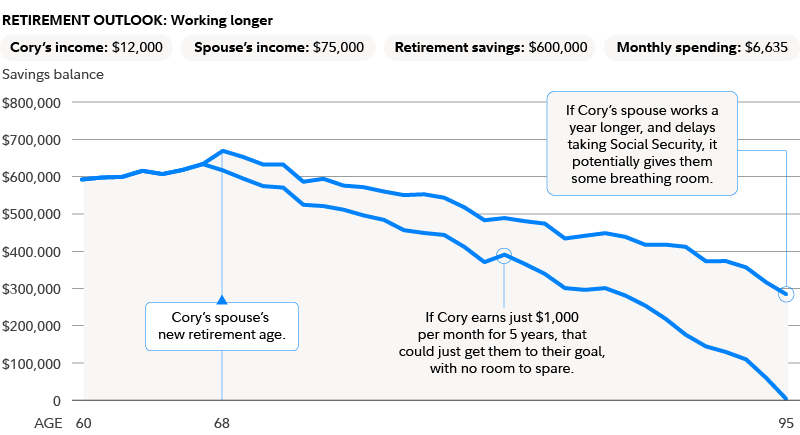

The hypothetical analysis above shows that if Cory were to cut $500 of expenses from her monthly budget, in addition to investing all her severance pay, her savings shortfall could be pushed out until age 92. Additionally, while it may be challenging to find full-time work at her previous salary, it's possible she could find part-time work to supplement her income; for example as a consultant, teacher, through some sort of gig work, or by starting a small business. If she can earn $1,000 a month for 5 years, she may be able to extend her retirement savings until age 95.

2. Consider whether her partner or spouse could work a bit longer

IMPORTANT: The projections or other information generated by the Planning & Guidance Center's Retirement Analysis regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Your results may vary with each use and over time.

The chart uses information from Fidelity's Retirement Analysis in the Planning & Guidance Center as of July 2024. It assumes the person planning and her spouse are age 59, live in Massachusetts, have an expected retirement age of 67, and are planning until ages 95 and 93, respectively. It further assumes estimated monthly retirement expenses of $6,635, yearly household income prior to layoff of $165,000, and Social Security benefits of $2,500 and $2,430 per month starting at age 67 and 68 respectively. In addition to showing the impact of investing a $45,000 severance and cutting $500 per month in expenses, the chart further shows the impact of the person planning earning $1,000 a month. Retirement assets are assumed to be invested in a Growth with Income portfolio and taxes are assumed to be filed as married filing jointly. In the scenario where her spouse works 1 year later, we model their Social Security to be $2,430 at age 68 (up from $2,250 at age 67).2

You can explore retirement planning with Fidelity's calculators and tools. For more information about the Planning & Guidance Center Retirement Analysis tool, including the methodology and any limitations, visit: https://www.fidelity.com/bin-public/060_Guidance_Pages/documents/IRE_METHODOLOGY.pdf.

Income Analysis: What does this show? A hypothetical illustration, in today's dollars, of the amount of monthly income we estimate you could potentially have in retirement. It also shows your estimated monthly expenses in retirement, allowing you to determine whether or not there may be a gap between the two.

If her spouse has the flexibility to work 1 additional year past his expected retirement age of 67 while continuing to save into their retirement account, the couple could potentially wind up with a savings surplus of nearly $285,000. That's because the additional income prevents Cory from having to make up for her spouse's lost wages of $75,000 by withdrawing from savings over time and losing out on the potential for compound returns over her spouse's and her own lifetime.

3. Consider an annuity to supplement retirement income

Finally, Cory could consider purchasing an annuity with a portion of her retirement savings. Fixed income annuities can help her build reliable retirement income to pay for her essential expenses in retirement. There's also a stability factor: Unlike investments, annuities are not dependent on markets, and they continue making regular, predictable payments in any market environment.

You can estimate retirement income from a lifetime income annuity using Fidelity's Guaranteed Income Estimator.

In addition to the financial strategies above, here are some other retirement planning tips to think about.

Consider tax-savvy withdrawals

Taxes can be complicated, and they can have a big impact on your retirement income. Here are some ways to minimize their potential bite.

- One tax-efficient method involves withdrawing first from taxable accounts such as a checking account or brokerage account, then tax-deferred accounts such as 401(k)s and IRAs, and finally from a tax-free Roth account. This approach allows more of your tax-deferred accounts to grow over time.

While brokerage accounts may incur capital gains when investments are sold, long-term capital gains are taxed at 0% up to $96,700 for a couple filing jointly and $48,350 for a single filer in 2025. It's important to note, however, that distributions from a 401(k) are generally taxable at ordinary income rates, so grouping withdrawals into a concentrated number of years could put you into a relatively high tax bracket.

- Another approach is to make proportional withdrawals from each retirement savings account. Once you determine a target amount, you would make withdrawals from each account based on the account's percentage of your total savings. The overall effect could lead to more stable income as well as a more stable tax bill over time, by accelerating tax-deferred withdrawals and reducing future required minimum distributions (RMDs).

Additionally, proportional withdrawals could potentially lower lifetime taxes and potentially increase after-tax income by taking tax-deferred withdrawals during periods of low tax rates, which might be the case for Cory given that she may have less or no income. Consult a tax advisor about your personal situation.

Once again, tax-deferred withdrawals from tax-deferred accounts may add to ordinary income, which in turn could increase taxes on Social Security income, and potentially higher monthly payments for Medicare due to the Income-Related Monthly Adjustment Amount, or IRMAA.

Read more about Tax-savvy withdrawals in retirement in Viewpoints.

You can also gauge the potential effect of retirement income strategies on your taxes with Fidelity's retirement strategies tax estimator.

Assess your health care options

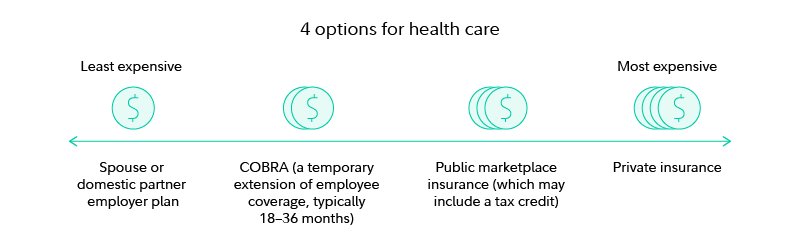

Perhaps the most costly and complicated part of the early retirement equation may be figuring out how to obtain and pay for health insurance, which is particularly important since people generally are living longer in retirement.

On average, according to the 2025 Fidelity Retiree Health Care Cost Estimate, a 65-year-old individual may need $172,500 in after-tax savings to cover health care expenses in retirement.

Among the things to consider: You may have access to your employer's health care plan for 18 months via COBRA. Another option could be to go to HealthCare.gov Marketplace and sort out choices for individual care there. If, like Cory above, you have a spouse who works and is covered by an employer plan that includes family coverage, you could explore whether joining that plan might be the most cost-effective alternative.

You can compare options with Fidelity's Health Insurance Before Medicare Planner.

In addition to health insurance, you may also want to consider planning for long-term care, which can be paid for in a variety of ways, including through insurance.

Create an estate plan

If you're retiring sooner than you expect, it's also important to consider whether you have a solid estate plan in place, which can help provide an orderly and intentional distribution of your assets when you pass away.

An estate plan typically includes a will, health care power of attorney (or proxy), an advanced health care directive, and a durable financial power of attorney. Depending on your planning goals and specific situation, a revocable and possibly irrevocable trust may be things to consider.

Jointly owned assets and accounts generally pass to the surviving joint owner upon one joint owner's death. Assets owned as tenants in common rely on the probate process to transfer the interest of one deceased tenant. (The interest does not pass by beneficiary designation or joint ownership.) For individually owned assets, having a beneficiary on file can circumvent the probate process. Consider working with an attorney or financial professional to ensure your assets and accounts are properly titled and aligned with your overall estate planning goals.

Find out more about estate planning in Viewpoints: 5 steps to create an estate plan.

Consider the long-term

Remember it's always a good idea to consult with a financial or tax professional to come up with a plan that fits your situation. While an involuntary retirement can be a challenge, it's also an opportunity for you to reorganize your financial situation as you prepare for the next phase of your life.