Few decisions have as big an impact on your lifestyle as the home you choose to live in. The space literally shapes many moments in your life, and can help determine who you know, the activities you engage in, and more. Your home is also a big deal for your financial life—few choices have as big an impact on your expenses and wealth as your home.

Housing expenses go beyond mortgage or rent: Utilities, insurance, and taxes are all part of housing expenses, and all vary based on where you choose to live. In many cases, a home also represents a large amount of wealth that could be used to fund retirement—on average, home equity makes up about 70% of net worth, according to the US Census Bureau.

With so much on the line, it's important to think carefully about the financial implications of where you will live in retirement. To illustrate how the decision to relocate can play into retirement planning, let’s look at a hypothetical couple, Frank and Julie. The couple has worked with a financial professional at various times over the years, and after their kids recently moved out, the couple wanted to understand what moving might mean for their retirement finances.

They met with their Fidelity professional, Danielle, to discuss their options. Danielle laid out the plan—they would start by discussing their goals, then get a sense of the current situation, then look at what changes might mean for their savings.

1. The goals

First and foremost, Frank and Julie want to be close to their current jobs for the next few years until they retire. Even after retirement they want to be close to their children and grandchildren, and to stay involved in some local art and community organizations. They love their current home, but it is probably unnecessarily big and located in an expensive neighborhood with good schools that they no longer use. Danielle asked about the possibility of renting, which can sometimes be a better option financially, but emotionally, it was important to Frank and Julie to own. So both agreed that they'd like to stay put for now, but would consider buying something less expensive when they retired at age 65.

2. The checkup

Before making any decisions, Danielle wants to get a good sense of the couple's current housing expenses and how those expenses factor into their retirement income plan. Frank and Julie bought their home about 10 years ago as a place to raise their kids. They own the home, but continue to carry a mortgage. They expect that when they retire they will have about $500,000 in home equity, and will have to pay about $11,500 each year for their mortgage, which is set to continue for 10 years into retirement. They also pay about $1,000 a month in taxes, and about $400 a month in insurance, utilities, and maintenance costs.

Beyond the equity in their home, the couple has saved about $1,000,000 in their retirement and savings accounts. They expect to retire in 10 years at age 65, want their retirement plan to last through age 96, and plan to maintain their current investment strategy.

3. The options

The couple has identified a condo development in a neighboring town that they think might be close enough to their friends and family. They estimate that they could buy a condo outright using the equity from the sale of their home. In fact, even after accounting for the transaction costs of the move and the purchase price, they think they could walk away with about $90,000 to add to their savings.

The condo would come with about $2,400 in annual association fees. But, the move would eliminate their mortgage, saving around $11,500 each year. It would also hypothetically reduce their housing-related expenses by about $7,000 a year, thanks to decreased taxes, maintenance, and utilities. In total, they would save about $16,500 each year.

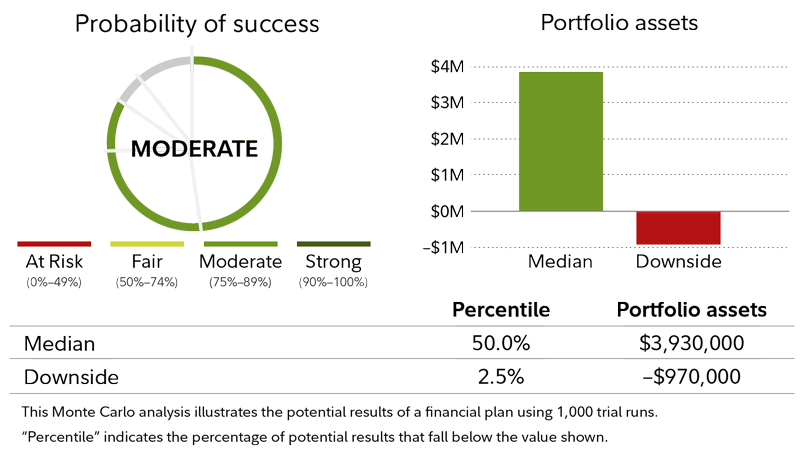

Danielle helps them model what the future might hold if they stay put, or if they move. To illustrate the impact of the decision, Danielle uses an investment analysis tool to run 1,000 hypothetical market scenarios.2 These market simulations are illustrations based on the historic performance of stocks, bonds, and other investments.

The illustrations show that if Frank and Julie stay on their current track, their savings have a "moderate" probability of lasting until the couple reaches age 96—meaning that in 75% to 89% of the simulations, their savings appeared to let them maintain their lifestyle in retirement. (See the footnote * for important details about the assumptions and calculations made in this article.) In an average market, the couple might reach age 96 with about $3.9 million left in their portfolio, in today's dollars. In a very difficult market, defined in this case as the worst 2.5% of hypothetical market scenarios, they would likely fall short by about $970,000.

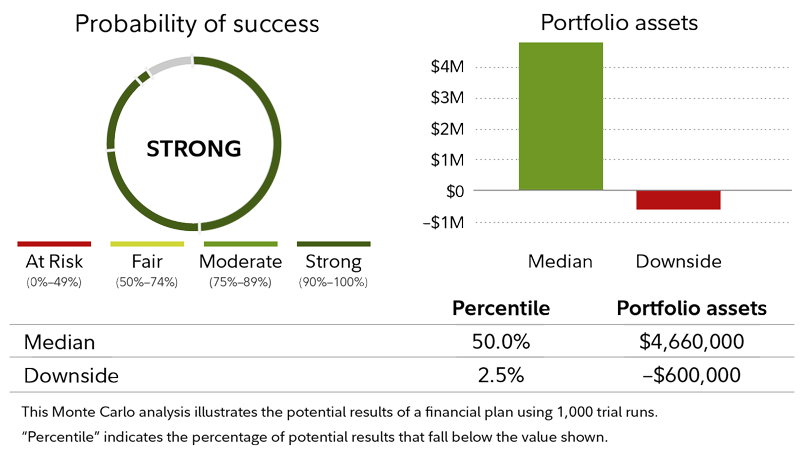

Danielle runs the same analysis adding the money that's left from the sale of the home to the couple's retirement savings and using the lower ongoing housing costs.

The probability that the savings would last through the couple's planned retirement increases to between 90% and 100%—which Frank and Julie think feels like a strong plan. Overall, the illustrations show that the new plan might increase their lifetime assets by more than half a million dollars in average market scenarios.

| Probability of success | Balance at age 96 in median market scenario | Balance at 96 in down market scenario | |

|---|---|---|---|

| Stay in current home | Moderate (75%–89%) | $3.9 million | −$970,000 |

| Downsize | Strong (90%–100%) | $4.6 million | −$600,000 |

|

IMPORTANT: The projections and other information generated by eMoney Advisor regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Results may vary with each use and over time. See footnotes for important details about how these values were calculated.

|

|||

Decision time

While Frank and Julie felt pretty good about their retirement to start with, looking at the numbers helped them put the future impact of their housing decisions in perspective. Taking the long view let them see just how big an impact even moderate annual savings could have. The improved likelihood of meeting their financial goals was appealing, and so the couple decided they would downsize as their retirement approached.

The bottom line

Housing is a big chunk of most people's budgets. But it can be hard to see the big-picture impact of lots of monthly bills. Taking a step back to see how those costs might impact a financial plan over decades may help you make more informed choices. Working with a financial professional to consider the numbers, can help you find the answer that's right for you.