You might think of your HSA as a checking account, where you temporarily put money you will need to pay for qualified medical expenses. But if that's all you think your HSA is, you may be missing out on some important benefits.

That's because your HSA has 3 key tax advantages:1

- You don't pay federal income tax on contributions.

- Any earnings, whether from investments or interest on cash holdings, grow tax-deferred.2

- Withdrawals for qualified medical expenses are tax-free, whether you make them now or in the future.

Some people never spend the money they put in their HSA during their working years, instead planning to take advantage of the tax-advantaged nature of the account by saving and investing to pay for medical expenses in retirement. But even those who use it to pay some of their current qualified medical expenses usually wind up accumulating a balance over the years. Some or all of that balance can be invested and have the potential to grow tax-deferred1 to help cover the cost of future health care expenses.

The question for many people is: If I want to make the most of my HSA, how much should I keep in cash to cover near-term expenses? The answer depends on how much of your qualified medical expenses you can cover without using your HSA. That's not so easy when you can't look into a crystal ball and see how healthy—or not—you'll be in the coming year.

If you want to have ready access to at least some of your cash to pay for qualified medical expenses this year, you can estimate a "cash target"—an amount of money you want to have in your HSA in cash at any given time during the year. Once you know how much cash you need to keep on hand, you may want to consider investing the rest for long-term growth. We can help you get started.

How to estimate a cash target

How do you feel about paying for your health care expenses today? Are you comfortable writing a check for a $200 office visit or a $75 prescription, but would want to ensure you have immediate access to cash in your HSA if you incur a bill that is, say, $500? The cash target you set will depend on a combination of your expected expenses and your comfort in handling both these bills—and those you don't expect.

A cash target isn't a pot of money you collect and then never touch. Instead, you may be using the cash in your HSA to pay for current qualified medical expenses and replenishing it with new contributions.

Everyone's target is different. It depends on your expectations for spending on health care, as well as your ability to absorb a large, unexpected medical expense, potentially using other personal savings to cover any gap.

These steps can help you understand your needs and how to prepare for the unexpected.

1. Gather some information

The first thing you should do is estimate how much you spent on qualified medical expenses last year. This includes:

- Doctor's visits: co-insurance, co-pays, and any other out-of-pocket costs

- Prescription drugs

- Mental health services, such as therapy appointments

- Eye care, including exams, glasses, and contact lenses

- Dentist and orthodontist expenses

Tip: If you are not able to figure out an estimate, you should be able to log in to your health insurer's website to see how much you spent last year. Or, you could look at your credit card statements or information from your drug store.

2. Consider what you expect in the coming year

Was last year pretty typical for you, or did you have large expenses you don't expect to repeat this year? Or, are you expecting larger expenses this year—maybe you're thinking of starting a family, or it's time for the kids to get braces?

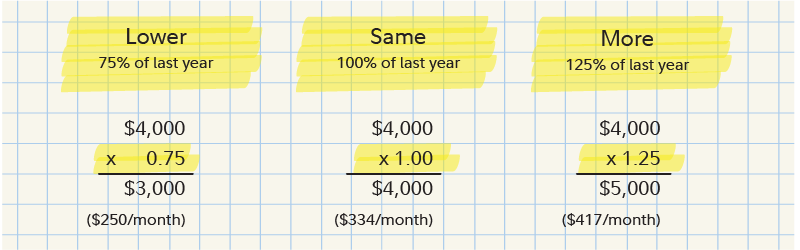

Depending on whether you expect lower, higher, or similar expenses in the coming year, you can use a percentage of last year's expenses to come up with an estimate for the coming year. We use these percentages as directional guidance, but you may nudge them higher or lower (as estimating the cost of future health care expenses is difficult and somewhat unpredictable).

Health care spending: Last year vs. this year—a hypothetical example

Tip: If you had a health procedure last year that you don't expect to repeat, you can simply subtract the amount spent out of pocket on that procedure from your total. If you already know the estimated out of pocket cost of something you're planning for in the upcoming year, you can add that cost to last year's total.

3. See where you stand

Now consider what you're setting aside in your HSA, including any employer contributions. Then see if you tend to spend more than you contribute.

Many people think about their HSA contributions from a monthly standpoint and make contributions based on how much money they are budgeting per paycheck to fund ongoing benefits such as insurance premiums, 401(k) contributions, and HSA contributions.

If you are falling short of your expected monthly spending, you have a few options:

- Increase your monthly contribution to cover your gap amount. (If you discover you're not contributing enough, you can change your contribution amount during the year.)

- Make a one-time contribution to your HSA by check or electronic transfer to cover the gap. Be sure this amount and any employer contributions made over the remainder of the year won't put you beyond the maximum allowable annual contribution.

For 2025, the IRS contribution limits for HSAs are $4,300 for individual coverage and $8,550 for family coverage. The HSA contribution limits for 2026 are $4,400 for self-only coverage and $8,750 for family coverage. Any employer contributions will count toward these limits.

If you're 55 or older during the tax year, you may be able to make a catch-up contribution, up to $1,000 per year. Your spouse, if age 55 or older, could also make a catch-up contribution, but will need to open their own HSA. See IRS Publication 969 for more on annual HSA contribution limits.

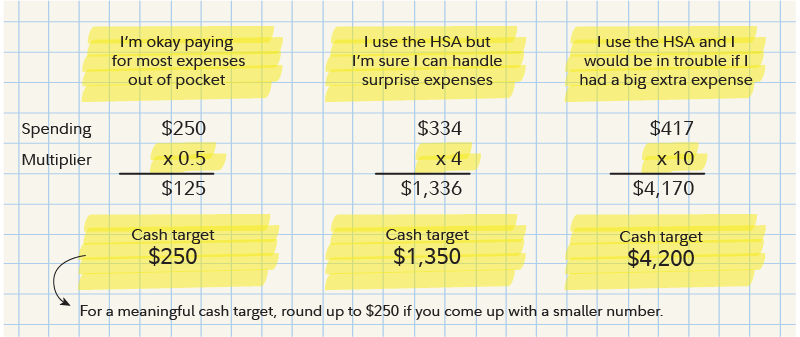

Once you have a handle on how you are using your HSA for health care spending and saving, consider the calculation below to pick your cash target. This is not a monthly figure but a rolling total—the amount of cash you should aim to keep in your HSA at any given time in case you need it. Although it makes sense to keep saving and investing in your HSA to pay for future medical bills, you can always liquidate your invested assets in your HSA if you need to, but the right cash target should allow you to avoid this.

The multipliers (see example) are based on Fidelity's assessment of the ability of people with different financial capacities to cover an expensive health event in a single month.

Cash target: How much will I spend this year on health care? A hypothetical example

Once you identify your cash target, you can consider investing the rest for longer-term growth. Many health insurance providers have online tools to help you manage your HSA and set a cash target. Money you invest is still part of your HSA, and is available for current or future use. When you want to access it—whether it's 2 days, 2 years, or 20 years from now—you can sell some of your investments at any time. Money from the sale will appear in your cash balance when the trade settles, usually within a few business days.3

Lastly, if you are a Fidelity customer and have an HSA with another provider, you can transfer your HSA to Fidelity. Then, you could work with a Fidelity professional to develop investing strategies for your HSA and other accounts.