Cash and short-term investments play important roles in a financial plan, mainly providing liquidity and a buffer against market volatility. They also provide orderly and routine returns that feel safe and predictable. But there can be some downsides if they make up the majority or entirety of your long-term investment mix.

"Sometimes investing successfully can feel counterintuitive," says Naveen Malwal, CFA, institutional portfolio manager with Fidelity's Strategic Advisers. “I can understand why the volatility of the stock market may lead some investors to feel stocks may be risky. However, investors who focus on the growth potential of stocks, not just the downside, often reach their financial goals more easily than they would if they were investing mostly in cash.”

Here are 3 potential benefits of investing in stocks, bonds, and other investments that can provide growth potential—plus 2 ways to do that confidently and help reach your goals.

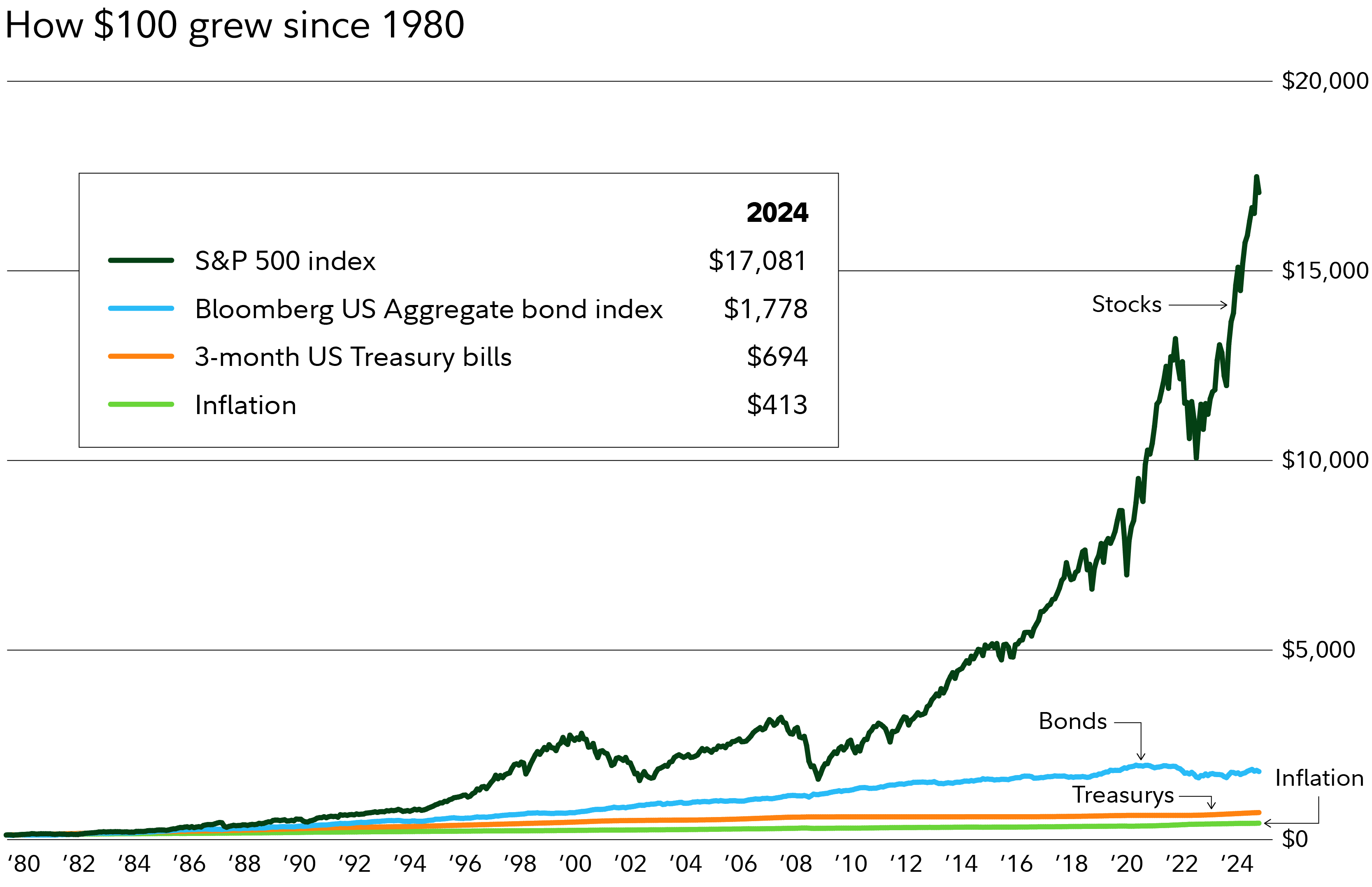

1. Your money may grow more quickly

High-yield savings accounts and safe investments like money market funds trade yield for stability. While your account value won't generally go down due to events outside your control, it may not go up very much over time either.

"Looking back historically, investing in short-term investments has been OK for investors, but nowhere near as good as in stocks, or a combination stocks, bonds, and cash. Diversifying away from cash has generally led to stronger returns for investors, which means they have often reached their financial goals more easily," Malwal says.

2. Fight inflation and help maintain purchasing power

Inflation is something that everyone has experienced, particularly in recent years. It's hard to miss that your money doesn't go as far as it used to—your usual purchases like groceries and prescriptions may be taking up a bigger chunk of your paycheck or savings than they used to.

Earning a rate of return higher than the rate of inflation can help ensure that you're able to continue to afford the things you want to buy. Unfortunately, "the return on short-term investments over the long run has barely kept up with inflation, so it's hard to stay ahead, especially when there is the potential for higher-than-average inflation," says Malwal.

A related risk of staying in relatively safer areas like savings accounts, Treasurys, and CDs can be reinvestment risk. When the Federal Reserve raises interest rates, savers can benefit as yields rise. But when the Fed lowers interest rates, the yield on safer investments tends to go down. So it can be hard to replace a maturing investment with another one with the same risk and return.

For example, let's say you buy a 3-year CD today with a 5% annual percentage yield (APY). Then over the 3-year term, interest rates fall. When your CD matures and you want to buy another one, you may have to accept lower yields or buy a longer-term CD. There's no guarantee that you will be able to reinvest your money at the same level of risk and receive the same level of return in the future.

"If the return on a short-term investment decreases, for example from 5% to 4%, due to declining interest rates, an investor can have a harder time staying ahead of inflation," says Malwal.

Read Viewpoints on Fidelty.com: How to plan for the worst and stay invested

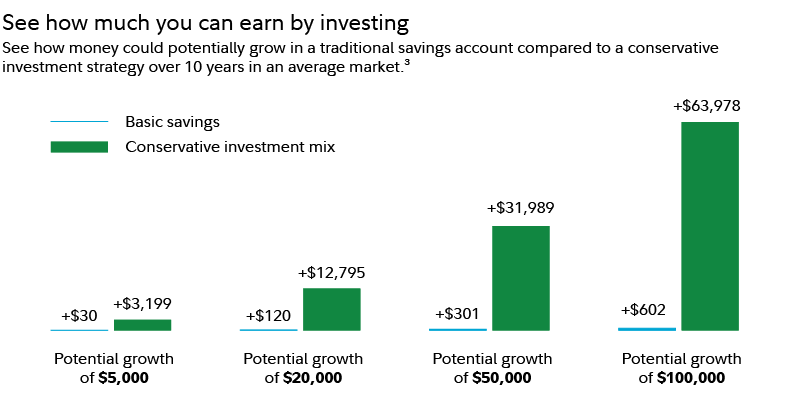

3. You may have a better shot at reaching your goals

Retirement is one big goal most people have, but there are myriad other goals that you may be working toward: a dream vacation, a wedding, a big party, a new car, remodeling the kitchen, and so on. If there are several years until your goal, investing for more growth potential could potentially help you successfully reach or exceed your goal.

"By investing in a more diverse mix of stocks and bonds and short-term investments, the investor has a higher chance of achieving their goal, potentially with a couple of added benefits. With a higher rate of return, they may reach their goal quicker. And, once they actually reach the end of their time frame, they could have more money than they otherwise would have. The possibility of having more to spend in the future would be a potential benefit that the saver could miss out on compared to a cash investor," says Malwal.

More than 1 in 10 retirement investors has an investment mix that Fidelity would consider too conservative for their time frame.1,2 A little extra return could potentially improve their chances of maintaining their lifestyle in retirement.

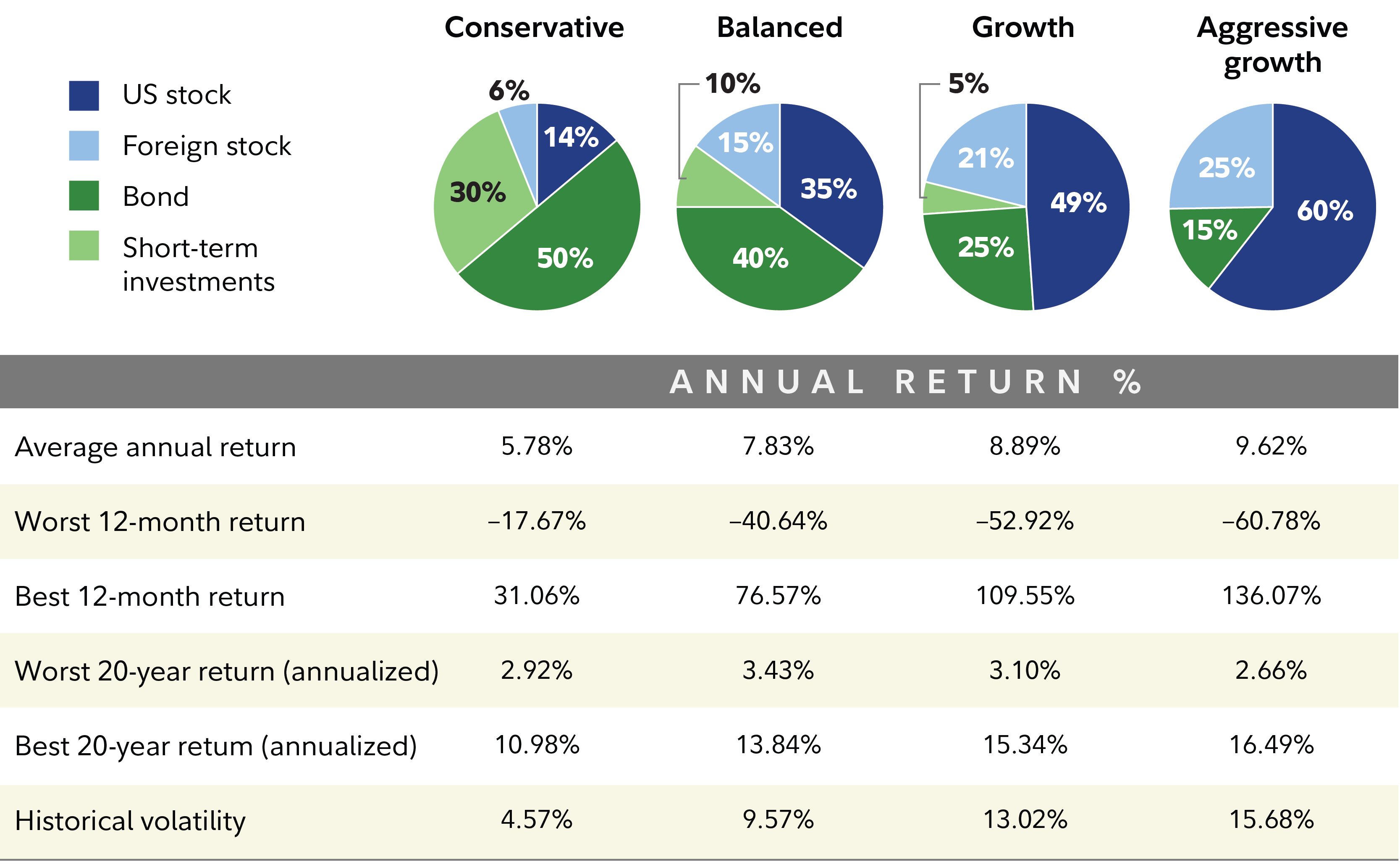

Diversification may be a better way to manage investment risk

There's no perfect investment that offers the best of all worlds—low risk and high returns. But there is a way to take advantage of the many different patterns of investment risk and return: diversification.

Diversification can be a helpful strategy because different types of investments offer varying levels of risk and return. Some types of investments may outperform during economic downturns while others shine brightest during boom times. Some investments may do well as interest rates rise while others get a boost from low interest rates.

The goal of diversification is not necessarily to boost performance—it won't ensure gains or guarantee against losses. But diversification does have the potential to improve returns for whatever level of risk you choose to target.

A risk-averse investor could still invest in short-term investments like money market funds, CDs, and Treasurys with the addition of bonds and a small portion of equities. By mixing riskier investments with some relatively safer choices, they may be able to get a higher return while still keeping the risk of losing money low.

If you’re not sure how to do it yourself, there’s good news: Financial professionals can help you pick investments and balance the need for principal protection with the need for some growth potential. By determining an appropriate rate of return to target based on your financial situation, time frame, and comfort with risk—while accounting for inflation—professionals can work with you to determine what investments and strategies may fit your goals. And they can help in many more ways as well.

Read Viewpoints on Fidelity.com: The guide to diversification

Risk versus return

Financial professionals are here to help

Working with a trusted professional can help boost your confidence about your money and investing—a recent survey found that investor confidence about reaching their long-term goals increases significantly after working with a financial professional.5

Getting professional help can be affordable as well. For straightforward investment management, robo advisors can simplify the investment process. Fidelity’s robo advisor, Fidelity Go®, is a hybrid robo advisor. With a balance of $25,000 or more, you can speak on the phone with a professional for live, personalized coaching.

Read Smart MoneySM on Fidelity.com: What’s a robo advisor, and how does it work?

Your financial picture probably includes so much more than investments. Working with a professional can help you understand how all the pieces fit together by asking you about your personal and financial goals, and working with you to help answer questions such as:

- Are your spending and cash flow appropriate?

- What does financial protection mean to you, and how important is it?

- What does growth mean to you, and how important is it?

- Are your investments aligned with your preferences?

- How will you manage your investment portfolio?

"As they discuss their situation with a financial professional, many investors learn about other opportunities, so it may turn out that they don't have to take that much more risk to get the benefit of a more diversified set of investments," Malwal says.

"Perhaps they do still want to keep most of their investments in a short-term space, but there's a smaller portion they would be willing to allocate to stocks and bonds. That combination may be enough for them to feel that their money is relatively secure, and they have a better chance of staying ahead of inflation and reaching a long-term goal," he says.

Knowing that you have options and that you've made an informed choice can help you feel more in control. While the stock market may go up and down more than most people would like, your investment mix doesn't have to be as volatile to provide growth potential. If you're not sure how to create a financial plan that includes an appropriate investment mix for your situation, consider working with a financial professional.