If groceries were marked down 20% at your local supermarket, people would probably be lined up around the block to buy them. Yet many people don't feel that way when stock prices fall. When you purchase stocks and other securities during a down market, it can be like buying them on sale.

Dollar-cost averaging is a simple strategy that can help investors stay on track with their investing goals over the long run. But it can be a particularly effective strategy during down markets—both by countering the emotional resistance many people feel to investing when markets are down, and by potentially letting investors purchase shares at a discount.

What is dollar-cost averaging?

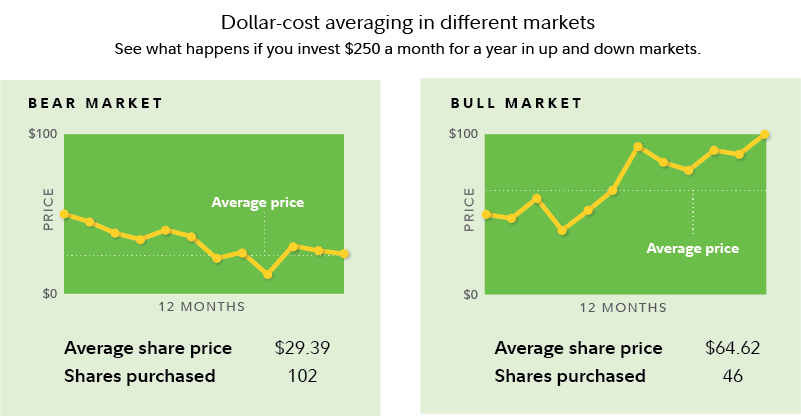

Dollar-cost averaging is a strategy in which you invest your money in equal amounts, at regular intervals—say $250 a month—regardless of which direction the market or a particular investment is going. Over time, this can help you buy more shares when the price is relatively lower and buy fewer shares when the price is relatively higher.

Dollar-cost averaging is not a strategy for deciding what to invest in—rather, it can help you take the stress out of deciding when to invest. Using it as part of a comprehensive financial plan that includes a diversified mix of stocks and bond exposure can help you stay on track toward your long-term financial goals, regardless of what's happening in the market.

Why consider dollar-cost averaging?

There are 3 main reasons to consider dollar-cost averaging, particularly during times of increased market uncertainty:

- It can help you counter the emotional resistance you may feel to taking the investing plunge—so you don't miss an opportunity for long-term growth.

- It can be particularly effective through market volatility and down markets, when investors may be able to buy shares at lower prices.

- It can help you make regular, consistent investing a habit that you stick to for the long term.

Of course, like any investing strategy, dollar-cost averaging can come with certain risks and drawbacks.

For one thing, dollar-cost averaging does not assure a profit or protect against loss in declining markets. It also involves continual investments in securities, so you should consider your financial ability to continue your purchases through periods of low price levels.

It also may not be the best approach for getting a lump sum invested into the market—for example, if you've received an inheritance, a bonus, or another large figure that you intend to invest. While a lump sum can be held in cash and then invested in increments, it can also be invested all at once, which carries more risk but may provide better returns potential (because any money you have sitting in cash will miss out on potential market returns).

Finally, it can be important to keep in mind the impact of any transaction fees. If you pay a commission or other transaction fee each time you make an investment, then dollar-cost averaging may generate higher fees than a strategy of less-frequent investments.

A powerful strategy for down markets

When markets decline or run into volatility, it can be easy for investors' emotions to take over. By committing to regular periodic investments, dollar-cost averaging can help take the emotions out of your investing decisions. And if you dollar-cost average through a volatile or down market, you're likely to purchase more shares, more cheaply than you would in a bull market.

Let's assume that you have $250 a month to invest and have identified a mutual fund you'd like to invest in. Using dollar-cost averaging, you invest that amount each month for a year. In a bull market, the fund's share price might be gradually increasing over the year—meaning your $250 investment buys fewer shares each month as the year goes on. In a bear market, by contrast, your monthly investment goes further—letting you buy more shares with the same amount of money.

How to dollar-cost average

- Choose an investing amount and frequency.

- Select investments.

- Set up automatic investments with Fidelity (and automatic contributions to that account, if needed).

Good news: If you participate in a 401(k), you probably already use dollar-cost averaging through the regular contributions from your paychecks.

As you can see, dollar-cost averaging during the bear market can let you accumulate more shares. If you are a long-term investor and can ride out the market's temporary decline, that could set you up well for when the market eventually recovers.

Lessons from the 2008 financial crisis

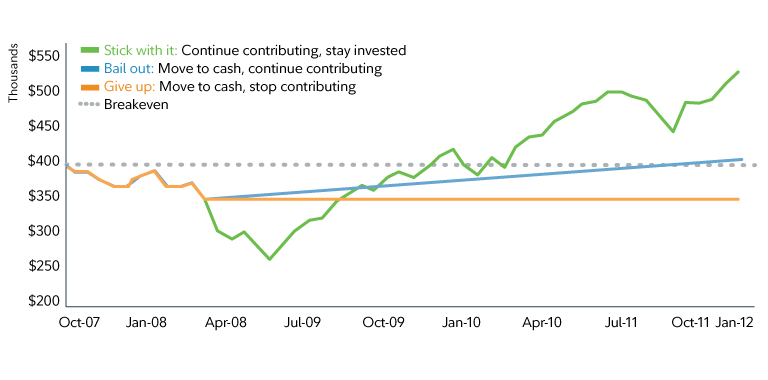

Consider the financial crisis of 2008. Here's how dollar-cost averaging might have paid off for someone who invested consistently through the 2007–2009 bear market, notable for being one of the most severe in a generation.

Continuing to save and invest may help grow your money

Investors who stuck it out after the global financial crisis were first to recover

Investors who consistently put money into the market would have seen their portfolio balance drop initially. Then it would have steadily climbed again when markets started to recover. In comparison, investors who pulled their money out in the depths of the 2008 crisis and kept it in cash would have ended up far behind those who invested consistently.

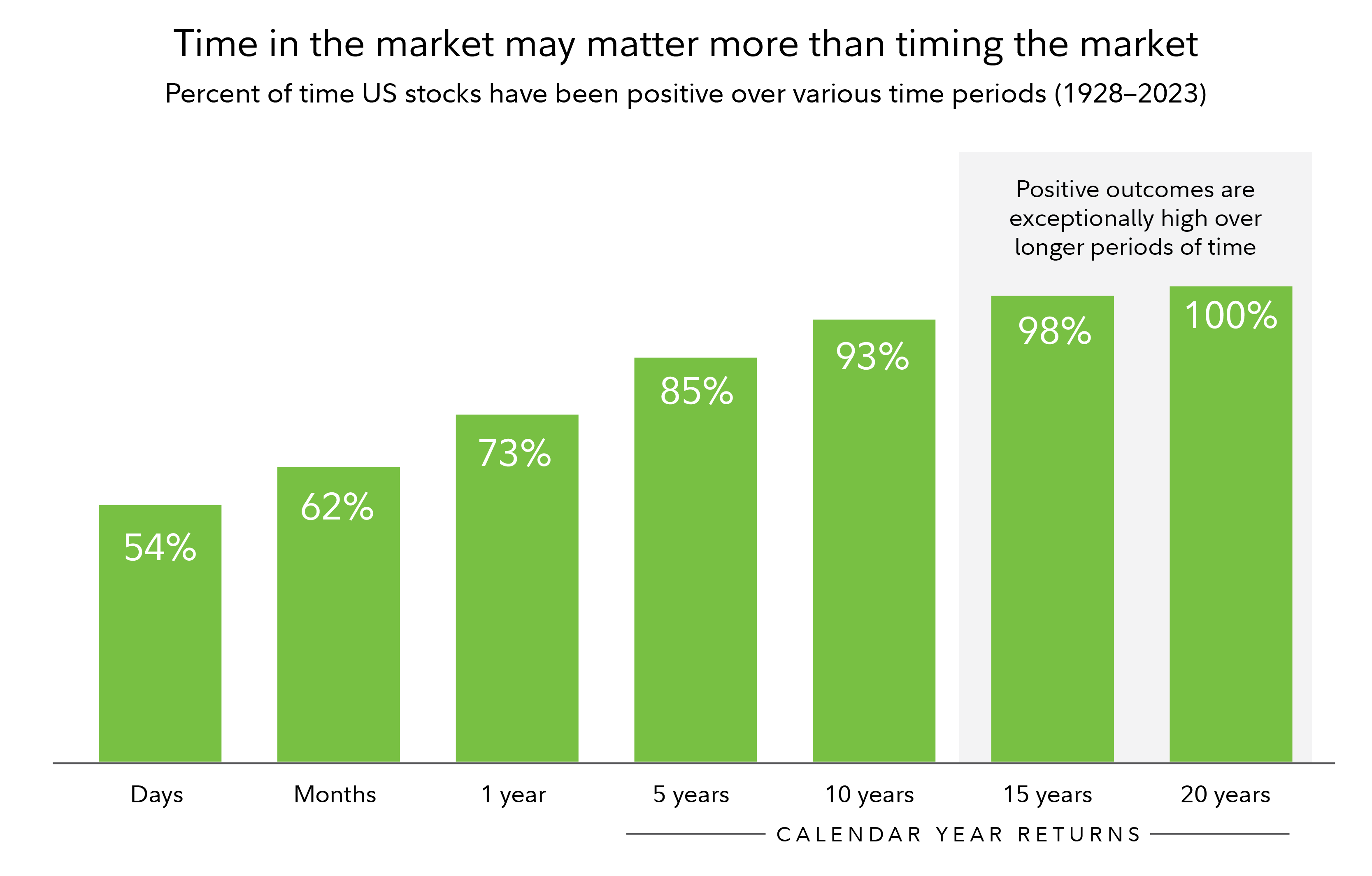

Of course, as this example shows, time horizons matter. Investors who use dollar-cost averaging during a down market may need to be patient while waiting for their investments to recover. As the chart below shows, however, over longer periods the market has always historically recovered from setbacks. While past performance is no guarantee of future results, US stocks have historically generated positive returns over all 20-calendar-year periods.

Keep in mind that while dollar-cost averaging can be particularly powerful during and through down markets, that doesn't mean you should abandon the practice once markets recover. Perhaps the greatest benefit of dollar-cost averaging is that it can help you make a habit out of investing in your future—no matter what the market is doing.