It's easy to feel like everyone has their financial act together—everyone, that is, except you. But the truth is, many people are anxious about their financial standing and wonder how they're doing, especially when it comes to retirement savings.

To get a sense for how you're doing compared to other people, you may want to look at the average retirement savings by age. That way, you can compare your retirement savings with people who have been working and saving for about the same amount of time as you. Of course, you'll also want to see if you're on track for your retirement—fortunately Fidelity does have an easy guideline that can help (more on that later).

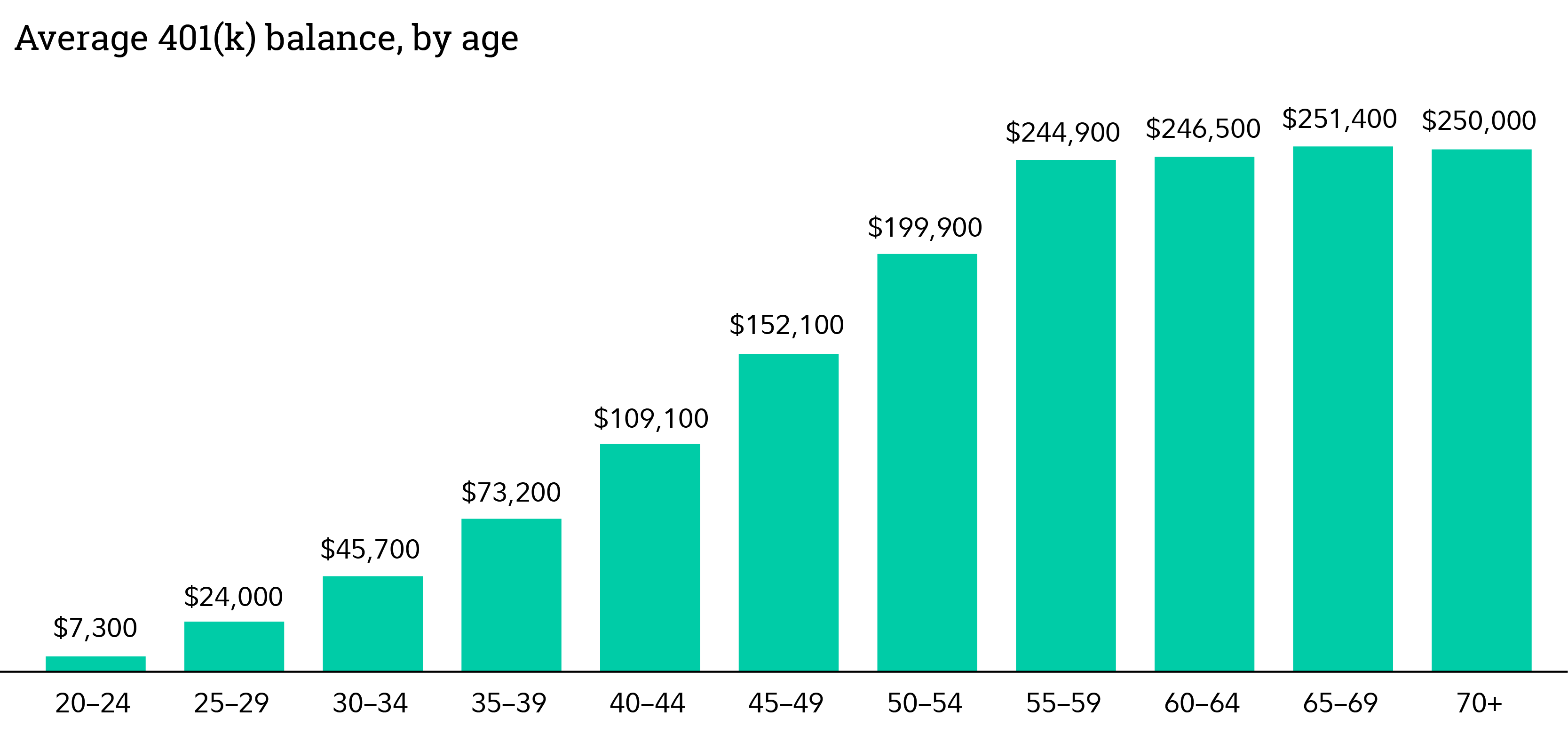

Average retirement savings by age

Nailing down retirement savings by age can be difficult because people may have money saved outside of 401(k)s and IRAs. Real estate, brokerage accounts, savings accounts, nonretirement CDs—and even health savings accounts—could all be earmarked for someone's retirement. But a look at 401(k) and IRA balances can give you a rough measure of how you are doing compared to your peers.

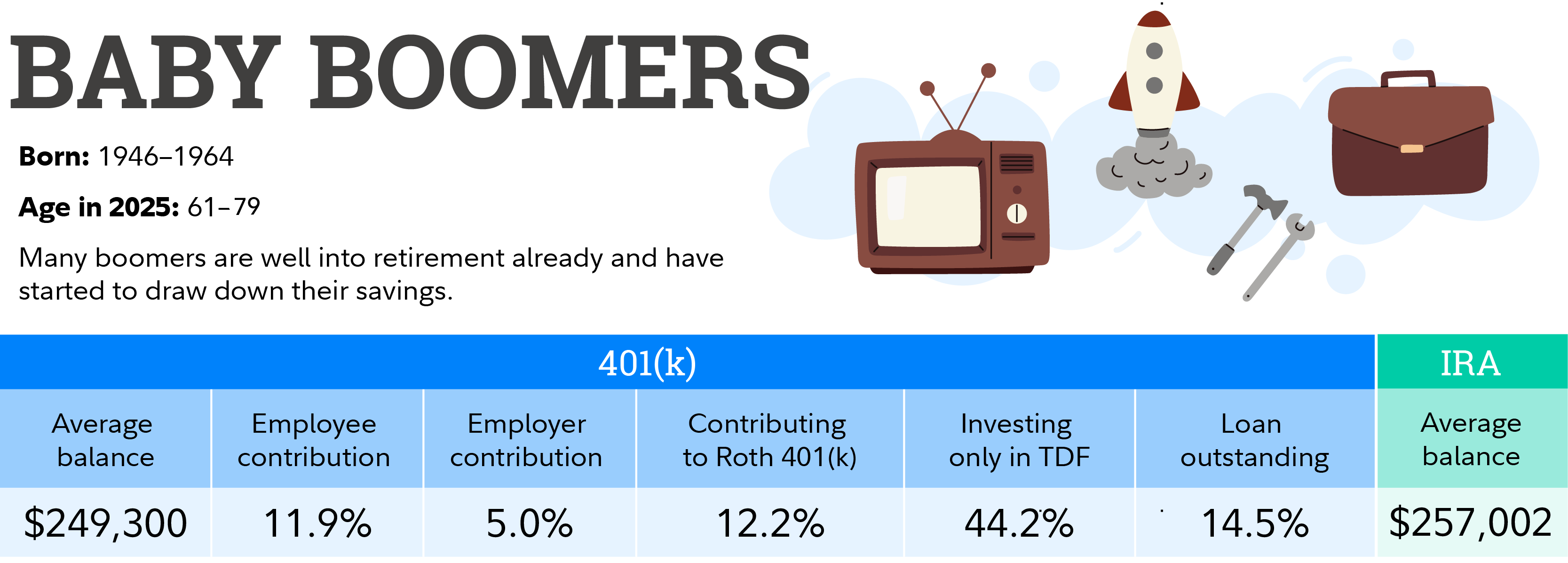

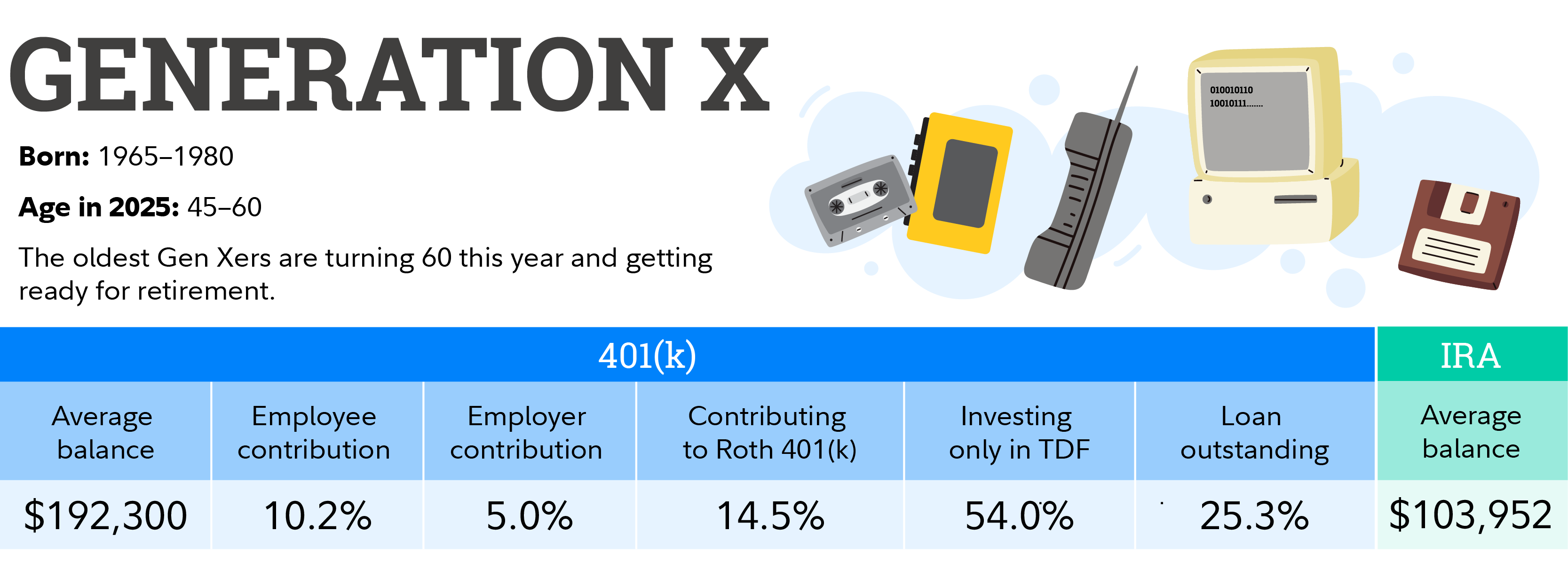

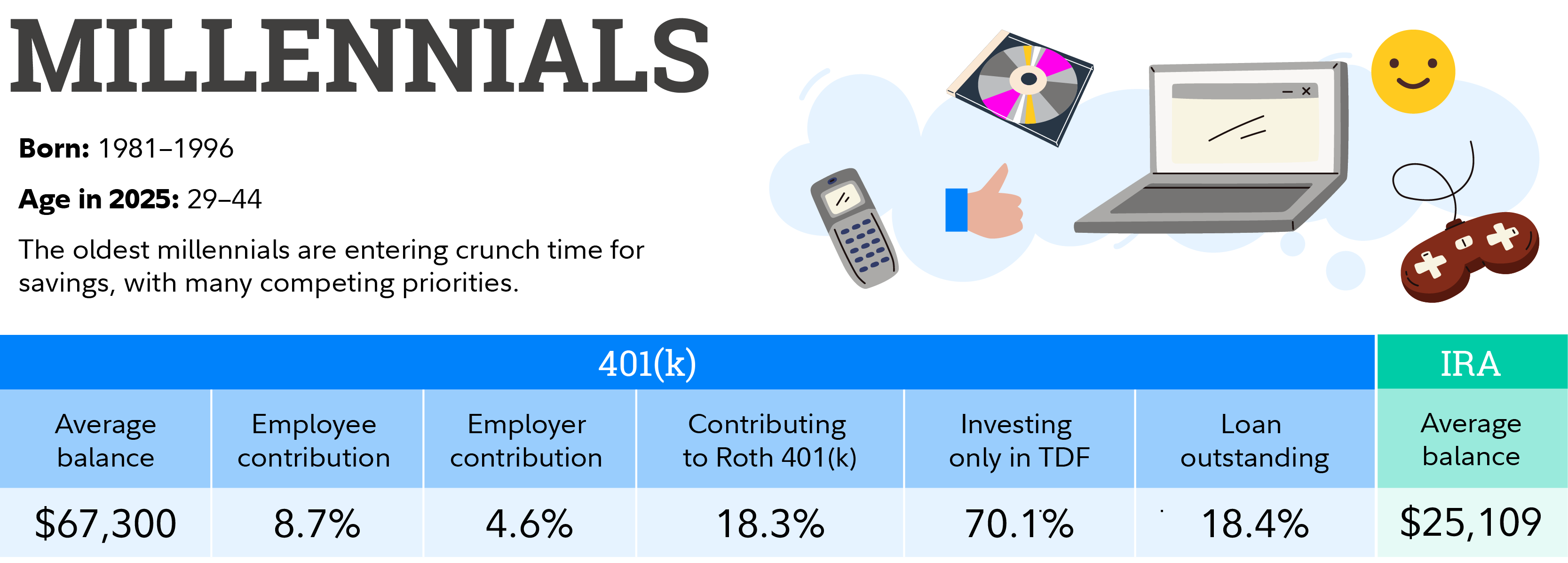

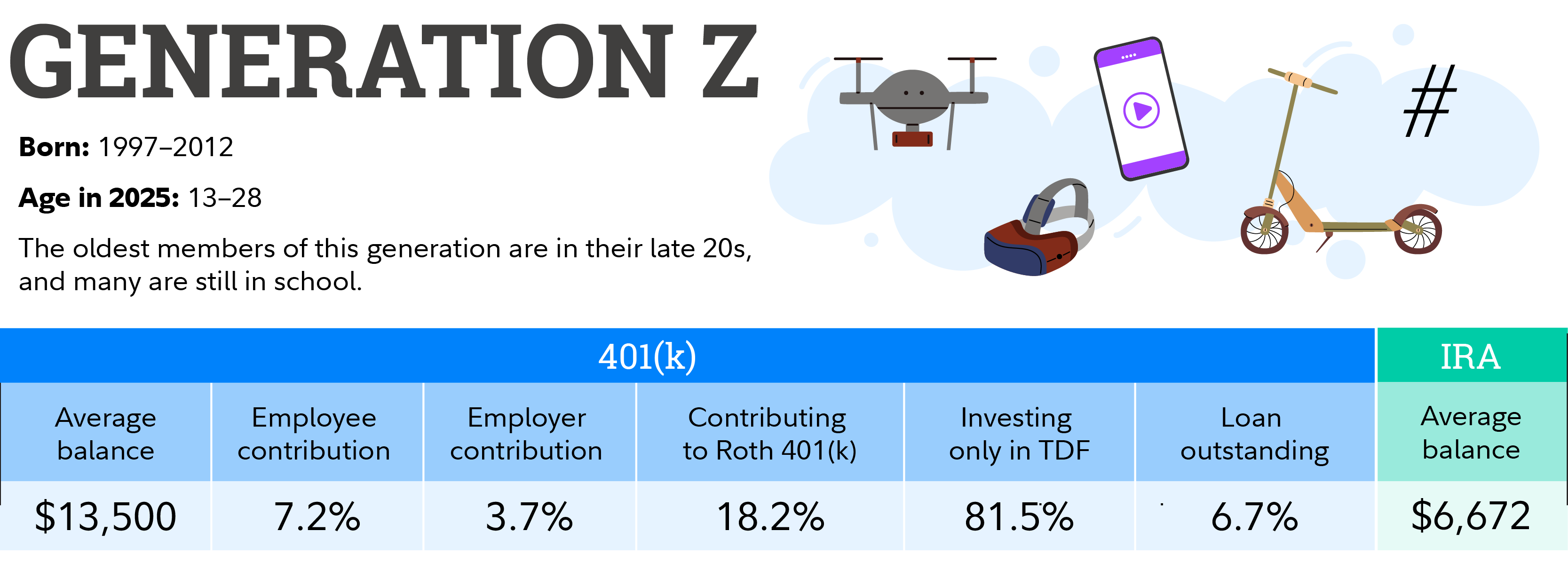

Average retirement savings by generation

Not surprisingly, older generations have saved more than the younger ones. Note that the average savings rate overall is 14.1%, which is close to 15%, the amount that Fidelity suggests saving to maintain your lifestyle in retirement (it includes any match from your employer).

| Average 401(k) balance | Employee contribution | Employer contribution | Contributing to a Roth 401(k) | Investing 100% in target date fund | Loan outstanding | Average IRA balance | |

|---|---|---|---|---|---|---|---|

| Baby boomers | $249,300 | 11.9% | 5.0% | 12.2% | 44.2% | 14.5% | $257,002 |

| Gen X | $192,300 | 10.2% | 5.0% | 14.5% | 54.0% | 25.3% | $103,952 |

| Millennials | $67,300 | 8.7% | 4.6% | 18.3% | 70.1% | 18.4% | $25,109 |

| Gen Z | $13,500 | 7.2% | 3.7% | 18.2% | 81.5% | 6.7% | $6,672 |

Note: TDF stands for target date fund. Source: Fidelity Investments Q4 2024. 401(k) data based on 26,700 corporate defined contribution plans and 24.5 million participants as of December 31, 2024. These figures include the advisor-sold market but exclude the tax-exempt market. Excluded from the behavioral statistics are nonqualified defined contribution plans and plans for Fidelity's own employees.

Generations as defined by Pew Research: Baby boomers are individuals born between 1946 and 1964, Gen X are individuals born between 1965 and 1980, millennials include individuals born between 1981 and 1996, and Gen Z includes individuals born between 1997 and 2012. Fidelity business analysis of 16.8 million IRA accounts as of December 31, 2024. Considers only active participants with balance.

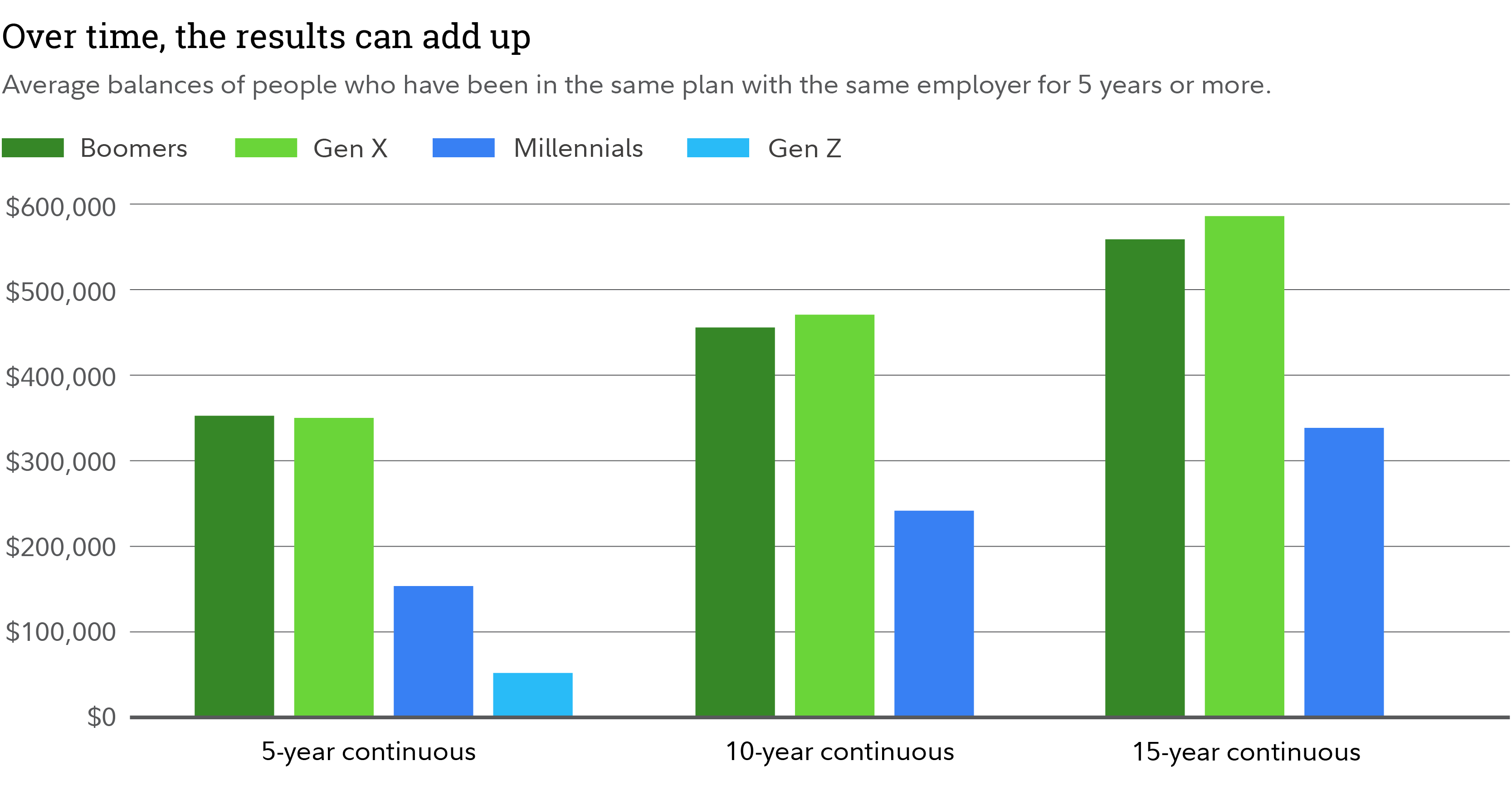

The power of consistently investing for retirement

Another way to measure how you are doing is to look at data for people who have been contributing to their workplace retirement plan for years and years. Being in the same plan with the same employer may provide some stability and routine, which may be helpful for saving over a long period of time.

To avoid a savings setback when changing jobs, try to ensure that you're able to save at least as much as you were saving at your previous job. If you can't swing it right away, make an appointment with yourself to check your retirement savings rate again in a few months.

How to increase your retirement savings

Don't get discouraged if you feel behind. "Saving for retirement is a marathon, not a sprint," says Mike Shamrell, vice president of thought leadership at Fidelity. He recommends that you keep a long-term focus, especially if your retirement is decades away.

It's important to consider your situation and spending habits. The amount you need to save for your retirement may not be the same as the amount your friends or neighbors should save. It should be based on the age you plan to retire and how you want to live in retirement—frugally or extravagantly for instance.

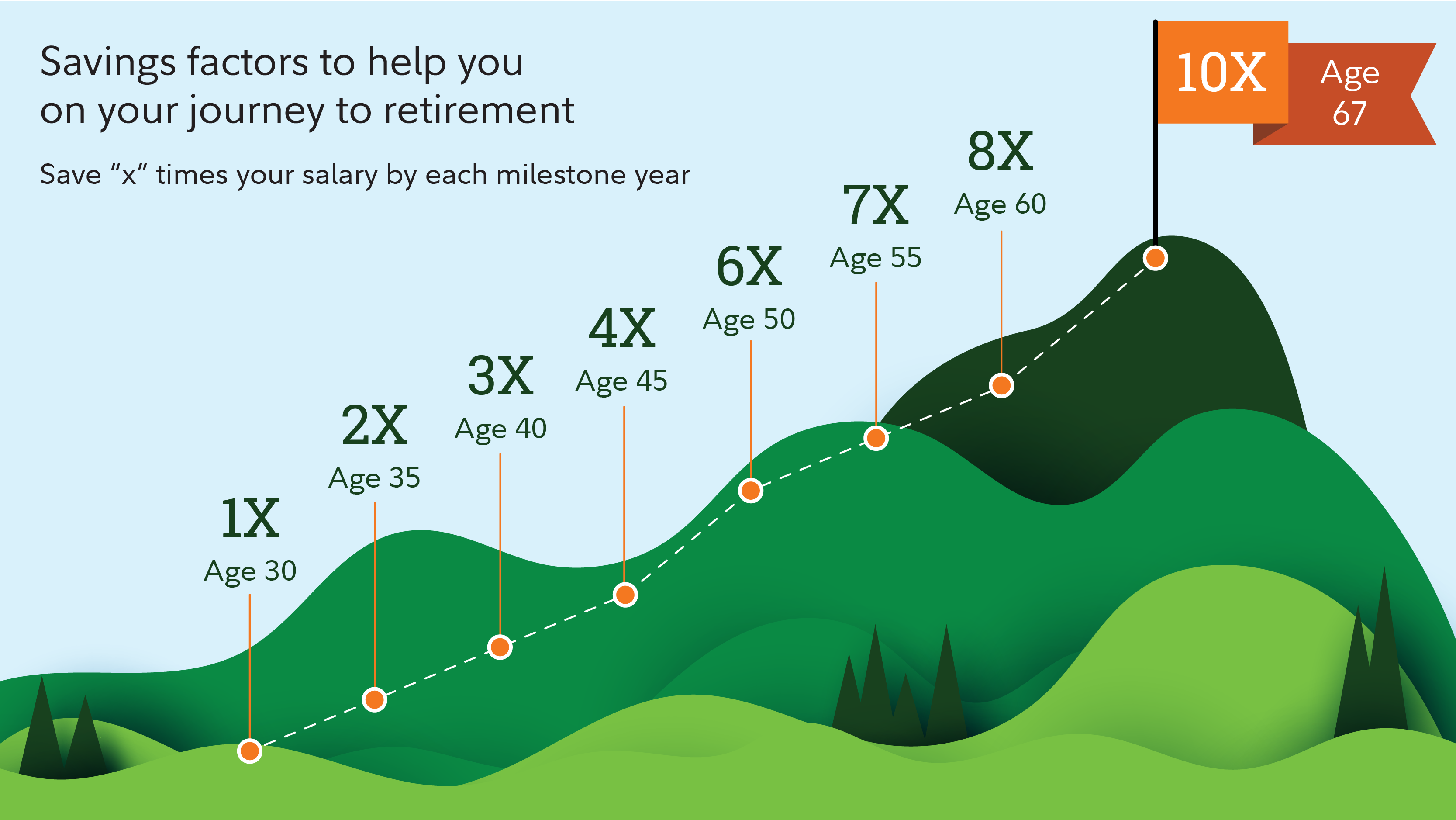

To understand if you're saving enough, Fidelity has some suggestions.

- Save at least 15% of your pre-tax income every year. This includes the money you put in your 401(k), IRA, and any other accounts meant for retirement. It also includes money you receive from your employer, like through a 401(k) match.

- Invest for growth potential. Helping your money grow with investments that provide a rate of return above the rate of inflation can help ensure you can maintain your lifestyle in retirement. A diversified, age-appropriate mix of investments could help you reach your goals more quickly and easily than investing in cash or very safe investments.

- Aim to save 10 times your income by age 67. If you plan to retire earlier, you may need to save a higher multiple of income (for instance, 12 times your income).

- Get your savings factors: Answer 3 simple questions to find out how much of your salary to consider saving by specific ages.

- Weigh saving in a 401(k) and an IRA: After contributing enough to get any available 401(k) match, consider whether you'd like to save more through your 401(k) or an IRA. Both accounts have advantages. For example, an IRA may offer more investment variety whereas a 401(k) lets you save more per year and doesn't have income restrictions. Fidelity generally recommends prioritizing a 401(k) because of the potential for an employer match. Read Fidelity Smart Money: IRA vs. 401(k): What's the difference?

- Keep increasing your savings rate when possible: Any extra money you can put aside per year will improve your retirement prospects. Once you turn 50 you can add more per year with catch-up contributions.

Finally, the Fidelity figures are just guidelines, not the only measure of success. If you don't end up with 10 times your salary by age 67, having some money saved, whether it's 8 times your salary, 4 or 1, is better than none.