A new year means new opportunities to increase your financial security. It’s a perfect time to wipe the slate clean, set goals, and make plans to reach them.

For many people, that means saving more money. About 2/3 of Americans said they’re considering making a financial resolution for the year ahead. The top financial resolution was saving more money in 2026. Paying off debt and spending less money also ranked high in the survey.1

One of the best ways to boost your savings is by paying yourself first. It may not take a lot; increasing your savings rate (the amount you save annually expressed as a percentage of income) by just 1% can significantly boost your savings over time.

Here are 5 ways to help do that.

1. Choose to save. Balancing spending and saving comes down to choices. For most people, even high earners, it takes attention, planning, and intention to build up a healthy amount of savings. That’s why Fidelity believes in the power of setting goals and delayed gratification. Planning and pursuing goals can increase your chances of success.

Pre-committing to a plan and treating savings like a bill that must be paid can help ensure your plan succeeds. For instance, let’s say you want to build your emergency savings in 2026 and commit to saving $6,000. Saving $500 per month could get you there. If you’re paid bi-weekly, you could save $230.77 each pay period and accomplish your goal.

Like all skills, patience and perseverance can be developed over time. If you’ve never tracked your spending, it can be a great place to start. Fidelity’s planning tools can help you track your income and spending, net worth, and progress to your goals.

2. Automation: an overlooked savings trick. In the evolution of the 401(k), researchers realized that using psychological nudges could potentially improve savings behavior. They found that employees who were automatically enrolled into workplace retirement savings plans were likely to stay enrolled rather than taking steps to opt out.

Savers can copy that method for increasing savings. Setting up recurring transfers from your savings account to an investment account can help make sure you’re saving consistently, even if it’s just $1 at a time. With Fidelity's recurring investments feature, you can set up your transfers and recurring investments in one place: Set your investing on repeat

Automation can also help ensure that savings are always a priority. Building new habits or stretching your abilities takes time and automation is a way to assist your new savings habits. If you need to ease into it, Fidelity has a fun way to help you boost your savings, called Smart Habits. It automatically transfers money into your Fidelity account each week for 52 weeks. It starts with $1 in the first week and builds to $52 in the final week.

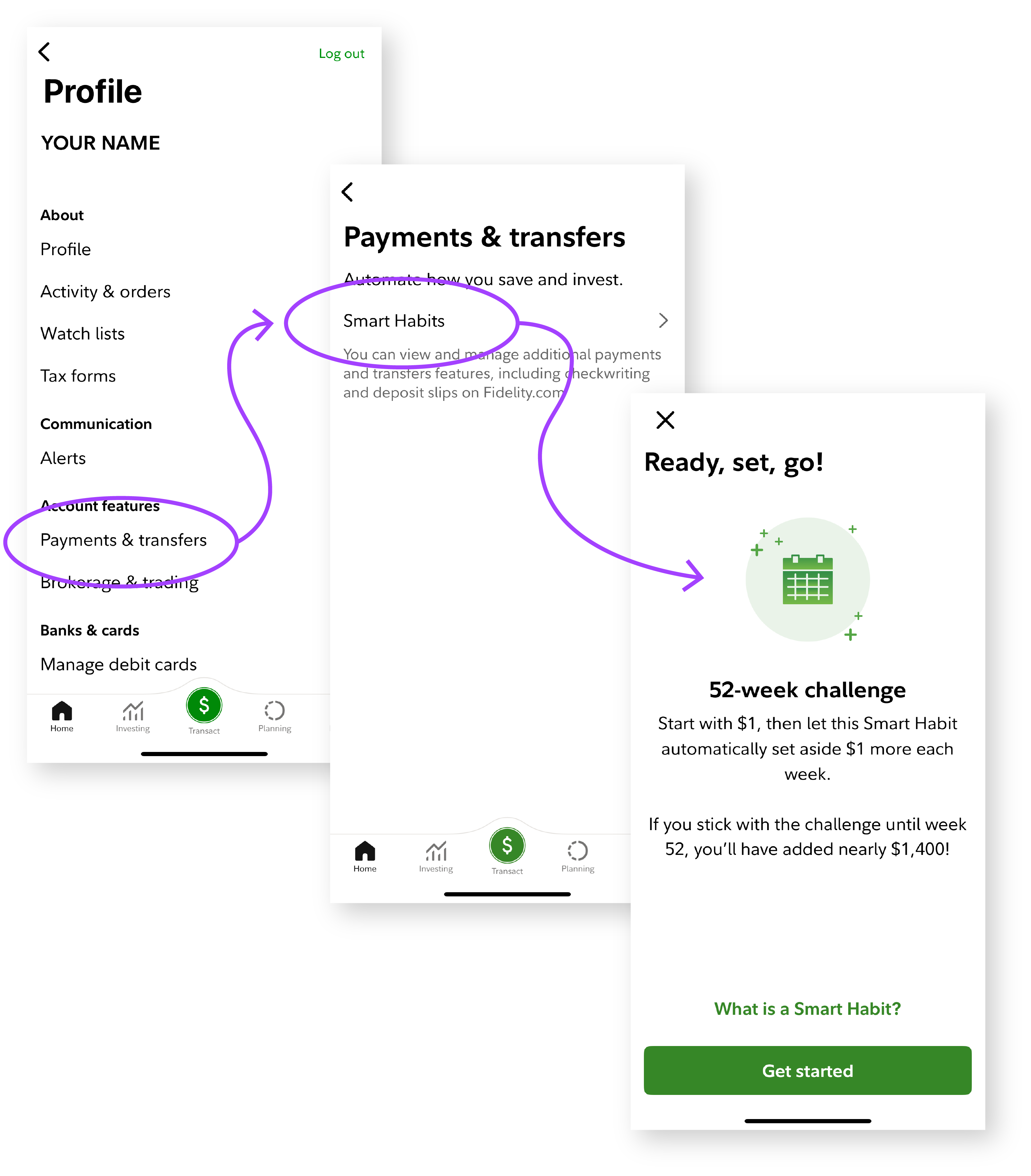

To access Smart Habits in the mobile app, log in and do the following:

- From the "Home" tab, select the "Profile" icon in the top right-hand corner.

- In the "Account Features" section, select "Payments and Transfers."

- Select "Smart Habits."

3. Make emergency savings a priority. Nearly half of Americans had to dip into their emergency savings over the last year and building savings back up is a major goal for many people.1

Aiming to save at least $1,000 for emergencies can be a good start. Once you’ve saved that much, keep saving consistently until you reach the level of savings that makes sense for you.

Generally, Fidelity suggests saving enough to cover your essential expenses for 3 to 6 months. Setting up recurring transfers can be a powerful tool to help build savings.

Read Fidelity Viewpoints: How much to save for emergencies

4. Take tax breaks. Tax-advantaged accounts like IRAs, 401(k)s, health savings accounts (HSAs), and 529s all offer the chance to amplify your savings with a tax benefit.

| Pre-tax or deductible contributions | Any earnings grow tax-deferred | Tax-free withdrawals2,3,4 | |

|---|---|---|---|

| Health savings account | X | X | X |

| Traditional IRA/401(k) | X | X | |

| Roth IRA/Roth 401(k) | X | X | |

| 529 plan | X | X |

It can make sense to focus your initial efforts on accounts that may offer a match like a 401(k)/403(b) and health savings accounts (HSAs). Your employer's match is essentially "free money," so not taking advantage of it is a bit like leaving money on the table. (That said—look into whether your employer's contributions take time to vest, and think about whether you'll stay at your job long enough for them to fully vest before you start banking on that free money.)

An HSA can be a helpful account to use now and in the future if you’re eligible to contribute. You just need to be enrolled in a high-deductible health plan for the year to contribute to an HSA.

Contributing to an HSA can help you reduce your taxes now and can also help you save money on qualified medical expenses. Spending money from your HSA for qualified medical expenses lets you use pre-tax dollars plus earnings tax-free. You can also invest for growth potential which can help you grow the account to use anytime in the future, like in retirement, if you have few medical expenses or can pay out of pocket for some. Read Fidelity Viewpoints: 3 healthy habits for HSAs

Ultimately, Fidelity suggests aiming to save 15% of your pre-tax income toward retirement each year (this includes any employer matching contributions). This savings rate includes all the accounts you plan to use for retirement, including several types of accounts beyond your 401(k), like the aforementioned HSA. Read Fidelity Viewpoints: Maxing out your 401(k)? What to consider next

You may be eligible for tax credits as well. Tax credits can directly offset some of the taxes you owe and free up money for saving. Visit our Learn site: Managing taxes

5. Try to increase your savings rate over time

If you get a bonus from work or if you get a raise, consider saving a portion of the extra money. Even a little bit can add up. Read Fidelity Viewpoints: Just 1% can make a big difference

Slow and steady

Building savings can take time. Investing for growth potential can help boost your returns and lead to potential compounding over the years. Consistently saving what you can, taking advantage of government-provided tax breaks, and increasing your savings rate over time can help you reach your big goals and help you thrive financially.