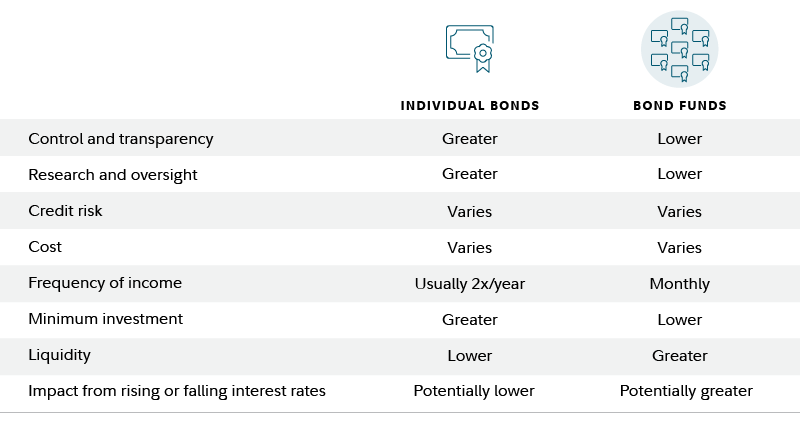

There are pros and cons to buying individual bonds, a mutual fund, or ETF that invests in bonds.

Buying individual bonds can give you greater control over exactly what’s in your portfolio, but also comes with the responsibility of managing that portfolio. Investing in a fund can let you buy a diversified portfolio even with a small initial investment, but means you’ll have less control over the specifics of what you own. When interest rates rise or fall, investors in mutual funds and ETFs may be more likely to experience volatility in the performance of their investment, while investors in individual bonds who hold their bonds to maturity may not realize any impact.

The right choice may depend on the amount of money you have to invest, your ability and interest in researching investments, willingness to track them on an ongoing basis, and your tolerance for different types of risk. In some cases, it may make sense to combine individual bonds with bond mutual funds.

Understanding why you own bonds, particularly during changing rate environments, can help you decide.

Investing in individual bonds

Investing in individual bonds means choosing and buying them one by one, as if you were buying a portfolio of individual stocks.

To learn more, read Fidelity Viewpoints: What is a bond?

Some of the key features and tradeoffs of investing in individual bonds rather than in funds:

Control and transparency: Greater

Buying individual bonds means you have total control over what you own (within the limits of what bonds are available in the marketplace, given the amount of money you have to invest). You choose what you buy, and whether to hold those bonds until maturity or try to sell them before they mature. You may also be able to better plan and control your income stream, because you'll know the maturity dates and coupon payment dates of the bonds. It also means that you can look at the exact details of what you own anytime you wish.

Required research and oversight: Greater

Assembling and managing a portfolio of bonds can entail significant research and ongoing monitoring. To assemble a diversified portfolio, you might need to invest in a broad range of different bonds from different issuers. You’ll generally be responsible for researching and monitoring the financial stability of each issuer, determining if each bond’s price is reasonable, and building a portfolio around your need for income, risk tolerance, and general diversification. (Fidelity can help you do this, through our fixed income research center and fixed income alerts.)

The required level of research and oversight may be reduced if you’re only buying securities that don’t present credit risk—such as US Treasury bonds, which are backed by the full faith and credit of the US government, or certificates of deposit that are insured by the FDIC. (FDIC insurance limits are currently set at $250,000 in aggregate deposits, per issuer, per account type.)

Credit risk: Varies

Investing in individual bonds rather than bond funds doesn’t present greater or less credit risk. If you assemble a portfolio of extremely high-quality bonds, then you may be taking on less risk, while assembling a portfolio of lower-quality bonds may entail greater risk. Diversification can help to reduce the overall credit risk of a portfolio, and achieving broad diversification can be more cumbersome with individual bonds.

Cost: Varies

Buying individual bonds may entail transaction costs when you purchase investments (and when you sell, if you choose not to hold until maturity), but unlike bond funds, individual bonds generally don’t entail any ongoing management fees. If you simply buy a portfolio of bonds and hold them until maturity, your total costs could be quite low. Placing more trades will typically increase your costs. Investors may also pay a mark-up when buying individual bonds and face a mark-down when selling them.

Investors pay no commissions or concessions when participating in new bond issue offerings with Fidelity, although there may on occasions be a fee if the new-issue bond trade is placed with a representative.

To learn more, read Fidelity Viewpoints: How not to overpay for bonds and the commission and fee schedule for bond trading.

Frequency of income: Generally twice a year

When you invest in individual bonds, you’ll receive income anytime a bond makes a coupon payment or matures. Most bonds make coupon payments twice a year, though the exact dates may vary with the bond.

The predictability of bond coupon payments can be one key point of appeal for investors who choose individual bonds. For example, it’s possible to construct a portfolio of bonds that makes equal coupon payments each month to target a steady stream of income. Another popular strategy is to build a bond ladder, by buying bonds with various maturities.

To learn more, read Fidelity Viewpoints: How to earn steady income with bonds, and try Fidelity’s Bond Ladder Tool.

Minimum investment amount: Greater

Investing in individual bonds typically requires a significantly higher initial investment amount compared to bond funds. Bonds usually trade with a minimum order quantity—which may be as low as 1 (translating to $1,000 of face value) or as high as 100 (translating to $100,000 of face value) or more. Assembling a diversified portfolio entails buying individual bonds across many different issuers. Fidelity generally recommends that when investing in bonds that present credit risk, such as corporate bonds or municipal bonds, you have at least several hundred thousand dollars allocated to fixed income in order to consider investing with individual bonds.

However, as with credit risk, the required investment amount may be reduced if you’re buying securities that don’t present credit risk, such as US Treasurys or FDIC-insured CDs, because diversification may be less of a concern. These may be bought for as little as $1,000 and Fidelity offers Fractional CDs, available in minimums and increments of $100.

Liquidity (ability to access cash): Lower

As mentioned, with individual bonds you’ll generally receive a cash inflow anytime a bond makes a coupon payment or matures. If you need to access your principal before a bond matures then you can sell it, although this may entail transaction fees. Certain bond types that trade in more liquid markets—such as Treasurys and certain corporate bonds—may be easier to sell than most municipal bonds, where markets are thinner and less liquid. Selling before maturity can result in either a profit or a loss compared with the price you paid at purchase.

Impact from rising or falling rates: Potentially lower

When the prevailing level of interest rates in the marketplace rises, the market value of individual bonds generally falls. When interest rates fall, bond prices rise. This relationship is true for bonds held individually and bonds held via a mutual fund. However, investors who hold individual bonds will not realize this impact (i.e., with a realized capital loss or gain) if they hold their bonds to maturity and the bonds make all their payments as promised.

Investing in bond funds

Investing in a bond mutual fund or ETF is much like investing in a stock mutual fund. You put your money into a pool with other investors, and a professional invests your money. In an actively managed fund or ETF the manager may invest according to what they think the best opportunities are, in accordance with the fund’s stated investment goals. In an indexed fund or ETF the manager will seek to track the composition and performance of the underlying bond index. Some of the features and tradeoffs that might lead an investor to or away from bond funds:

Control and transparency: Lower

While you have control over what fund you invest in—including whether you invest in a fund focused on US or global debt, investment-grade or lower-rated debt, and taxable or municipal debt—once you’re invested you don’t have control over exactly what the fund holds. Funds always have stated objectives, and generally have guardrails around what they may invest in (for example, funds that focus on investment-grade bonds may be prohibited from holding below-investment-grade bonds or may have strict limits on how much they can own). However, within those limits and guardrails it may be up to the fund manager to invest in whatever securities they feel present the best opportunities.

Similarly, while mutual funds must publish their complete holdings periodically, these are often only available a few times a year, and with a lag. ETFs generally offer greater transparency than mutual funds, with many ETFs disclosing their complete holdings every day.

Required research and oversight: Lower

One key convenience and potential advantage that draws investors to bond funds is the reduced level of research required. While you may want to do a thorough comparison of available funds and the track records of various managers (and you’ll want to monitor performance after you invest), you don’t need to research any individual bonds or issuers.

Credit risk: Varies

How much credit risk you take on with a bond fund depends on what type of mutual fund or ETF you choose. High-yield funds, or funds that invest in floating-rate loans, are generally focused on below-investment-grade issuers, and so come with greater credit risk. Funds that focus on US Treasurys may come with much less. Again, diversification can reduce the overall credit risk presented by a portfolio, and achieving broad diversification can be easier with bond funds

Cost: Varies

Bond funds typically charge expense ratios, which cover the costs of management and research and are levied on an ongoing basis. Depending on the mutual fund or ETF you choose and where you buy it, you could face additional transaction or sales fees.

Frequency of income: Generally monthly

Bond funds typically streamline their payments to investors into a monthly schedule of distributions, the amount of which may fluctuate from month to month. While these distributions may be called “dividends,” they may be primarily composed of interest income from the portfolio’s underlying bonds, and how that income is taxed depends on the underlying investments that are generating that income.

To learn more, Read Fidelity Viewpoints: Tax implications of bonds and bond funds.

Minimum investment: Lower

Building a diversified fixed income portfolio with bond funds typically requires much less money than it does with individual bonds, because bond funds are often broadly diversified among hundreds or even thousands of issuers. This means it may be possible to build a well-rounded fixed income portfolio with just one fund, or a few funds. Some bond mutual funds require minimum initial investments of a certain amount, such as $1,000 or more, while others have no minimum requirements.

Liquidity: Greater

Mutual funds offer daily liquidity. Investors can place a trade to redeem some or all of their shares anytime, with trades typically executing after the next market close. There may be transaction or redemption fees associated with selling shares, but investors do not have to sell any individual bonds themselves or wait for any bonds to mature if they need to cash out. Because ETF shares trade on exchanges, like stock, they offer intraday liquidity. This means investors can generally purchase or sell shares at any time during regular market trading hours.

A fund’s net asset value depends on market conditions, and so may constantly fluctuate with movements in interest rates and other factors. When you redeem shares of a fund, the sale may result in a capital gain or loss.

Impact from rising or falling rates: Potentially greater

The value of a fund is essentially marked to market daily, and investors will see this volatility in the value of their holdings. This means that when interest rates rise, investors may see a decline in the value of their investment, and when interest rates fall, investors may see a gain in value. Because bond funds do not have a defined maturity date, and the investor chooses when to purchase and when to sell, as prices fluctuate due to interest rate changes and other factors, it is possible that an investor may receive less principal back than initially invested.

Learn more

Ready to take the next step? Learn more about investing for income and explore fixed income investing at Fidelity. You can research individual bonds at the fixed income research center, consider how a managed account could help you assemble a diversified portfolio of individual bonds, or learn more about Fidelity’s bond mutual funds and ETFs.