Growth or value. Weighing the merits of these 2 competing investment styles is like choosing between Batman and Superman. You want both.

Both growth and value stocks can maximize value for investors, but the 2 schools of investing take different approaches.

Growth investing

Growth investors are attracted to companies that are expected to grow faster (either by revenues or cash flows, and definitely by profits) than the rest. As growth is the priority, companies reinvest earnings in themselves in order to expand, in the form of new workers, equipment, and acquisitions.

Don't expect dividends from growth companies—right now it's go big or go home. Growth companies offer higher upside potential and therefore are inherently riskier. There's no guarantee a company's investments in growth will successfully lead to profit. Growth stocks experience stock price swings in greater magnitude, so they may be best suited for risk-tolerant investors with a longer time horizon.

Value investing

Value investing is about finding diamonds in the rough—companies whose stock prices don't necessarily reflect their fundamental worth. Value investors seek businesses trading at a share price that's considered a bargain. As time goes on, the market will properly recognize the company's value and the price will rise.

Additionally, value funds don't emphasize growth above all, so even if the stock doesn't appreciate, investors typically benefit from dividend payments. Value stocks have more limited upside potential and, therefore, can be safer investments than growth stocks.

Growth or value stocks—a quick cheat sheet

Growth stocks

- More "expensive:" Their stock prices are high relative to their sales or profits. This is due to expectations from investors of higher sales or profits in the future, so expect high price-to-sales and price-to-earnings ratios.

- Riskier: They're expensive now because investors expect big things. If growth plans don't materialize, the price could plummet.

Value stocks

- Less "expensive:" Their stock prices are low relative to their sales or profits.

- Less risky: They have already proven an ability to generate profits based on a proven business model. Stock price appreciation isn't guaranteed, though—investors may have properly priced the stock already.

Are there funds that offer a little of both?

There are "blended" funds created by portfolio managers that invest in both growth stocks and value stocks. Many managers of these blended funds pursue a strategy known as "growth at a reasonable price" (GARP), focusing on growth companies, but with a keen awareness of traditional value indicators.

Style is one factor, size is the other

When selecting a stock fund or an individual stock, consider the 2 main categories: style and size. You just became a style master—we value how you’ve grown (see what we did there?). Size is the other category, which can be measured by market capitalization. This term simply describes the size of the companies in which the fund invests, as measured by the total value of all its outstanding shares. Size does matter.

Use Fidelity's StyleMaps to help find the right fund

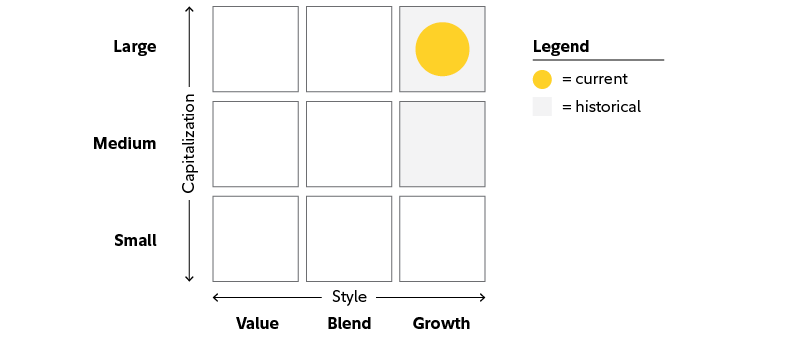

Fidelity's StyleMaps use a combination of recent and historical Morningstar® data to categorize this size/style dichotomy. On the horizontal axis, the fund is categorized as value, blend, or growth. On the vertical axis, the fund is categorized by market capitalization. "Small" is less than $2 billion in market cap, "medium" is $2 billion–$10 billion, and "large" is greater than $10 billion. The map below, for instance, identifies a large-cap growth fund.

If you can determine your own strategy by choosing one of the 9 size/style categories, then you can choose from the number of funds in that category. These funds can also provide diversification—a must for any prudent investor. Ultimately, what may be best for you is a mix of both growth and value funds.