Exchange-traded funds (ETFs) have some features of both individual stocks and mutual funds, but are unique investment vehicles. From a tax perspective, here are some basic rules about ETFs you need to know.

Dividends

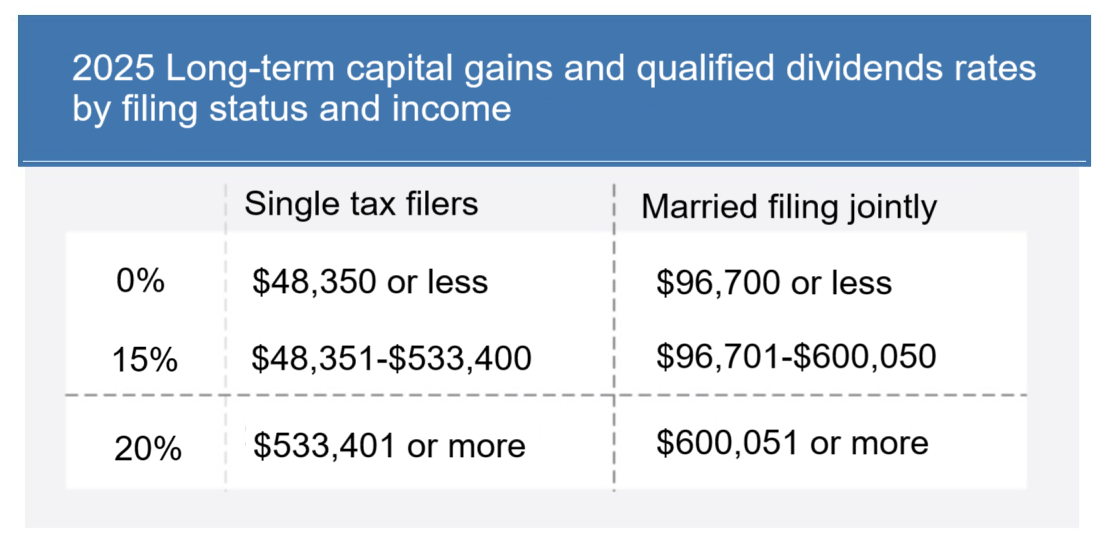

Annual distributions from an ETF to investors may be treated as qualified or nonqualified dividends. See the chart below for qualified dividend tax rates. Please note that just because the ETF reports on Form 1099-DIV that its distribution was a qualified dividend does not automatically make it qualified for the investor. The investor must have held the ETF for at least 61 days during the 121-day period beginning 60 days before the ex-dividend date.

Basis

Like stock, an investor’s basis in ETF shares usually is based on cost—what the investor paid for the shares, plus any sales commissions. (Different rules apply if the investor receives shares by gift or inheritance.) Basis is increased by any taxable dividends that are reinvested in additional ETF shares.

Capital gain or loss

When you sell shares in ETFs, you’ll have a capital gain or loss, depending on your basis in the shares. This is no different than the tax treatment that applies to the sale of shares in individual stocks or in mutual funds. See chart below for 2025 rates.

Capital losses on the sale of shares in ETFs can be used to offset capital gains and up to $3,000 of ordinary income ($1,500 for married persons filing separately). Capital losses in excess of these limits can be carried forward and used in future years.

In addition to the capital gains tax, there is also a special Medicare tax of 3.8%. This applies to net investment income (including gains from sales of ETFs) and applies to investors with modified adjusted gross income (MAGI) above $200,000 for single filers and $250,000 for couples filing jointly. The tax of 3.8% is on top of capital gains taxes. So for investors paying long-term capital gain rates, they can be as high as 23.8%, not including state and local taxes, which can push your tax rate even higher.

Tax efficiency

It is repeatedly said that ETFs offer tax efficiency. What does this mean? There are essentially two reasons for this label.

- Marketing timing. Unlike mutual fund shares that can only be bought and sold at the end of the trading day, shares in ETFs can be purchased throughout the trading day like stocks. This allows investors to get in and out of their holding when investment decisions and tax results dictate. What’s more, ETFs also utilize a process called "Create and Redeem" to facilitate investor purchases and sales of the ETF shares. Under Create and Redeem, ETFs (unlike traditional, open-end mutual funds) do not have to sell individual securities in order to meet redemptions; instead can use an Authorized Participant (AP) to act as a tax-smart clearinghouse to facilitate redemptions.

- Distributions. Both mutual funds and ETFs generally are required to distribute capital gains to investors, which can potentially result in a significant tax cost annually.

A Final Word

To determine the potential tax impact on you of buying, holding, or selling ETFs, talk with your personal tax advisor.