Fidelity Youth®

A teen-owned brokerage account that gives ages 13-17 the freedom to invest in most US stocks, ETFs, and Fidelity mutual funds—while parents stay connected.

Fidelity Youth® Account benefits

Helping the next generation grow their knowledge, build smart money habits, and plan for the future.

$0 fees to open

The Fidelity Youth® Account has no subscription fees, no account fees, and no minimum balances to open.1

Investing with as little as $1

Start small and explore the market with confidence with tools, education, and resources built for new investors

![]()

Debit card available

Teens can optionally request a debit card to make purchases directly from their Youth Account.

Investing and education—together in the Fidelity Investments® app

Fidelity Youth® is now part of the Fidelity Investments® app, with powerful tools and approachable content all in one place.

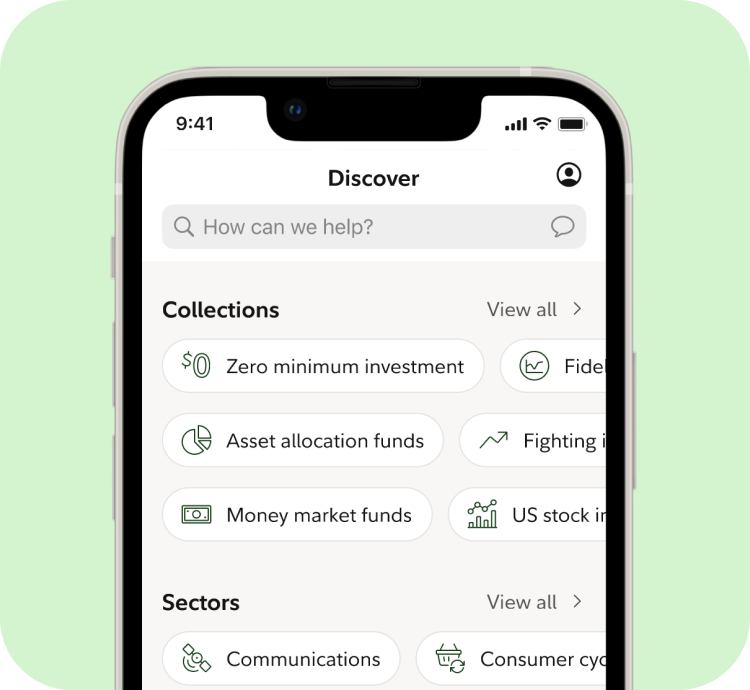

More ways to explore markets

Browse investments by sector, collection, or market movers. Use enhanced charts and watchlists to track opportunities and trends over time.

Seamless money transfers

Parents can quickly and easily transfer money from their Fidelity account to their teen’s Youth Account to support saving, investing, and other financial priorities.

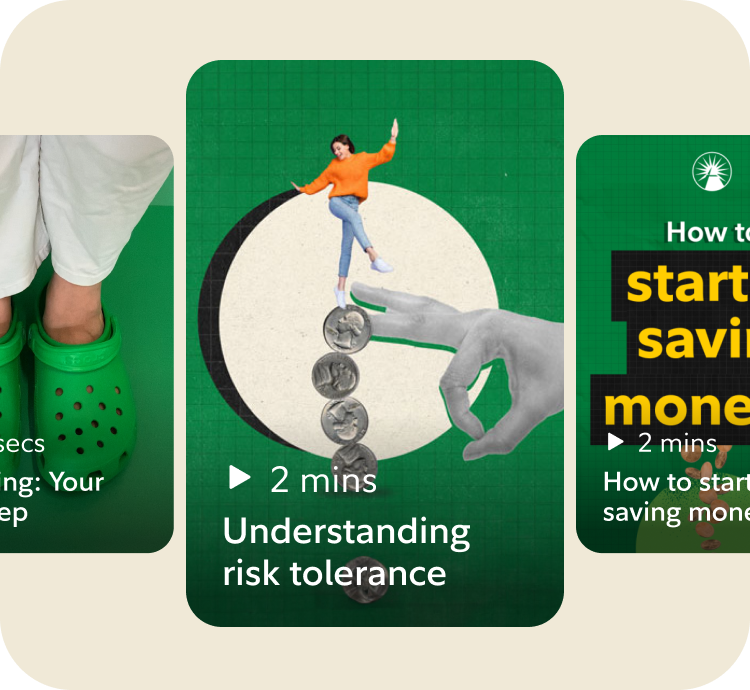

Teen-friendly learning

Explore articles and videos designed to help make money topics clear and approachable, from saving and budgeting to investing basics.