At Fidelity, we're steadfastly focused on helping clients find the right financial solutions to achieve their goals, leveraging our vast resources to deliver planning and investment solutions.

But some clients have financial needs that require a highly specific set of solutions. This is where we're able to tap into one of our most valuable assets—the independent investment advisor firms participating in the Wealth Advisor Solutions® program—who can offer access to specialized services.

How Wealth Advisor Solutions can complement your Fidelity team

The Wealth Advisor Solutions program gives clients access to independent investment advisor firms that can offer a wide range of specialized services designed to meet specific needs.

![]() Your Dedicated Advisor

Your Dedicated Advisor

Your advisor will get to know you and what's important to you. Together, you'll partner on a customized plan designed to help grow and protect your wealth

![]() Your Investment Advisory Team

Your Investment Advisory Team

Your Fidelity team provides discretionary investment management services for accounts which include monitoring of investments to ensure adherence to an account's investment strategy and portfolio specialists who can provide up-to-date market insights in context of your plan.

![]() The Service Team

The Service Team

Our skilled service team is always available at 800-343-3548 and is the best resource for support with transactions, such as account maintenance and money movement. Digital support is also available on Fidelity.com, the Fidelity Mobile® app, and through the Virtual Assistant.

![]() Your Planning Support

Your Planning Support

These associates help with preparation and follow-up on advisor interactions to help you implement your plan and next steps.

Wealth Advisor Solutions® Program

Wealth Advisor Solutions® Program

Your Fidelity advisor can refer you to independent investment advisor firms with a wide breadth of experience—including customized portfolios, tax planning & strategy services, and alternative investments—based on your needs.

When you and your Fidelity advisor uncover an area of complexity that might be better served by an independent investment advisor firm, or when you express a desire for additional customization, we conduct a thorough assessment of your needs, then see which participating providers in the Wealth Advisor Solutions® program may provide a good fit. If you’d like, we can help you with an introduction to the firm as you explore your options:

- Customized Investment Portfolios

- Alternative Investments

- Complex Estates & Trusts

- Integrated Tax Planning & Prep

- Solutions for Concentrated Positions

Key takeaways

![]()

Fidelity can provide referrals to participating Wealth Advisor Solutions independent investment advisor firms who can work with you to help you address a range of complex financial needs.

![]()

Although you'll maintain a unique relationship with your independent investment advisor firm, for the most part your assets will be custodied at Fidelity.

![]()

Regardless of where your assets are custodied, we can continue to provide planning support around your full financial picture.

The independent investment advisor firms who participate in the Wealth Advisor Solutions® program can deliver a wide range of specialized services. You bring us your greatest challenges and we'll work to pair you with a firm positioned to deliver effective solutions.

Some of the challenges these firms can help you face:

Taxes

I'm looking for a comprehensive solution designed to help reduce what I pay in taxes.

See options

Concentration

I'm looking for ways to reduce the risk of having too much of my portfolio tied up in a single asset.

See options

Personalized solutions

I'm looking to invest in more targeted, personalized stock and bond portfolios.

See options

Income generation

I'm looking for income that goes beyond more traditional sources, like annuities or withdrawals from my investments.

See options

Opportunistic investing

I'm looking for ways to capitalize on unusual market conditions.

See options

Expanded investment options

I'm looking for less traditional types of investments that allow me to diversify in ways that might not otherwise be available.

See options

Advanced planning

I'm looking for help planning for both the expected and the unexpected.

See options

Legacy planning

I'm looking to create a long-term positive impact for the people, organizations, and causes I care about.

See options

Business owner services

I need to align my personal and business assets, to drive growth, manage taxes, and develop a succession plan.

See options

Private banking and lending

I'm looking for access to funds to facilitate a large purchase and smarter ways to manage my cash.

See options

Executive compensation

I'm looking to make the most of my compensation and benefits packages while managing the tax implications.

See options

Foundations and endowments

I want to help the charitable organization I work with manage its assets so I can focus on our mission.

See options

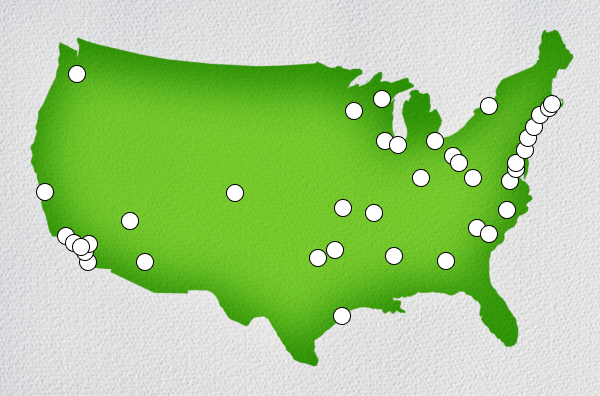

Participating independent investment advisor firms

We work with a range of independent investment advisor firms, each positioned to meet very specific client needs. As a complement to our own offering, we work to provide access to a wide range of firms with a national presence, as well as smaller local firms if you'd prefer to work with someone closer to you. While some offer a robust menu of in-house capabilities, others provide more specialized services. The firms in our program may manage anywhere from $1 billion to over $30 billion in assets.

Existing Fidelity Institutional® independent investment advisor firms are sourced based on the complementary services they may offer to clients.

Fidelity reviews each firm to determine which meets the necessary criteria to participate in the Wealth Advisor Solutions referral program.

Once a new firm is accepted into the program, they're able to receive referrals.

Please keep in mind: An independent investment advisor firm's acceptance to participate in Wealth Advisor Solutions does not serve as a recommendation. Further, Fidelity does not vet, monitor, or endorse investment performance of participating firms.