1.Tax-smart (i.e., tax-sensitive) investing strategies (including tax-loss harvesting) are applied in managing certain taxable accounts on a limited basis, at the discretion of the portfolio manager primarily with respect to determining when assets in a client's account should be bought or sold. As the discretionary portfolio manager, Strategic Advisers LLC ("Strategic Advisers") may elect to sell assets in an account at any time. A client may have a gain or loss when assets are sold. There are no guarantees as to the effectiveness of the tax-smart investing strategies applied in serving to reduce or minimize a client's overall tax liabilities, or as to the tax results that may be generated by a given transaction. Strategic Advisers does not currently invest in tax-deferred products, such as variable insurance products, or in tax-managed funds, but may do so in the future if it deems such to be appropriate for a client. Strategic Advisers does not actively manage for alternative minimum taxes; state or local taxes; foreign taxes on non-U.S. investments; federal tax rules applicable to entities; or estate, gift, or generation-skipping transfer taxes. Strategic Advisers relies on information provided by clients in an effort to provide tax-sensitive investment management and does not offer tax advice. Except where Fidelity Personal Trust Company (FPTC) is serving as trustee, clients are responsible for all tax liabilities arising from transactions in their accounts, for the adequacy and accuracy of any positions taken on tax returns, for the actual filing of tax returns, and for the remittance of tax payments to taxing authorities.

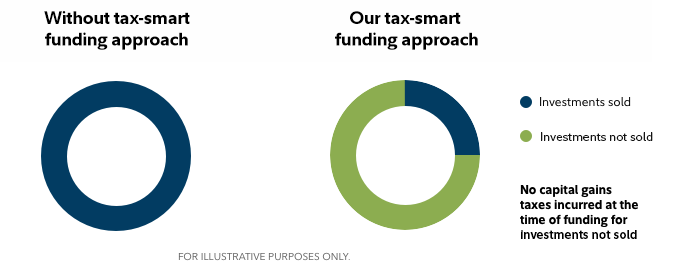

2. For a list of eligible investments, contact a Fidelity representative. Clients may elect to transfer noneligible securities into their Accounts. Should they do so, Strategic Advisers or its designee will liquidate those securities as soon as reasonably practicable, and clients acknowledge that transferring such securities into their Accounts acts as a direction to Strategic Advisers to sell any such securities. Clients may realize a taxable gain or loss when these shares are sold, which may affect the after‐tax performance/return within their Accounts, and Strategic Advisers does not consider the potential tax consequences of these sales when following a client's deemed direction to sell such securities. Strategic Advisers reserves the right not to accept otherwise eligible securities, at its sole discretion. When a client funds their account with existing investments, transition results will vary depending on the number of concentrated positions, alignment with the new portfolio, and level of embedded gains. Outcomes can range from selling none of your existing positions, to selling all your existing positions. Clients may realize taxable gains or losses if eligible securities are sold.

3. Non-margin loans are made by third-party lenders (the "Bank(s)"). Fidelity has a minority percentage, non-controlling ownership interest in Leader Bank; however, Fidelity does not recommend any of the Banks. There are many lenders in the marketplace – you should carefully and independently evaluate all your options and choose the one that's right for you.

Customers may choose to use a third-party lender of their choice to collateralize their accounts and may receive different services or pricing. Please note that the solutions as described herein refer to the Lending Solutions Line of Credit program which uses the third-party lenders with whom Fidelity has specific contractual agreements.

The Bank(s) are solely responsible for any information about the lending product offered, including any discussions about the loan product or any estimate or loans terms provided to you.

If you take out a line of credit with the Bank(s), the collateral securing your loan will be held in your account(s) subject to the terms of the Control Agreement between you, Fidelity, and the Bank(s). Loan proceeds cannot be deposited into a Fidelity account and cannot be used to purchase securities.

Fidelity is compensated by the Bank(s) in the Lending Solutions program for promoting the availability of their line of credit product, assisting with the loan application process, and providing ongoing support during the life of the loan. Fidelity's compensation will generally be equivalent to a percentage of any average outstanding loan balance. Fidelity associates will be compensated upon the loan being drawn down.

Interest rates for a line of credit offered by the Bank(s) in Fidelity's Lending Solutions program are offered in a tiered structure and will vary based on the amount of the loan commitment. The interest rate you will pay on your line of credit may be higher than the rate you would pay if you dealt directly with the Bank(s) and may be higher than the rate you would pay if you obtained a similar loan from another bank. Please note that not all banks in the program offer these line of credit products directly to the public.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Generally, among asset classes stocks are more volatile than bonds or short-term instruments and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Although the bond market is also volatile, lower-quality debt securities including leveraged loans generally offer higher yields compared to investment grade securities, but also involve greater risk of default or price changes. Foreign markets can be more volatile than U.S. markets due to increased risks of adverse issuer, political, market or economic developments, all of which are magnified in emerging markets.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Other than with respect to assets managed on a discretionary basis through an advisory agreement with Strategic Advisers LLC, you are responsible for determining whether, and how, to implement any financial planning recommendations presented, including asset allocation suggestions, and for paying applicable fees. Financial planning does not constitute an offer to sell, a solicitation of any offer to buy, or a recommendation of any security by Fidelity Investments or any third party.

Fidelity® Wealth Services provides non-discretionary financial planning and discretionary investment management through one or more Personalized Portfolios accounts for a fee. Advisory services offered by Strategic Advisers LLC (Strategic Advisers), a registered investment adviser. Brokerage services provided by Fidelity Brokerage Services LLC (FBS), and custodial and related services provided by National Financial Services LLC (NFS), each a member NYSE and SIPC. Strategic Advisers, FBS, and NFS are Fidelity Investments companies.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917