Asset allocation is just a starting point. Your portfolio needs to be monitored because markets, the economic outlook, and your personal situation can change. A professionally managed portfolio gives you this oversight.

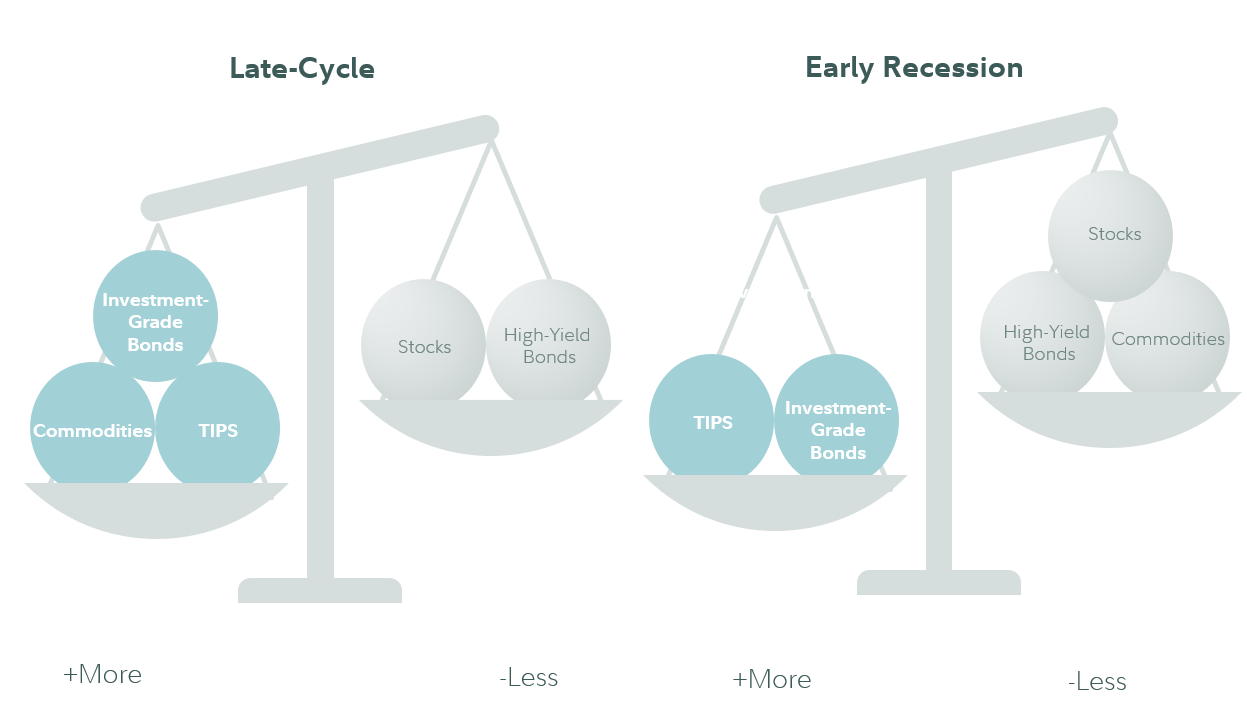

Remember, not all types of stocks and bonds have performed the same way in all types of market and economic conditions. It can be challenging for the average investor to know which investments to focus on throughout a full economic cycle. And it can be equally as challenging to know if or when you should shift your focus or make adjustments to your portfolio's investments.

Rebalancing, or periodically adjusting the mix of stocks, bonds, and short-term investments in your portfolio to make sure your asset allocation continues to reflect your feelings about risk and your goals, an important part of maintaining your portfolio. You'll want to conduct ongoing reviews of your personal and financial situation to determine if anything's changed and whether those changes warrant adjusting your investments.

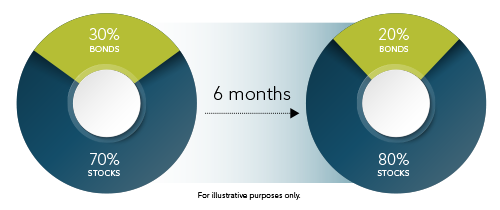

Consider a hypothetical portfolio of 70% stocks and 30% bonds. When it's created, this mix makes sense for this particular investor. But fast forward 6 months. Stocks have appreciated significantly while bonds have fallen, so that mix is now closer to 80% stocks and 20% bonds. The investor is now taking on more risk than originally intended. The longer this investor goes without rebalancing, the more the risk may increase or decrease