Asset allocation

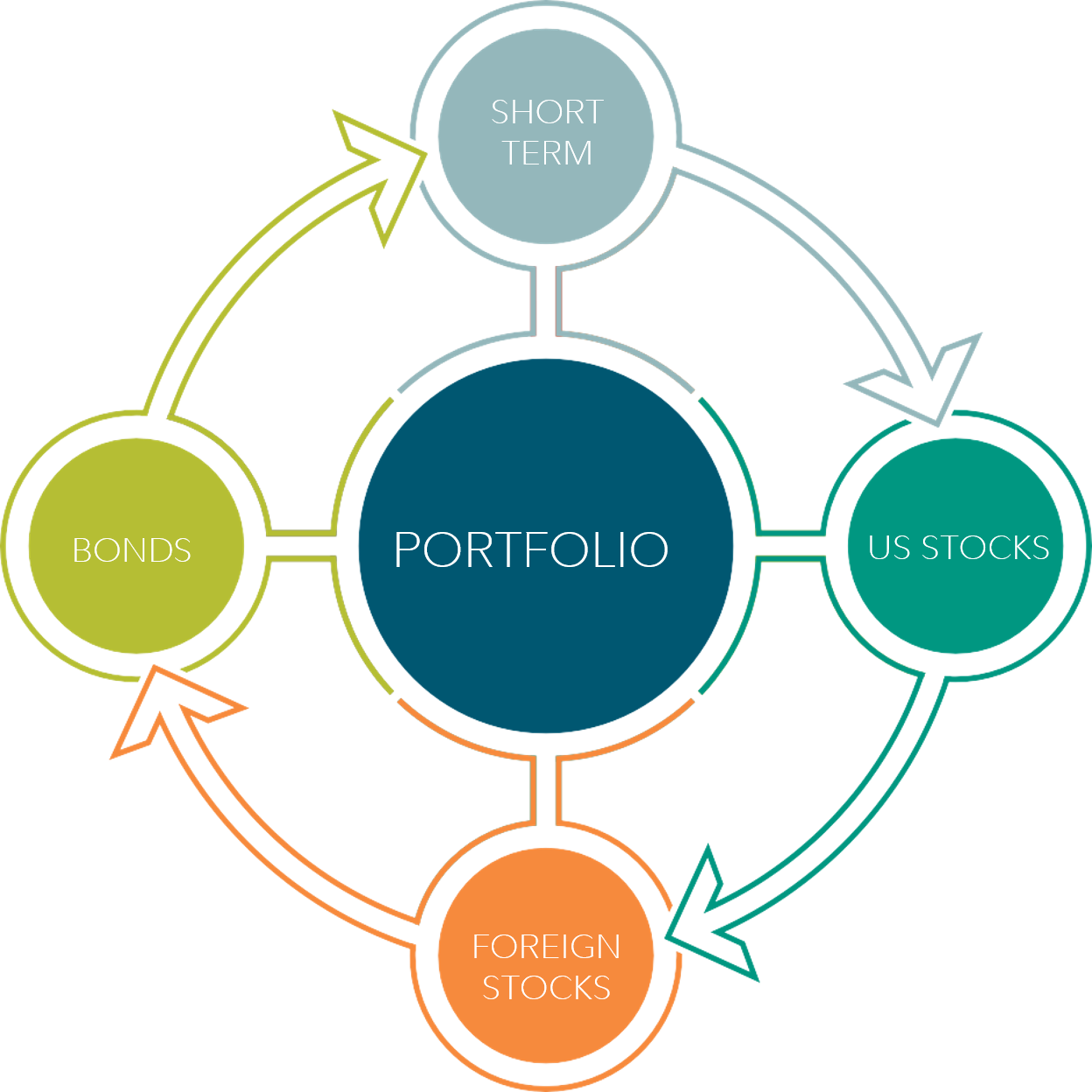

After we assign your account(s) to a goal, we will recommend a mix of stocks, bonds, and short-term investments—sometimes referred to as an asset allocation—that we believe is appropriate for your goal and comfort level with risk.

DO YOU HAVE THE MIX THAT'S RIGHT FOR YOU?

Up to 90% of the variability of a portfolio's returns over time can be explained by asset allocation‡

‡"Does Asset Allocation Policy Explain 40%, 90% or 100% of Performance?", Roger G. Ibbotson and Paul D. Kaplan, Financial Analysts Journal, January/February 2000.

How we align asset allocation and risk

Recommending an asset allocation for your goal is the result of a rigorous process that accounts for a range of factors, including your time horizon, financial situation, and comfort with risk. Our recommended mix of stocks, bonds, and short-term investments is designed to enhance your chances of reaching your goal.

Time horizon

Time to and duration of goal

While we look at the amount of time until you’ll start taking withdrawals, we also consider a number of other factors, including assets assigned to your goal, the amount you’re saving toward your goal, and the possibility you may need to withdraw money early.

Risk tolerance

Emotional capacity to bear risk

We'll explore your comfort level with risk and willingness to take it on, as well as your investment experience, investing knowledge, and how you may react during a market decline.

Financial situation

Financial ability to bear risk

We assess your age, overall household financial situation, any funds you have set aside for emergencies, essential expenses, and any assets you have that are not assigned to this goal.

Understanding the relationship between risk and return

As the illustration below shows, asset allocation selection comes with its own set of trade offs. In general, the higher the percentage of stocks, the higher the potential return. However, as you can see, this higher potential return also comes with a higher risk that the account could fluctuate in value more—particularly in the short term. It's important to remember that all these options, including the most conservative ones, are subject to market volatility and the risk that your account could lose money.

More information

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Generally, among asset classes stocks are more volatile than bonds or short-term instruments and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Although the bond market is also volatile, lower-quality debt securities including leveraged loans generally offer higher yields compared to investment grade securities, but also involve greater risk of default or price changes. Foreign markets can be more volatile than U.S. markets due to increased risks of adverse issuer, political, market or economic developments, all of which are magnified in emerging markets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Account holdings

We believe that one of the best ways to achieve your financial goals is through a well-diversified portfolio that reflects your comfort with risk and time horizon. In choosing appropriate holdings for Personalized Portfolios accounts, we evaluate hundreds of investment options. Your account will usually have exposure to a wide range of securities of different market capitalizations, sectors, and investment styles.

Your Personalized Portfolios accounts may be comprised of:

Mutual funds

Managed by either Fidelity or non-Fidelity managers, which may also include funds that are exclusive to Fidelity® Wealth Services clients.

Exchanged traded funds (ETFs)

Offered by either Fidelity or other firms.

Individual stocks

Through separately managed account (SMA) sleeves.1 We offer both direct indexing and actively managed SMAs for accounts with taxable registrations.

What is a separately managed account (SMA) sleeve?

An SMA sleeve is a portfolio of individual stocks held within an eligible taxable Personalized Portfolios account that can help enhance your after-tax returns. You can own one or more stock SMA sleeves within your Personalized Portfolios account instead of a stock mutual fund or ETF. Investing in SMA sleeves allows for:

- Direct ownership of stocks gives you the ability to personalize your holdings and can help with capital gains management, which can help add to your portfolio's tax efficiency.

- Increased potential for tax-loss harvesting3 opportunities, which can be a good way to offset capital gains.

- If you fund your account with stocks you currently own, it may be possible to build around those holdings, which could reduce the tax impact of building your portfolio.

More information

You could lose money by investing in a money market fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the fund is not a bank account and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Fidelity Investments and its affiliates, the fund’s sponsor, is not required to reimburse the fund for losses, and you should not expect that the sponsor will provide financial support to the fund at any time, including during periods of market stress.

Fidelity's government and U.S. Treasury money market funds will not impose a fee upon the sale of your shares.

Before investing in any mutual fund or exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus, an offering circular, or, if available, a summary prospectus containing this information. Read it carefully.

Tax-smart (i.e., tax-sensitive) investing techniques (including tax-loss harvesting) are applied in managing certain taxable accounts on a limited basis, at the discretion of the portfolio manager primarily with respect to determining when assets in a client's account should be bought or sold. As the discretionary portfolio manager, Strategic Advisers LLC ("Strategic Advisers") may elect to sell assets in an account at any time. A client may have a gain or loss when assets are sold. There are no guarantees as to the effectiveness of the tax-smart investing techniques applied in serving to reduce or minimize a client's overall tax liabilities, or as to the tax results that may be generated by a given transaction. Strategic Advisers does not currently invest in tax-deferred products, such as variable insurance products, or in tax-managed funds, but may do so in the future if it deems such to be appropriate for a client. Strategic Advisers does not actively manage for alternative minimum taxes; state or local taxes; foreign taxes on non-U.S. investments; federal tax rules applicable to entities; or estate, gift, or generation-skipping transfer taxes. Strategic Advisers relies on information provided by clients in an effort to provide tax-sensitive investment management, and does not offer tax advice. Except where Fidelity Personal Trust Company (FPTC) is serving as trustee, clients are responsible for all tax liabilities arising from transactions in their accounts, for the adequacy and accuracy of any positions taken on tax returns, for the actual filing of tax returns, and for the remittance of tax payments to taxing authorities.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Generally, among asset classes stocks are more volatile than bonds or short-term instruments and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Although the bond market is also volatile, lower-quality debt securities including leveraged loans generally offer higher yields compared to investment grade securities, but also involve greater risk of default or price changes. Foreign markets can be more volatile than U.S. markets due to increased risks of adverse issuer, political, market or economic developments, all of which are magnified in emerging markets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917