Choosing an investment approach

In designing an investment solution for you, we follow a multi-faceted approach designed to fit your goals and the way you want to invest.

Our diversified, multi-asset class portfolios can be personalized around your time horizon, comfort with risk, and other preferences. You have two different options when it comes to how the investment team actively manages your portfolio through market fluctuations.

Total Return

Designed for investors who

- Are comfortable with greater fluctuations in portfolio values in pursuit of high potential growth

- Believe they're likely to remain invested during market downturns

Objective

Managed around your comfort with risk and willingness to stay invested during market fluctuations in exchange for the potential for higher returns

How portfolios are managed

Adjust exposure to a broad range of stocks, bonds, or other investments as needed

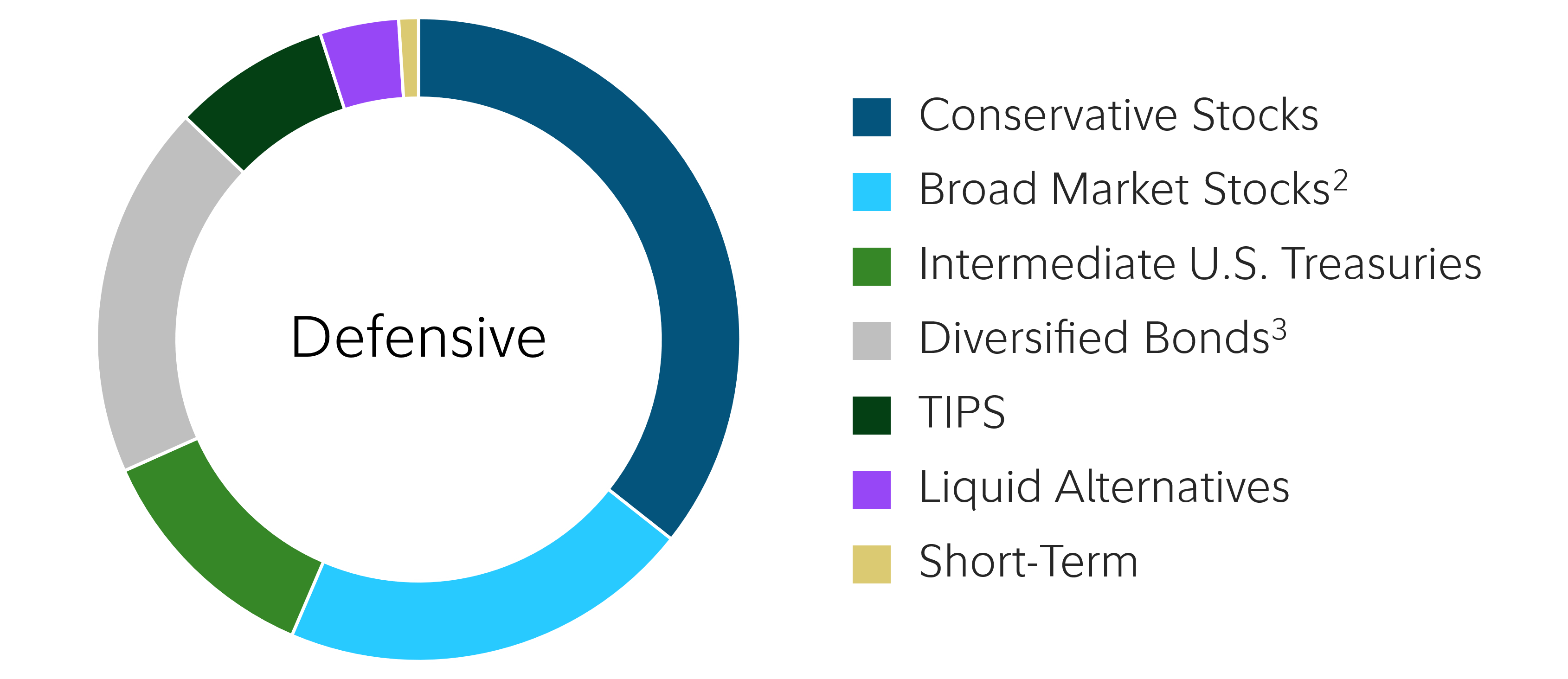

Defensive

Designed for investors who

- Are looking for a smoother investment experience while still pursuing potential growth

- Believe they're less likely to remain invested during market downturns

Objective

Managed around your comfort with risk while seeking to reduce volatility to help you stay invested during market downturns

How portfolios are managed

Look to emphasize more conservative investments that tend to react less to market fluctuations

Growth with Income (60% Stocks)

Sample portfolios1

While Total Return and Defensive portfolios generally offer similar exposures to primary asset classes, it is at the sub-asset class level where you will find the differences between the two approaches.

*Approximately 3% of the stocks in the broad market category are lower volatility stocks.

Exposure to stocks

20% – 100%

8 different asset allocations available

20% – 70%

6 different asset allocations available

In some cases, Defensive portfolios may maintain a lower exposure to stocks than the associated model portfolio

Investment universes

Total return

There are several different portfolio construction options available, including a focus on Fidelity funds or index-based investments or the option to build your portfolio using a wide range of Fidelity and non-Fidelity funds.

These options are also available primarily comprised of sustainable investments.

Comparing investment results*

During sustained market downturns, losses may be less severe for Defensive portfolios, while gains may be higher during rising markets for Total Return portfolios. However, the intent is that over the long-term the two approaches will provide similar investment results, and both can help clients achieve their financial goals. Learn more about historical performance.

*In this scenario, your losses and gains refers to the value of your portfolio. For illustrative purposes only. Not indicative of any investment.