Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Past performance is no guarantee of future results.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Market indexes are included for informational purposes and for context with respect to market conditions. All indexes are unmanaged, and performance of the indexes includes reinvestment of dividends and interest income, unless otherwise noted. Review the definitions of indexes for more information. Please note an investor cannot invest directly into an index. Therefore, the performance of securities indexes do not incorporate or otherwise reflect the fees and expenses typically associated with managed accounts or investment funds.

U.S. Stocks = The Dow Jones U.S. Total Stock Market Index is an all-inclusive measure composed of all U.S. equity securities with readily available prices. This broad index is sliced according to stock-size segment, style, and sector to create distinct sub-indexes that track every major segment of the market.

International Stocks = The MSCI All Country World Ex-U.S. Index (Net MA) is a market capitalization–weighted index designed to measure the investable equity market performance for global investors of large- and mid-cap stocks in developed and emerging markets, excluding the United States.

U.S. Bonds = The Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar–denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, mortgage-back securities (agency fixed-rate pass-throughs), asset-backed securities, and collateralized mortgage- backed securities (agency and non-agency).

High Yield Bonds = ICE BofAUS High Yield Index is market capitalization weighted and is designed to measure the performance of U.S. dollar denominated below investment grade (commonly referred to as "junk") corporate debt publicly issued in the U.S. domestic market.

Short Term = The Bloomberg U.S. 3–6 Month Treasury Bill Index is a market capitalization–weighted index of investment-grade, fixed-rate public obligations of the U.S. Treasury with remaining maturities from three up to (but not including) six months, excluding zero-coupon STRIPS.

Commodities = The Bloomberg Commodity Index Total Return Index measures the performance of the commodities market. It consists of exchange-traded futures contracts on physical commodities that are weighted to account for the economic significance and market liquidity of each commodity.

Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. This material is provided for informational purposes only and should not be used or construed as a recommendation for any security.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Any fixed income security sold or redeemed prior to maturity may be subject to loss.

The commodities industry can be significantly affected by commodity prices, world events, import controls, worldwide competition, government regulations, and economic conditions.

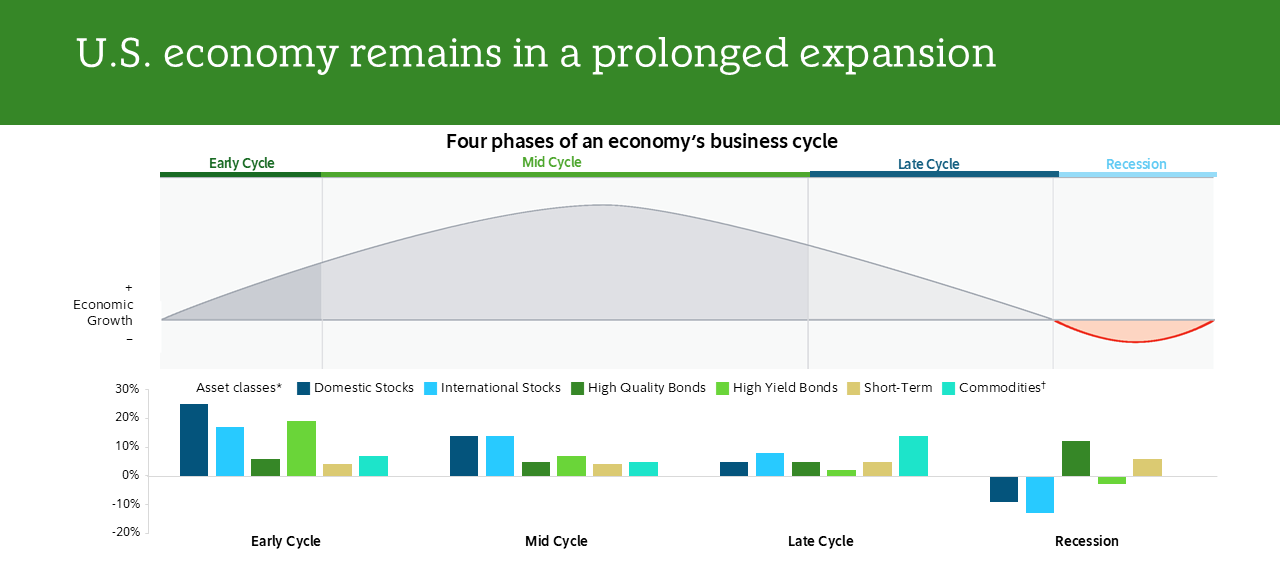

The Business Cycle Framework depicts the general pattern of economic cycles throughout history, though each cycle is different; specific commentary on the current stage is provided in the main body of the text. In general, the typical business cycle demonstrates the following: During the typical early-cycle phase, the economy bottoms out and picks up steam until it exits recession, then begins the recovery as activity accelerates. Inflationary pressures are typically low, monetary policy is accommodative, and the yield curve is steep. Economically sensitive asset classes, such as stocks, tend to experience their best performance of the cycle. During the typical mid-cycle phase, the economy exits recovery and enters into expansion, characterized by broader and more self-sustaining economic momentum but a more moderate pace of growth. Inflationary pressures typically begin to rise, monetary policy becomes tighter, and the yield curve experiences some flattening. Economically sensitive asset classes tend to continue benefiting from a growing economy, but their relative advantage narrows. During the typical late-cycle phase, the economic expansion matures, inflationary pressures continue to rise, and the yield curve may eventually become flat or inverted. Eventually, the economy contracts and enters recession, with monetary policy shifting from tightening to easing. Less economically sensitive asset categories tend to hold up better, particularly right before and upon entering recession.

Advisory services provided for a fee through Strategic Advisers LLC (Strategic Advisers), a registered investment adviser and a Fidelity Investments company. Brokerage services provided by Fidelity Brokerage Services LLC (FBS), and custodial and related services provided by National Financial Services LLC (NFS), each a member NYSE and SIPC. Strategic Advisers, FBS, and NFS are Fidelity Investments companies.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917