Tax-smart investment1A comprehensive suite of strategies designed to help you reach your goals faster. |

Transition management

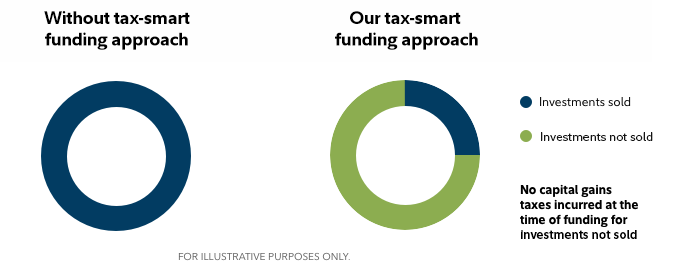

When building your strategy, we take a personalized approach, carefully considering which investments to keep and which to sell. Our goal is to reach your desired asset allocation while reducing potential capital gains taxes. If you have holdings that we believe fit within your investment strategy, we'll look to integrate them into one or more of your Personalized Portfolios accounts2 as opposed to selling all your existing investments in order to "start from scratch." This can help reduce the potential tax consequences of building your investment strategy. Note that the use of asset location can enhance the effectiveness of this strategy.

Tax-smart withdrawals

When clients need to withdraw money from their accounts, those withdrawals generally involve selling securities, which usually results in taxes. However, with careful planning, there are things that can be done that may help reduce those taxes. This approach is called tax-smart withdrawals and depending on the tax registration of the accounts we're managing on your behalf, it can take many forms.

For instance, if we know a client will need to take periodic withdrawals, like required minimum distributions (RMDs), the investment team can maintain cash positions in order to facilitate those withdrawals. If an account's cash holdings fall below a certain threshold and securities need to be sold, we can look at individual tax lots for investments that have appreciated less, or that have been held for longer than one year—two factors that can reduce the tax impact of those sales.

In cases where we're managing accounts with different tax registrations, we may choose to sell assets from some accounts and not others in an effort to reduce the tax impact. More importantly, we can do this while still maintaining the appropriate goal asset allocation in an effort to ensure that clients' investments remain aligned with their goals.